-

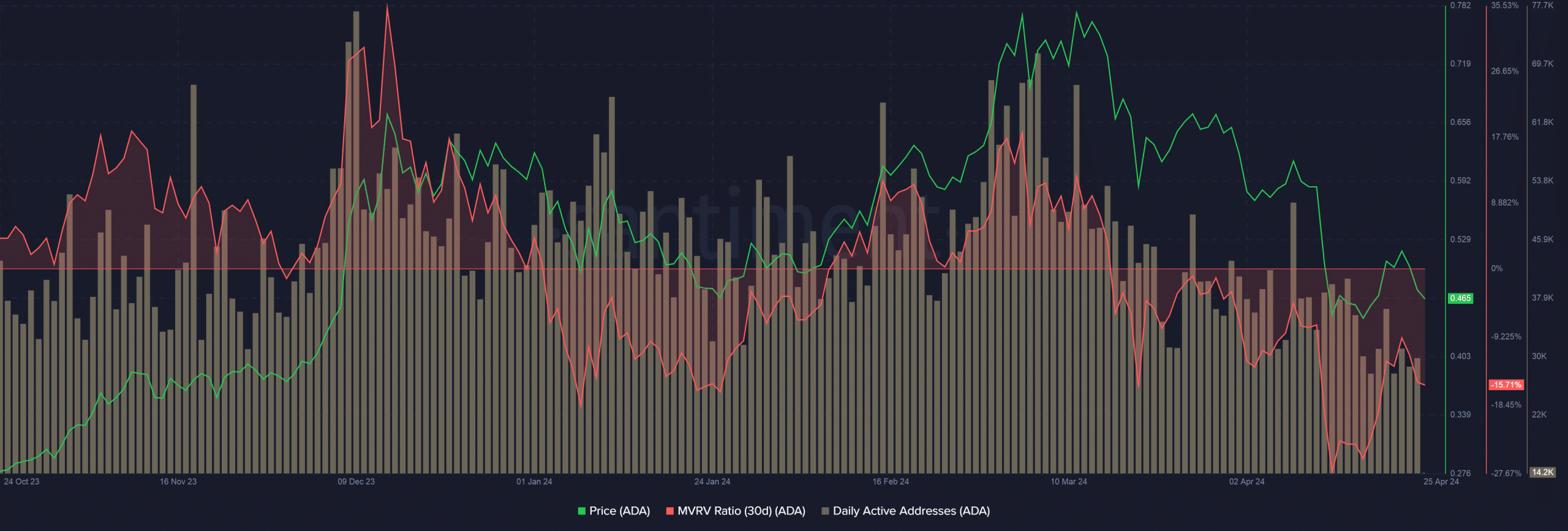

ADA’s unrealized loss widened to 15.71% as of this writing.

