- Ethereum noted a decline in bullish conviction in the Futures market

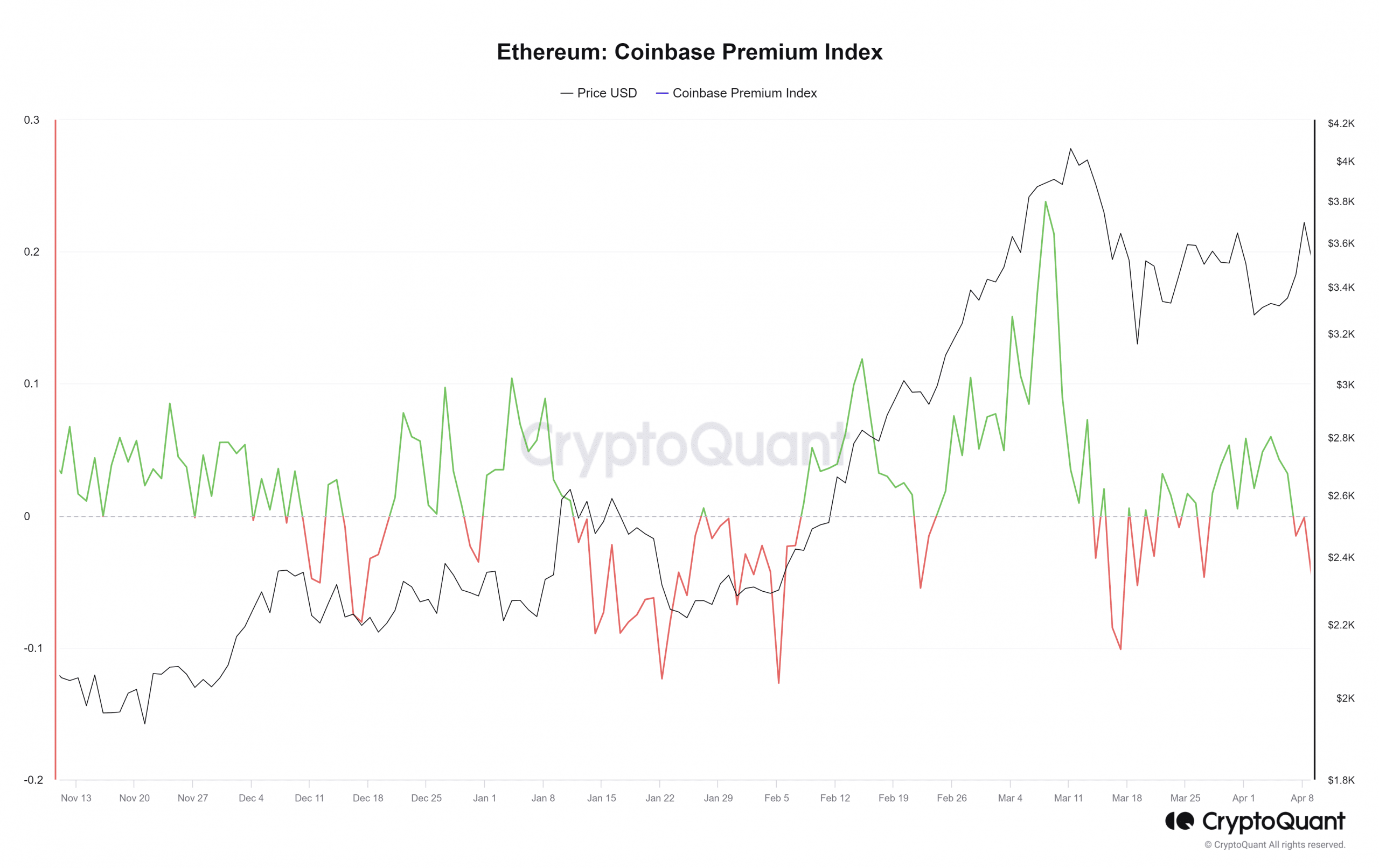

- Coinbase Premium Index showed traders from the U.S are adamant about the altcoin

Ethereum‘s price surged from $3.2k to $3.7k in just three days, representing a notable gain of 16.2%. Yet, the bullish momentum was halted at the previous resistance level of $3.7k, which has been a barrier since last month.

