Last year’s crypto report for 2023, as well as our own observations, revealed that Bitcoin experienced significant expansion. The overall crypto market, in turn, underwent a phase of revival.

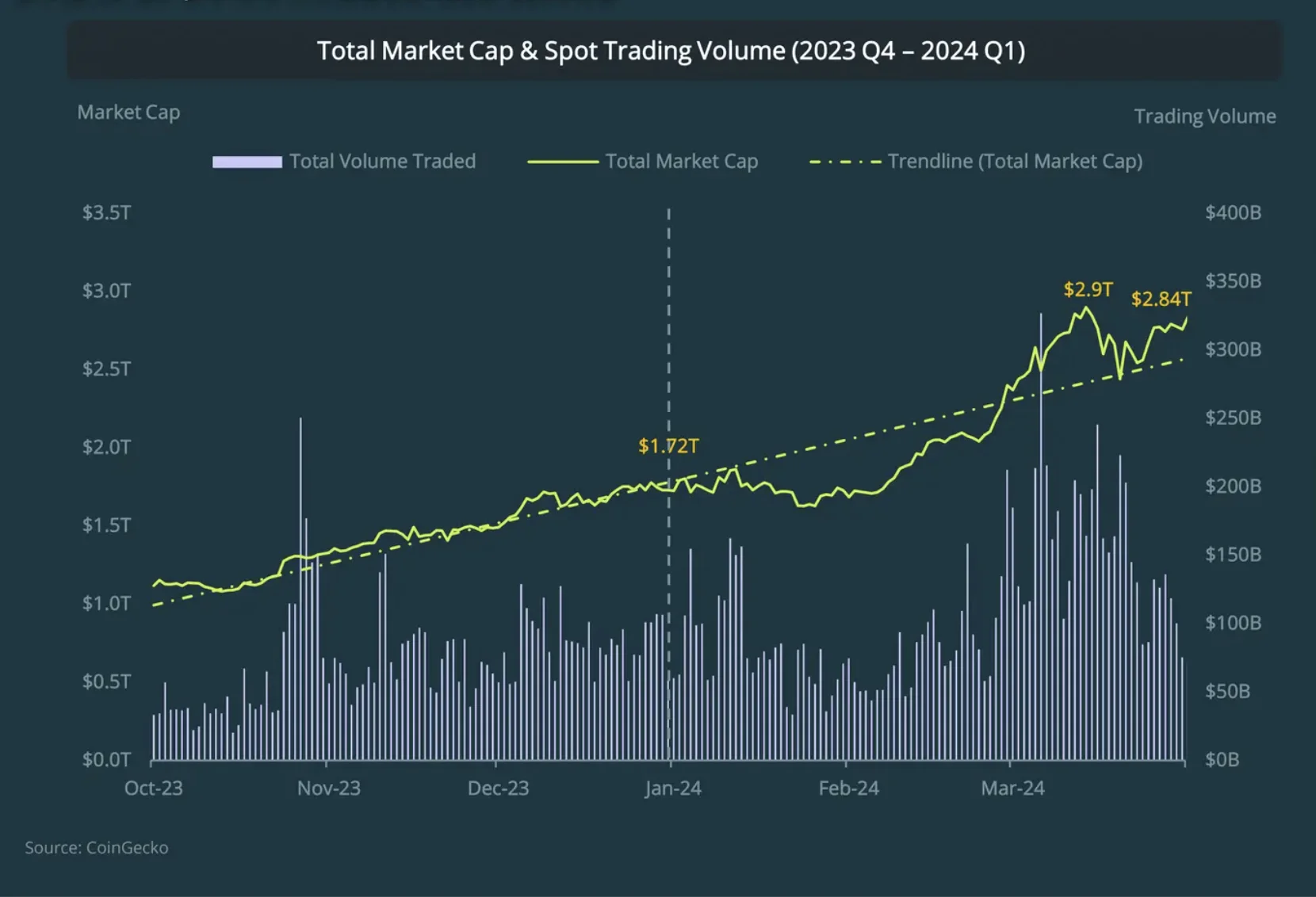

Moving forward, let’s examine some significant happenings in Q1, 2024, which served as a strong foundation for various cryptocurrencies. Consequently, the total market capitalization surged by approximately +64.5%, peaking at an impressive $2.9 trillion on March 13.

What makes this significant? The expansion in this quarter has almost doubled the size recorded in Q4, 2023. A pivotal factor contributing to this surge was the approval of the Bitcoin ETF earlier in the year. Consequently, Bitcoin hit a fresh record high in March. However, this is only the beginning.

The beginning of 2024 showed promising signs, yet there’s room for improvement. Let’s keep an eye on its progression, as Bobby Ong, the Co-Founder & COO at CoinGecko, noted.

In the year 2024, crypto has made a robust beginning with the endorsement of US Bitcoin Spot ETFs and the eagerness surrounding Bitcoin Halving.

Despite ongoing international political and economic uncertainties, we remain hopeful that the industry will continue to advance and introduce fresh products for consumers.

With the help of CoinGecko’s quarterly report, we’re bringing attention to the key occurrences and influences from Q1, 2024. This information will aid you in setting effective trading plans and beginning your journey on a successful note.

5 Highlights of Q1 2024 Crypto Highlights

- Bitcoin reached a new all-time high in March, representing a growth of +68.8% in Q1;

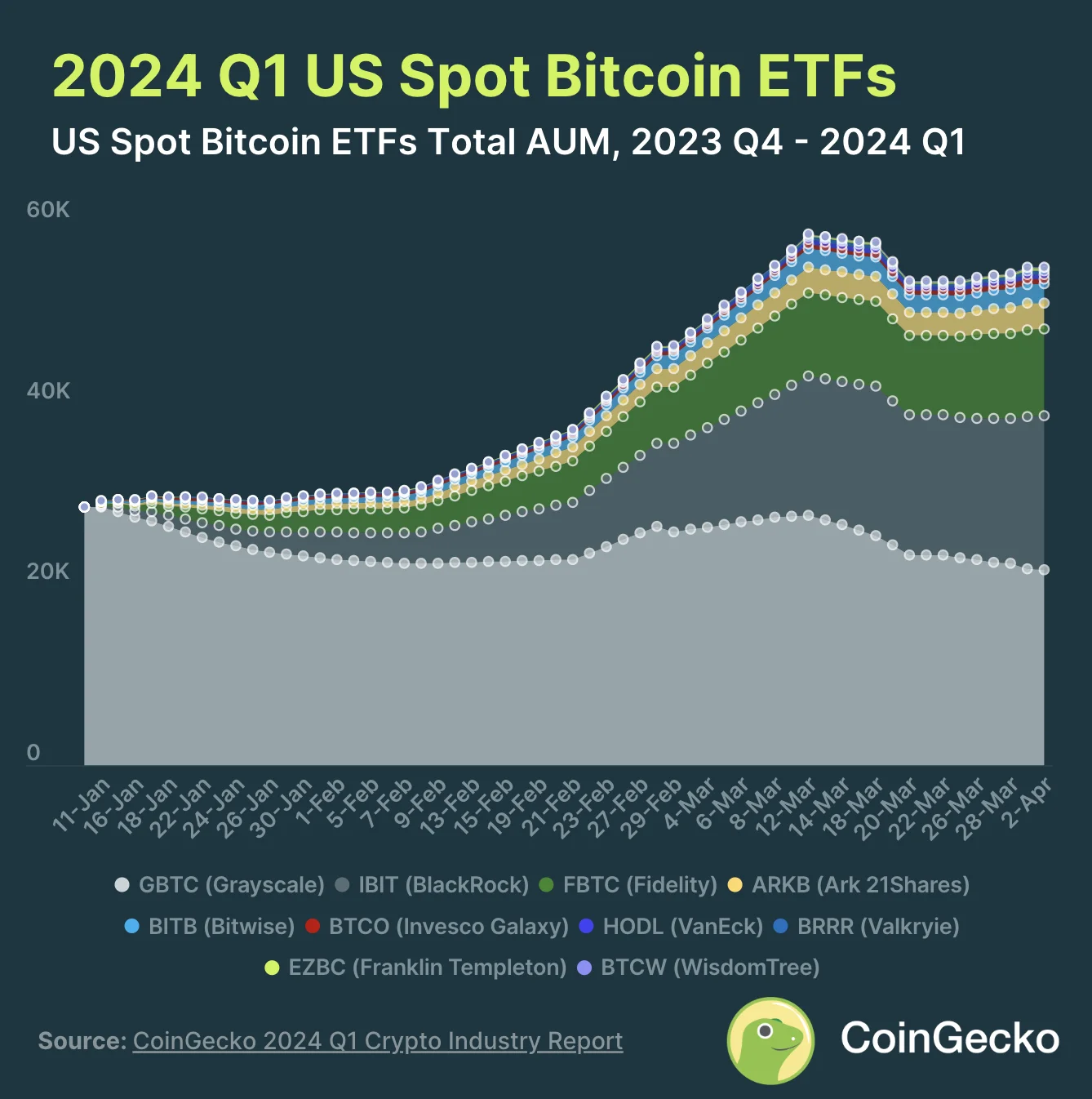

- By April 2, US Spot Bitcoin ETFs had over $55.1B worth of assets under management;

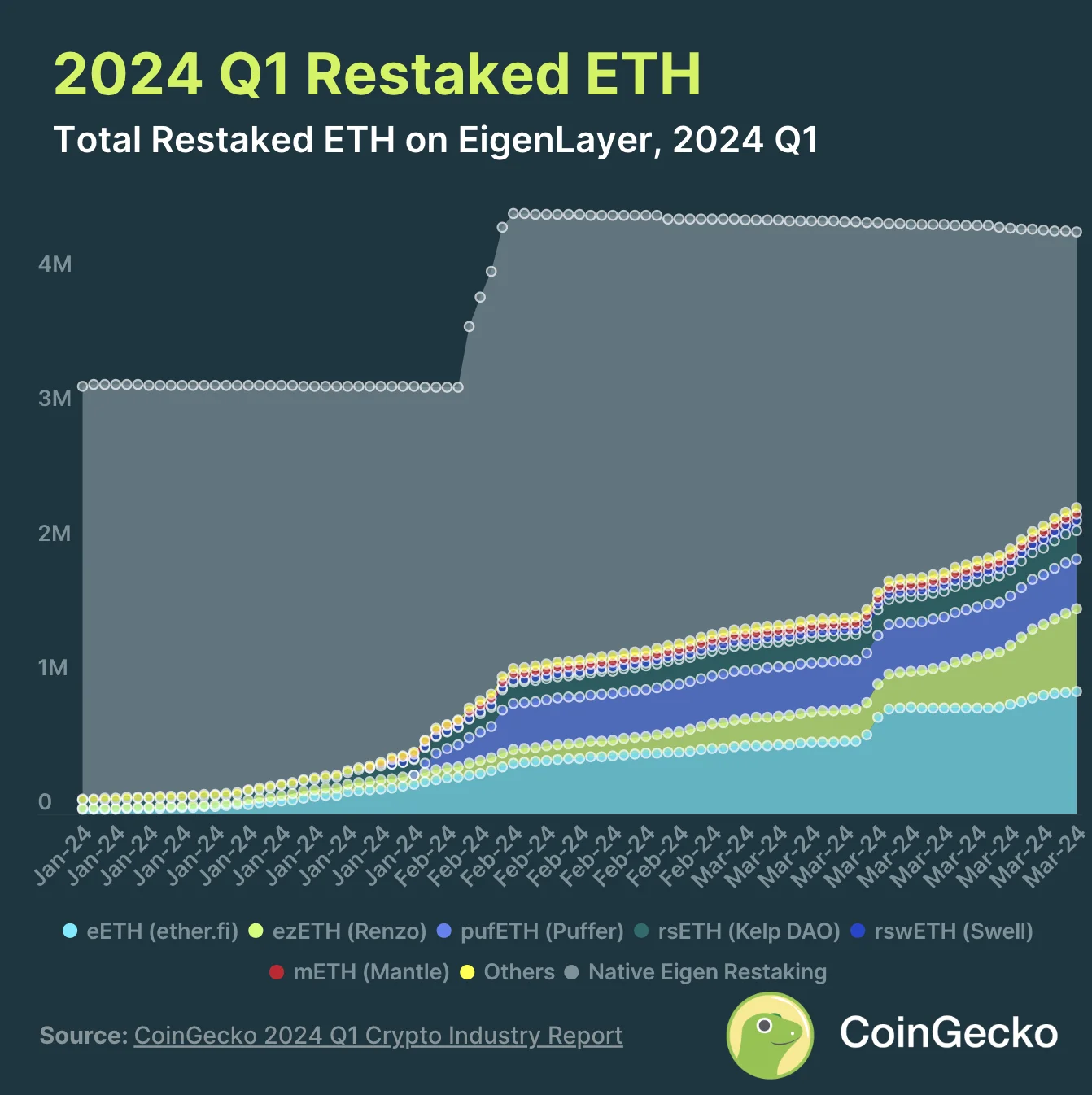

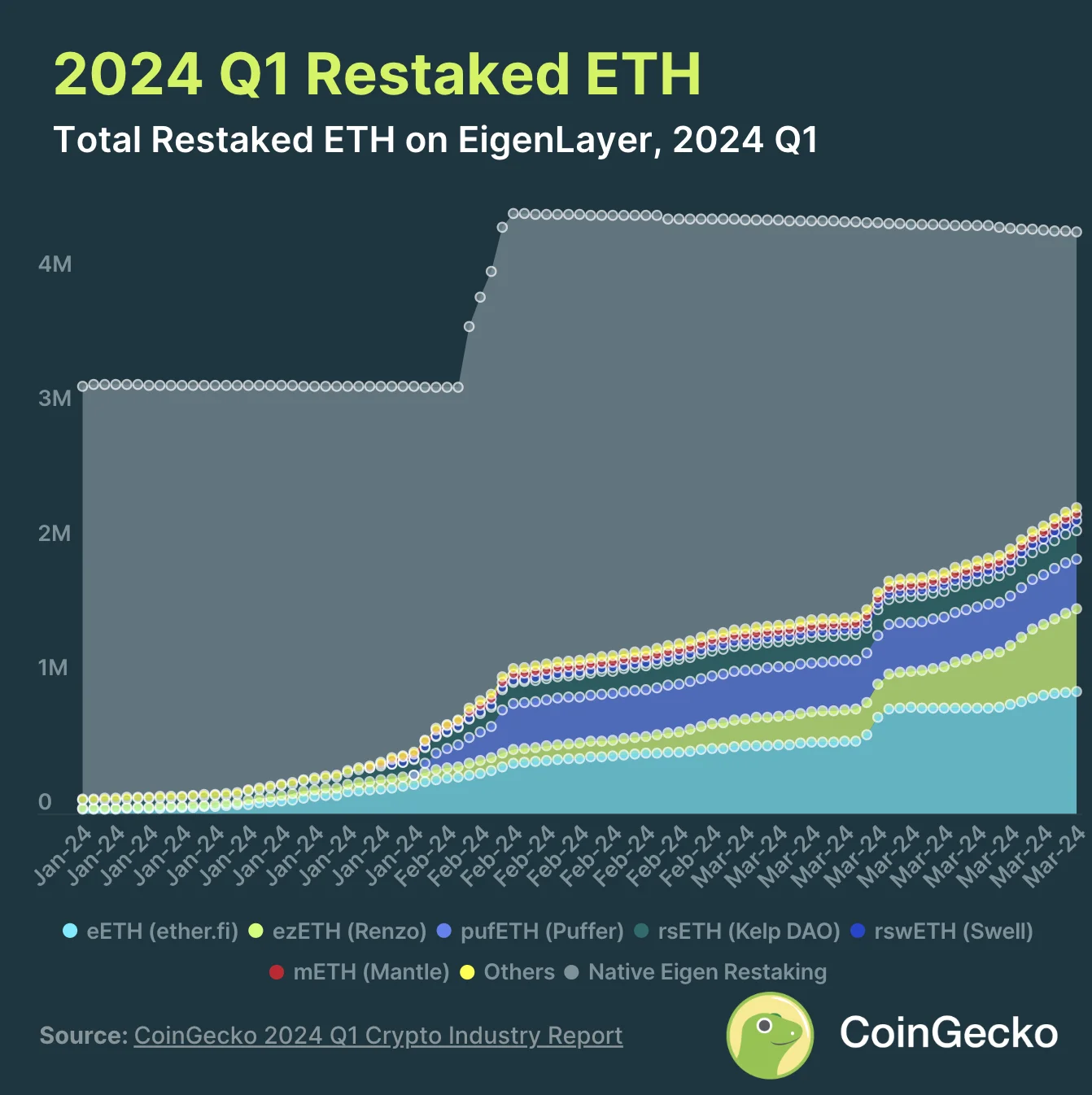

- Ethereum’s restaking on EigenLayer has reached an impressive quarterly growth of 36%;

