-

Polygon’s NFT sales spiked 9.6% in the last 24 hours

Whales were busy accumulating MATIC at discounted prices

As an analyst with a background in blockchain and cryptocurrency, I’ve been closely monitoring the trends and developments in the NFT market across various Ethereum Virtual Machine (EVM) based blockchains. Polygon has consistently stood out as a leader in this space, and recent data only reinforces its position.

Although MATIC‘s price performance may vary, Polygon stands out as the frontrunner when it comes to non-fungible token (NFT) activity on Ethereum Virtual Machine (EVM) blockchains during the month of April.

Tracking Polygon’s NFT market

Based on AMBCrypto’s analysis of data from Dune Analytics, Polygon processed approximately 3.4 million transactions on April 15, marking a nearly 10% increase compared to the previous week. This significant volume underscores Polygon’s leading position in the market, as BNB Chain managed only around 1.9 million transactions during the same period, which is almost half of Polygon’s transaction count.

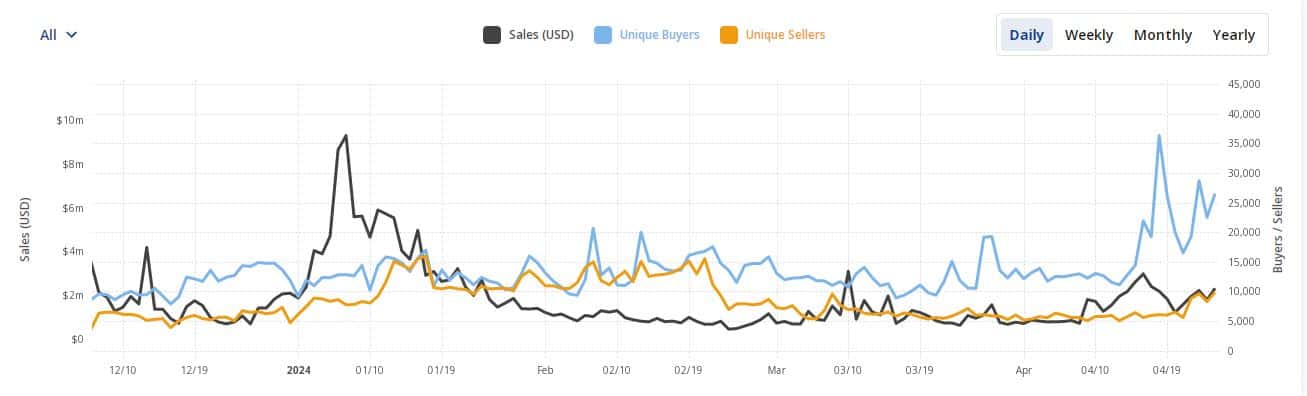

As a researcher, I’ve discovered that Polygon held a commanding position in Ethereum Virtual Machine (EVM) rankings. Yet, its market performance was equally noteworthy. Polygon ranked fourth in NFT trading volume within the previous 24 hours, according to CryptoSlam data. A notable surge of 9.6% propelled sales above $2.5 million.

As a researcher studying the current state of blockchain networks, I’ve observed that for over a month now, the network I’m examining has maintained the fourth position in the ranking. Notably, it lags behind the top three Layer-1 (L1) chains – Ethereum, Bitcoin, and Solana.

High NFT activity boosting burn rate?

Matic, similar to numerous other cryptocurrencies, gains worth based on the transaction action on its underlying network. Fees for each Matic transaction are partly incinerated, creating a deflationary impact on the coin.

As a researcher, I’ve come across some intriguing data from burntracker.io indicating that approximately 48,865 MATIC tokens were burned in the last 24 hours. It’s important to note that this event might have had a subtle impact on MATIC prices, with CoinMarketCap reporting a 1% increase within the same timeframe. However, it’s essential to exercise caution when making definitive statements regarding causality between the two occurrences.

Over a broader timeframe though, MATIC struggled, plummeting by nearly 34% in just over the month.

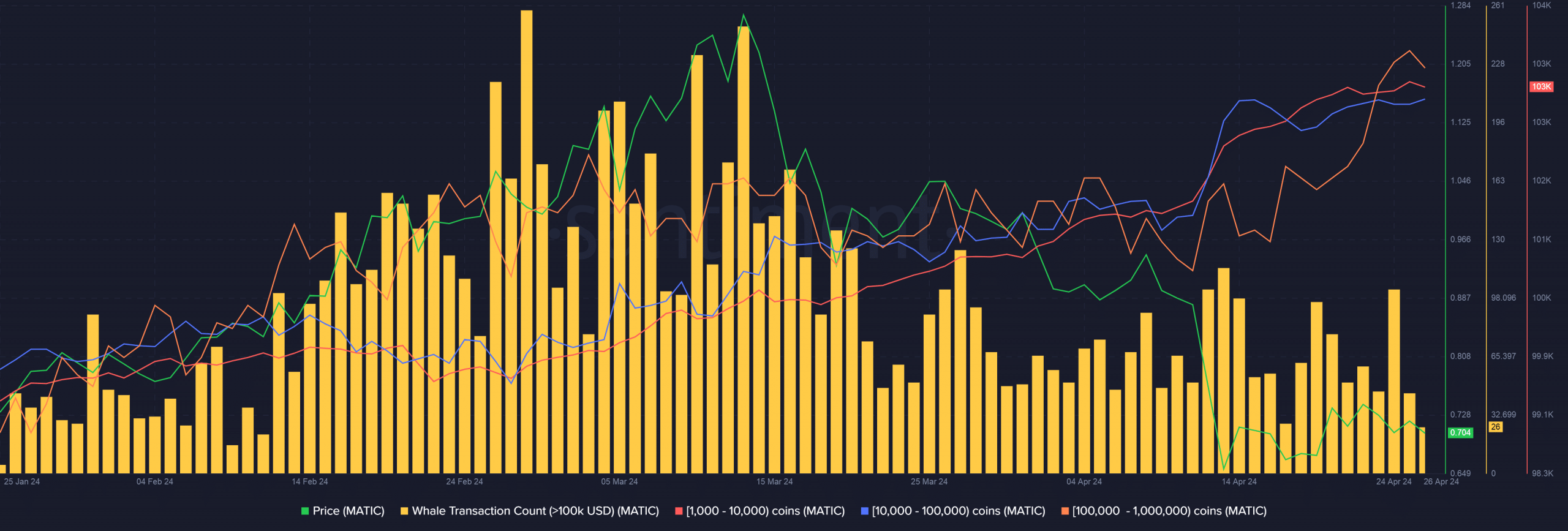

Whales bag MATIC at discount

During the price downturn for MATIC, large investors, or “whales,” took advantage of the situation to increase their holdings, according to data from AMBCrypto obtained through Santiment. At the same time, the number of users holding between 1,000 and 1 million coins steadily grew.

As an analyst, I’ve observed a trend where wealthy investors have expressed confidence in MATIC‘s future growth prospects. Consequently, they have been actively acquiring more of the asset, reflecting their bullish outlook for the medium term.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-04-27 16:07