BlackRock’s iShares Bitcoin Trust (IBIT) has officially crossed the $80 billion mark in assets under management (AUM), setting a new record for speed in the ETF space. Who knew Bitcoin could be such a fast track to wealth? 🚗💨

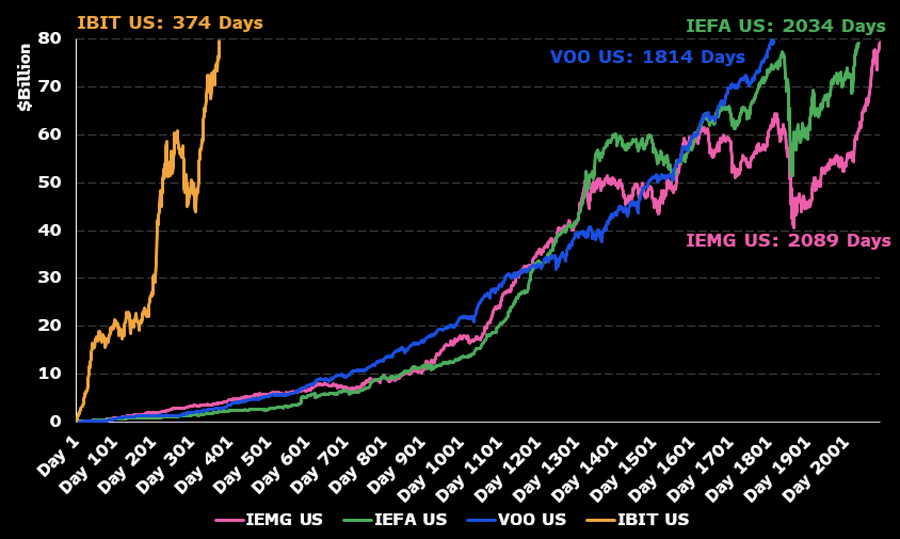

The milestone, reached on July 11, comes just 374 days after the fund’s launch—making IBIT the fastest ETF in history to hit this level. That’s like sprinting to the moon and back in a pair of Crocs. 🚀👟

BlackRock’s Bitcoin ETF Climbs Into World’s Top 25 Funds

Notably, the previous record-holder, Vanguard’s S&P 500 ETF (VOO), took nearly five times longer to reach the same threshold. I guess some things just take a bit more patience, like waiting for a bus in the rain. 🌧️🚌

According to Bloomberg ETF analyst Eric Balchunas, IBIT’s rapid ascent signals a major shift in how investors are accessing Bitcoin. It’s like the crypto world’s version of a viral TikTok dance. 💃🕺

He noted that while the fund attracted over $1 billion in inflows in a single night, much of the recent AUM growth is also due to Bitcoin’s sharp price rally. It’s like the stock market’s version of a Black Friday sale, but with more zeros. 🛍️💰

As of this week, IBIT holds more than 700,000 BTC, which accounts for roughly 3.55% of all Bitcoin in circulation. That’s a lot of digital dough, folks. 🍞