On April 8th, there was a significant increase in Ethereum (ETH) being sent to cryptocurrency exchanges, as reported by AMBCrypto’s most recent assessment. Despite a previously optimistic outlook, the attitude has recently started to change.

U.S investors refuse to believe in ETH’s rally

The Coinbase Premium Index represents the percent difference in prices (USDT pair) between Binance and Coinbase. This index has fallen since 5 April to show that Binance ETH prices were greater.

Put simply, U.S investors showed little excitement towards cryptocurrencies, as they are unable to trade on Binance and instead use Coinbase. Consequently, even with a significant increase in price to $3.7k, the attitude among investors on this side of the Atlantic has remained subdued.

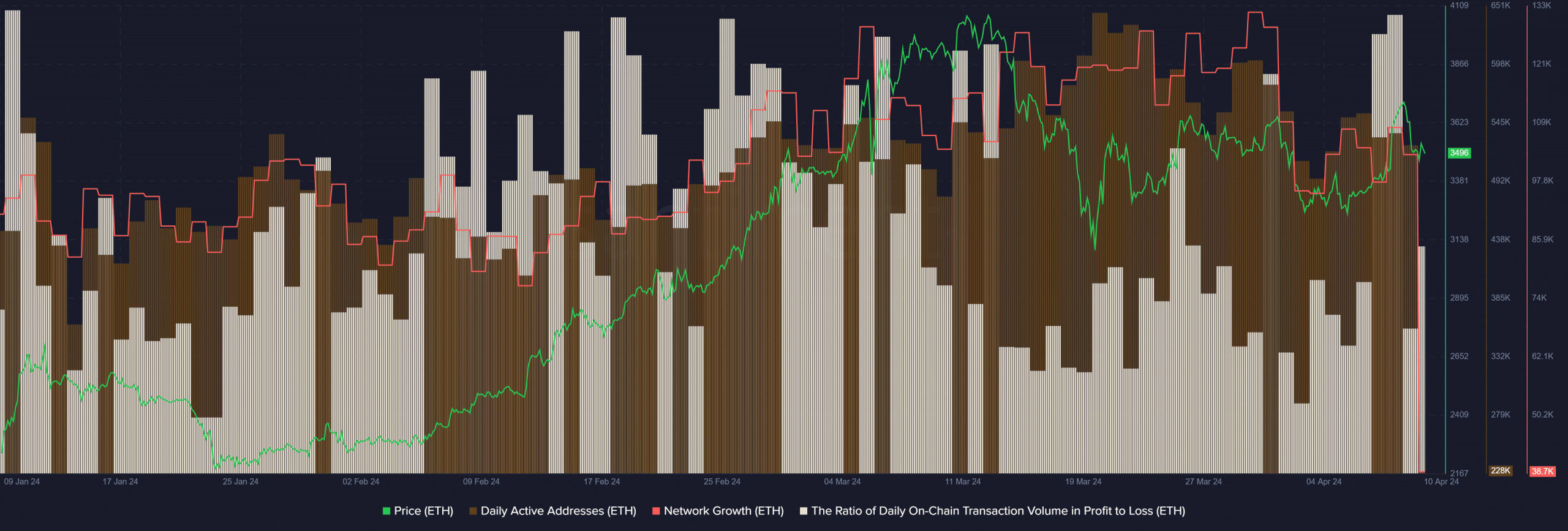

On April 8th, the daily transaction volume ratio of profits to losses on the blockchain, as reported by Santiment, surged to 3.01. This figure had been stuck at 3 since February. As a result, traders may want to monitor this metric closely to see if it could signal an impending short-term price downturn.

On March 30th, there was a noticeable decrease in the number of daily active addresses and network growth indicators for Ethereum. Over the preceding ten days, these figures had also been declining. This downturn suggested decreased user engagement and organic interest in Ethereum. The question then arises: What is the current mood in both the Ethereum spot and futures markets?

