- Bitcoin’s price hike has pushed spot trading volume to multi-year highs

- Market has seen an influx of new investors this year too

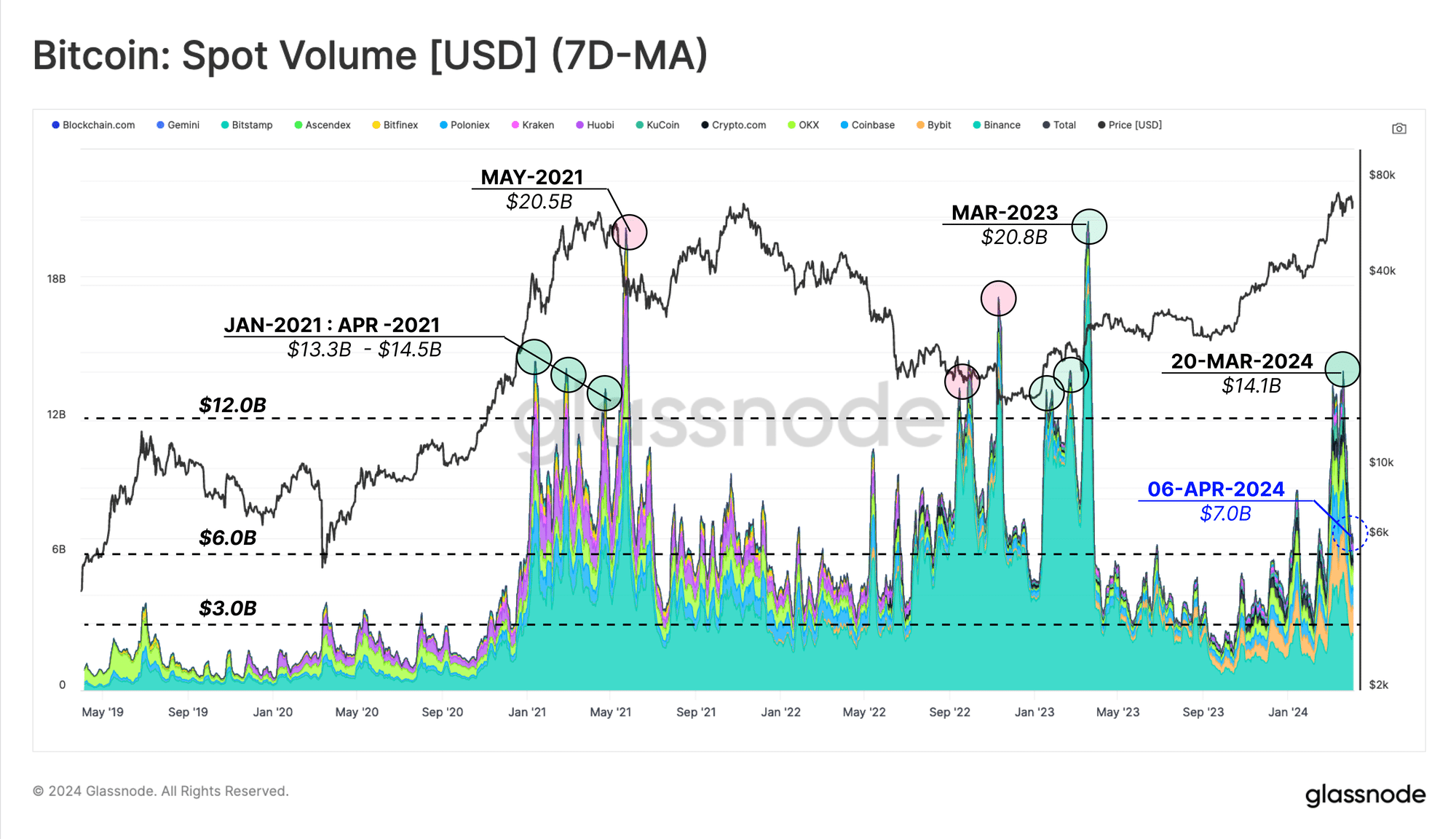

The price surge of Bitcoin (BTC), starting from October 2023, has driven its trading volume to reach levels last seen during the bull market in 2020-2021, based on data from Glassnode.

Based on information from a data source that monitors blockchain transactions, Bitcoin’s price has experienced some setbacks lately, resulting in a minor decrease. However, the coin’s trading volume, representing the number of transactions occurring each day, amounts to approximately $7 billion at present.

According to Glassnode’s analysis, the difference between Bitcoin’s 180-day and 30-day moving averages for trading volume has grown since the market rally started in October 2023. Specifically, the faster moving average has been noticeably higher than the slower one during this period.

This observation from the on-chain data supplier implies that the coin’s robust year-to-date expansion can be attributed to substantial interest in the spot markets.

Additionally, the increase in Bitcoin’s market price has led to a significant rise in the number of coins being bought and sold on cryptocurrency exchanges, according to Glassnode.

