-

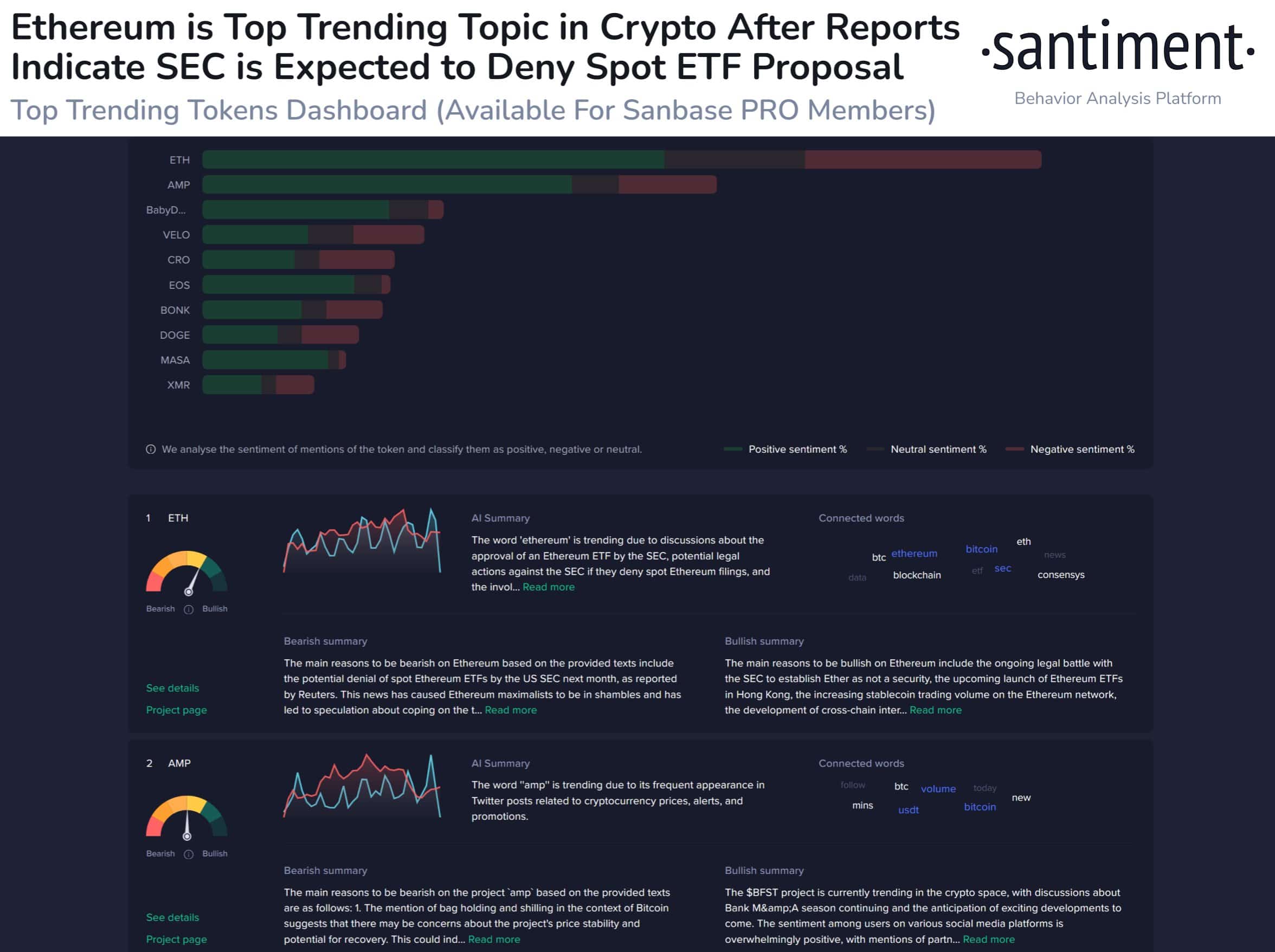

Cynicism around Ethereum grew on social media due to the expectation of the rejection of Ethereum’s spot ETF.

