-

Though dev activity dropped, Polkadot’s network activity hiked on the charts

A trend reversal could be on the cards for DOT’s price action

As an analyst with extensive experience in the crypto market, I’ve closely monitored Polkadot (DOT) and have observed some intriguing trends recently. Despite a drop in development activity, DOT’s network activity has seen a significant surge.

Polkadot (DOT) has been recognized for its strong development activity throughout the years. Yet, more recent data shows that Ethereum (ETH) and BNB Chain have surpassed its previous levels in the past few days. During this period of change, DOT’s price trend on the charts became downward.

Polkadot’s development activity drops

Recently, Coin98 Analytics posted on Twitter a chart detailing various blockchains arranged based on their developmental activity. Notably, Polkadot had 827 developers working on it during the previous week. Moreover, this platform saw approximately 5000 code commits weekly.

Although the number in isolation wasn’t small, it paled in comparison to other blockchains. For example, Ethereum had over 2000 weekly developers who made over 19,000 commits. Polkadot had fewer weekly commits than both Ethereum and BNB Chain, which recorded over 6,000 commits per week.

As a crypto investor, I’ve observed that Polygon (MATIC) and Optimism (OP) have surpassed DOT in recent weeks with impressive development activity. Specifically, their weekly commitments on GitHub amounted to around 6,300 for Polygon and 5,200 for Optimism.

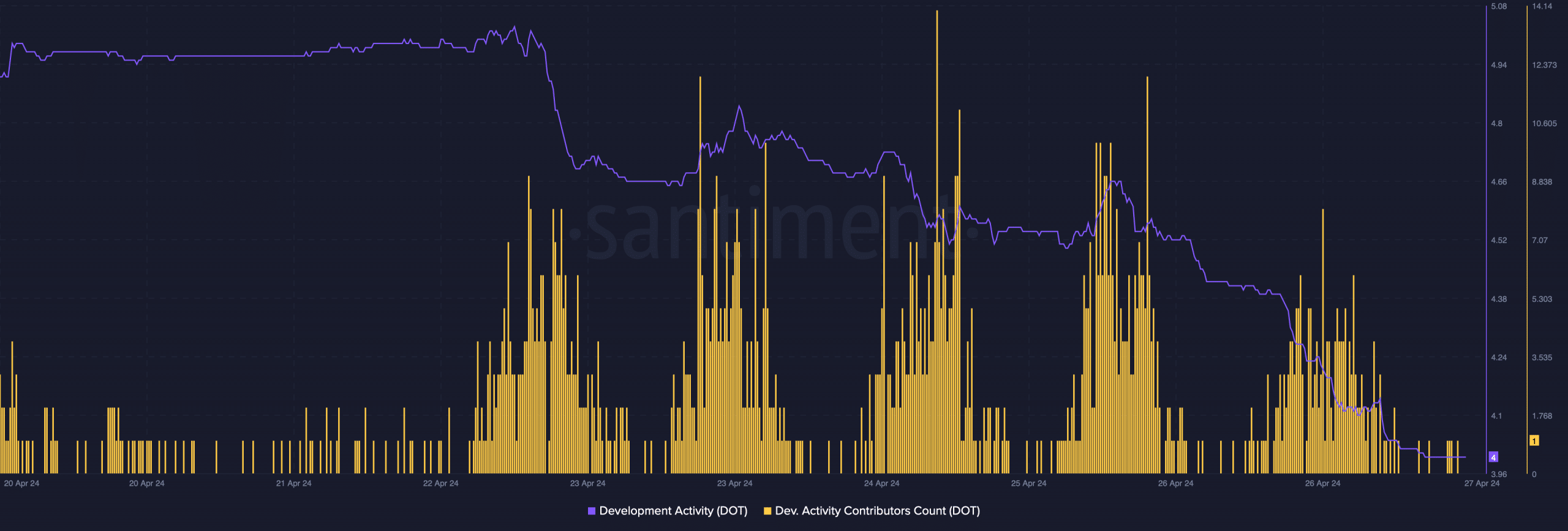

According to AMBCrypto’s interpretation of Santiment’s data, we discovered a comparable trend regarding Polkadot (DOT). A significant decrease in development activity was identified over the past week. Nevertheless, there were several surges in the number of contributors to DOT’s development activity during the same period.

