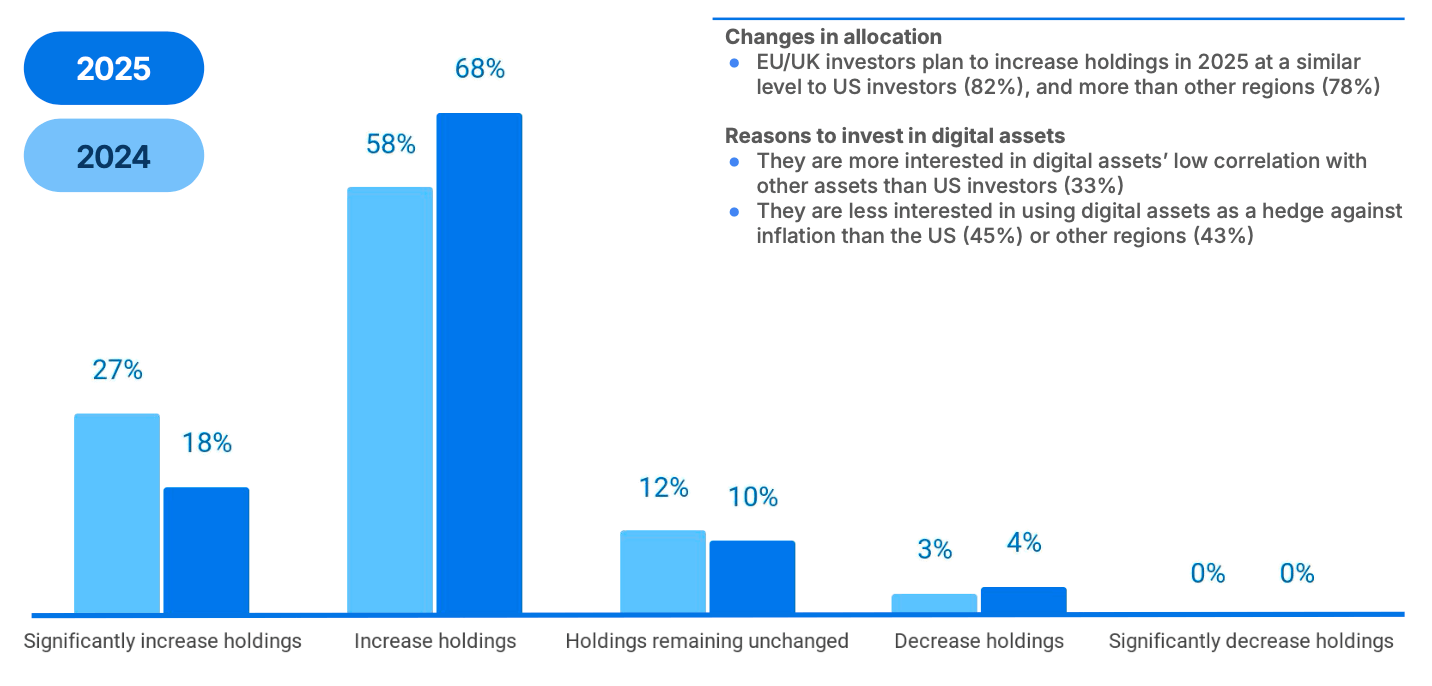

Ah, the sweet scent of cryptocurrency! It seems to have caught the nose of institutional investors across the EU and UK, as 86% of them plan to boost their holdings or enter the market by 2025, according to a Coinbase and EY-Parthenon survey of 97 institutions. 🤑💸

DeFi Engagement Set to Jump 2.5x in European Institutions

Half of these respondents intend to allocate over 5% of their assets under management (AUM) to digital assets, up from 46% in 2024, signaling a deepening commitment despite volatility concerns. 📈📉

Regulatory clarity emerged as the top catalyst for growth (58%), with licensing frameworks, custody rules, and tax treatment cited as critical needs. Volatility (51%) and market manipulation risks (42%) remain key concerns, though 71% of institutions already hold altcoins beyond bitcoin and ethereum. 😱🤯

“Regulatory clarity was cited as the top concern for digital asset managers, and respondents stated that increasing regulatory clarity would be the number one catalyst to propel the industry forward,” the Coinbase and EY-Parthenon report notes.

The study’s authors add:

“Asset managers in Europe also place a greater emphasis on expecting consumer adoption and greater knowledge of digital assets to support adoption.”

Preferred investment routes include registered vehicles like exchange-traded products (ETPs), favored by 57% of respondents. Tokenization attracted strong interest, with 58% “very interested” in assets like tokenized commodities (56%) and real estate (42%). Nearly 70% of these investors plan allocations by 2026, primarily for portfolio diversification.

DeFi engagement is projected to surge 2.5x to 68% within two years, though 66% of non-participants cited knowledge gaps as a barrier. Stablecoins see robust utility, with 81% of institutions using or exploring them for foreign exchange (75%) and transactional efficiency (67%). 💱📈

Despite optimism, the Coinbase and EY-Parthenon report states that 66% flagged internal expertise shortages as a hurdle to DeFi adoption, while 62% highlighted regulatory compliance risks. The findings point to a maturing European market where rising allocations coincide with demands for clearer frameworks and education. 📚👩🏫

Coinbase and EY-Parthenon conducted the global survey in January 2025, with European data reflecting institutions managing over $1 billion in assets.

Read More

- Best Controller Settings for ARC Raiders

- Ashes of Creation Rogue Guide for Beginners

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- 10 Most Brutal Acts Of Revenge In Marvel Comics History

- Teen Mom’s Cheyenne Floyd Welcomes Baby No. 3, Second With Zach Davis

- Katy Perry and Justin Trudeau Hold Hands in First Joint Appearance

2025-07-12 03:57