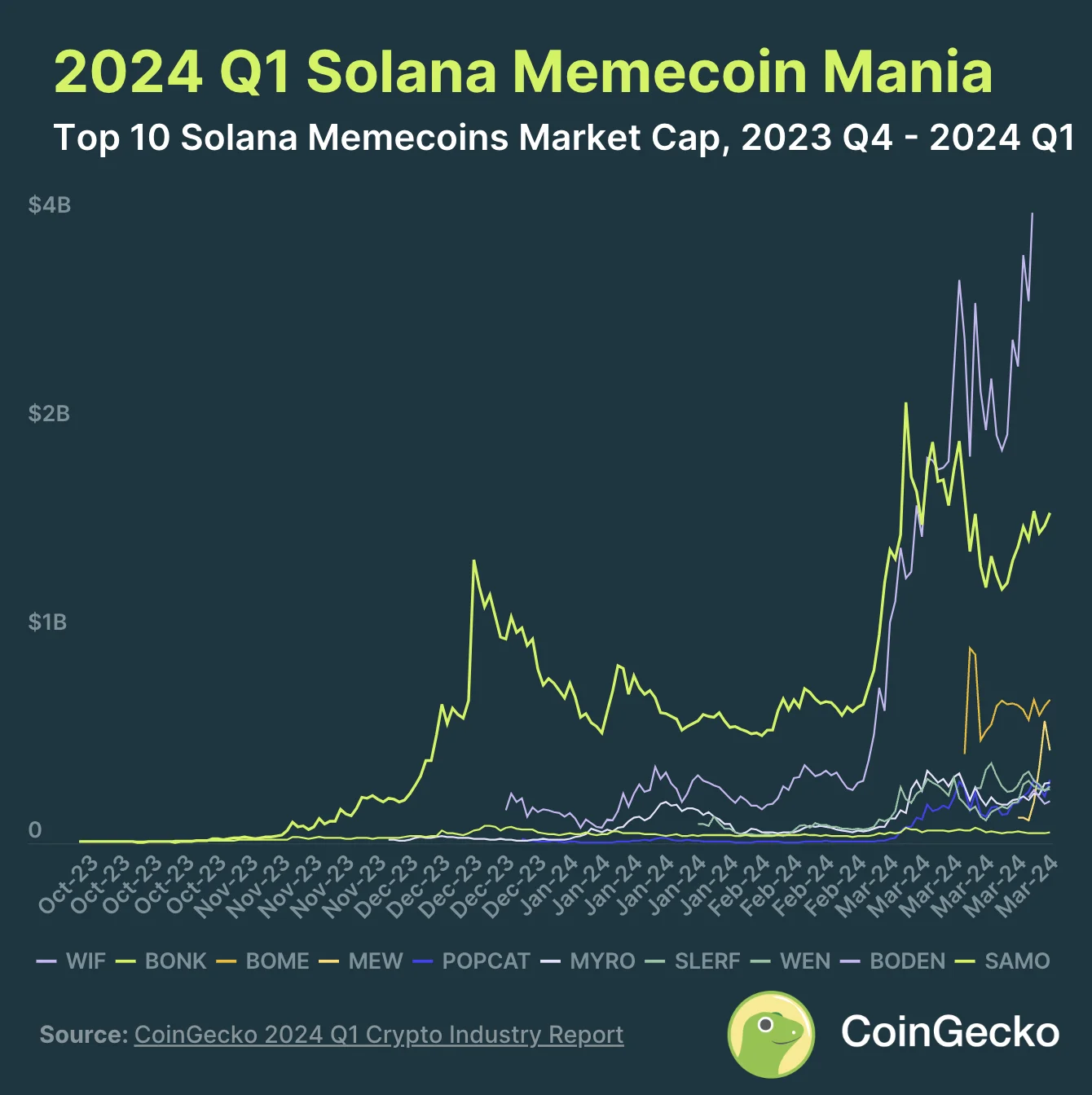

- Solana-based meme coins skyrocketed in Q1, and it’s top 10 reached a market cap of $8.32B;

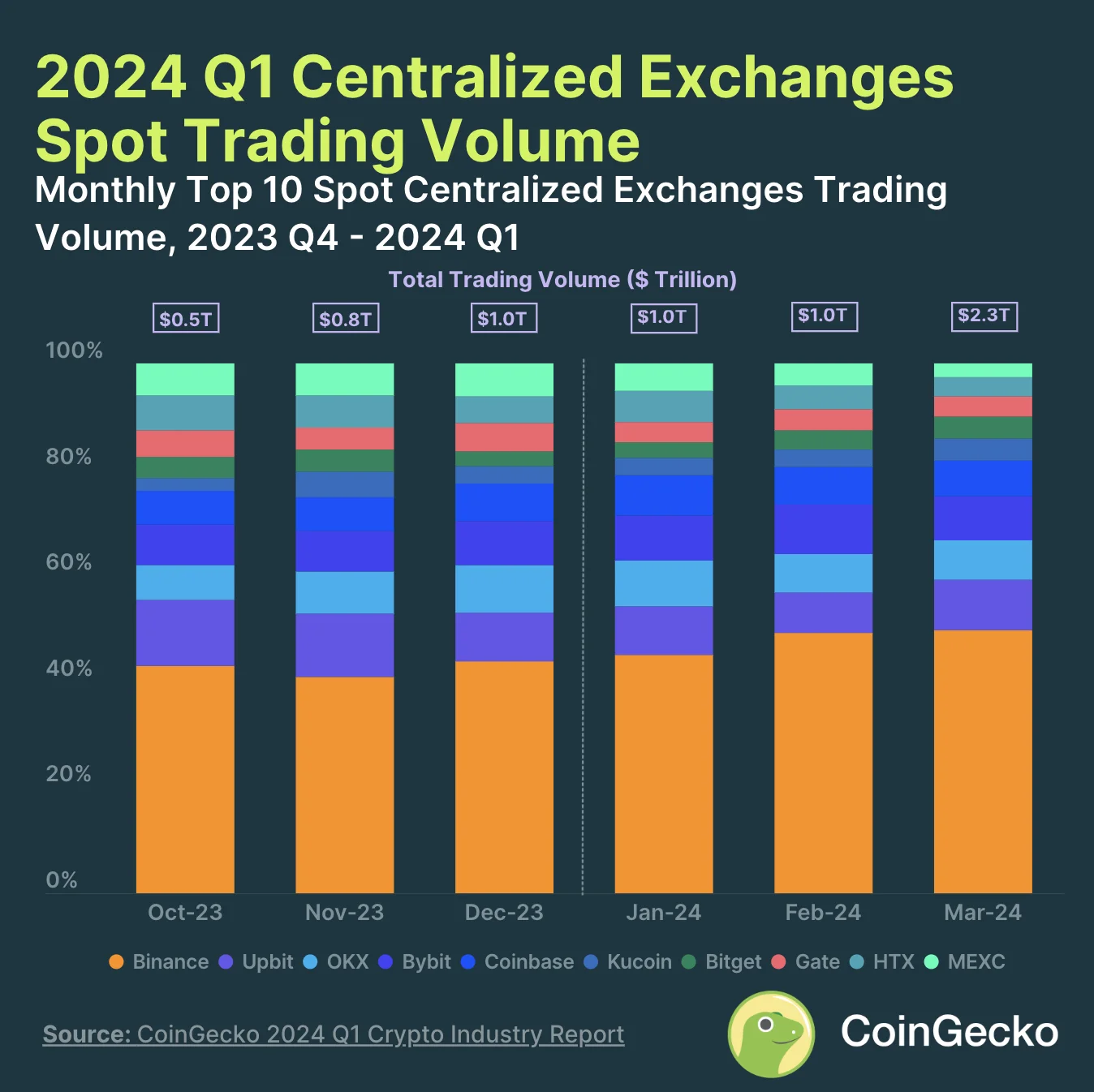

- CEX’s spot trading volume reached $4.29T in Q1, the most increased since the end of 2021;

Let’s now delve into greater detail!

