-

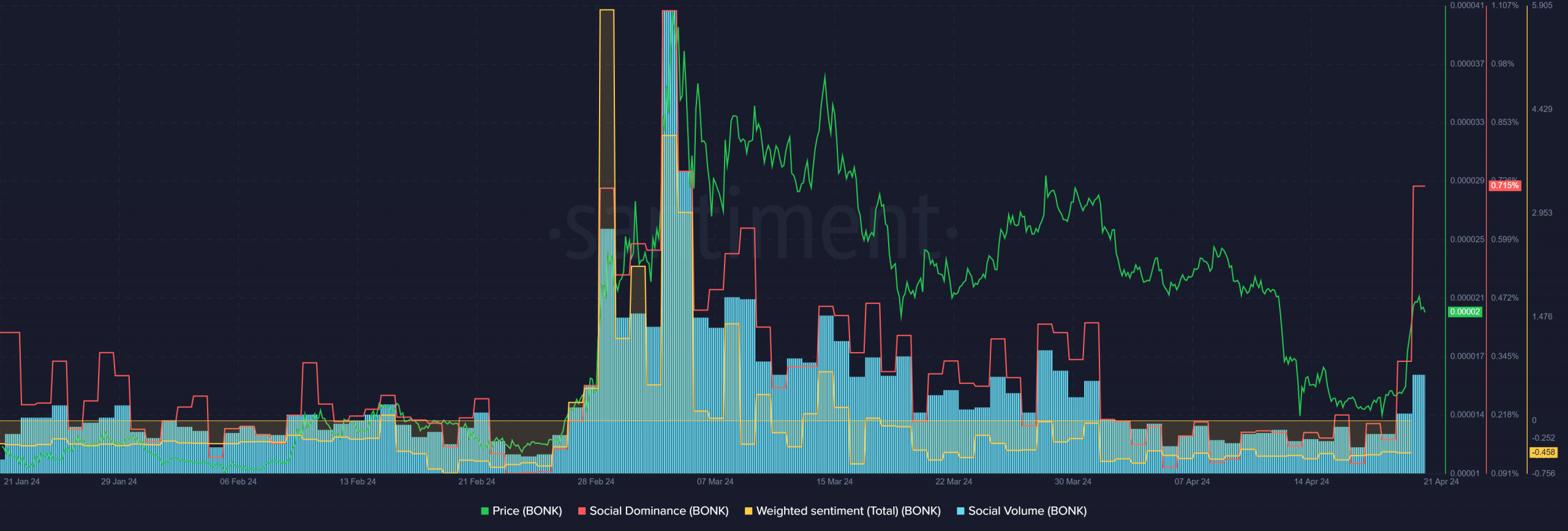

BONK saw social metrics expand as prices soared higher in the past two days.

The 78.6% Fibonacci level was a make-or-break level.

Over the weekend, the popularity of BONK, the memecoin, experienced a significant increase, soaring fivefold in just two days. According to AMBCrypto’s interpretation of Santiment data, this surge in interest was driven by market participants, although not all of it was favorable.

A current AMBCrypto analysis indicated that BONK experienced a significant increase in trading activity and price, up 67.7% from its April 19th lows. Could this be a sign that the bulls have regained control?

The weighted sentiment stayed resolute

When BONK prices surged from $0.000014 to $0.0000214 during that period, there was a significant uptick in social media chatter about it. This heightened social activity resulted in a substantial rise in social dominance, which grew from 0.165% on the 19th to an impressive 0.715% on the 21st – almost a fivefold increase.

Despite the temporary price rise, the predominant feeling towards BONK on social media continued to be negative. This suggested that the community’s faith in the memecoin was still lacking.

Speculators’ enthusiasm for BONK drove up Open Interest from $130 million to $219 million as prices surged. This increase indicated that many traders wanted to seize profits and held optimistic, short-term views on the stock.

At the rally, the funding rate turned out to be negative. Furthermore, a large number of short positions were forced to close during the price surge, contributing to the rise in value.

Is the rally organic, and where should buyers enter if it is?

Over the last two days, the trading volume has significantly increased. Consequently, while it’s plausible that the derivatives market influenced price rises, the heightened trading activity was also a contributing factor. There’s a chance that bulls could initiate a rebound.

The CMF was at +0.25 at press time and signaled significant capital flow into the market.

Realistic or not, here’s BONK’s market cap in BTC’s terms

The RSI also pushed back above the neutral 50 mark to show bullish momentum.

If the bullish trend persists, the 78.6% Fibonacci level could act as a significant support for the market, just as it did during mid-March. Maintaining this position is essential for the buyers to keep their advantage.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Flight Lands Safely After Dodging Departing Plane at Same Runway

2024-04-22 10:15