So, it appears that Itaú Asset Management – a perfectly respectable Brazilian bank, and rather a large one at that – has decided to dip a toe into the rather boisterous waters of Bitcoin. Not a full-fledged plunge, mind you. Oh, no. More of a cautious paddle, suggesting investors might, just might, allocate a trifling 1%-3% of their portfolios to the stuff, starting in 2026. It’s a “small, complementary holding,” they assure us. As if one needs a bank to tell one how to be sensible! 🙄

Itaú Backs Small Bitcoin Positions

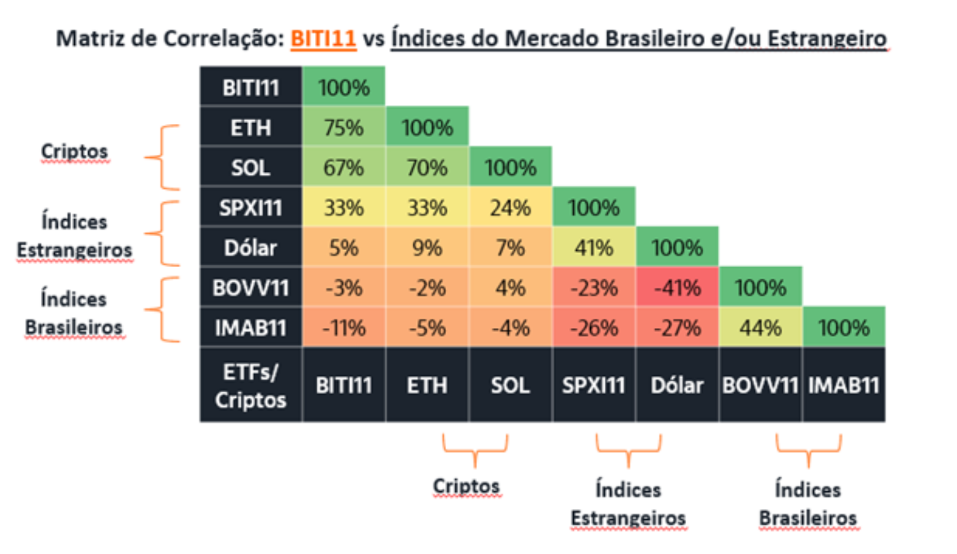

Apparently, Bitcoin doesn’t seem to get chummy with all the usual suspects in the financial world, which is considered a plus. And Brazilian investors have been having a bit of a devilish time with their currency lately, so a dash of something a little… different… might offer a spot of relief. Rather brilliantly, Itaú went and set up a dedicated crypto division in September 2025, staffed by a chap named João Marco Braga da Cunha – a name which, frankly, sounds like a cocktail, not a banker. He’s tasked with helping clients navigate this brave new world of regulated crypto frippery.

Access Through Local Products

Brazilian savers, bless their pragmatic souls, can already get at Bitcoin through something called the IT Now Bloomberg Galaxy Bitcoin ETF (ticker: BITI11 – sounds frightfully modern). It started trading back in 2022, offering a way to dabble without getting one’s hands too dirty. It’s all frightfully well-behaved, alongside unit trusts and pension products, naturally.

Small But Existing Crypto Footprint

Itaú boasts (and who can blame them?) of managing a modest R$850 million in regulated crypto – a pittance compared to their colossal 1 trillion reais under management. Still, it’s a signal, you see. A signal that they’ve noticed the digital rumpus and decided to give it a polite nod. The sort of nod one gives to a distant, slightly eccentric relative.

Market Context And Timing

This whole affair seems to be tied to recent currency wobbles in Brazil. A 1%-3% position is apparently meant to be a little buffer against the shocks. Not exactly a revolution in investment strategy, but then, revolutions are so dreadfully unsettling. Itaú insists it’s a long-term game, not a flippant foray for a quick profit. Good show, that!

What This Means For Investors

The upshot for you, the average investor, is rather simple: don’t go overboard. Keep it small, keep it controlled. A 1% slice won’t exactly transform your fortune, and even 3% remains a “satellite” position, as the chaps in finance like to say. Itaú plans to offer more options as demand flourishes, from sensible low-volatility fluff to riskier ventures. One suspects they’ll be watching with a distinctly calculating glint in their eye. 🧐

Read More

- Best Controller Settings for ARC Raiders

- DCU Nightwing Contender Addresses Casting Rumors & Reveals His Other Dream DC Role [Exclusive]

- Stephen Colbert Jokes This Could Be Next Job After Late Show Canceled

- Ashes of Creation Rogue Guide for Beginners

- Is XRP ETF the New Stock Market Rockstar? Find Out Why Everyone’s Obsessed!

- 7 Home Alone Moments That Still Make No Sense (And #2 Is a Plot Hole)

- 10 X-Men Batman Could Beat (Ranked By How Hard It’d Be)

- The Night Manager season 2 first look trailer delivers explosive return for Tom Hiddleston’s Jonathan Pine

- DC K.O.: Superman vs Captain Atom #1 Uses a Fight as Character Study (Review)

- Metroid Prime 4: Beyond Gets Rated T by ESRB for Release in North America

2025-12-15 03:15