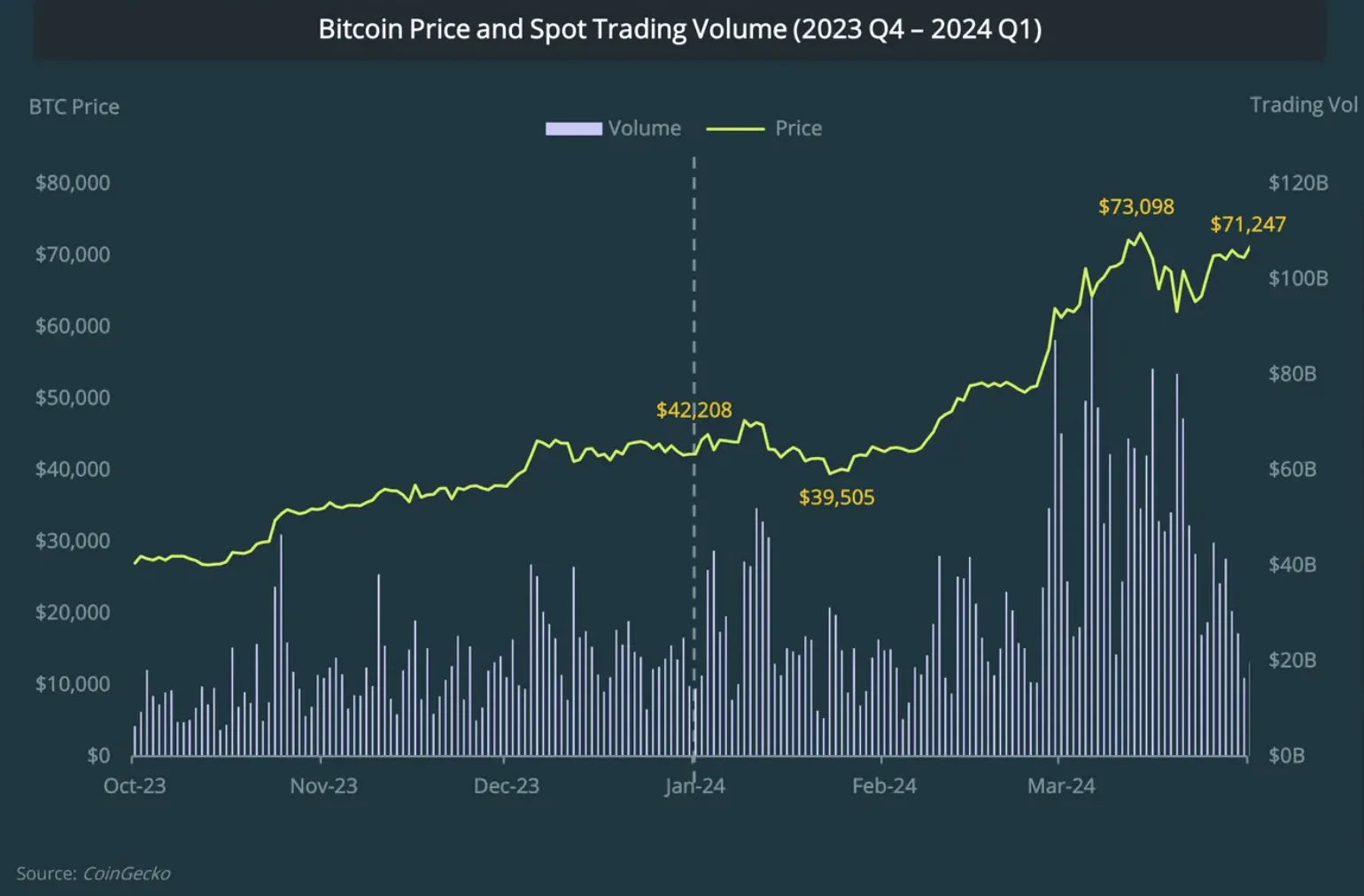

1. Bitcoin’s Massive Growth of +68.8% in Q1, 2024

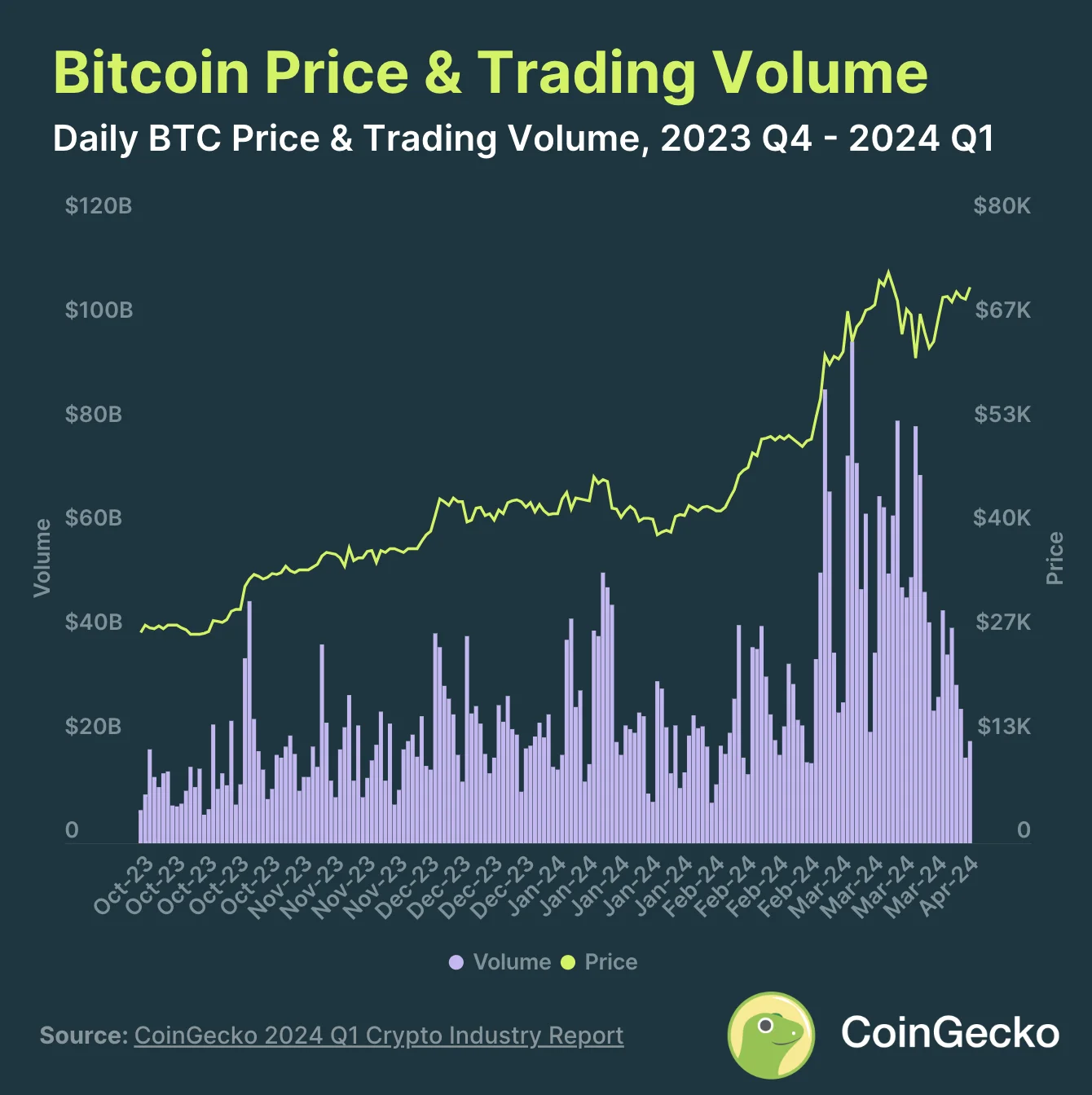

In the year 2023, Bitcoin experienced a remarkable comeback that led to a significant gain of over 155.2%. Subsequently, another surge in growth took hold of Bitcoin, causing it to hit a new all-time high of $73,098 by March 2024. This represented an impressive increase of approximately 68.8% during the first quarter of 2024.

Although the current state of Bitcoins is better than before, there was a setback following the extended-release and US Spot Bitcoin ETF approvals. This event caused BTC to experience a decrease of 16.0%, resulting in its lowest quarterly price at $39,505.

Initially, its value surged by 85.0% upon reaching its all-time high (ATH). However, this growth was short-lived as another correction ensued, causing a decline of 18.0%. The quarter ultimately concluded with a closing price of $71,247.

Alternatively, BTC‘s trading volume has hit a fresh mark, with an average of $34.1 billion daily – marking an impressive 89.8% increase from the $18.0 billion recorded in Q4, 2023.

2. The US Spot Bitcoin ETFs Held +$55.1B in AUM

Following the SEC’s final decision on Bitcoin ETFs, which had been highly anticipated, the consequences were swiftly felt.

Despite a net loss of $6.9 billion for Grayscale’s ETF investors, the fund still gained an impressive $21.7 billion in assets under management (AUM) during Q1 2024. Consequently, the GBTC ETF maintained its title as the largest Bitcoin ETF.

With more than $17.0 billion in earnings from its Bitcoin ETF, BlackRock now holds the second largest position in this market.

3. Ethereum’s EigenLayer Restaking Hit $4.3M

In the first quarter of 2024, the amount of Ethereum being restaked experienced significant increase, primarily driven by EigenLayer. This surge led to a 36% rise in value, resulting in a total of $4.3 million.

Approximately 2.28 million Ethereum (ETH) representing over half (52.6%) of the staked Ethereum were managed by Liquid Restaking Protocols (LRTs).

In Q1, EtherFi held the largest market share among LRT protocols at 21.0%, growing an impressive 2,616% during this period. By the end of March, EtherFi managed to accumulate approximately 0.91 million Ethereum.

4. Solana-based Meme Coins Reached a Market Cap of $8.32B

Discussing the top 10 Solana meme coins, their combined market value surged by an impressive 801.5%, equivalent to approximately $8.32 billion. Concluding the quarter, these coins boasted a collective market cap of $9.36 billion.

Top 10 Solana meme coins:

-

Bonk (BONK);

Samoyedcoin (SAMO);

Dogwifhat (WIF);

Book Of Memes (BOME);

Mew Inu (MEW);

Popcat (POPCAT);

Myro (MYRO);

SLERF;

Wen (WEN);

Jeo Boden (BODEN);

5. CEX: The Most Increased Spot Trading Volume Since 2021

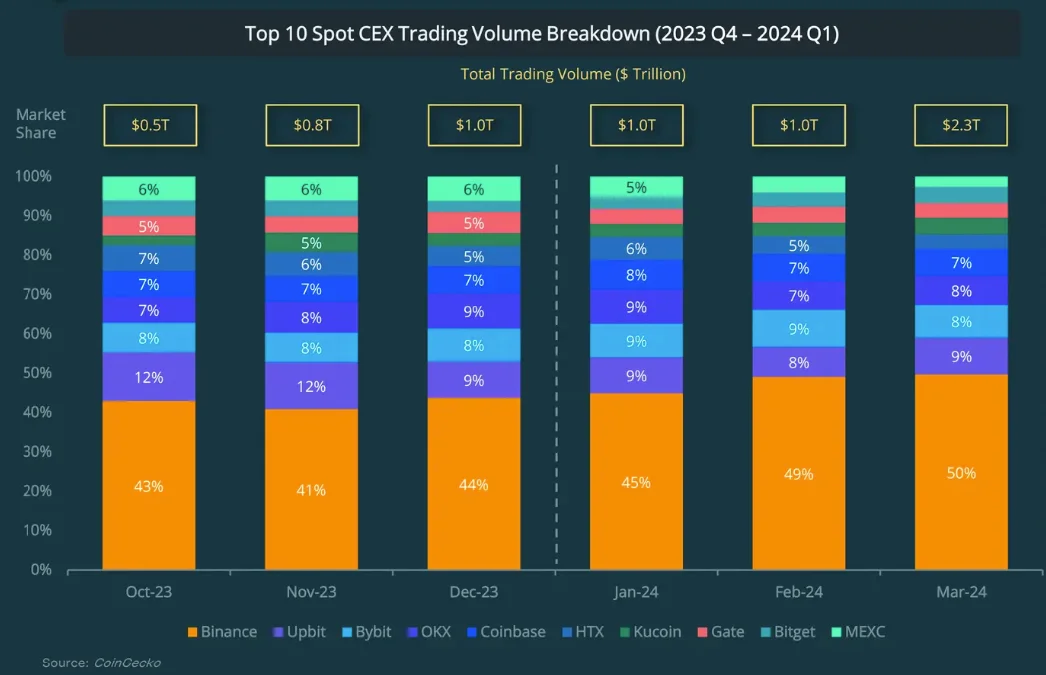

The excellent news is that the leading 10 Cryptocurrency Exchanges experienced an impressive 95.3% increase from one quarter to the next, totalling $4.29 trillion. This achievement is noteworthy, considering it surpasses the last recorded high in December 2021.

It came as no surprise that Binance maintained its position as the dominant crypto exchange at the end of the quarter, accounting for half of the market share. On the other hand, MEXC experienced a decrease in market share due to increased trader interest in major cryptocurrencies like Bitcoin, Ethereum, and Solana.

Q1, 2024 Crypto Market at a Glance

In 2023, the crypto market experienced some turbulence and required a full year to bounce back. Conversely, 2024 got off to a robust start, fueled by the approval of the US spot Bitcoin ETF and an eagerly anticipated event: Bitcoin’s halving.

But allow us to go into greater detail and uncover the state of the crypto market in Q1, 2024.

The Spot Trading Volume & Crypto Market in Q1

In Q1, the overall value of the crypto market experienced a significant increase of 64.5% or approximately $1.1 trillion. This growth is nearly double the amount from the previous quarter, which was around $607 billion. As a result, by March 13, the total crypto market cap had reached an impressive $2.9 trillion.

In terms of trading volume, the average was $109.2 billion, marking a significant quarter-over-quarter growth of 45.4%.

Within the Top 30 Cryptos, we have:

-

#11 TON, which claimed its spot from 15th place;

#12 SHIB, shifted from 17th;

#14 BCH secured its place from the 21st position;

Sadly, DAI and ATOM slipped in rankings, now at #27 and #28 instead of their previous positions at #20 and #22, respectively.

#22 APT, #25 STX, #30 ARB, and #29 WIF experienced a notable change, superseding OP, INJ, OKB, and XLM in their roles.

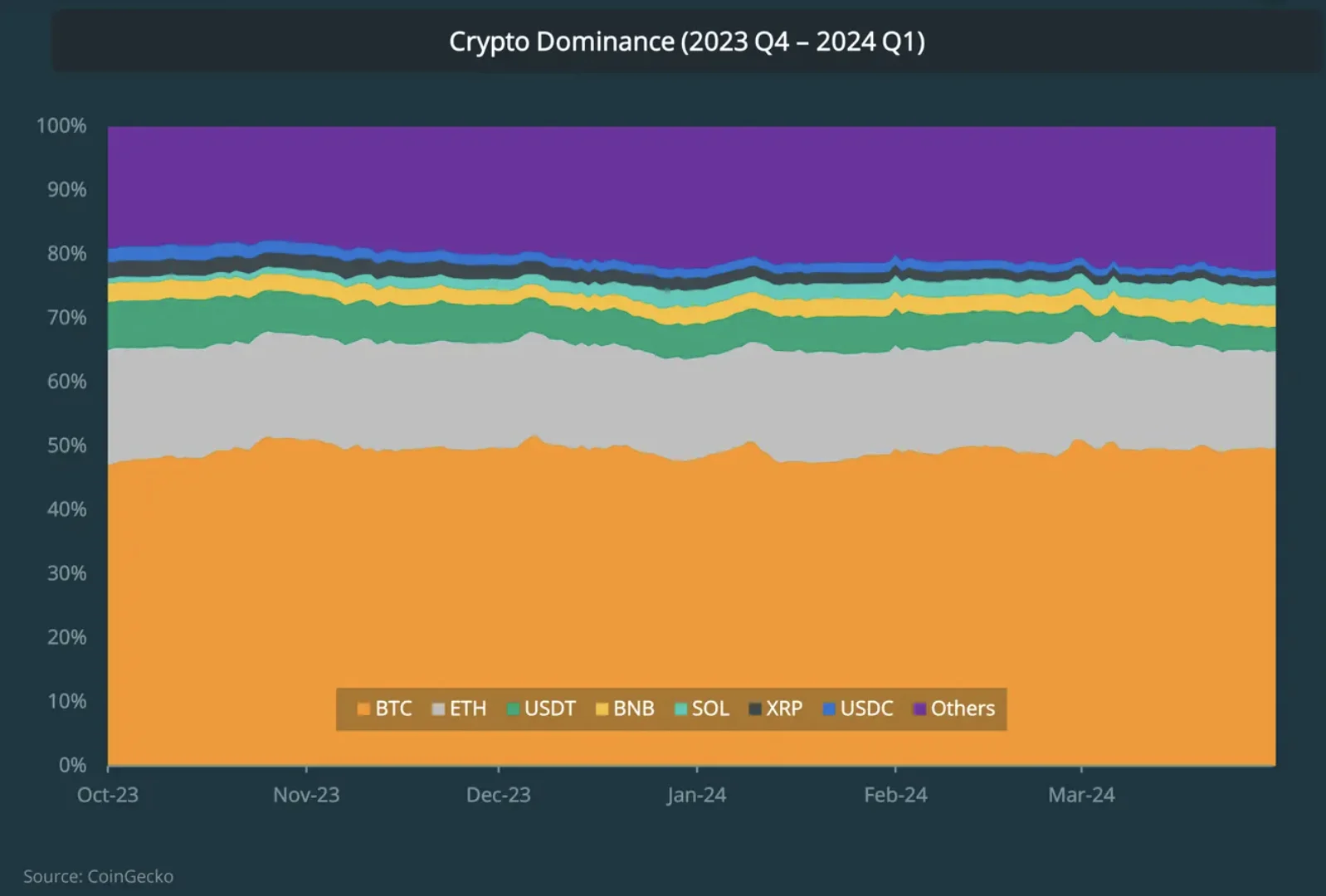

QoQ Crypto Market Dominance

once again, Bitcoin (BTC) held its position with a gain of 1.4%, amounting to 49.4%. Ethereum (ETH), USDT, BNB, Solana (SOL), XRP, and USDC followed suit with varying degrees of growth. Specifically, BNB and SOL experienced minor upticks of 0.5% and 0.7%, respectively.

On the other hand, ETH suffered a 0.5% loss, XRP 0.7%, USDT 1.6%, and USDC 0.3%.

