-

Bitcoin’s halving event could tarnish bullish expectations

Cardano and MATIC are expected to rally, but investors should be prepared for short-term losses

The Bitcoin halving, which reduces the reward for mining new blocks from 6.25 to 3.125 BTC, is expected to occur in about ten days. Despite this being publicly known, there are numerous other unpredictable elements that could impact the price.

The need for ETFs (Exchange-Traded Funds) continues unabated, with Bitcoin holding steady above the $60k mark since early March. Despite hitting an all-time high of $73.7k initially, Bitcoin retreated on price charts afterward. As we approach the upcoming Bitcoin halving event, it’s essential to ponder its potential impact and how altcoins like Cardano (ADA) and Matic may respond.

Comparing the current price action to the 2020 and 2016 halvings

Previously, Bitcoin underwent halvings in May 2020 and July 2016. In May 2020, Bitcoin’s price fluctuated between $8,500 and $10,000. The month prior saw a significant increase in Bitcoin’s value, rising from $6,000 to nearly $9,400.

During the summer of 2016, Bitcoin experienced a significant increase in value. The price jumped from $440 to a peak of $785 in May and June. However, in July, around the time of the halving event, the price action became quiet and the value stayed between $630 and $680 for almost an entire month.

Over the last two months, Bitcoin’s price behavior has been more akin to 2016 than 2020. Both years displayed a surge leading up to the halving event, followed by a prolonged period of sideways movement. In August 2016, a significant drop brought the price down to $500. If this pattern persists, we might expect Bitcoin to retrace towards around $50,000 in May.

What should Cardano and MATIC investors expect?

Instead of “AMBCrypto analyzed the on-chain metrics of the two altcoins to assess investor confidence in recent weeks,” you could say:

