- Bitcoin’s bullish price trajectory ensures profitability amid challenges

- Halving could cause supply shock, driving volatility and price rise

In the year 2024, Bitcoin (BTC) has shined exceptionally, fueled by the introduction of ETFs and marked by its fourth halving event. Moreover, miner conduct has undergone a noticeable transformation as well.

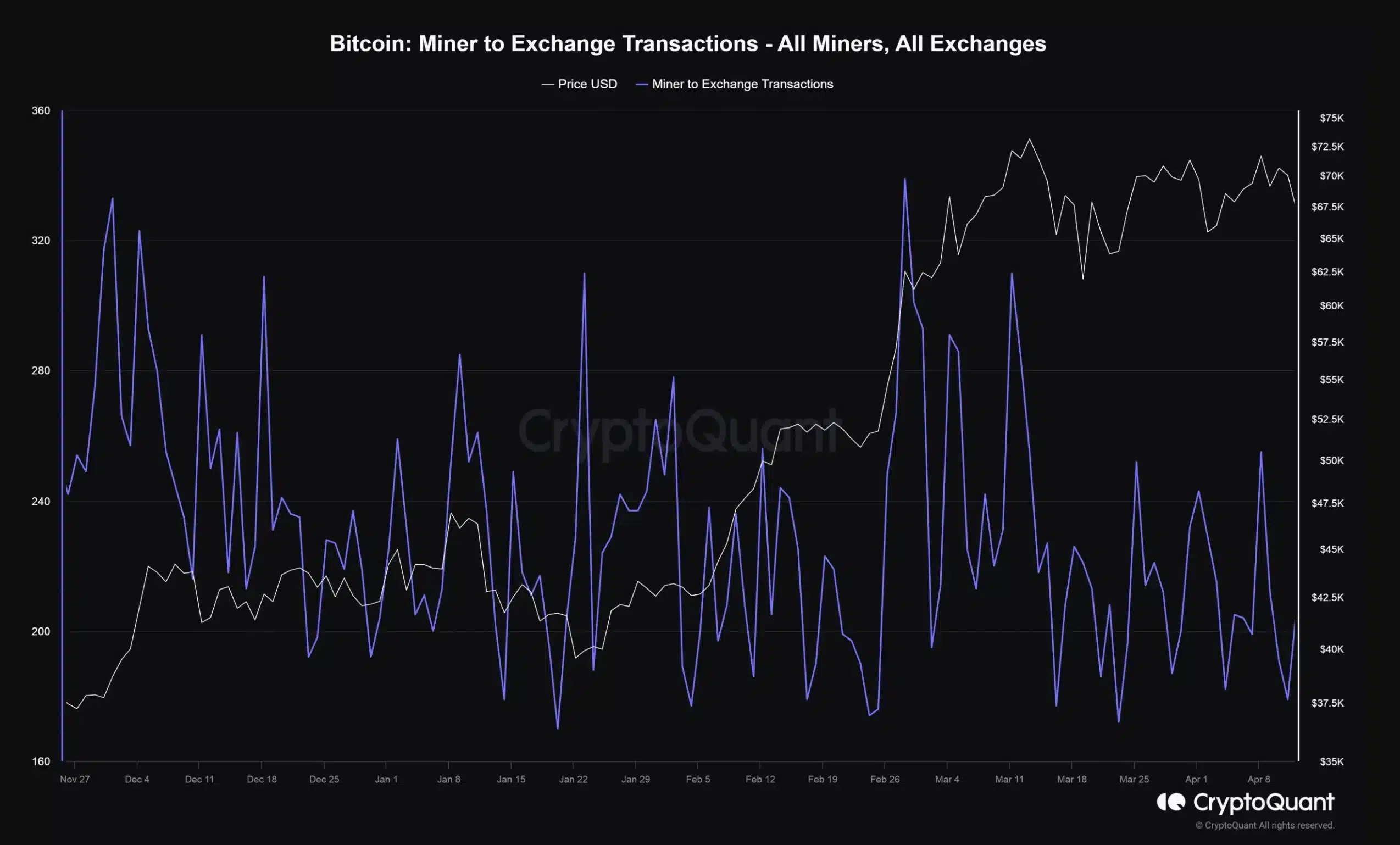

More recently, information from CryptoQuant’s researchers indicates that miners have been transferring around 374 Bitcoin to trading platforms each day for the past month. This figure is significantly lower than the typical daily amount seen in February.

How will Bitcoin’s halving affect miners?

Some people may argue that the Bitcoin halving is a disaster for miners, but according to Adam Sullivan, CEO of Core Scientific, this isn’t necessarily true.

“Bitcoin halving is not the Armageddon moment for us.”

He added,

Today, when Bitcoin surpasses $60,000, most mining machines will continue operating as they’re profitable. Previously during the halving, these machines managed to remain profitable.

In simpler terms, many mining companies are financially strong enough to weather temporary losses in profitability following the halving event. However, smaller and less efficient miners could encounter struggles post-halving, potentially leading to consolidation within the industry.

Is there potential for a supply shock?

Mark Yusko, the Founder of Morgan Creek Capital Management, holds a different perspective. According to him, the Bitcoin halving could be more impactful than many anticipate, bringing about a substantial reduction in the cryptocurrency’s supply.

In simpler terms, I believe the upcoming halving will have a more significant effect than many expect, and its implications may not yet be fully reflected in Bitcoin’s current price. The recent all-time high was primarily driven by increased demand rather than the upcoming halving event itself.

He added,

When the “having” (referring to a specific event or situation) takes place, miners may overlook the fact that they’ll still face struggles since their expenses remain constant while rewards decrease. Consequently, this will lead to a sudden and significant increase in supply.

In an independent conversation, Dan Dolev, the Managing Director at Mizuho Securities, shared his perspective that the halving event might lead to a wave of selling after the news has been announced.

@BobLoukas was quick to refute this though, stating,

“‘The halving is not priced in.Totally False.”

Bitcoin’s future outlook

In spite of doubts and uncertainty leading up to its halving, Bitcoin saw significant demand afterwards, resulting in a 3.26% increase in its value. As David Alderman, an analyst for Digital Assets at Franklin Templeton, explained.

“As the price goes up, I think the noise is going up a lot more.”

Intriguingly, Bitcoin has followed its traditional trend and increased in value after the halving event, even with continuing geopolitical conflicts.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

- Is Trump’s Presidency a Game Changer for the US Dollar and Bitcoin?

2024-04-20 18:15