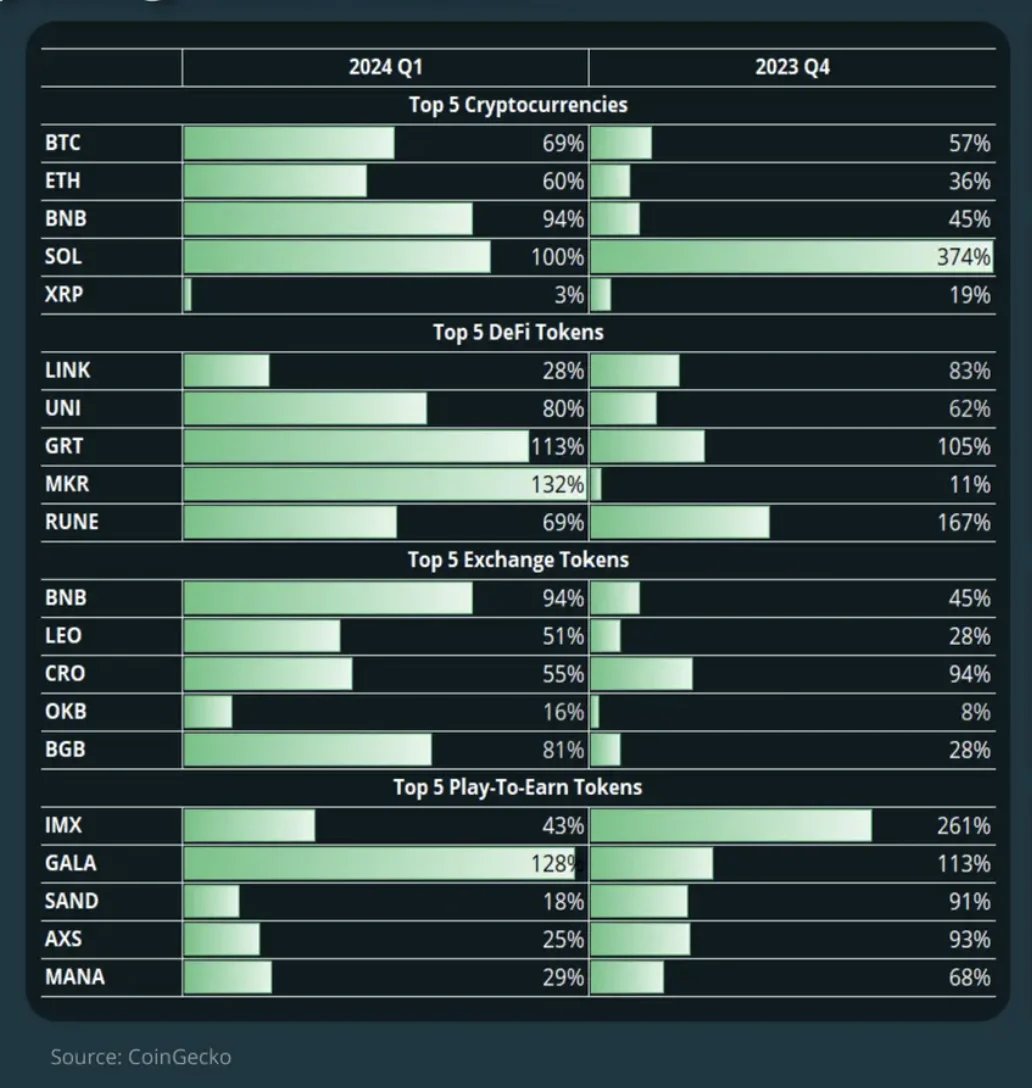

Q1, 2024 Crypto Price Performance Key Insights

Without a doubt, Solana led the way among the top 5 cryptos in the last quarter, experiencing a 100% surge. Close behind was Binance Coin, which rose by 94%. Bitcoin took third place with a gain of 69%, surpassing Ethereum’s 60% increase.

Despite this, MKR surpassed the top five cryptocurrencies in every category by an impressive 132% price surge. Notably, GRT came in second with a strong 113% gain, while UNI experienced a substantial rally of 80%.

In terms of exchange tokens, BNB has clearly outshined the others with a remarkable 94% growth. Yet, among the top five, a fresh challenger named BGB has emerged, pushing KCS out of the spot.

Among the Play-to-Earn (P2E) tokens, GALA had the best performance, recording a gain of 128%. In sixth place was RON, which also saw notable growth at 114%.

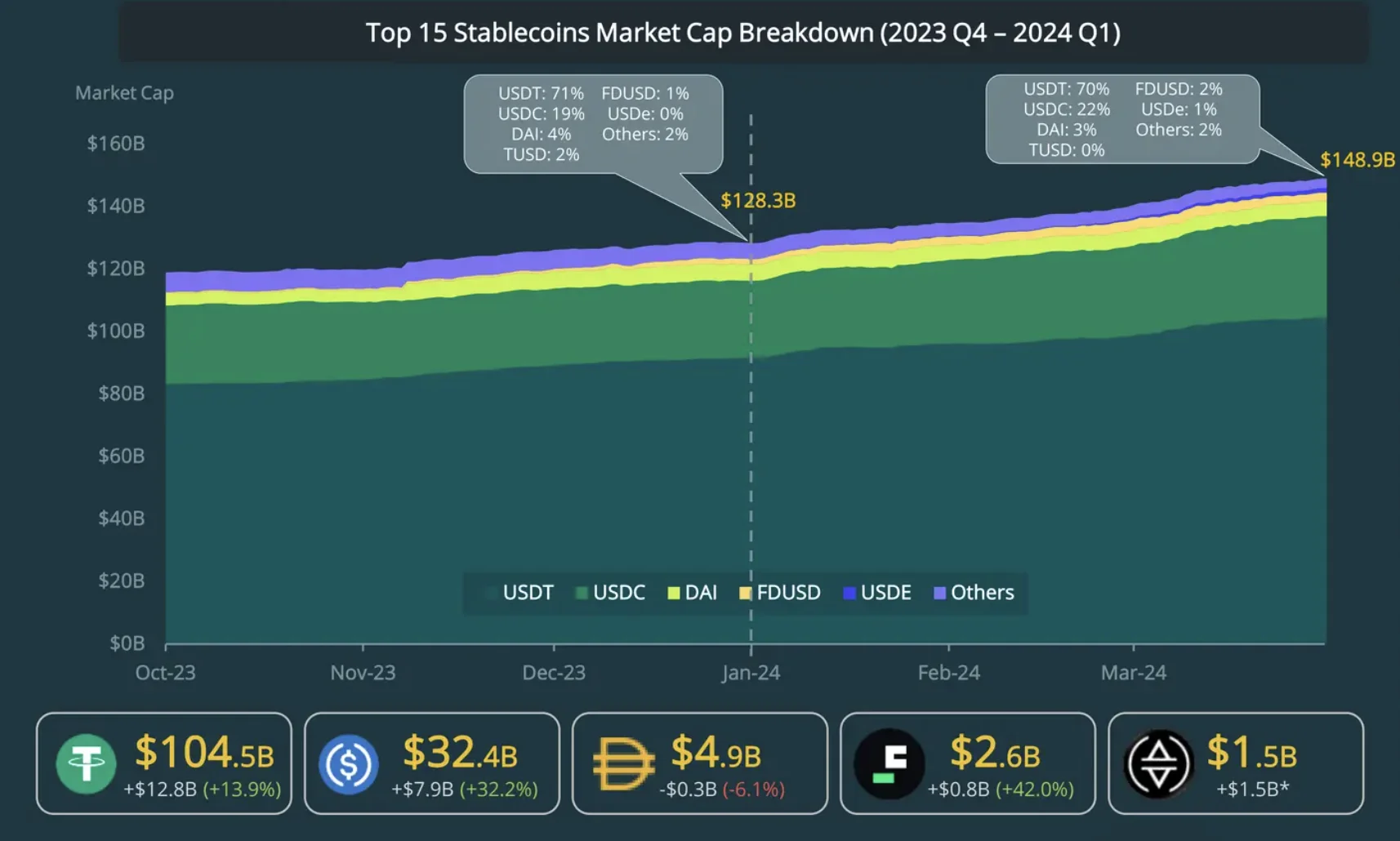

Top 15 Stablecoins of Q1, 2024

In Q1 2024, the stablecoin market experienced significant growth, reaching a total of 15.1% or $20.6 billion. This represents a marked improvement from Q4 2023, when the market closed with a decline of 11.3%. This positive development is noteworthy considering the decrease we reported in our 2023 crypto review.

Yet, let’s see a breakdown!

In the year 2023, USDT strengthened its hold and ruled the market; meanwhile, the first quarter of 2024 brought about a massive surge of approximately $12.8 billion for USDT. USDC experienced a substantial growth of around $7.9 billion during the same period.

TUSD lost its hold on the market, making way for USDe, Ethana’s recently introduced synthetic stablecoin, which managed to amass a market capitalization of $2 billion within two weeks.

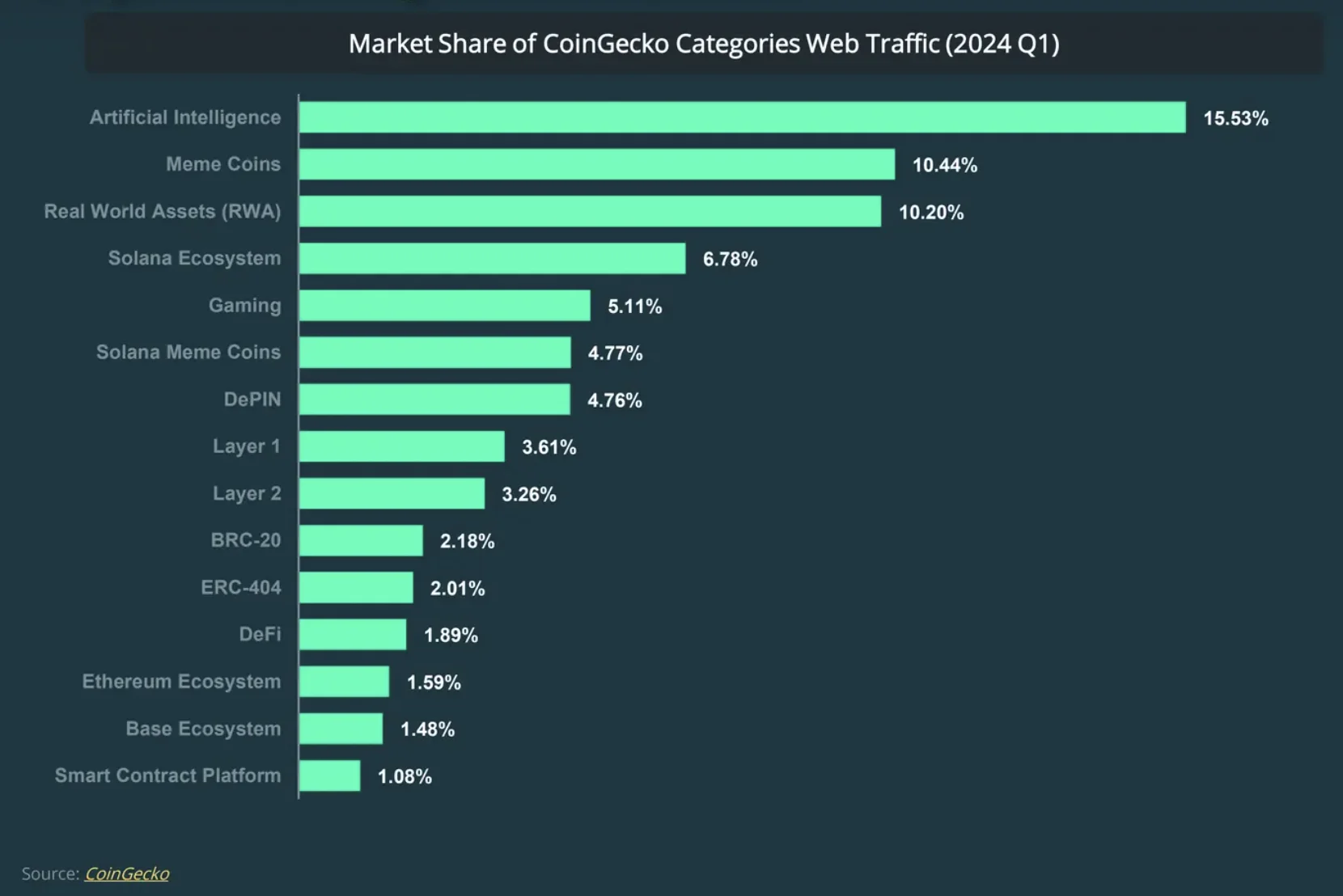

Q1, 2024 Crypto Trending Categories

With the help of CoinGecko’s analysis, we can explore some of the trending investment categories in greater depth to enhance your investment strategy.

In the first quarter of 2024, Artificial Intelligence (AI), meme coins, and Real-World Assets (RWAs) stood out as the most popular investments, attracting approximately one-third of investors’ focus.

In simpler terms, both the Solana network and the gaming industry are attracting the attention of investors with over 5% interest, leaving room for up-and-coming projects like ERC-404 to enter the scene.

In the realm of blockchain networks, just three out of the forty-six examined – Solana, Ethereum, and Base – have remained significant players in the top fifteen narratives. Conversely, the narratives surrounding NFTs, DeFi on Avalanche, FTX holdings, and BRC-20 have seen a decrease in interest.

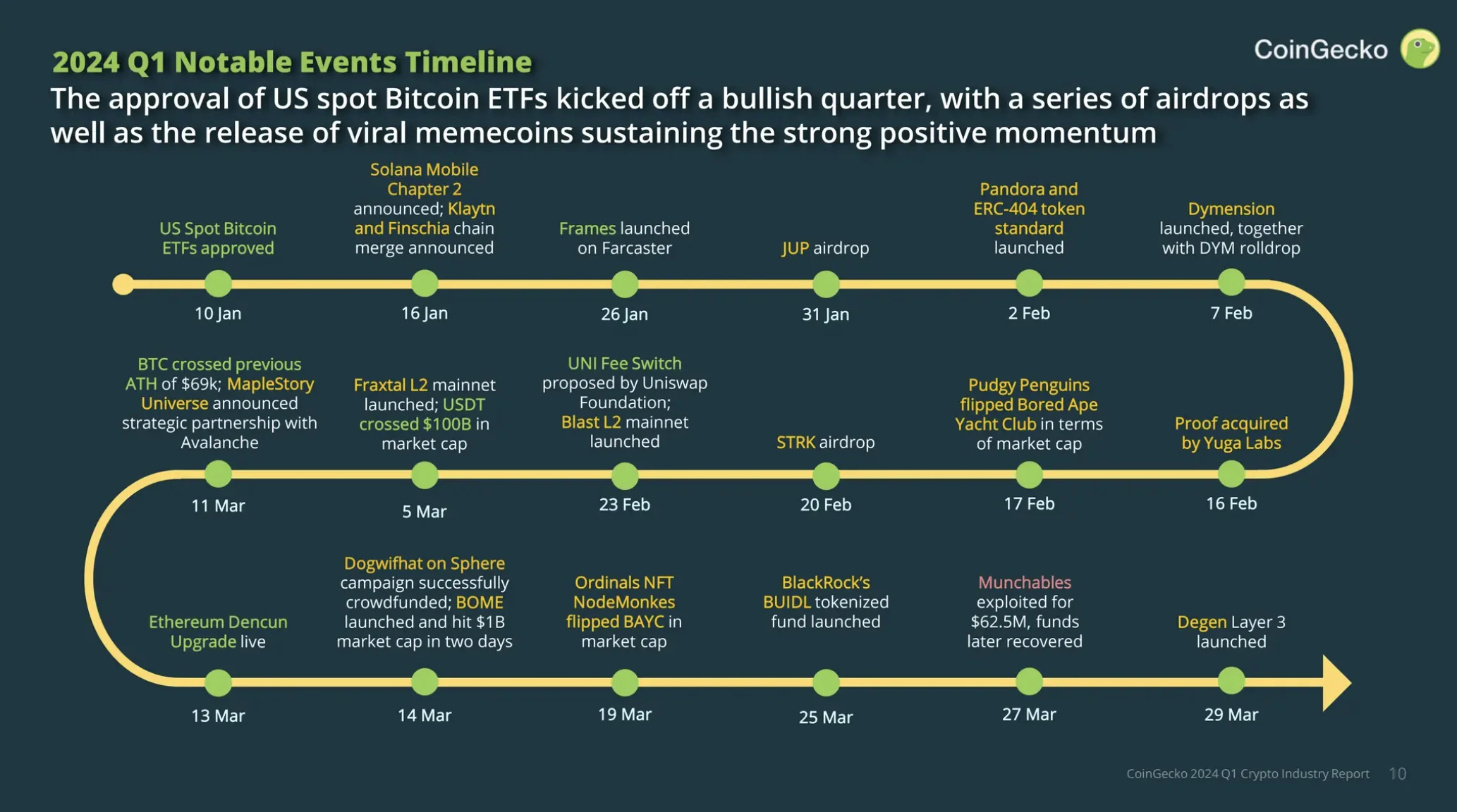

Top Significant Q1 2024 Crypto Events

When considering recent developments, it’s natural to focus on the Spot BTC ETF proposal. However, there are other significant happenings we should be aware of as well. Let’s review the main points!

