-

BTC spot ETF saw an outflow of over $200 million.

Exchange netflow was dominated by positive flow.

After gaining regulatory approval for Bitcoin [BTC] ETFs in the United States, there has been a significant increase in Bitcoin‘s trading volume. With the price of Bitcoin looking set to surpass its previous record high, the investment in Bitcoin ETFs reached a peak monthly level.

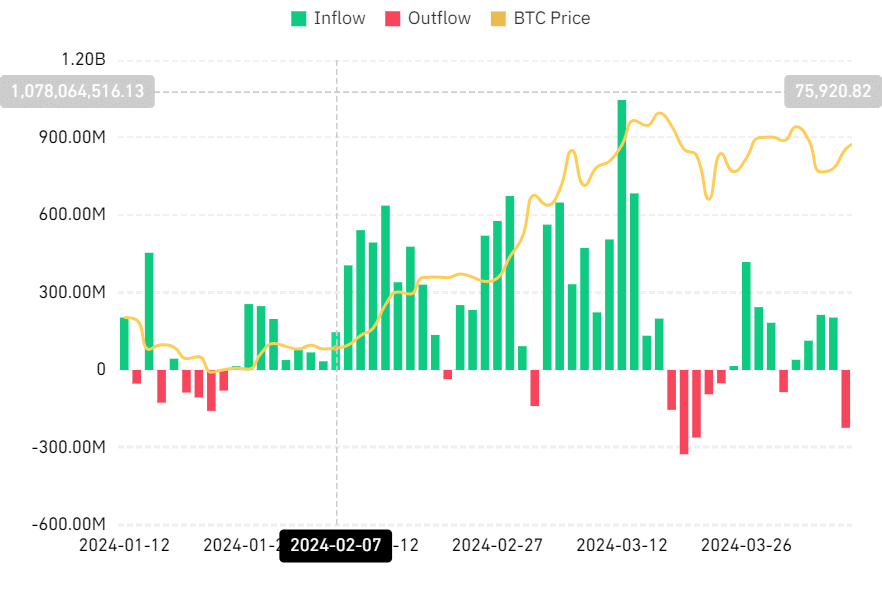

Outflow dominates Bitcoin spot ETF volume

On April 8th, there was a significant increase in Bitcoin spot ETF netflow activity on Coinglass, which had not been seen since March 27th. But this surge went against the recent trend.

On the chart, April 8th is marked with a notable decrease, representing the initial such occurrence since March 20th. The figure reveals that approximately $223 million in Bitcoin was withdrawn on this day.

It’s worth noting that the last time we saw such a large amount of Bitcoin being transferred out of wallets, the cryptocurrency was going through a price drop. However, unlike past occurrences, this significant transfer took place while Bitcoin was on an upward trend and reached new heights above $71,000.