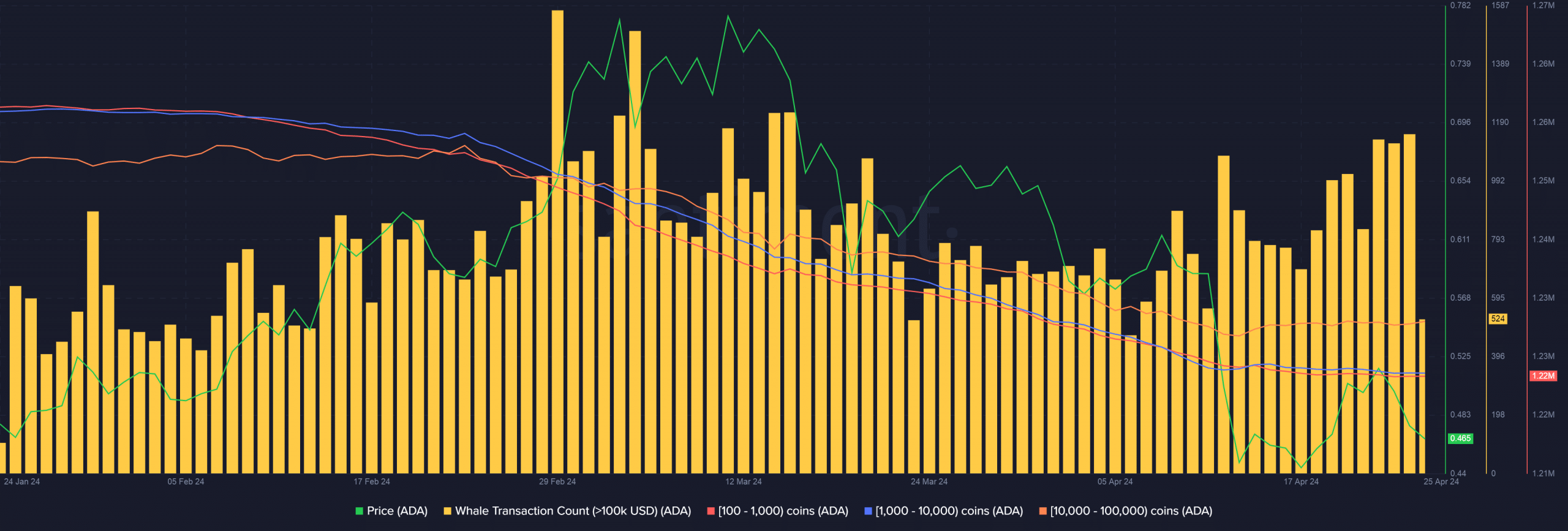

Whales weren’t buying ADA’s dip.

As an experienced analyst, I’ve seen my fair share of market ups and downs, and the recent trend with Cardano [ADA] has been particularly noteworthy. With ADA’s unrealized loss widening to 15.71% at press time, it’s clear that many holders are underwater, and this could negatively impact demand in the short term.

I’ve observed that a significant proportion of Cardano [ADA] investors are currently experiencing losses within the leading layer-1 (L1) networks. This observation raises questions about the potential demand for ADA in the immediate future.

ADA under water

As a researcher studying the cryptocurrency market, I’ve come across some intriguing data from IntoTheBlock’s latest on-chain analysis. According to their findings, approximately 35% of Cardano (ADA) investors were in profit during that specific timeframe. In contrast, a much larger proportion of Bitcoin (BTC) and Ethereum (ETH) investors were enjoying profits – around 86% for Bitcoin and 81% for Ethereum.

As of now, ADA holds the position of being the 10th largest cryptocurrency in terms of market capitalization. However, its price performance has been underwhelming recently. Over the past month, the coin experienced a significant decrease, losing approximately 28% of its value. Additionally, on a year-to-date basis, ADA has dipped nearly 22%. (Source: CoinMarketCap)

ADA’s subpar performance caused it to lose ground in market standings over the past month. Coins like Dogecoin (DOGE) and Toncoin (TON) surpassed ADA in terms of value during this period.

Around mid-May last year, ADA reached its highest point of $0.77 in twelve months. However, since then, the price has been on a downward trend. As a result, the current average unrealized loss for the network hovers at 15.71%, according to data observed by AMBCrypto from Santiment.

On average, holding ADA coins would result in a loss of 15.71% for their owners if they decided to sell at the current market prices.

One important aspect to consider is the effect of the price drop on the on-chain activity for ADA. The number of daily active addresses decreased significantly, dropping from over 70,000 at the price peak down to approximately 30,000.

Good time to stockpile ADA?

From my perspective as an analyst, instead of soaring prices and high profits, muted price levels and meager profitability could potentially offer chances for acquisition. Other coins, however, have been witnessing more intense selling pressure due to profit realization.

But were investors really interested in buying ADA’s dip?

Read ADA’s Price Prediction 2024-25

Based on AMBCrypto’s interpretation of Santiment’s findings, there has been a noticeable decrease in the amount of ADA coins held by large investors, or “whale cohorts,” over the past 2-3 months. This trend indicates that these investors have likely sold more ADA coins than they bought during this period.

For optimistic owners of ADA, it may be encouraging to consider that the current ADA bull market could be part of a larger market cycle, exactly one year following the 2020 Bitcoin halving. If historical patterns hold true, ADA’s price could potentially reach new heights and challenge its all-time high in the year 2025.

Read More

- OM/USD

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Solo Leveling Season 3: What You NEED to Know!

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- The Perfect Couple season 2 is in the works at Netflix – but the cast will be different

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

- Joan Vassos Reveals Shocking Truth Behind Her NYC Apartment Hunt with Chock Chapple!

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

2024-04-26 06:40