- Bitcoin is expected to rally massively after the summer’s halving event.

- Some anomalies suggest that this time might be vastly different.

Bitcoin‘s price has surged significantly since late October 2023. The upward trend is clear in the market data, but it remains uncertain what may come next. To gain insight into potential developments during this cycle, AMBCrypto referred to a CryptoQuant Insights analysis.

A significant and somewhat unsettling query emerged regarding the unique nature of the current Bitcoin price surge. While there are valid points to consider that distinguish this rally from previous ones, it’s essential for investors to assess their level of worry.

Has the current bull run been in place since March 2023?

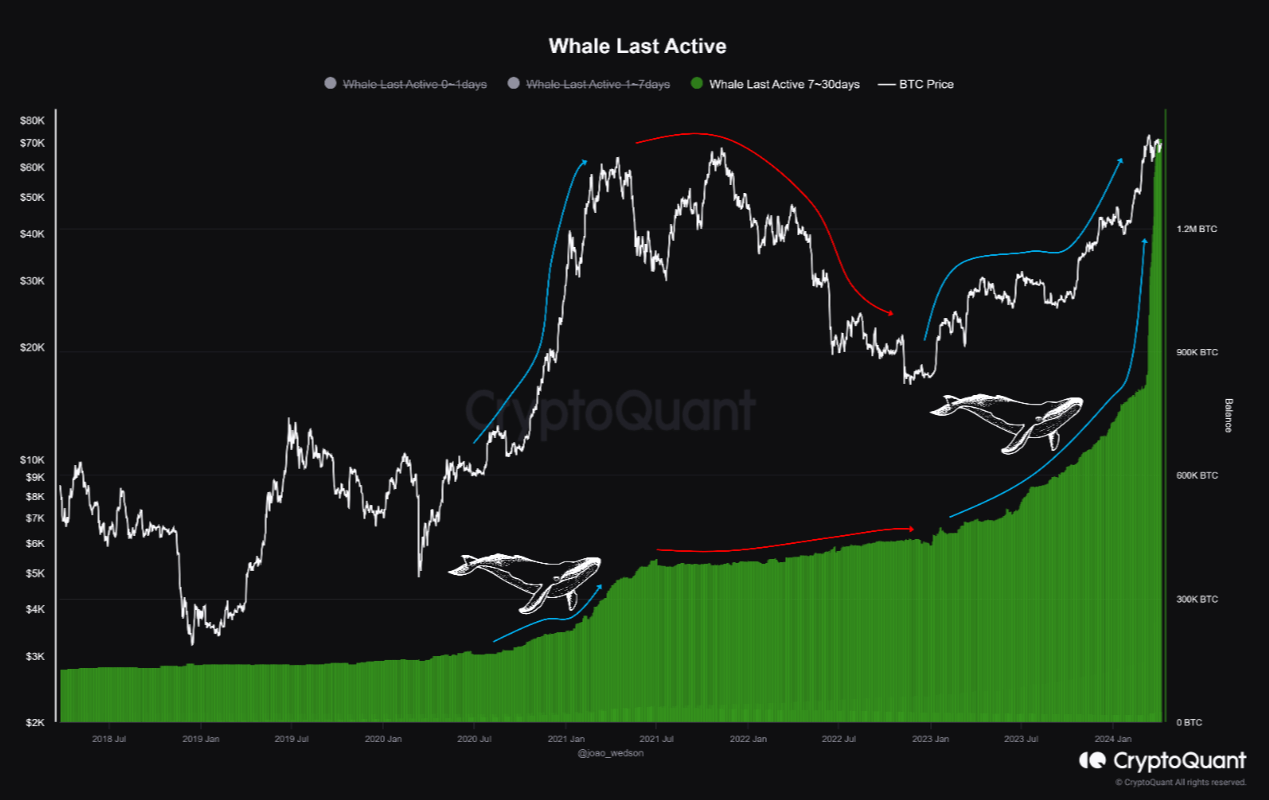

User joaowedson of CryptoQuant noted that the number of inactive whale Bitcoin addresses has been rising since March 2023, as indicated by the Whale Last Active 7-30 days chart. In the past bull market, around mid-2020, a similar surge in whale activity preceded a significant Bitcoin price rally.

Over the past 6-8 months, a comparable scenario unfolded with the indicator showing a significant uptick.

An additional signal supporting the ongoing uptrend as a prolonged bull market, starting at $30k, was the whale indicator’s indication in conjunction with price movements.