1. January 10: US Spot BTC ETF Gets Approved;

-

Bitcoin ETF enables investors to gain exposure to BTC’s price movements through 2 distinct types of ETFs: Spot ETF, in which Bitcoin is owned, and Futures ETF, whereby investors gain exposure by investing in crypto futures contracts.

2. January 16: Solana Mobile Chapter 2 Announcement, Klaytn & Finschia Get Merged;

- Solana Mobile Chapter 2 is a new crypto-focused phone with over 100,000 preorders within the first month.

- The Klaytn and Finschia merger constitutes Asia’s largest Web3 ecosystem, and it was approved through voting by holders and governance members of both parties.

3. January 26: Frames Gets Launched on Farcaster;

4. January 31: JUP Airdrop;

5. February 2: Pandora & ERC-404 Token Standard Just Launched;

- Pandora was the first ERC-404 token that reached as high as $32,000 from a low of $250 in just under a week. It has a supply of only 8,000 tokens and traded some $76 million in volumes in just 24 hours.

6. February 7: Dymension Launched & DYM Rolldrop;

- The Dymension network launched its mainnet and offered a token airdrop worth over $390 million.

7. February 16: PROOF Acquired by Yuga Labs;

8. February 17: Pudgy Penguins Outperformed BAYC as Market Cap;

9. February 20: STRK Airdrop;

10. February 23: UNI Fees Switch Proposal & Blast L2 Mainnet Was Launched;

-

The UNI fee switch ensures that a part of the earned fees by the LPs gets distributed to $UNI token holders who have delegated and staked their tokens.

11. March 5: Fraxtal L2 Mainnet Launched & USDT Jumped Over The $100B Mark;

12. March 11: BTC Crossed Its ATH of $69K & MapleStory Universe Partners with Avalanche;

- MapleStory Universe plans to operate Avalanche’s ‘Subnet’ technology to expand the project’s blockchain-based game ecosystem.

13. March 13: ETH Dencun Update Was Live;

14. March 14: Dogwifhat on Sphere Crowdfunding & BOME Launches With $1B Market Cap In 2 Days;

15. March 19: Ordinals NFT NodeMonkes Outperformed BAYC In Market Cap;

16. March 25: BlackRock’s BUILD is Tokenized Fund Launch;

17. March 27: Munchables Gets Exploited – $62.5M Later on Recovered;

18. March 29: Degen Layer 3 is Launched;

Bitcoin Analysis in The Q1 2024

Bitcoin experienced some price instability during the past quarter, with one significant influence being the rejection of the Spot BTC ETF proposal. This event triggered a 16% decrease in Bitcoin’s value, which dipped as low as $39.505. However, following this correction, Bitcoin surged by 85%, eventually reaching an all-time high of $73.098.

Additionally, Bitcoin’s trading volume experienced a significant surge, growing by 89.8% between Q4 2023 and Q1 2024, reaching a total of $34.1 billion.

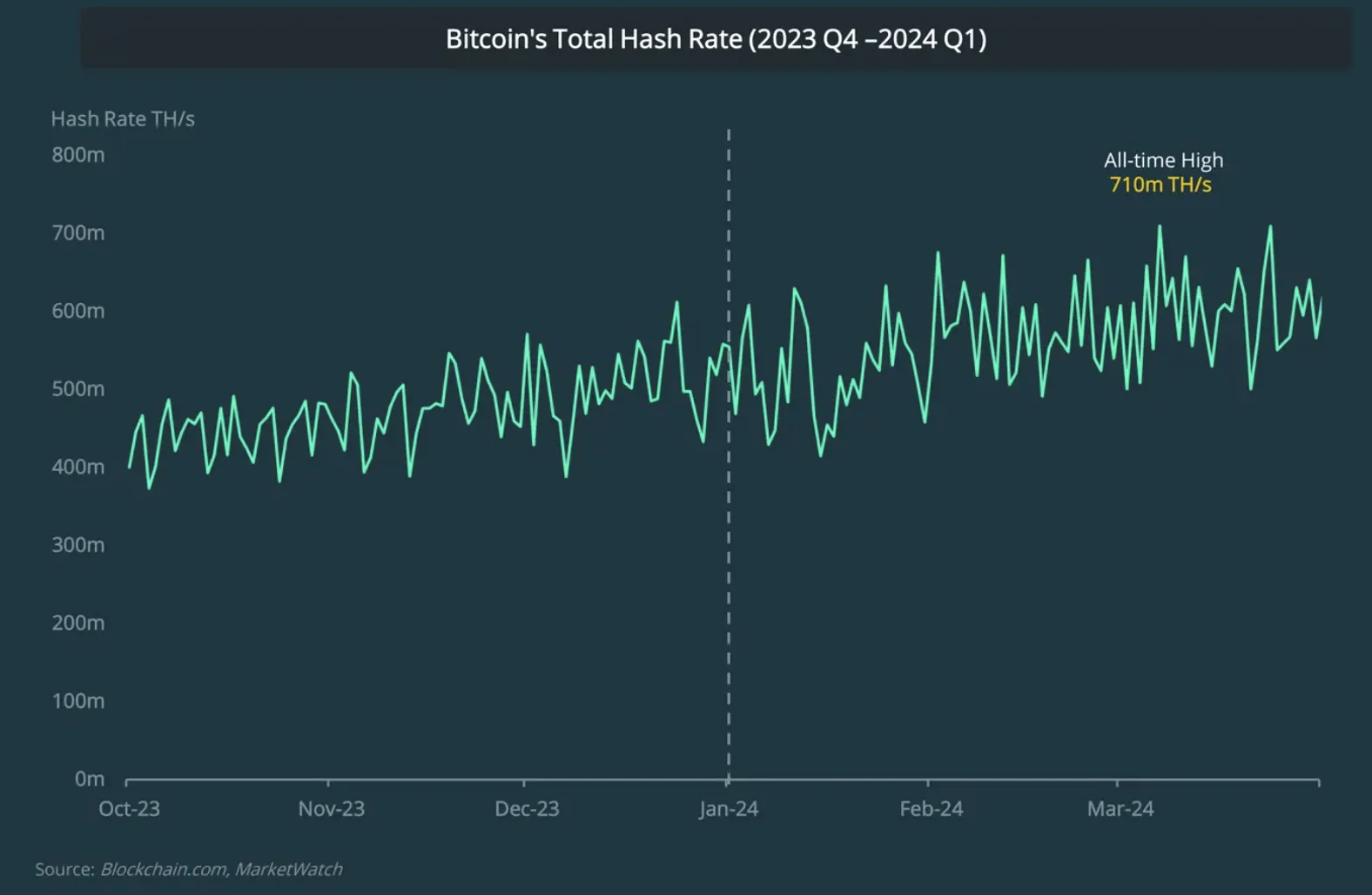

The Bitcoin Hash Rate in Q1 2024

When talking about the Bitcoin hash rate, an important point to note is that it set a new record of 710 million terahashes per second (TH/s) on March 7, representing just a 2% rise in comparison to its previous high.

Notable Bitcoin Mining Events:

-

Ethiopia is now the first African country to start BTC mining despite the crypto trading ban;

Marathon Digital Holdings partnered up with Applied Digital to purchase a 200-MW Bitcoin mining facility for $87.3 million;

Luxor Technology and Bitnomial are set to launch the first US Bitcoin mining hash rate futures;

Swan Bitcoin debuts its mining operation with a total hash rate of 8EH/s.

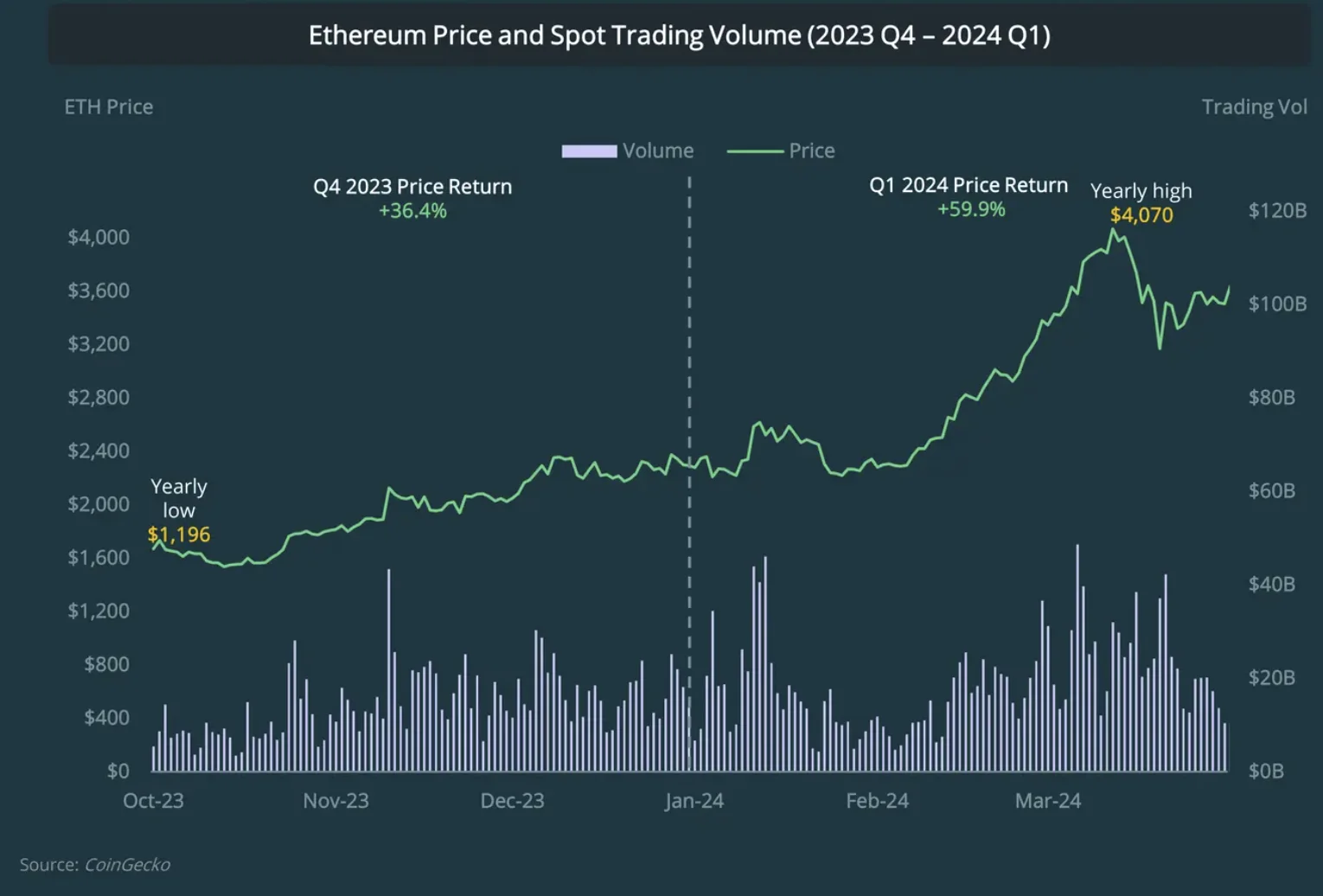

The State of Ethereum in Q1 2024

Excellent news for Ethereum as it experienced a significant surge in Q1, boosting its price by 59.9% and surpassing the $4,000 threshold. This upward trend was fueled by the upcoming Decusion update and the highly-anticipated approval of US Spot ETH ETFs.

After a strong beginning in Q1 2024, Ethereum’s success has been highly anticipated since its peak of $4.070 in December 2021 – a level not seen since then. As for trading volume, Ethereum experienced an increase from $14.7 billion in Q4 2023 to $19.1 billion in Q1 2024.

In addition, the Ethereum Improvement Proposal (EIP) was integrated during the Denas upgrade. As a result, gas fees have been notably cut down in Layer 2 solutions like Arbitrum, Optimism, and Base. This cost reduction has kept the demand for these platforms high.

Q1 2024 Ethereum Restaked

More and more ETH Liquid Staking protocols are emerging, with a 36% rise on Eigen Layer in Q1 and a total of 4.3 million staked ETHs. EthereFi, however, remains the most extensive protocol, accounting for 52.6%.

