- Bearish sentiment retained its dominance in Bitcoin’s market

- King coin might fall to $64k before another rally

The price of Bitcoin (BTC) dropped significantly over the past day due to turbulence in conventional markets and heightened geopolitical tensions. This development is significant because Bitcoin’s next reduction in reward for miners, known as halving, is set to occur within the next few days.

Despite the current setback, investors can remain optimistic since the cryptocurrency may bounce back on the price graphs fairly soon.

Bitcoin’s chart turns red

Based on data from CoinMarketCap, Bitcoin experienced a decline of over 5% in value within the past 24 hours. Currently, its price hovers around $67,241.90. Its market capitalization exceeds $1.32 trillion.

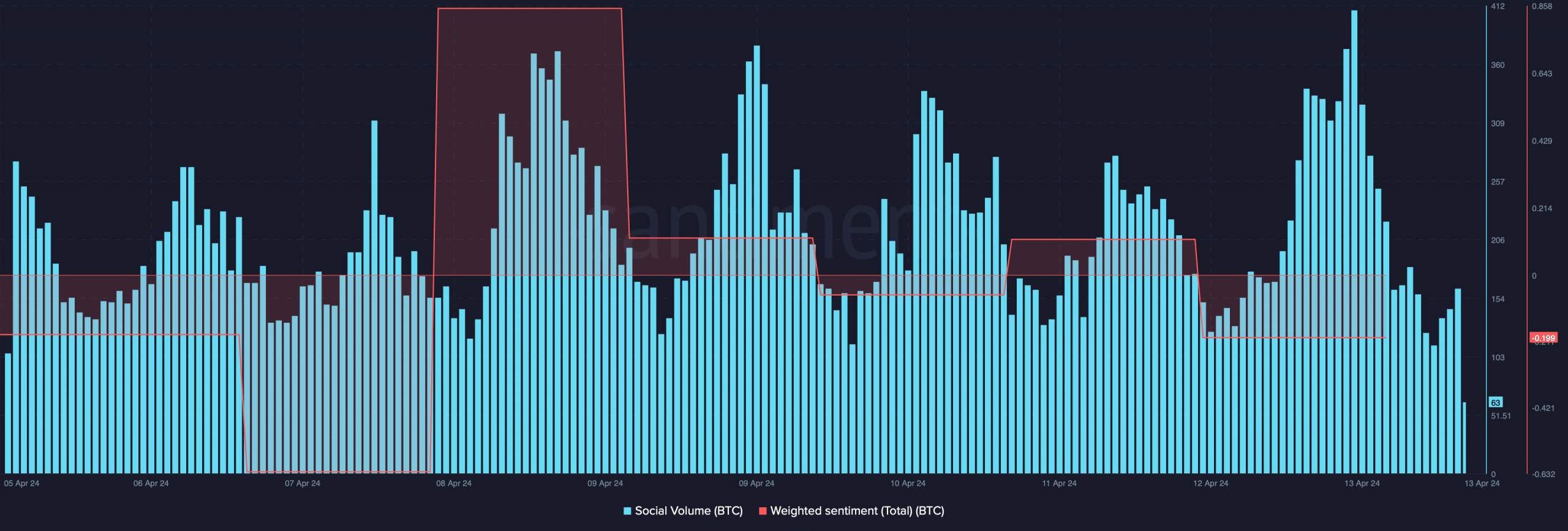

In the cryptocurrency world, Bitcoin’s price drop became a hot topic of conversation. This was evident in the increased social media chatter about it. Nevertheless, the sentiment analysis chart for Bitcoin showed predominantly negative feelings among investors, indicating that pessimism ruled the market.

However, the aforementioned correction might just be a deception.

Captain Faibik, a well-known cryptocurrency expert, recently posted on Twitter about an intriguing development. According to this update, Bitcoin’s price is continuing to follow a bullish trend. If Bitcoin manages to surge past this trend, it could potentially reach a new all-time high within the next few weeks. However, prior to that occurrence, there’s a possibility that Bitcoin’s price will dip back down to $66k.

Will BTC recover soon?

AMBCrypto’s look at Bitcoin’s metrics revealed that BTC might fall further in the short term.

Based on our examination of CryptoQuant’s statistics, we found that the crypto had a larger than usual inflow of funds into exchanges over the past week. Furthermore, its exchange reserves were growing rapidly, indicating strong selling activity.

Moreover, Bitcoin’s average rate of return to shareholders (aSORP) was showing red, implying that more investors had been cashing out their profits. Furthermore, the Net Unrealized Profit and Loss (NULP) indicated that investors were in the “confident” or “optimistic” phase, where they held significant unrealized gains. These indicators suggested a potential for continued price decline.

Based on our examination of Hyblock Capital’s figures, if the downward trend persists, Bitcoin’s price could drop to around $66k or $64k. Once Bitcoin reaches this point, there is a strong possibility it will bounce back if it retests the bullish pattern visible in its chart. Conversely, if Bitcoin does not retest this pattern, investors may witness further decline, potentially down to $57k.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The halving effect

Although some indicators showed warning signs for Bitcoin, it holds a hidden advantage that could potentially reverse the trend. In approximately a week, Bitcoin is set to undergo its next halving event. During this process, the production of new Bitcoins will be reduced. This decrease in supply might lead to an increase in demand and subsequently boost Bitcoin’s price.

An extra effect of the occurrence is it may provoke optimistic attitudes towards the cryptocurrency, potentially contributing to Bitcoin’s bounce-back in the near future.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-04-14 06:15