-

OpenSea NFT sales volume has dropped by over 40% since the beginning of April.

Blur’s market share of NFT sales volume continues to spike.

As a researcher with extensive experience in the NFT marketplace space, I find the recent trend in OpenSea’s sales volume and Blur’s market share quite intriguing.

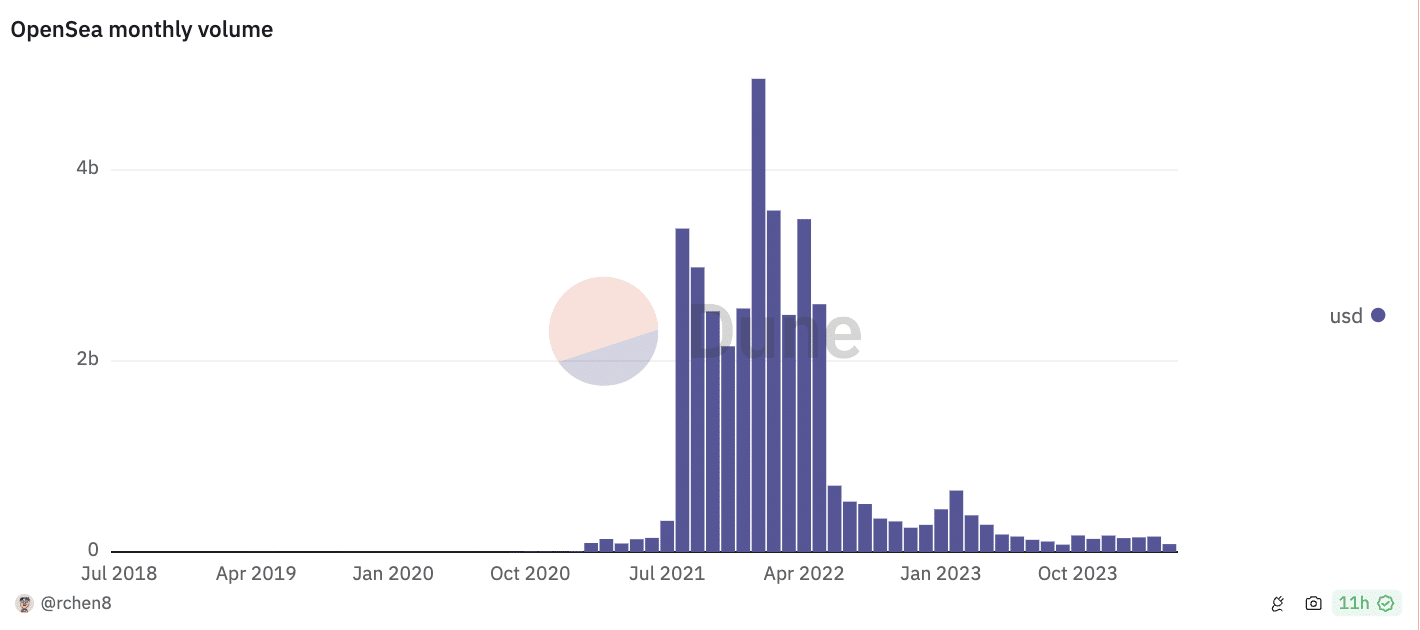

OpenSea, the prominent non-fungible token (NFT) marketplace, is on track to set a new record for the largest decrease in monthly NFT sales during April.

Based on information from a Dune Analytics dashboard compiled by Rchen8, this month’s NFT sales on the marketplace amount to approximately $82 million, which is the lowest figure recorded since September 2023.

I have noticed that the monthly NFT sales volume on OpenSea has been decreasing since the beginning of the year. The platform reached its highest YTD sales figure of $153 million back in February. However, since then, there has been a consistent drop in sales from one month to the next.

The drop in user activity during this autumn season can largely be explained by the significant decrease in OpenSea’s active user base. As of now, we have recorded a total of 63,339 active users for this month. This represents a substantial 22% decline from the 80,727 individuals who completed at least one transaction on the marketplace back in March.

Based on the current year-to-date data, there’s been a 48% decrease in the number of monthly active users, as indicated by the Dune Analytics dashboard.

I’ve noticed a significant decrease in the number of active users on the marketplace during April. As a result, the sales volume of Non-Fungible Tokens (NFTs) on OpenSea has reached its lowest point this year.

Over the past 25 days, approximately 110,000 NFTs have been purchased on OpenSea, marking the platform’s lowest monthly sales figure since June 2021.

Due to the minimal user engagement and meager sales figures on OpenSea this month, the revenue generated from primary transaction fees and royalties has accordingly decreased.

Over the past 25 days, primary transactions racked up a fee total of $2.8 million, while royalties contributed $1.9 million to the overall cost.

Blur takes lead

As an analyst, I’ve noticed an intriguing trend in the NFT marketplace landscape. Although Blur, the NFT marketplace and aggregator, boasts a smaller user base compared to OpenSea, it consistently achieves a greater trading volume.

Based on data from a Dune Analytics report compiled by Hildoby, approximately 8 out of every 10 NFT transactions completed in the past week took place on Blur. OpenSea accounted for around 1 in 5 of these transactions.

As a researcher observing the data, I discovered an intriguing phenomenon: despite having 24% more active users than Blur during that specific timeframe, OpenSea still experienced fewer transactions on its platform.

I’ve noticed that Blur’s traders were responsible for executing approximately 56% of all NFT sales transactions, whereas OpenSea’s user base accounted for around 44.2%.

Read More

- WCT PREDICTION. WCT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

2024-04-26 13:11