It’s worth pointing out that despite a decrease in developer activity on the blockchain lately, there was a significant surge in network activity over the past week.

According to AMBCrypto’s analysis of Artemis’ data, there was a significant increase in the number of daily active addresses for DOT on April 24th after a prolonged period of inactivity. This surge in usage led to a corresponding rise in the daily transaction count for DOT as well.

Bears are attacking DOT

During this period, the price of Polkadot’s DOT token experienced a dip, causing a slight decrease in its value. As per CoinMarketCap data, there was a loss of around 1.5% in the last week for DOT. More specifically, within the previous 24 hours, the token’s value dropped by approximately 2%. At the moment, DOT is being traded at $6.70, with a market capitalization exceeding $9.6 billion.

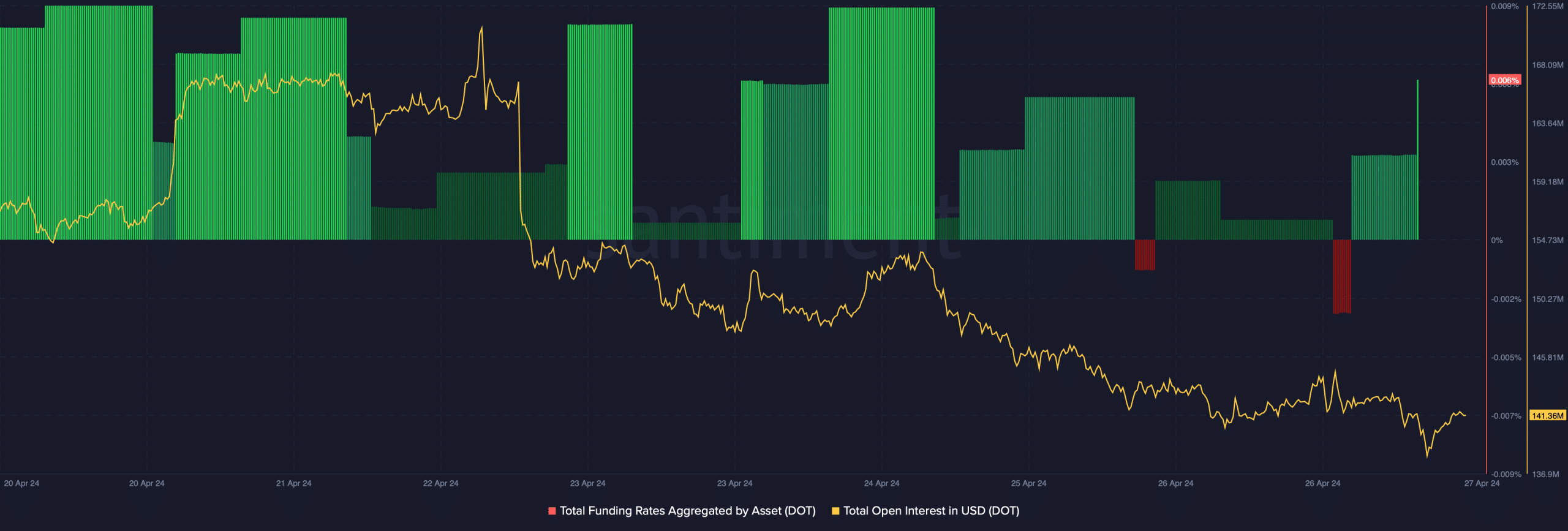

The funding rate for DOT has increased in the past few days. This is a bearish sign because historically, pricing trends have often moved inversely to the funding rate.

As a researcher studying the cryptocurrency market, I’ve observed that Polkadot’s open interest has decreased. A decrease in this metric suggests that there’s a possibility of the current market trend shifting.