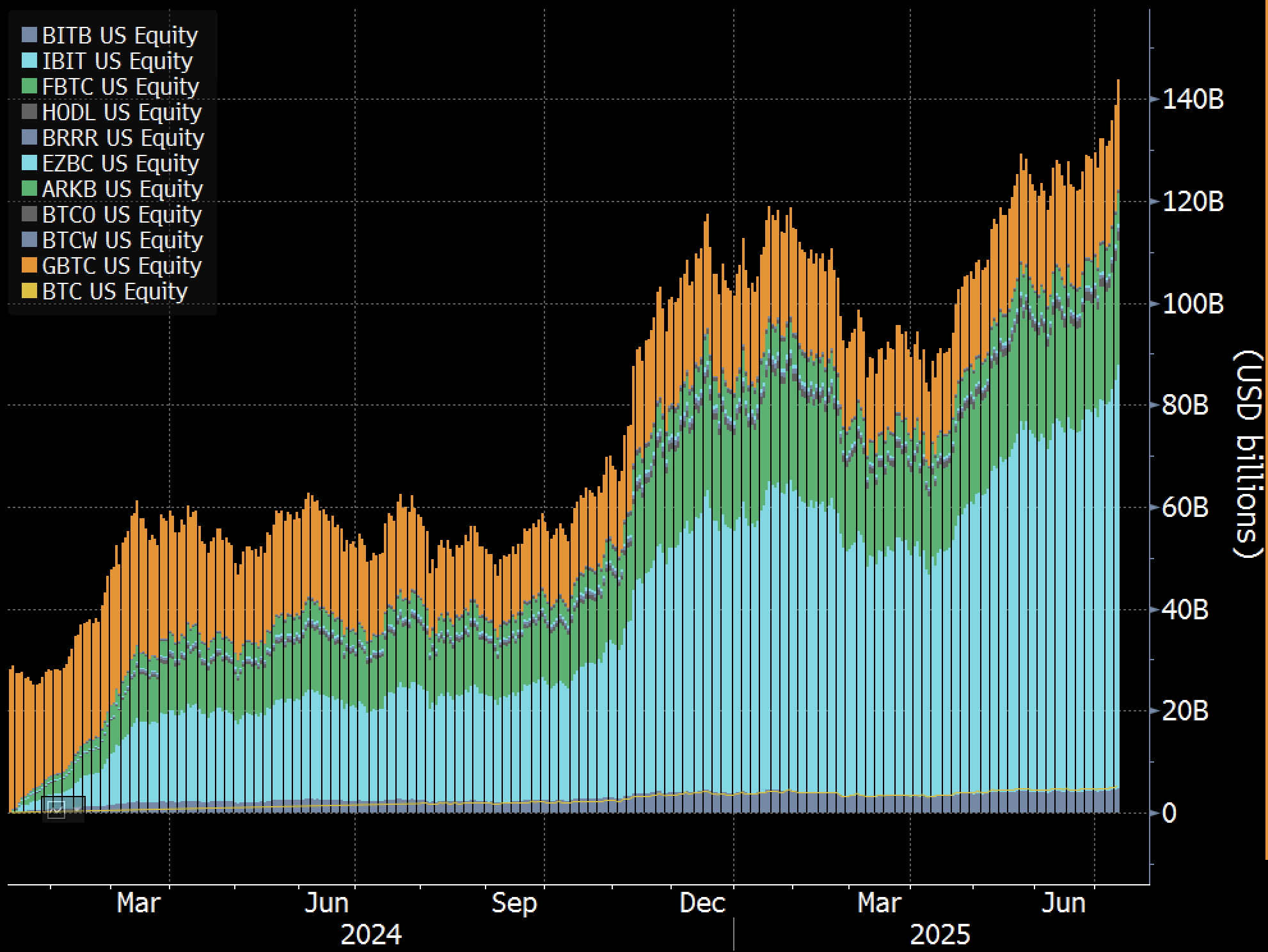

The broader market for US spot Bitcoin ETFs is also seeing record-breaking activity. Total assets held across all US-listed spot Bitcoin ETFs have now surpassed $140 billion for the first time, with IBIT alone representing nearly 59% of that value. It’s like the crypto world’s version of a monopoly, but with more transparency. 🎲📊

This wave of growth has pushed IBIT into the top 25 largest ETFs in the world, ranking it 21st by AUM. Not bad for a fund that’s younger than some of the interns. 🤷♂️👩💻

Data from SoSoValue shows that US spot Bitcoin ETFs have now seen cumulative inflows of more than $50 billion, including $2.7 billion in just the past week. That’s a lot of zeros, even for a math whiz. 🧮💸

Nate Geraci, president of NovaDius Wealth, pointed out that there have been seven days since January when daily inflows exceeded $1 billion, two of them occurring this week. It’s like a crypto gold rush, but with less panning and more clicking. 🏴☠️💻

The success of IBIT and its peers highlights the growing demand for regulated, easy-to-access Bitcoin investment products. For both retail and institutional investors, these ETFs offer a simplified path to Bitcoin exposure without the challenges of self-custody or navigating crypto-native platforms. It’s like having a personal crypto butler, minus the butler. 🧑💼💼

Read More

- Best Controller Settings for ARC Raiders

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- Ashes of Creation Rogue Guide for Beginners

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- 10 Most Brutal Acts Of Revenge In Marvel Comics History

- DC K.O.: Superman vs Captain Atom #1 Uses a Fight as Character Study (Review)

- All Her Fault cast: Sarah Snook and Dakota Fanning star

2025-07-12 14:56