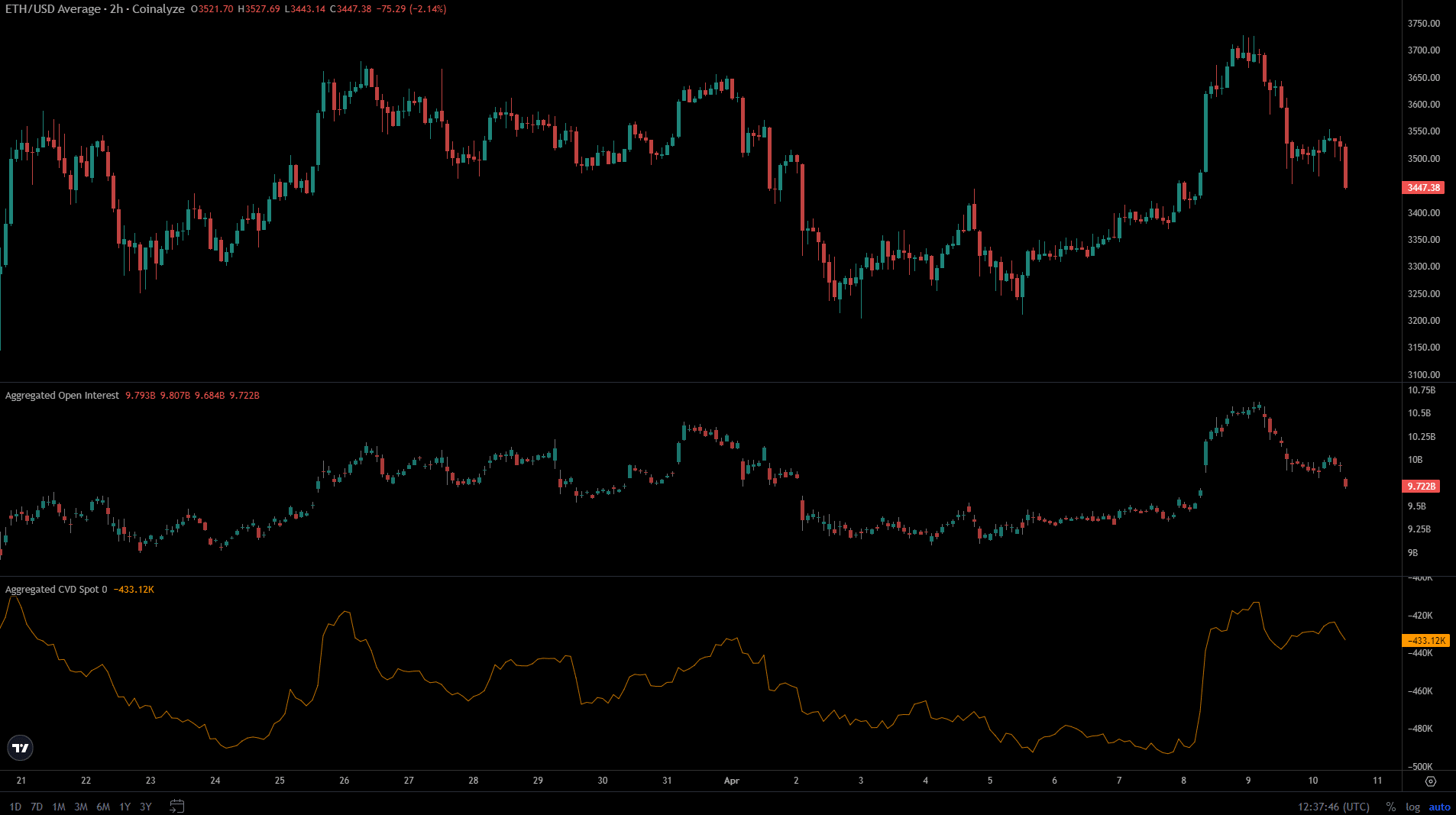

Open Interest data supported idea of bearish market sentiment

When ETH failed to surpass $3,700, Open Interest followed suit and decreased. Over the past 36 hours, this figure has dropped from $10.6 billion to $9.72 billion. The price decline in tandem with a decrease in Open Interest suggested growing bearishness among traders.

Read Ethereum’s [ETH] Price Prediction 2024-25

The downturn in Ethereum’s CVD price continued, although it hasn’t completely reversed the gains achieved since March 8th. It’s important to note that from March 26th to April 8th, Ethereum’s CVD moved downwards. This suggests that Ethereum market participants were not yet fully convinced of a bullish trend, but there was a possibility of a change if ETH managed to surpass the $3,700 threshold.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-04-11 03:03