Read Polkadot’s [DOT] Price Prediction 2024-25

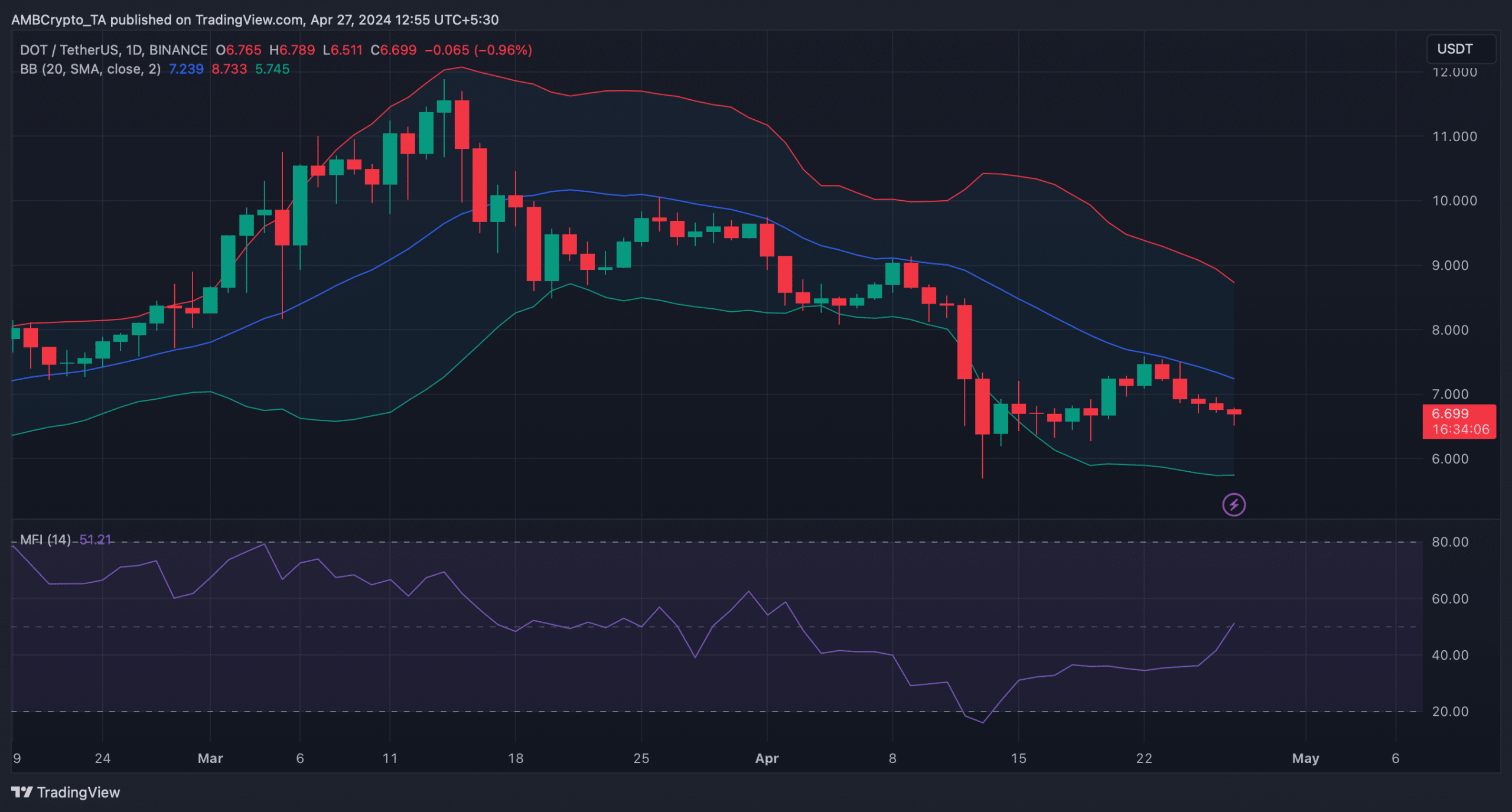

The Money Flow Index (MFI) of DOT showed a significant surge and was trending upward beyond the neutral zone, potentially indicating a price increase.

Lastly, according to Bollinger Bands analysis, DOT‘s price remained below its 20-day Simple Moving Average (SMA). A strong surge above this threshold might trigger a new bullish trend for the altcoin in the market.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-04-27 18:15