What to know: 🧐

By Francisco Rodrigues (All times ET, unless the clock decides otherwise 🕰️)

Ah, Bitcoin! That fickle darling of the digital realm, hath risen above $88,000, despite the Bank of Japan’s audacious rate hike-a move so bold, it would make even the most stoic economist blush. 🌸💸 Yet, lo and behold, the yen weakened, as if it had stumbled upon a banana peel in the grand theater of finance. Why, you ask? Fear not, dear reader, for it seems Prime Minister Sanae Takaichi’s spending plans are in peril, much like a poorly scripted tragedy. 🎭

Meanwhile, the 10-year Japanese government bond yield touched 2% for the first time since 2006-a feat as rare as a unicorn at a tax audit. 🦄📈

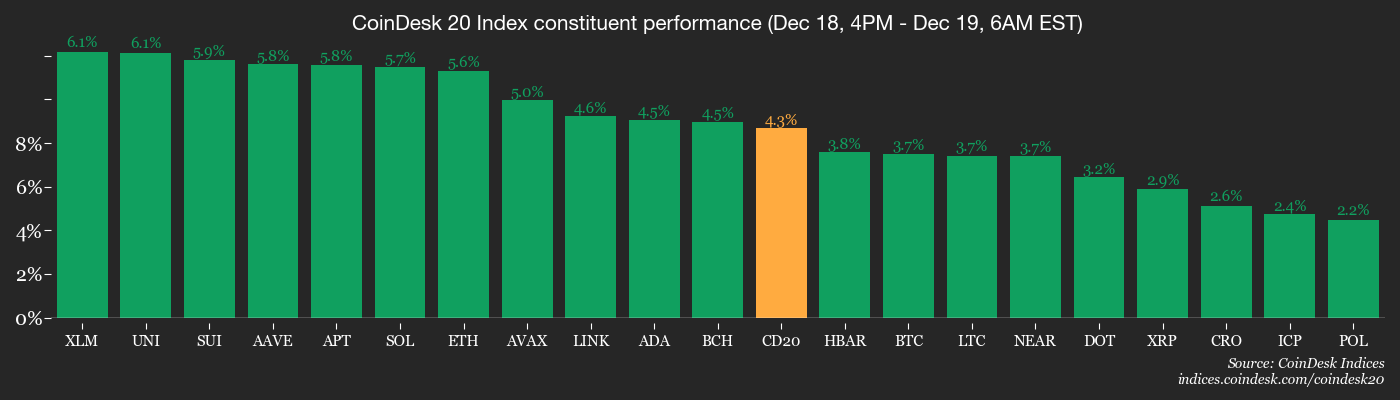

Other cryptocurrencies, not to be outdone, joined the fête. Ether pranced with a 3.4% gain, while BNB and SOL tiptoed with less than 1%. The CoinDesk 20 (CD20) index, ever the wallflower, advanced a modest 1.3%. 🕺💃

In the background, U.S. inflation data played the role of the unexpected guest, cooler than a cucumber at a summer picnic. This hath strengthened the whispers of a Federal Reserve rate cut, a potential boon for risk assets. Yet, prediction markets remain as stubborn as a mule, pointing to no rate cut next month. 🐌🤷♂️

But beware, for the AI trade looms like a tempest in a teapot. “Capital flows into AI infrastructure with the fervor of a lover,” quoth the analysts at QCP Capital, “yet monetization questions grow sharper than a wit in a Molière play.” Oracle and Iren, those grand players, ramp up spending, while revenues remain as flat as a pancake at a diet convention. 🥞💼

Should revenues fail to materialize, risk-asset valuations may plunge faster than a courtier’s reputation at Versailles. Several crypto firms, however, bask in the AI glow, especially bitcoin miners pivoting into AI infrastructure with multibillion-dollar deals. 🤑🤖

Regulatory winds also blow favorably. “The GENIUS Act’s regulatory architecture shall solidify in 2026,” proclaimeth Ira Auerbach, head of Tandem at Offchain Labs. Stablecoin issuers, once adrift in offshore regimes, now find solace on U.S. soil. 🇺🇸📜

And lo, retirement-plan providers prepare to test target-date funds with crypto exposure-a mere 0.5% to 1%, yet enough to stir the pot. “Digital assets, once a swing factor, now join the long-horizon portfolio,” Auerbach adds. “Structural demand begins to take shape, like a well-crafted sonnet.” 📈✍️