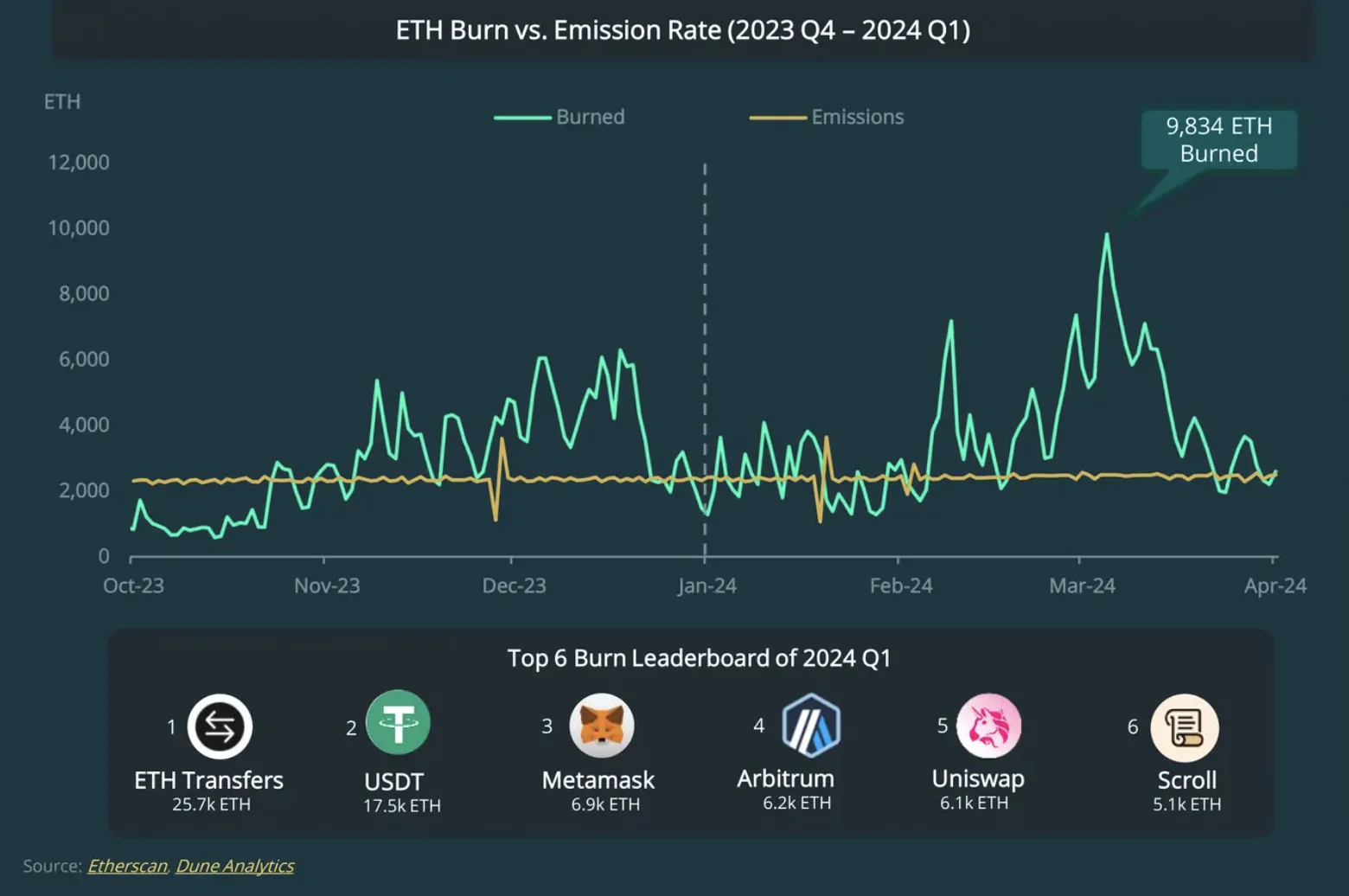

Ethereum Burn Rate in Q1 2024

In the first quarter of this year, Ethereum network eliminated approximately 113,100 ETH from existence. Out of that amount, about 333,600 ETH were destroyed through a process called burning, while just 270,500 new ETH were created. This is quite different from the fourth quarter of last year when 90,200 ETH were burned in a single month, which equates to an average burning rate of around 111,200 ETH per quarter.

Additionally, the largest single-day Ethereum burn occurred on March 5, amounting to 9.834 ETHs. Notably, the greatest Ethereum transfer burns took place in Q1, totalling 25,700 ETHs.

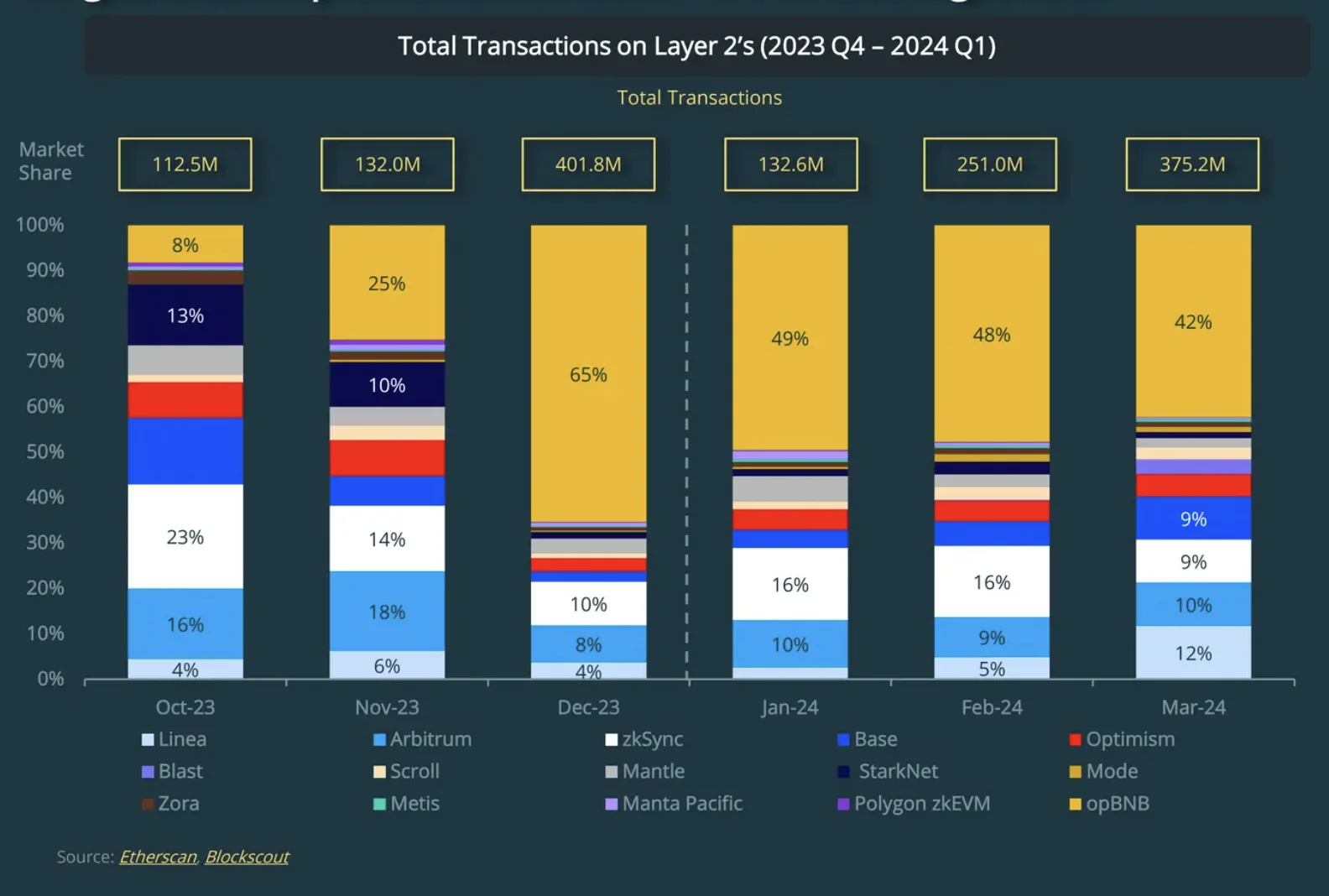

The Layer 2’s Adoption in Q1 2024

In the second quarter of 2024, more than 900.7 million transactions took place on the Layer 2 network. Among these transactions, opBNB handled approximately 46% or 414.1 million. An analysis of the data shows that there was a significant increase of 39.4% in L2 trades compared to the previous quarter when only 646.3 million transactions had occurred. In other words, the number of L2 trades grew substantially from the 1.3 billion recorded throughout the entirety of the previous year.

Despite Arbitrum being previously more active, Linea now surpassed it as the second busiest Ethereum L2, experiencing a significant increase of 125.5% quarter over quarter, equating to approximately 63.3 million transactions in Q1.

The State of Solana in Q1 2024

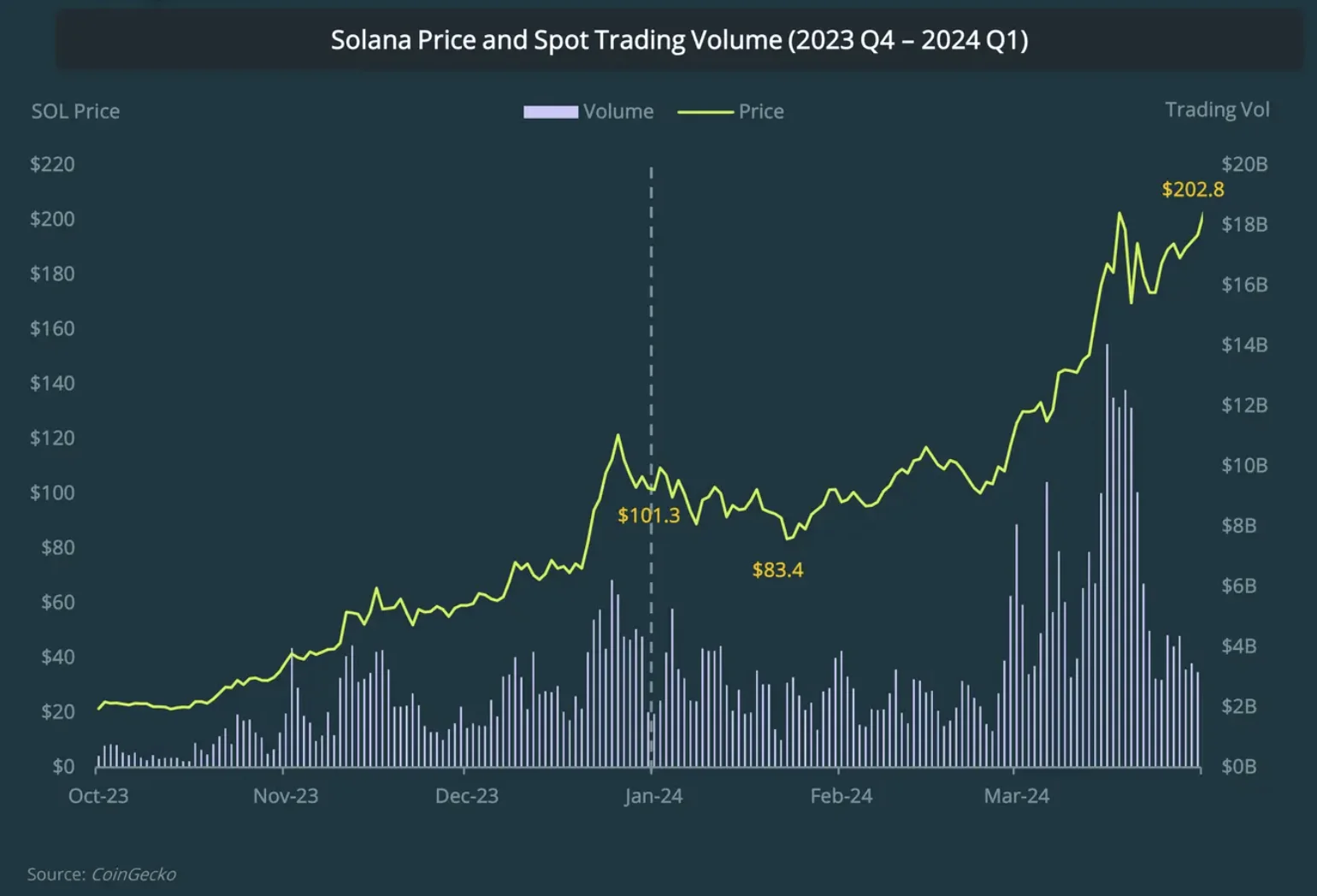

SOL Price vs. Trading Volume

Over the past year, Solana underwent an impressive revival. Its value surged by 10x in 2023, and in Q4, it experienced a remarkable price increase of 374%, resulting in a total gain of approximately 2x in Q1 2024. This translates to a stunning growth of over 100.1% and a price tag above $200.

In the fourth quarter of 2023, Solana’s average trading volume was $2.0B. However, it experienced a significant increase in the first quarter, nearly doubling to reach $3.8B. This represented a remarkable 92.8% growth when compared to the previous quarter. One explanation for Solana’s achievement is the excitement surrounding memecoins and airdrops, as well as the high on-chain activity that led to network congestion in March.

Despite the network’s consistent performance, there was a five-hour disruption on Solana in February this year, reminiscent of the nearly 19-hour interruption experienced in February of the previous year. Fortunately, the price of SOL remained unaffected by these outages.

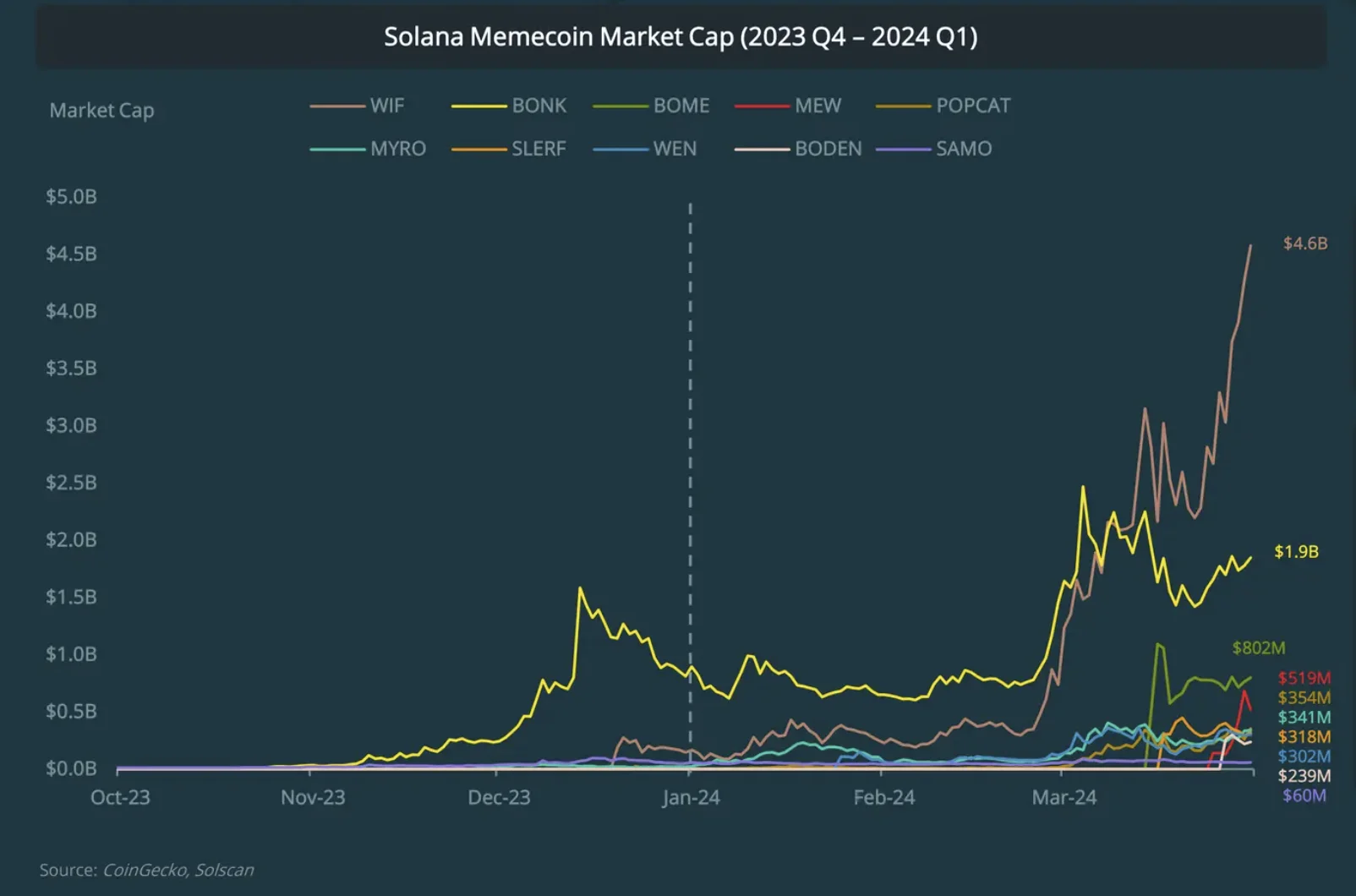

Solana Memecoin Hype in Q1 2024

For skeptics, the memecoin trend is genuinely thriving and the figures back it up. Consequently, the market value of 10 SOL memecoins grew by an impressive 801.5% or approximately $8.3 billion, concluding the first quarter of 2024 with a total worth of $9.36 billion.

