-

At press time, Bitcoin was trading at around $69,000

Open Interest figures were around $36 billion, despite BTC’s price decline

After a series of price increases, Bitcoin reached an all-time high above $71,000, causing excitement among some investors. But when it dipped back below $70,000, opinions became divided, as the number of buyers and sellers was nearly equal.

A weak bull trend?

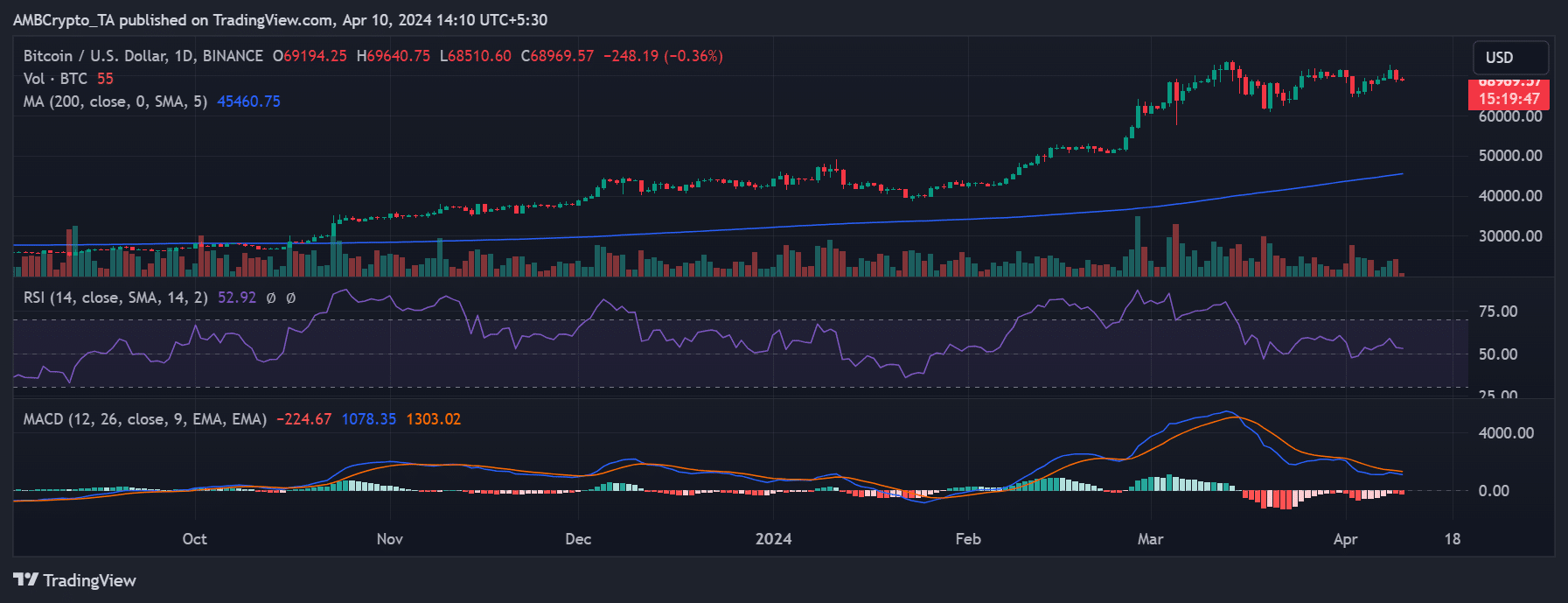

On April 9th, Bitcoin experienced a surprising dip, deviating from the anticipated upward trend and falling approximately 3% in value. According to the analysis of the daily price chart, Bitcoin ended the day at roughly $69,217, which was a significant drop from its opening price above $71,000.

This decline outweighed the previous day’s gains of over 2.7%.

When I penned down these words, the declining trend in Bitcoin’s price remained, though it had become somewhat less pronounced. The Relative Strength Index (RSI) line reflected this uncertainty, hovering near the neutral mark yet slightly above it. This indicated that Bitcoin was still experiencing a bullish trend, but it lacked the strength and conviction typical of a robust uptrend.

Buy or sell?