What to Watch 👀

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”. 📅

Token Events 🎟️

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”. 📅

Conferences 🎤

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”. 📅

- Nothing scheduled. 🦗

Market Movements 📊

- BTC is up 2.91% from 4 p.m. ET Wednesday at $88,092.82 (24hrs: +0.73%) 🚀

- ETH is up 6.82% at $2,969 (24hrs: -3.87%) 🌕

- CoinDesk 20 is up 3.33% at 2,707.79 (24hrs: +1.22%) 📈

- Ether CESR Composite Staking Rate is down 1 bp at 2.86% ⬇️

- BTC funding rate is at 0.01% (10.95% annualized) on Binance 📉

- DXY is up 0.23% at 98.65 📈

- Gold futures are unchanged at $4,360.50 🏆

- Silver futures are up 1.73% at $66.35 ✨

- Nikkei 225 closed up 1.03% at 49,507.21 📊

- Hang Seng closed up 0.75% at 25,690.53 📈

- FTSE is down 0.10% at 9,828.28 📉

- Euro Stoxx 50 is unchanged at 5,745.04 😐

- DJIA closed on up 0.14% at 47,951.85 📈

- S&P 500 closed up 0.79% at 6,774.76 🚀

- Nasdaq Composite closed up 1.38% at 23,006.36 🌟

- S&P/TSX Composite closed up 0.61% at 31,440.85 📈

- S&P 40 Latin America closed up 1.15% at 3,093.49 🎉

- U.S. 10-Year Treasury rate is up 2.9 bps at 4.145% 📈

- E-mini S&P 500 futures are up 0.27% at 6,849.00 📊

- E-mini Nasdaq-100 futures are up 0.4% at 25,363.25 🚀

- E-mini Dow Jones Industrial Average Index futures are unchanged at 48,356.00 😐

Bitcoin Stats 🔢

- BTC Dominance: 59.94% (+0.13%) 👑

- Ether-bitcoin ratio: 0.03347 (1.19%) ⚖️

- Hashrate (seven-day moving average): 1,031 EH/s 💪

- Hashprice (spot): $37.57 💰

- Total fees: 2.74 BTC / $237,800 🧾

- CME Futures Open Interest: 120,865 BTC 📜

- BTC priced in gold: 20.3 oz. 🏅

- BTC vs gold market cap: 5.9% 📊

Technical Analysis 📐

- BTC/USD is currently wedged between the $84,200 support and $90,500 weekly resistance. The 0.382 Fibonacci level sits lower at $84,200, yet the price holds above it, supported by a bullish RSI divergence-momentum rises despite consolidation. 📈✨

- A decisive weekly close above $90,500 would validate this divergence, likely triggering a trend continuation toward the 0.236 Fibonacci target at $100,400. 🚀🎯

Crypto Equities 💼

- Coinbase Global (COIN): closed on Thursday at $239.20 (-2.04%), +3.24% at $246.94 in pre-market 📉📈

- Circle (CRCL): closed at $80.99 (+2.26%), +3.04% at $83.45 📈

- Galaxy Digital (GLXY): closed at $22.51 (-1.32%), +3.07% at $23.20 📉📈

- Bullish (BLSH): closed at $42.88 (+1.73%), +1.28% at $43.43 📈

- MARA Holdings (MARA): closed at $9.69 (-2.42%), +2.68% at $9.95 📉📈

- Riot Platforms (RIOT): closed at $13.38 (+3.24%), +3.21% at $13.81 📈

- Core Scientific (CORZ): closed at $14.56 (+7.3%), +3.71% at $15.10 🚀

- CleanSpark (CLSK): closed at $11.20 (-2.44%), +3.66% at $11.61 📉📈

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $37.49 (+2.68%) 📈

- Exodus Movement (EXOD): closed at $15.21 (+4.61%) 📈

Crypto Treasury Companies 🏛️

- Strategy (MSTR): closed at $158.24 (-1.33%), +3.71% at $164.11 📉📈

- Semler Scientific (SMLR): closed at $17.11 (+1.06%) 📈

- SharpLink Gaming (SBET): closed at $9.02 (-2.7%), +5.1% at $9.48 📉📈

- Upexi (UPXI): closed at $1.88 (+0.53%) 📈

- Lite Strategy (LITS): closed at $1.35 (-1.46%) 📉

ETF Flows 💸

Spot BTC ETFs

- Daily net flows: -$161.3 million 📉

- Cumulative net flows: $57.55 billion 📈

- Total BTC holdings ~1.31 million 🏦

Spot ETH ETFs

- Daily net flows: -$96.6 million 📉

- Cumulative net flows: $12.54 billion 📈

- Total ETH holdings ~6.15 million 🏦

Read More

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- Best Controller Settings for ARC Raiders

- Gold Rate Forecast

- Resident Evil Requiem cast: Full list of voice actors

- Best Thanos Comics (September 2025)

- PlayStation Plus Game Catalog and Classics Catalog lineup for July 2025 announced

- The 10 Best Episodes Of Star Trek: Enterprise

- Best Shazam Comics (Updated: September 2025)

- How to Build a Waterfall in Enshrouded

2025-12-19 15:46