In addition, WIF dethroned BONK as one of the leading SOL memecoins, leaving only BONK and SAMO in existence prior to Q4 2023. It’s worth mentioning that BONK gained significant endorsement shortly after its December 2022 debut, securing the top spot in market capitalization. However, WIF managed to surpass it in March.

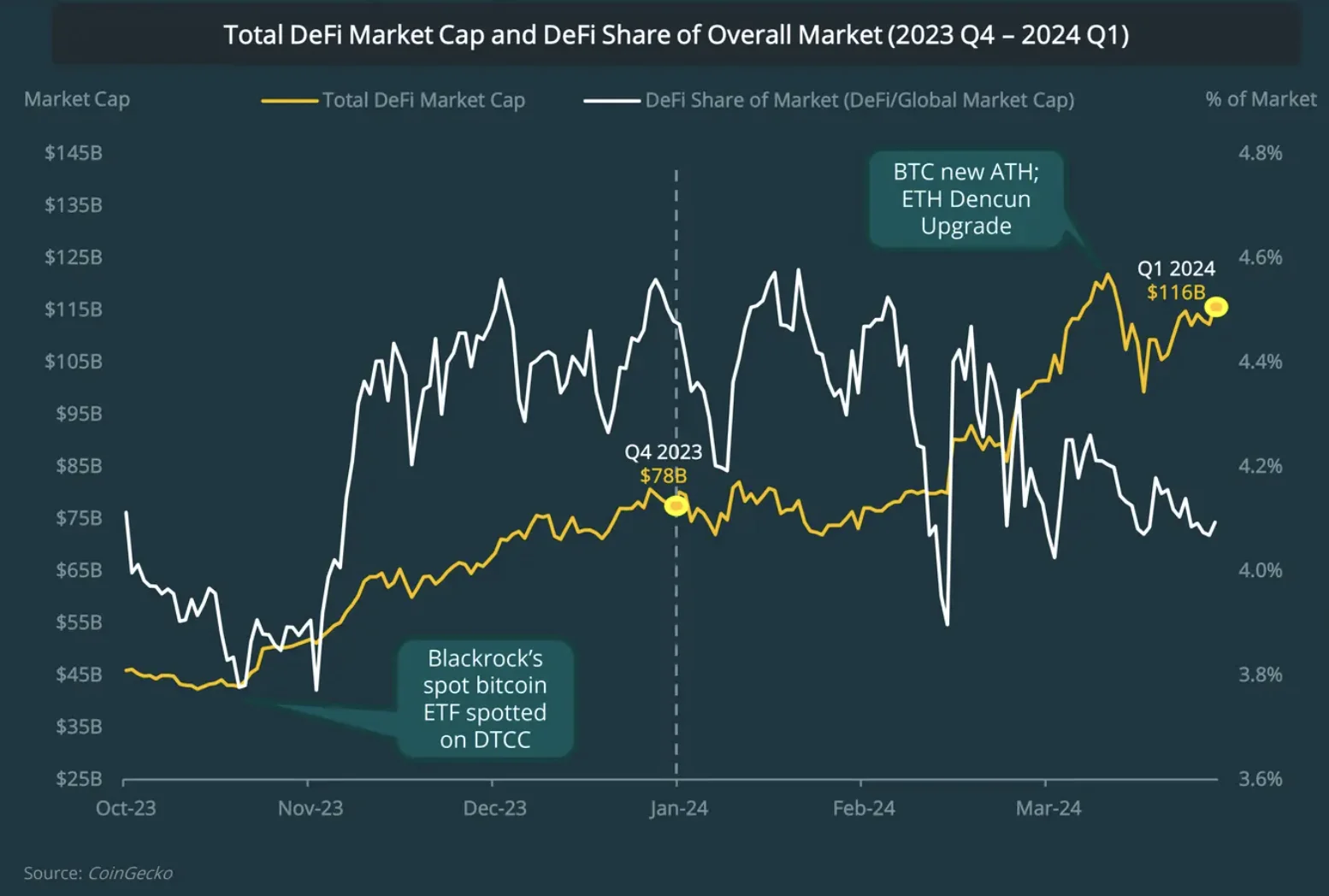

The DeFi Analysis in Q1 2024

In the first three quarters of 2023, the DeFi market’s total value remained relatively unchanged. However, during the last quarter, the market experienced significant growth due to optimistic market conditions, surpassing the crypto market cap by a remarkable 128.8%.

In the early part of Q1 2024, there was much anticipation for a strong start. However, the excitement around Bitcoin and meme coins overshadowed this, leading to significant attention and price increases. Despite this distraction, Bitcoin still managed a noteworthy gain of 49.1%.

In the middle of February, the Decentralized Finance (DeFi) market experienced a significant surge, hitting a record-breaking $90.3 billion. This unexpected rise led to a 4.4% rebound following a previous decline of 4%. Subsequently, it attained an impressive peak at $122 billion. Remarkably, this growth occurred just before Bitcoin achieved its all-time high, preceding Ethereum’s Denver update.

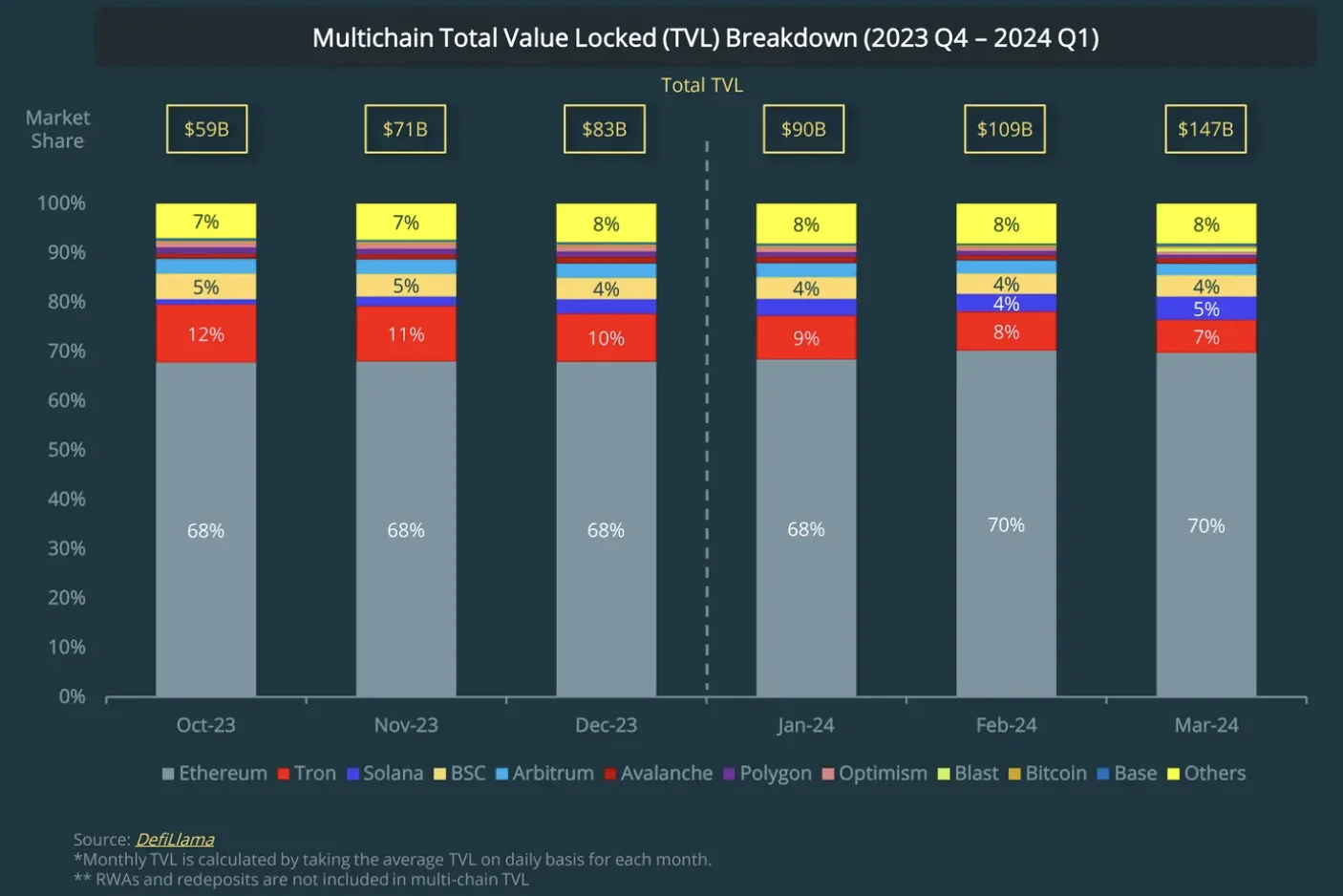

DeFi Multichain Market Share in Q1 2024

In Q1, 2024, the total value locked in Decentralized Finance (DeFi) across multiple chains experienced a significant surge, increasing by approximately 78% or around $83 billion, reaching a new high of $147 billion. This growth can be attributed to heightened enthusiasm for airdrops and memecoins. The Ethereum network, in particular, saw its value rise by roughly 70%, resulting in an additional $47 billion. The allure of staking rewards, spearheaded by EigenLayer, drove this expansion within the Ethereum ecosystem.

Since last year, Solana’s meme coin popularity has contributed to an additional 4% increase in its multichain total value locked (TVL). With a TVL share of 5%, Solana now surpasses BNB Smart Chain and ranks behind only Tron and Ethereum.

As you can see, Base and Blast, the Layer-2 networks, managed to catch up with other L2s like Optimism and Arbitrum, closing the quarter with $1.2B and $1.4B.

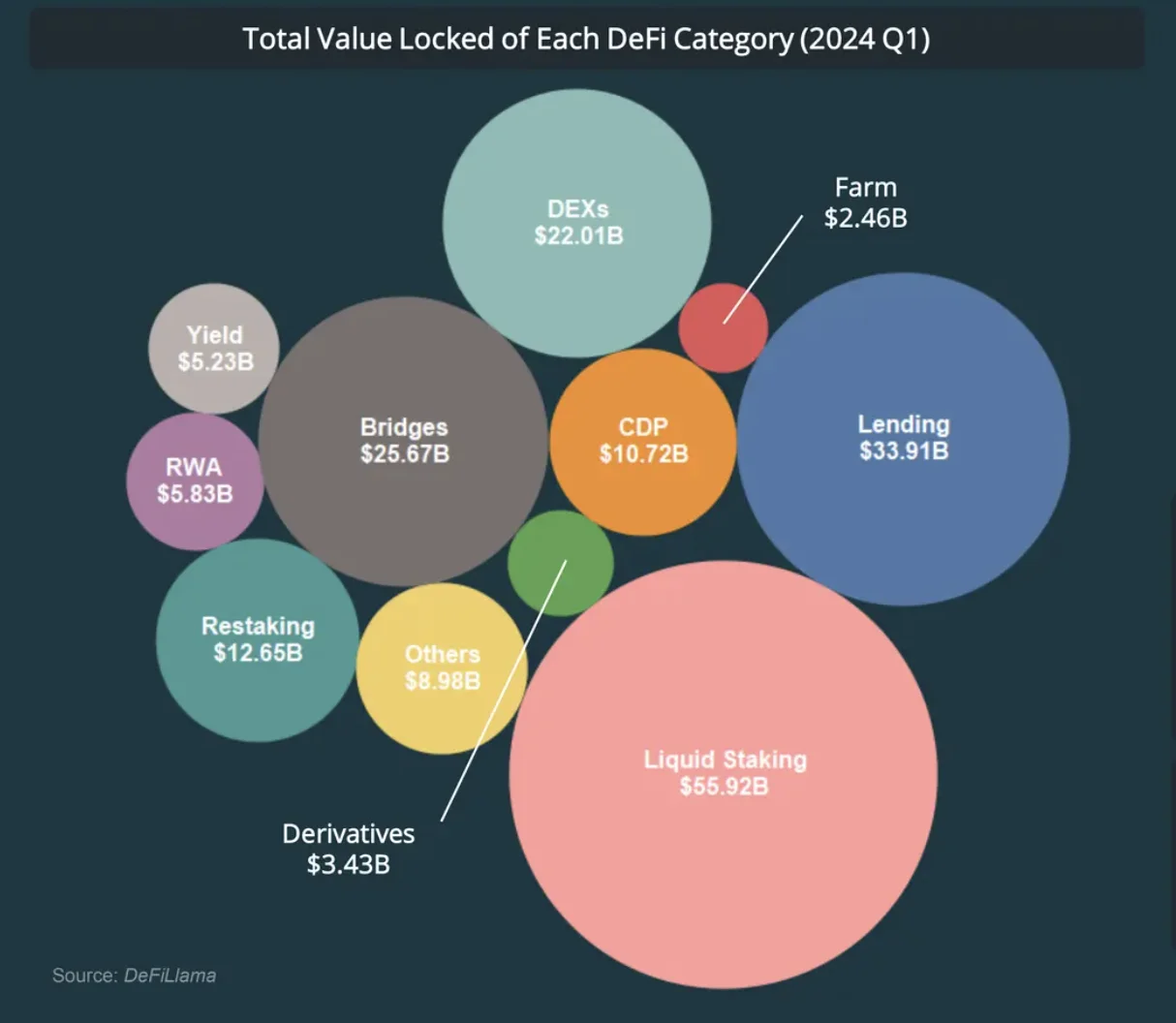

The DeFi Ecosystem in Q1 2024

In the first quarter of 2024, the restocking protocol stood out as a major success story with an impressive 1.068% rise in total value locked (TLV). Liquid staking took the top spot, contributing significantly to this growth despite Ethereum’s staked amount making up just 10.7% of the previous quarter. The primary driver of this increase was the substantial price surge of Ethereum, which jumped by an impressive 59.8%.