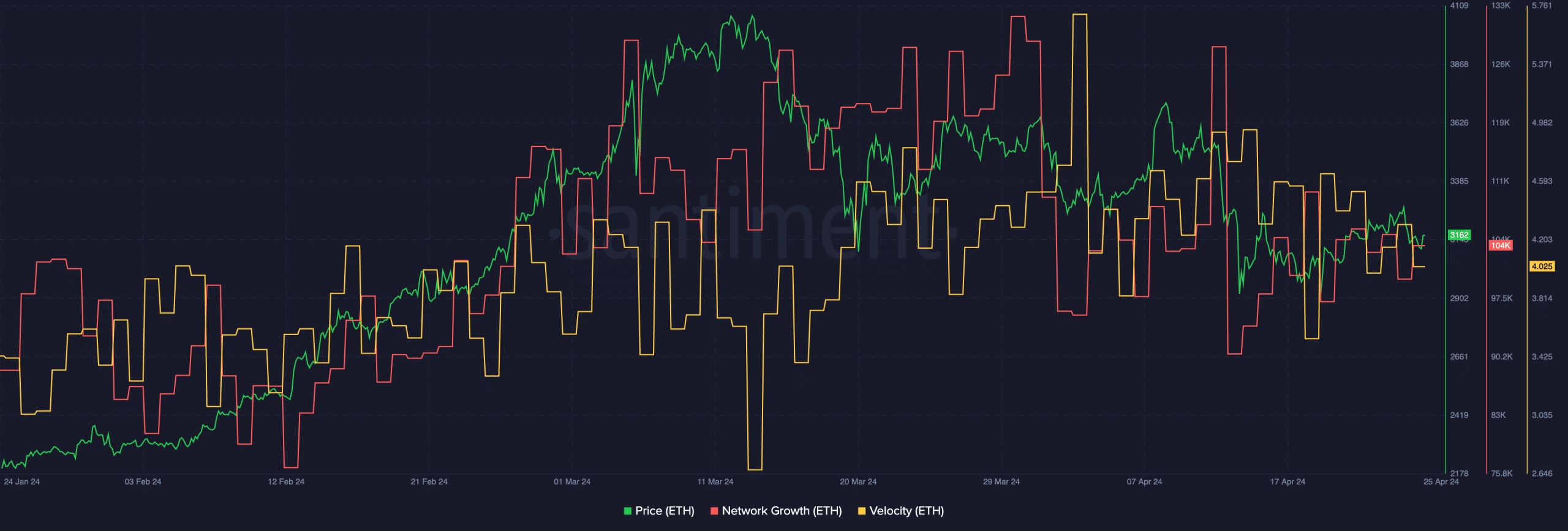

Price movement of ETH remained stable, and velocity and network growth remained the same.

As a researcher with experience in the cryptocurrency market, I’ve observed firsthand how social media sentiment can significantly impact the price and perception of digital assets like Ethereum [ETH]. While some may view the rejection of an Ethereum spot ETF as bearish news, others see it as an opportunity for non-Bitcoin assets to gain value.

Over the past few weeks, Ethereum [ETH] has experienced difficulty holding a stable position between $3,100 and $3,200 following its recent price downturn.

Word on the street

Although these elements were present, the social buzz surrounding Ethereum expanded, yet not all of this interaction involved constructive dialogue.

According to Santiment’s analysis, traders’ attention was heavily drawn to news items suggesting the SEC might dismiss Ethereum spot ETF applications in May.

Many people in the community think that the substantial rise in cryptocurrency values since mid-October is primarily due to the optimistic feelings generated by the approval of Bitcoin spot ETFs in early January.

Based on present signs, it seems the SEC might not be prepared to endorse additional assets for the time being.

Based on historical trends, it is common to see prices moving in the opposite direction of what many expect. The escalating anxiety, apprehension, and doubt (FUD) among traders, fueled by their growing impatience, might instead bring gains to non-Bitcoin assets.

Traders are growing increasingly bearish, with many assets having significantly retreated since Bitcoin reached its peak on April 14th. Consequently, there’s a good chance that some relief rallies will emerge over the next week.

As a crypto investor, I believe that Ethereum’s value could experience a short-term surge if there’s a softened stance or unexpected approval. However, the FOMO (Fear of Missing Out) among overly eager traders might cause a mid-term price drop. This volatility presents an opportunity for large holders to strategically sell and lower prices in the market.

Despite the widespread belief that selling based on rumors is the wise move, history has shown that there’s often a reason to consider purchasing when such news breaks.

What’s next for ETH?

At the moment of writing this, Ethereum (ETH) was being bought and sold for $3,151.30. Compared to the previous day, its price had dropped by a modest 0.35%. Additionally, there was a decrease of 4.04% in the amount of Ethereum traded during this 24-hour timeframe.

Over the past few days, the expansion of the network has remained relatively stable rather than significantly increasing, indicating a lack of enthusiasm among new Ethereum addresses for the cryptocurrency as of now.

Read Ethereum’s [ETH] Price Prediction 2024-25

The speed at which Ethereum (ETH) was changing hands stayed constant, suggesting a lack of increased trading activity.

Based on the current pace and expansion of the Ethereum network, it seems unlikely that there will be major price swings in the immediate future.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

2024-04-26 15:03