On a daily basis, the average exchange flow volume, which includes inflows and outflows, amounts to approximately $8.19 billion nowadays. This figure is noticeably larger than the maximum recorded during the 2020-2021 bull market.

Surge in new demand

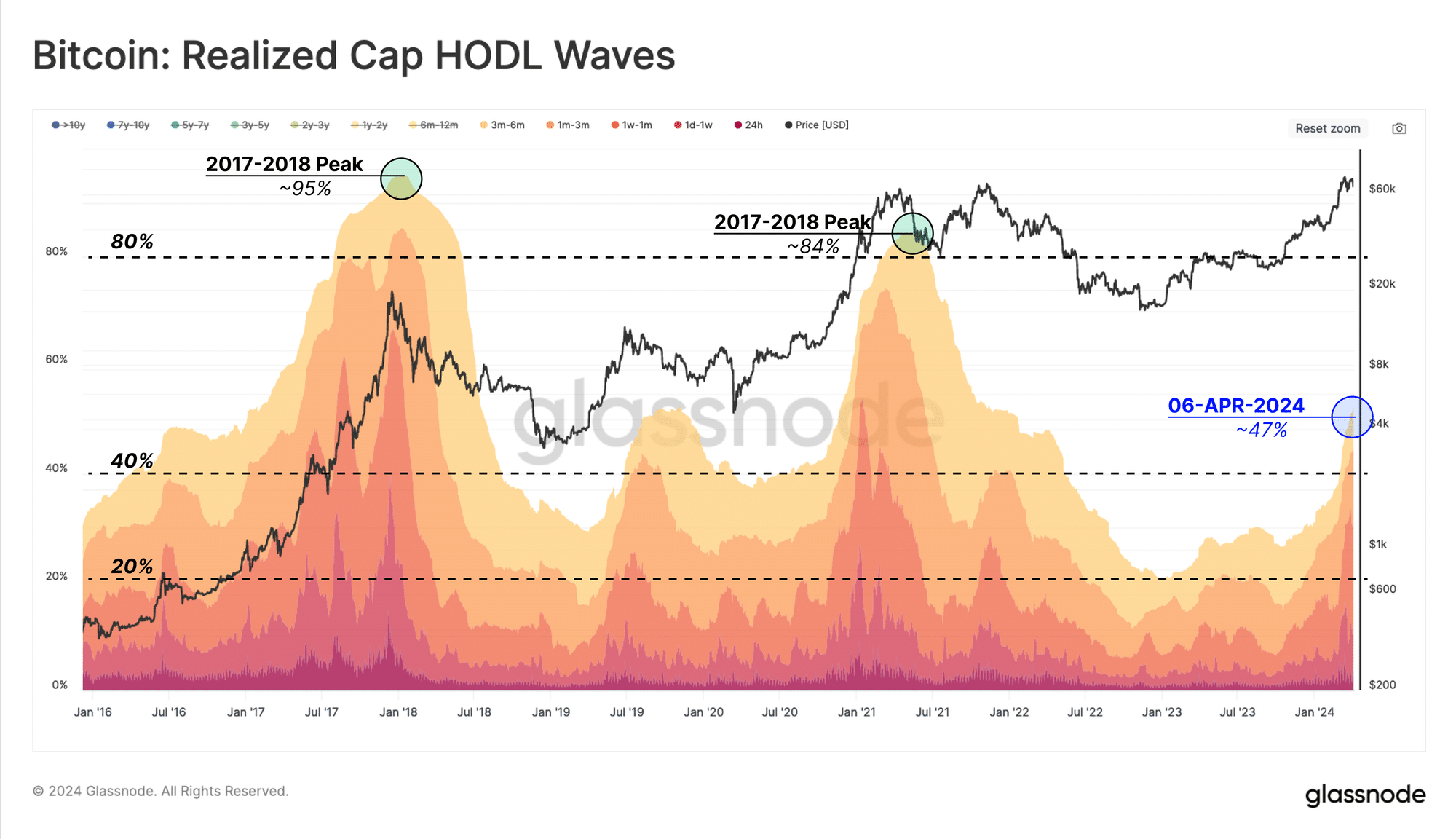

New investors are jumping into the bitcoin market as the current price surge continues, buying up coins that long-term investors are selling in order to secure profits.

According to Glassnode’s analysis, a larger proportion of Bitcoin’s total wealth is now being held by coins that are less than six months old.

Over the past year, the amount of Bitcoin held in addresses less than six months old has noticeably increased, accounting for approximately 47% of the total supply as of now.

Read Bitcoin’s [BTC] Price Prediction 2024-25

According to Glassnode,

Based on this information, it seems that an equal amount of Bitcoin is being held by long-term investors and those buying for the first time.

In conclusion, it’s important to note that Glassnode emphasized the significance of monitoring the actions of new investors since their proportion of the total capital is growing.

Due to the nature of this group of Bitcoin owners, they tend to be more reactive to price changes than long-term investors. They can quickly sell their coins when the price drops below what they originally paid.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-04-11 07:03