The aforementioned decline in Bitcoin’s price has sparked great discussion about whether to buy or sell the asset. In fact, Social dominance and volume on Santiment indicated a relatively balanced debate between these positions. Consider this – An analysis of social volume showed around 164 mentions of buy sentiment, compared to 125 mentions of sell sentiment.

The analysis of social dominance found that 4.9% of statements expressed a buy sentiment, while sell sentiment was at 3.7%. Notably, “Bitcoin halving” was the second most popular trending topic. These figures indicate that although the price has dropped, traders continue to pay close attention to the upcoming halving event’s potential influence.

Minimal activity in active addresses

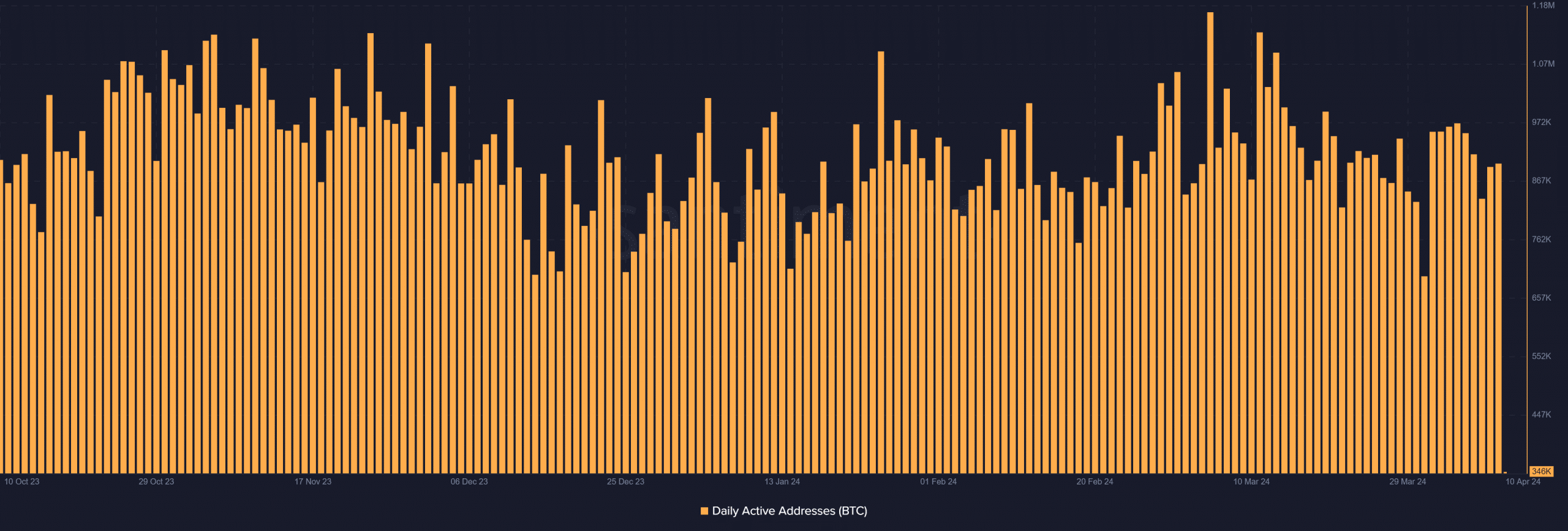

Over the last four days, there has been a modest uptick in the number of daily active Bitcoin addresses, staying just above the 800,000 mark. Specifically, between April 7 and 8, there was a surge from approximately 835,000 to over 892,000, followed by another increase to over 898,000 on April 9.

“The 7-day active addresses chart revealed a recent drop. Specifically, active addresses fell from around 4.9 million on April 7 to roughly 4.7 million by April 10. These figures indicate that while there are many active wallets, some users may be taking a cautious stance and waiting for further developments.”

– Read Bitcoin (BTC) Price Prediction 2024-25

At the moment the news is being released, Bitcoin’s Open Interest had decreased as well. According to Coinglass, the Open Interest was around $36.89 billion, which is lower than the $37.84 billion reported on April 9th. This suggests that a significant amount of money is still flowing into the market despite the decrease in figures. Bitcoin’s short-term price fluctuations are unlikely to have a major impact on this figure.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-04-11 00:07