Examining miner behavior

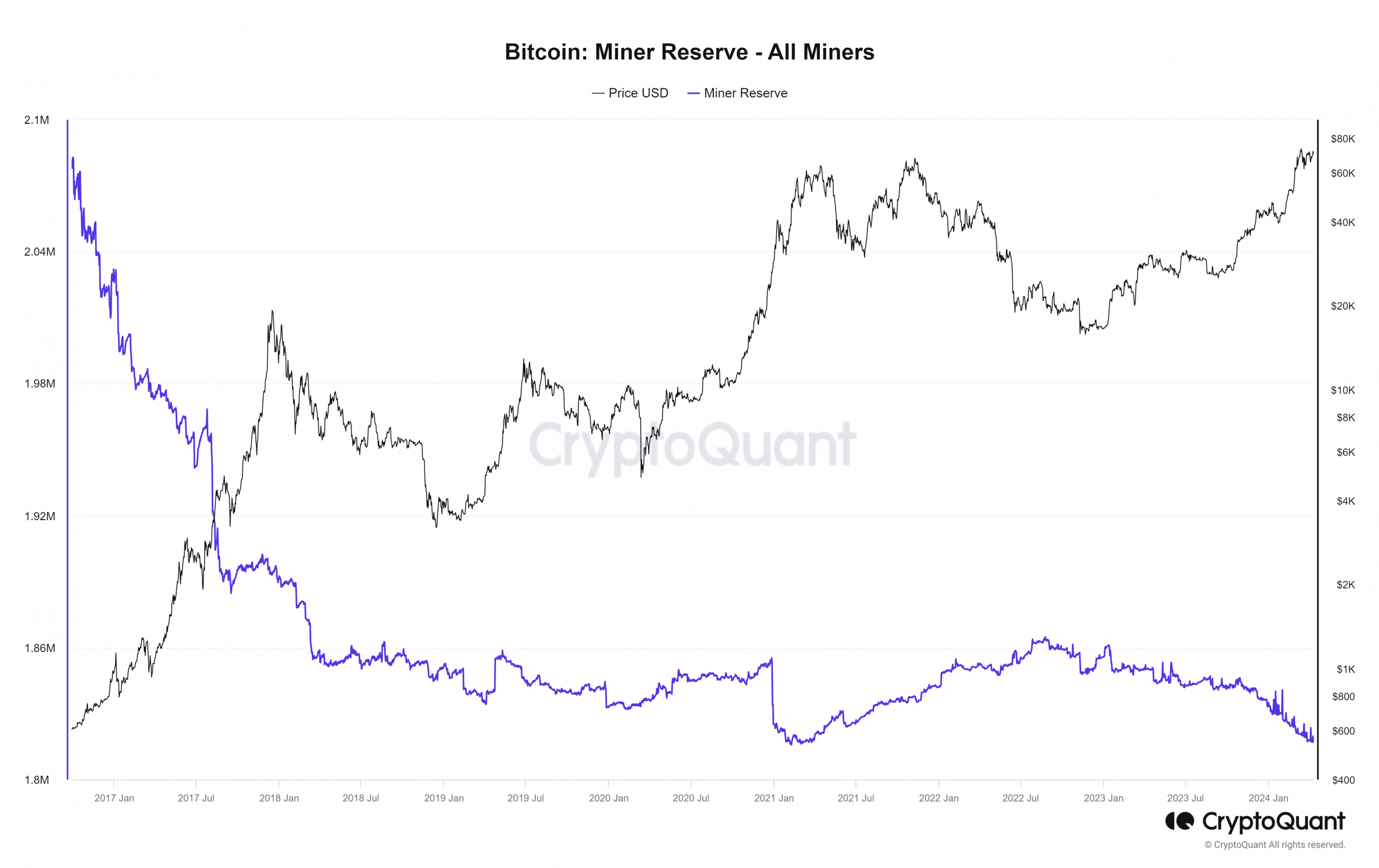

The Bitcoin halving is creating a lot of buzz in the community (following the excitement over Bitcoin ETFs and their significant investments), and miners find themselves right in the middle of it. The value of their block rewards will decrease from 6.25 Bitcoins to 3.125 Bitcoins, which might compel several miners to close shop if they can’t endure until Bitcoin prices rebound.

An possibility is that a decrease in the mining network’s hash rate and a drop in mining difficulty might take place, but this was highly improbable.

Based on data from CryptoQuant’s miner reserve chart, there has been a decrease in Bitcoin (BTC) miners’ reserves since November 2023. Historically, during the previous two market cycles, a significant drop in miner reserves has preceded a bullish trend for Bitcoin.

In other words, this finding supports the notion that Bitcoin’s price increase started prior to the halving occasion, something that didn’t occur during past trends. Additionally, Bitcoin reached a new all-time high (ATH) before the halving took place – an occurrence not seen in earlier cycles.

The importance of miners’ Bitcoin transactions was also something that has dwindled with successive cycles. This trend was likely to continue as the whales and institutional investors became the dominant players.

In that case, the halving event might become a “sell the news” type of event.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Based on the increased whale activities and miner reserves, as well as the upward trend in prices, it’s natural to wonder when this current bull market might come to an end.

The previous peak occurrences took place approximately 526 and 547 days following the halving process. However, given that we have been experiencing this current cycle for around 6 to 8 months now, there is a possibility that its duration may be significantly reduced. We’ll have to wait and see.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-04-10 07:03