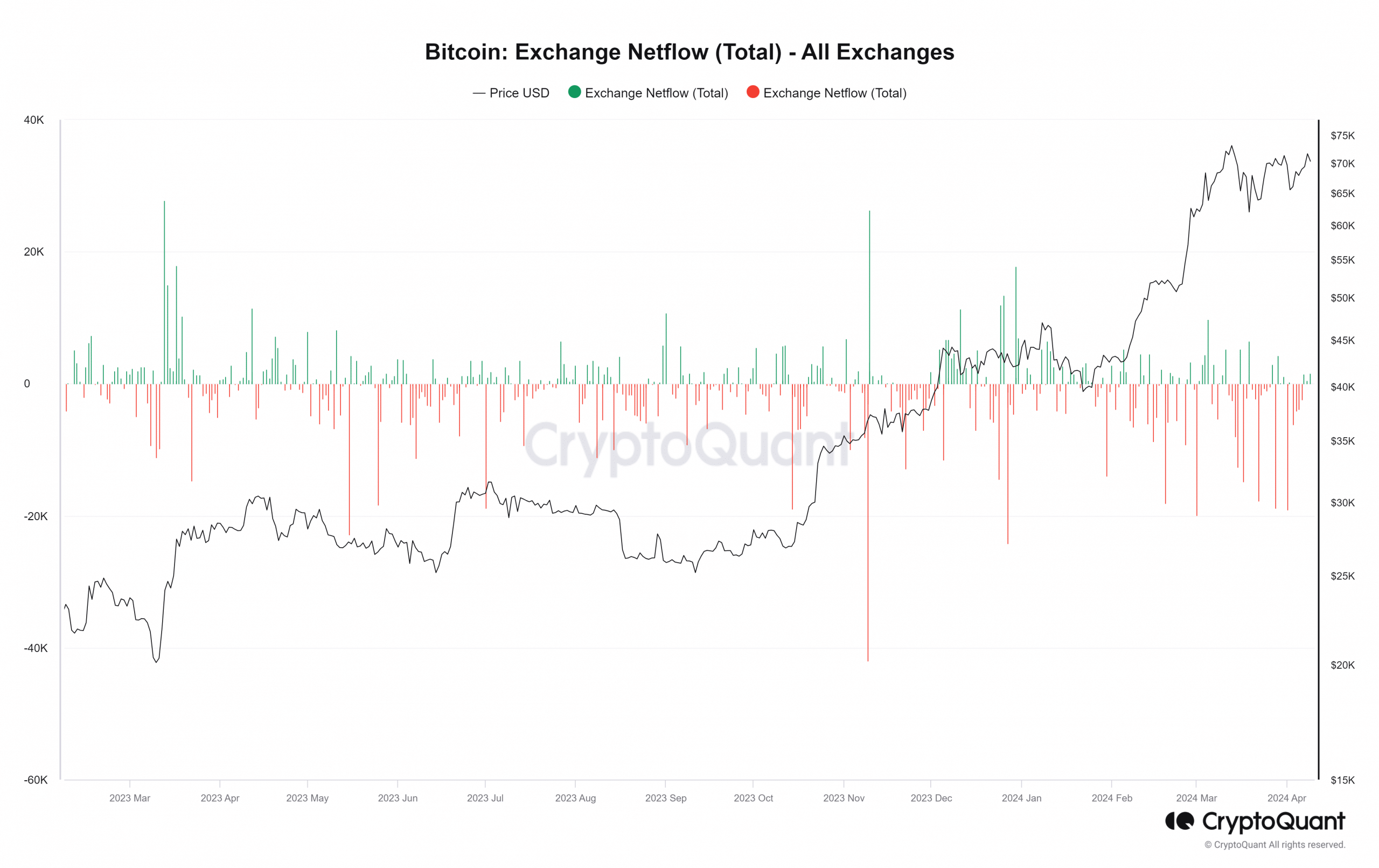

Bitcoin sees more exchange inflow

On April 8th, while there was a notable decrease in investments in the Bitcoin spot ETF as its price increased, the overall Bitcoin netflow showed a contrasting pattern with an influx of coins entering exchanges. This flow analysis implied that more traders were transferring their Bitcoins into trading platforms.

Despite the large amount of Bitcoin coming in (approximately 555 BTC), the overall volume wasn’t very impressive. Currently, however, the inflow has surged past 1,300 BTC.

Despite appearing to go in different directions based on Bitcoin spot ETF and exchange netflow metrics, their underlying reactions are actually quite comparable.

An increase in investors withdrawing funds from spot ETFs is a sign that they are selling off their shares for various reasons, such as realizing profits. On the other hand, an abundance of deposits in exchange netflows implies that some investors are also selling to lock in gains.

In both situations, the primary cause is the increase in Bitcoin’s value, which impacts their decisions similarly.

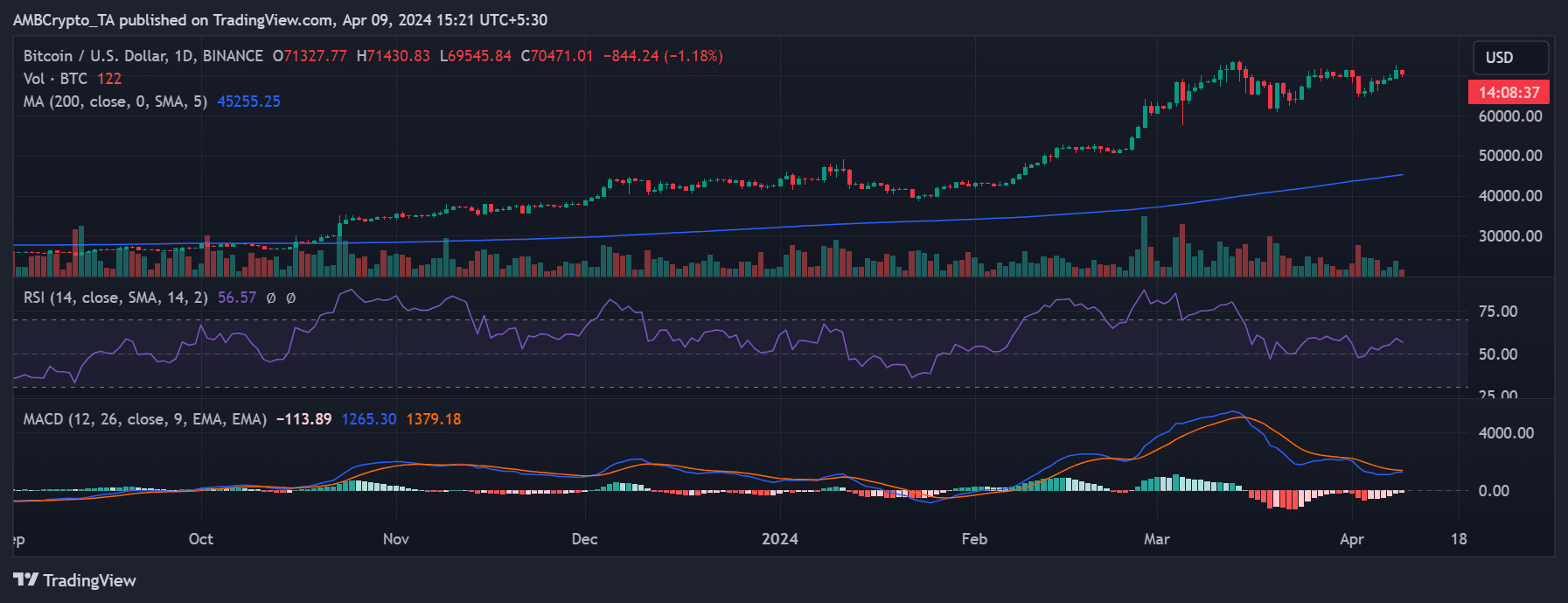

BTC price rise takes a breather

On the 8th of April, Bitcoin’s price rose about 1.73%, amounting to around $71,313. Although this wasn’t a new record for Bitcoin, market analysis suggested it was the third-priciest value in Bitcoin’s history.

Read Bitcoin (BTC) Price Prediction 2024-25

At the point of composing this text, BTC‘s price had dropped. The cryptocurrency was being exchanged for approximately $70,400, indicating a reduction of more than 1%.

Despite a reversal on this day following the day before’s advance, Bitcoin continued to follow an uplifting market trend.

Read More

- WCT PREDICTION. WCT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Grammys Pay Emotional Tribute to Liam Payne in First Honorary Performance

- Lucy Hale’s Sizzling Romance with Harry Jowsey: The Un serious, Fun-Filled Love Story!

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

2024-04-10 01:11