The State of NFTs in Q1 2024

NFT Trading Volume Across 10 Chains in Q1 2024

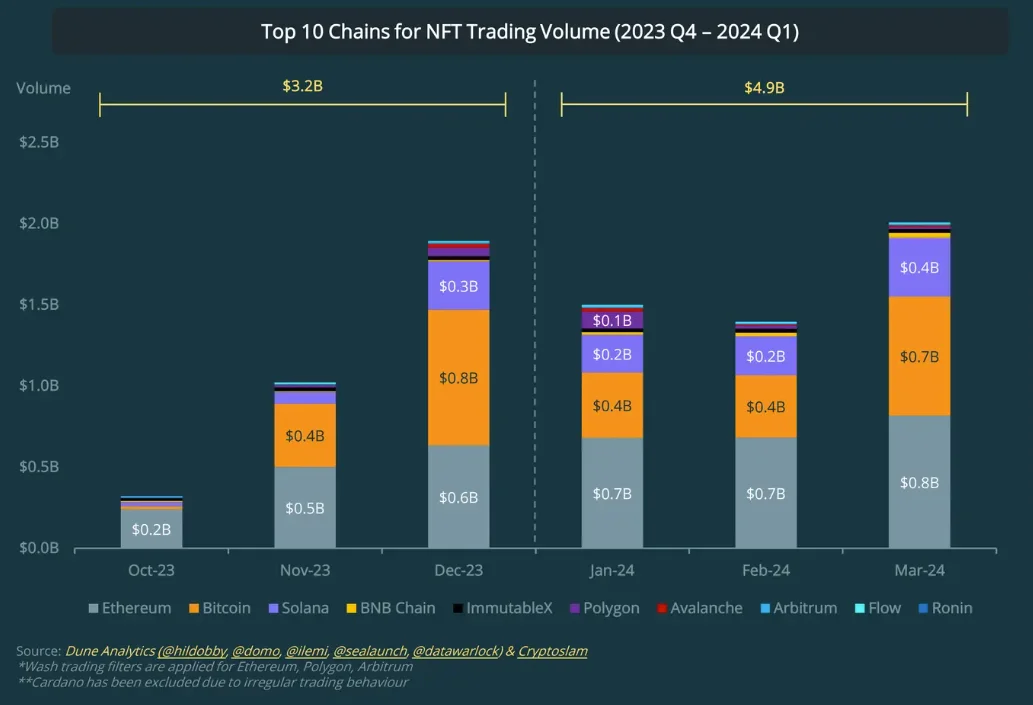

Over the past few years, the NFT trading volume has seen ups and downs. By Q4 2023, it had bounced back. And in the first quarter of 2024, the NFT market continued to regain strength. This was largely due to increased interest in NFTs from Bitcoin and Solana communities, leading to a significant 51.5% increase in trading volume.

Despite a 20.7% drop in trading volume at the beginning of January, NFT trading volumes surged by 51.5% on ten different platforms by the end of the first quarter. As a result, the total NFT trading value increased from $3.2 billion in Q4 2023 to $4.9 billion in Q1 2024.

The ongoing competition between Ethereum’s NFTs, Bitcoin’s NFTs, and those of Solana continues to be significant. Ethereum’s NFT market is currently in the process of bouncing back with over $2.2 billion worth of trades, while Bitcoin’s and Solana’s NFT sectors remain popular and attract a great deal of attention.

Despite the upcoming Bitcoin halving and the introduction of Runes, Bitcoin’s dominance in the NFT market share grew from 26.8% in January to 36.6% in March. This figure surpassed Ethereum’s market share by a significant trading volume of $735 million.

Polygon experienced significant growth in Q1, reaching an impressive trading volume of $105 million, primarily driven by the launch of the NFT game Gas Hero. However, towards the end of the quarter, the trading volume took a sharp decline, dropping by 88% to just $12.7 million.

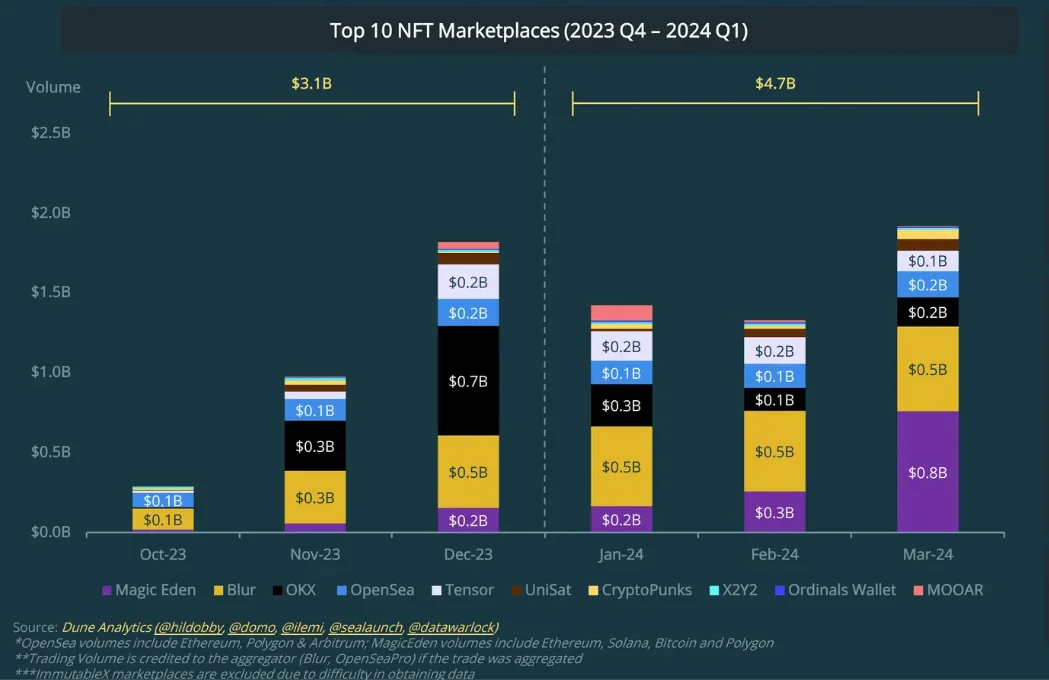

NFT Trading Volume by Platform in Q1 2024

In Q1 2024, Blur continued to dominate the marketplace scene with over $1.5 billion worth of NFT transactions, expanding its market share slightly to 27.6%. However, this position was challenged by Magic Eden’s entry into the market. Magic Eden introduced Diamond rewards and launched a new ETH-based marketplace in collaboration with Yuga Labs, causing a shift in the market dynamics.

Despite a disappointing performance for NFTs traded on OKX during Q1, their value plummeted by 73.3%, leaving them at around $128M. The trading volume on a monthly basis shrank significantly from 37.6% to just 9.5%.

MOOAR emerged as a leading NFT platform on Polygon, recording an impressive trading volume of $97 million.

Top Crypto Exchanges Trading Volumes in Q1 2024

Q1 2024 10 Spot CEX Trading Volume

In the final two quarters of 2023, crypto exchange trading volume experienced a significant surge, rising by 53.1% compared to the previous quarter. This trend continued into Q1 2024, where the spot CEX trading volume reached an all-time high of $4.3 trillion. This represents a staggering 95.3% increase from the previous quarter. Notably, this growth occurred concurrently with Bitcoin reaching its most recent all-time high price.

Binance continued to lead the way among spot cryptocurrency exchanges in 2023, experiencing a significant growth of 122.3% or $1.4 trillion, despite some challenges. In contrast, MEXC faced difficulties as investors and traders favored Bitcoin over smaller cap coins, which is a specialty of MEXC.

Q1 2024 10 Spot DEX Trading Volume

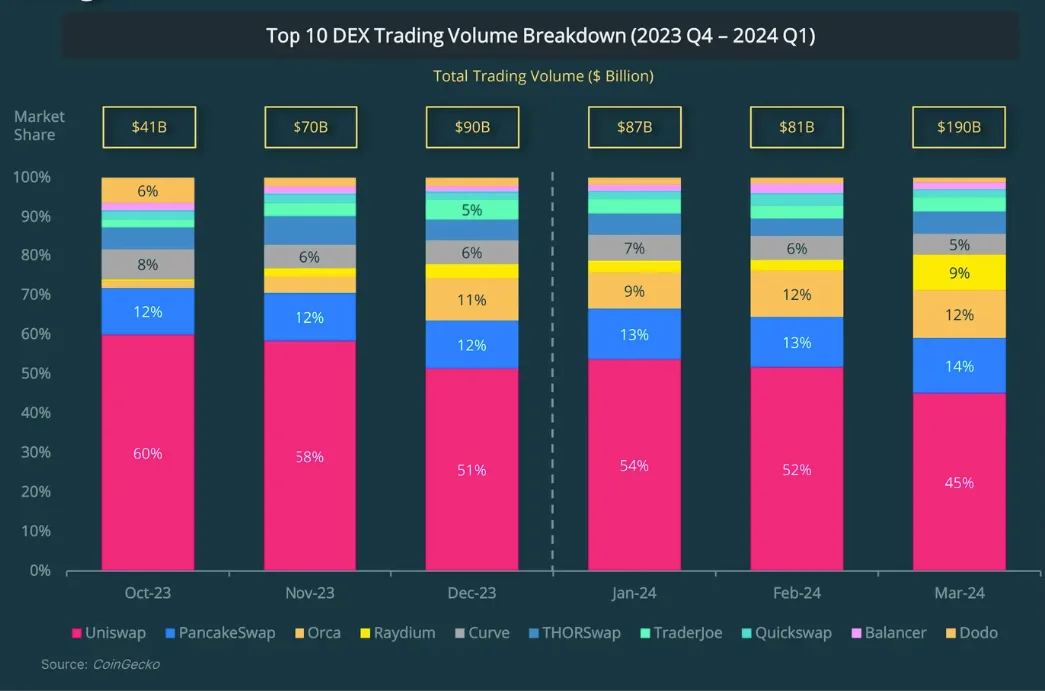

In the first quarter of this year, the decentralized exchanges (DEXs) on the Solana network experienced significant growth, increasing by an impressive 78.4% compared to the previous quarter. The total trading volume reached an impressive $357.6 billion during this period. Notably, March stood out as the most productive month, with a record-breaking $190 billion in trading volume since November 2021.

In the context of Solana decentralized exchanges (DEXs), Raydium emerged as the leading gainer in March, recording a substantial increase of 352.6% or approximately $17.1 billion, capturing a 9% market share. Not far behind, Orca experienced a noteworthy growth rate of 202.9%, translating to around $27.1 billion quarter-over-quarter, and claimed a 12% market share.

Challenges of The Crypto Market in 2024

The significant increase in cryptocurrencies can be explained by Bitcoin surpassing its all-time high and reaching new heights, along with the long-anticipated regulatory milestones, such as ETF approvals, and technological advancements. This may result in a crypto market bubble by 2024.

The positive news is that the green light for BTC spot ETFs came shortly after a significant event in the crypto world: Bitcoin’s halving. This event aimed to decrease the Bitcoin supply by half, leading to an increase in its worth.

Additionally, it’s important to note that fresh crypto regulations have emerged as significant disrupers within the market. This is not surprising given the volatile market conditions of 2022, which continued into 2023.

1. New Crypto Regulations

To keep you informed about the latest developments in the crypto industry, let’s explore the Securities and Exchange Commission (SEC) regulatory plan and recent modifications and suggestions.

Qualified Custodianship

In simpler terms, the SEC, through qualified custody, mandates financial investors and advisors to protect clients’ digital assets, excluding those held on conventional cryptocurrency platforms.

Regulated Exchanges

The Securities and Exchange Commission (SEC) is broadening the scope of what constitutes a fully regulated cryptocurrency exchange. This move aims to raise the bar for crypto businesses, particularly those in the Decentralized Finance (DeFi) sector, to be more accountable.

New Stablecoin Regulation

The US Congress is pondering a new stablecoin regulation as part of a broader financial package.

2. Social and Romance Crypto Scams

Crypto crooks and deceitful individuals are continually coming up with clever schemes to deceive users, and their latest tactics involve manipulating emotions through false romantic advances or urgent financial appeals.

In addition to the existing methods, there’s also the classic SMS phishing scam that has been upgraded with artificial intelligence. Nowadays, this deceitful technique can simulate emergencies and manufacture convincing situations where one is urged to send money in the guise of a charitable giving opportunity following any interaction.

An additional approach for brands is to enhance user identification verification, which might be challenging for some users, as observed on certain sign-in free platforms.

3. Anti-Money Laundering Sanctions on Crypto Bridges

Another perspective on crypto transactions is that they can be influenced by geopolitical standpoints. Consequently, in the year 2023, transactions conducted by sanctioned companies amounted to a volume of $14.9 billion, which represented approximately 61.5% of all illicit transactions recorded during that period.

In simpler terms, the consequences of these actions in the crypto bridges may make it even more difficult for businesses in the crypto market to thrive.

How to Overcome the Challenges of 2024

In simpler terms, there’s a good chance that in 2024, cryptocurrencies and financial regulators may join forces, leading to a more harmonious relationship between the crypto world and traditional finance. This collaboration could result in clearer guidelines and regulations, making it easier for more people to use and trust cryptocurrencies.

The Importance of Transparency and Education in Crypto

Crypto education and transparency remain crucial in bringing regulatory authorities and users closer together. By utilizing educational resources such as guides and reviews, individuals can stay current on regulations, ultimately benefiting all involved.

Crypto Asset Diversification

To reduce risk and potentially increase returns, consider expanding your cryptocurrency investments beyond Bitcoin (BTC) to include Ethereum (ETH) or smaller coins with promising growth prospects. But remember to assess current market trends and minimize risks by carefully evaluating potential pitfalls before making any new investments.

Embracing Crypto Tools

Using crypto tools may be the key to effectively protecting your assets and making knowledgeable choices in crypto trading, as well as simplifying tax calculations, identifying opportunities on decentralized exchanges, and more.

Final Thoughts

At the conclusion of our detailed Q1 2024 cryptocurrency report, you now have the clarity required to steer through the turbulent waters of the ever-changing crypto market.

Certainly, we recommend verifying information on your own and embracing the role of an independent and motivated student in the ever-evolving world of cryptocurrencies. Daily discoveries await you!

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

2024-04-25 09:42