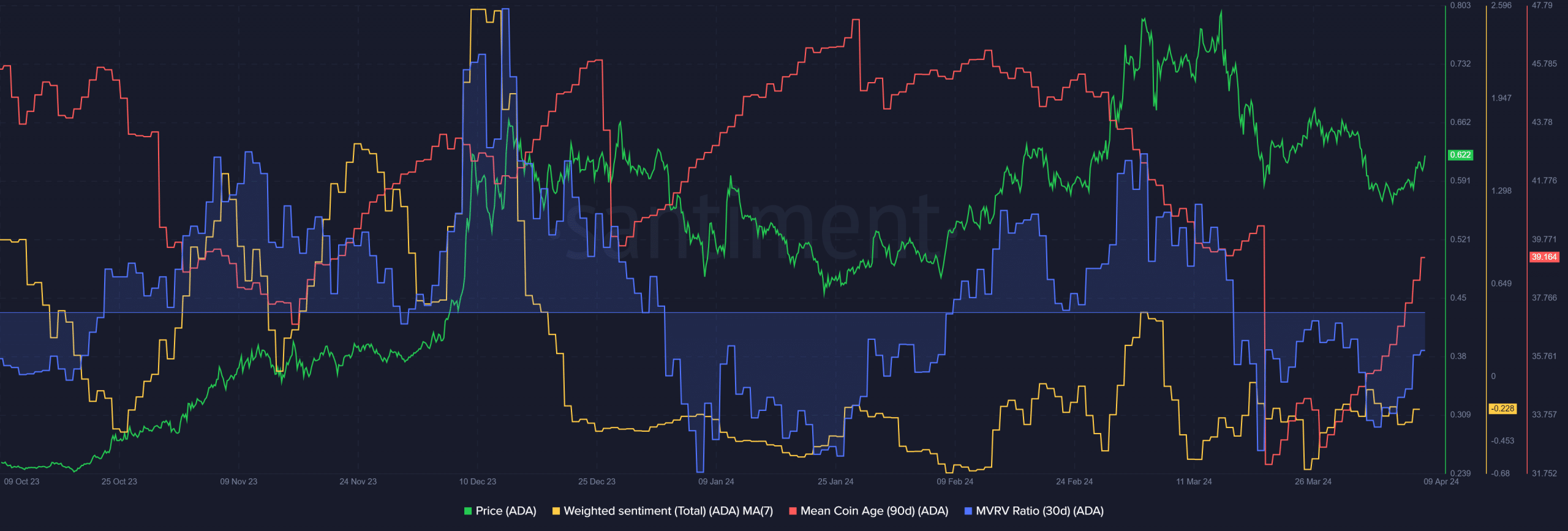

Simultaneously, the average age of coins in circulation started to rise steadily. This could be interpreted as a significant buying indication since it represents accumulation, notwithstanding the prevailing selling pressure. At the same time, the overall sentiment appeared lukewarm.

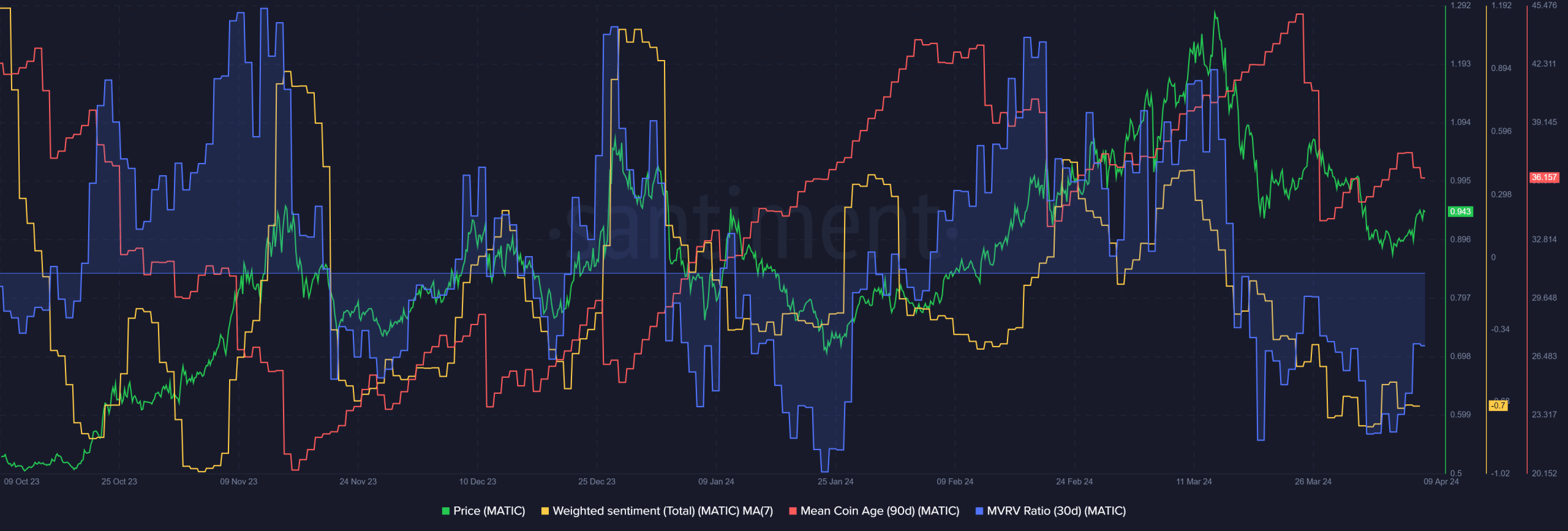

MATIC found itself in a comparable situation. There’s been a lot of negativity in sentiment recently, indicating pessimistic social media activity. Yet, the average age of coins for MATIC started to increase, but not as significantly as ADA‘s uptrend.

Read Polygon’s [MATIC] Price Prediction 2024-25

The 30-day MVRV ratio for Bitcoin was similarly negative as that of Cardano, indicating another potential buying opportunity. Nevertheless, it is important for investors to exercise caution, as a significant sell-off could be imminent for Bitcoin in the upcoming weeks. Be ready to capitalize on any potential price drops by preparing to make purchases at potentially lower prices.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-04-10 10:15