-

Selling pressure on Ethereum rose over the past week

Most market indicators looked bearish on ETH’s charts

As a crypto investor with some experience under my belt, I’ve grown accustomed to the volatile nature of this market. However, the recent turn of events with Ethereum [ETH] has left me feeling uneasy. Last week, ETH managed to surpass $3.2k, but alas, it couldn’t sustain its upward momentum. Given the current market conditions, there’s a real possibility that ETH could fall to its support level of $2.7k.

Last week, the price of Ethereum’s Ether token [ETH] surpassed $3,200. However, following this achievement, ETH took a turn for the worse and became bearish. With current market conditions, there’s a possibility that ETH could drop down to its support level at around $2,700 if things continue in a negative direction.

More red for Ethereum

As an analyst, I’ve observed that Ethereum’s (ETH) value increased by approximately 2% according to CoinMarketCap’s data during the previous week, reaching a new peak at around $3,200 on the 24th of April. However, this upward trend seemed short-lived as its price experienced a decline over the last day. Currently, Ethereum is being traded at roughly $3,118 with a market capitalization surpassing $380 billion.

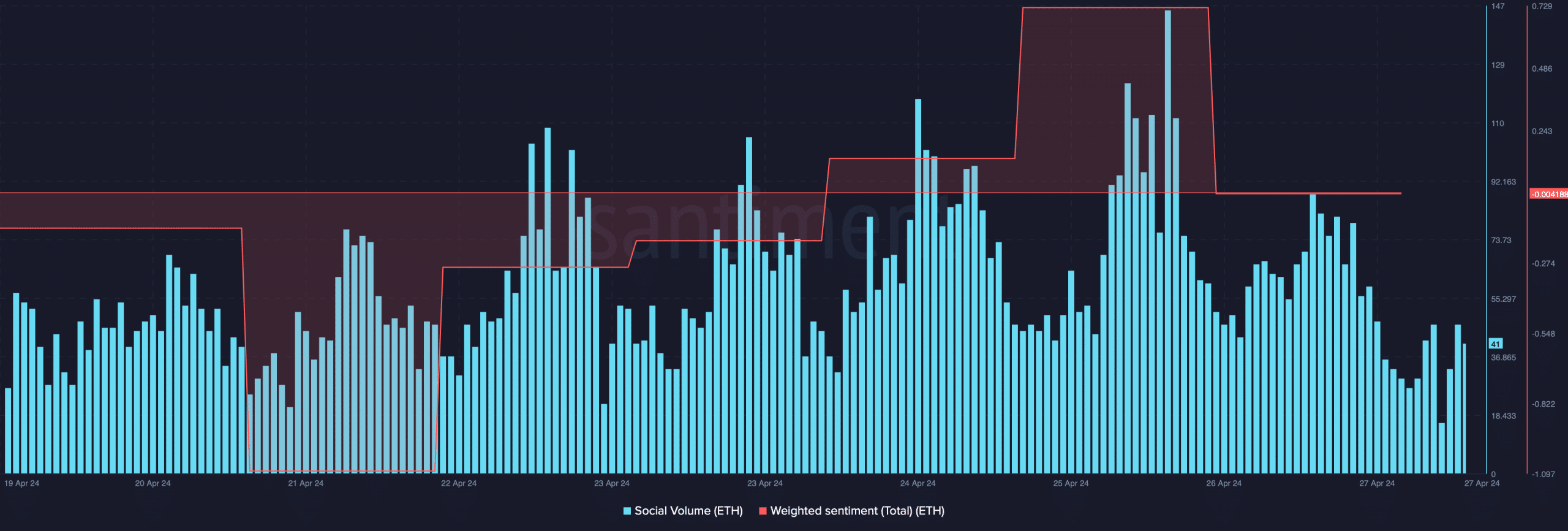

Based on IntoTheBlock’s statistics, approximately 79% of Ethereum investors are currently experiencing a profit. The decrease in Ethereum’s price has also caused its social media activity to decline. Furthermore, following a significant increase on April 25th, the sentiment towards Ethereum as expressed in weighted data indicated a shift towards bearish sentiments among investors.

If ETH experiences further price decreases, there’s a risk that its value could slide down to the $2,700 mark in the near future based on the latest prediction by well-known crypto analyst Crypto Tony. This likelihood becomes more likely if ETH fails to surpass the $3,600 resistance level.

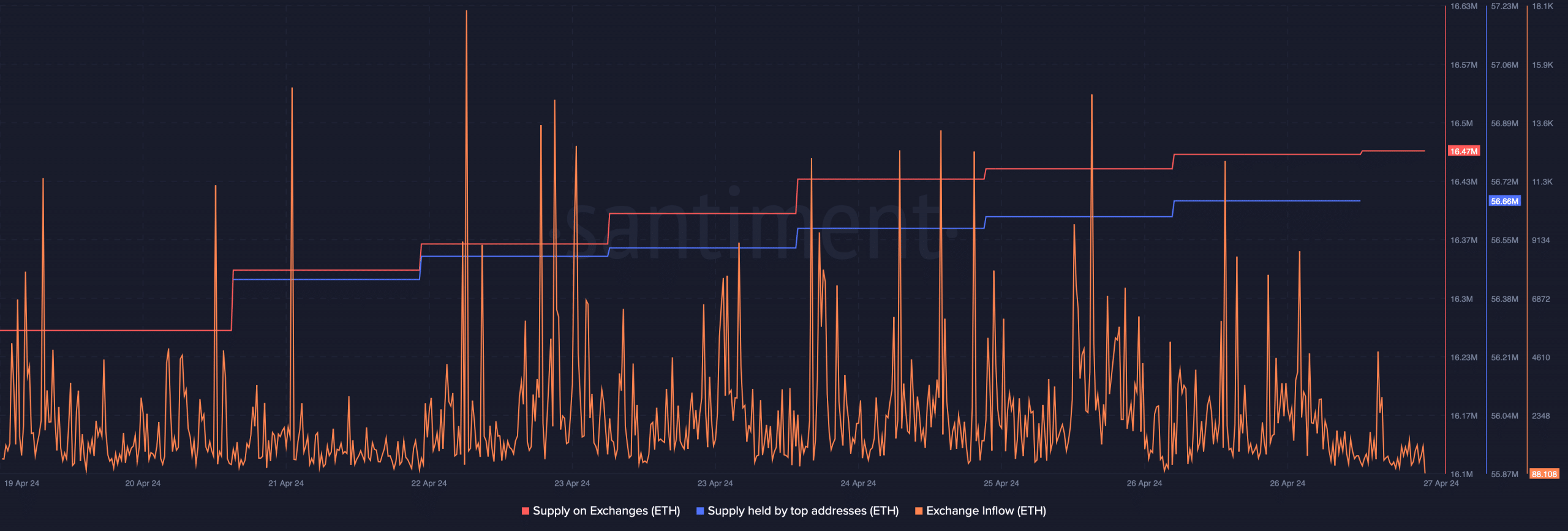

Therefore, AMBCrypto took a look at Santiment’s data to see whether metrics seemed bearish.

Over the past week, there has been a noticeable uptick in selling activity for the token, as indicated by the surge in exchange inflows. This trend was additionally corroborated by an increase in Ethereum’s supply held on exchanges, signaling strong selling pressure.

Despite going against common belief, whales continue to have faith in Ethereum, as indicated by an increase in its supply held by large address holders.

Ethereum’s immediate support levels

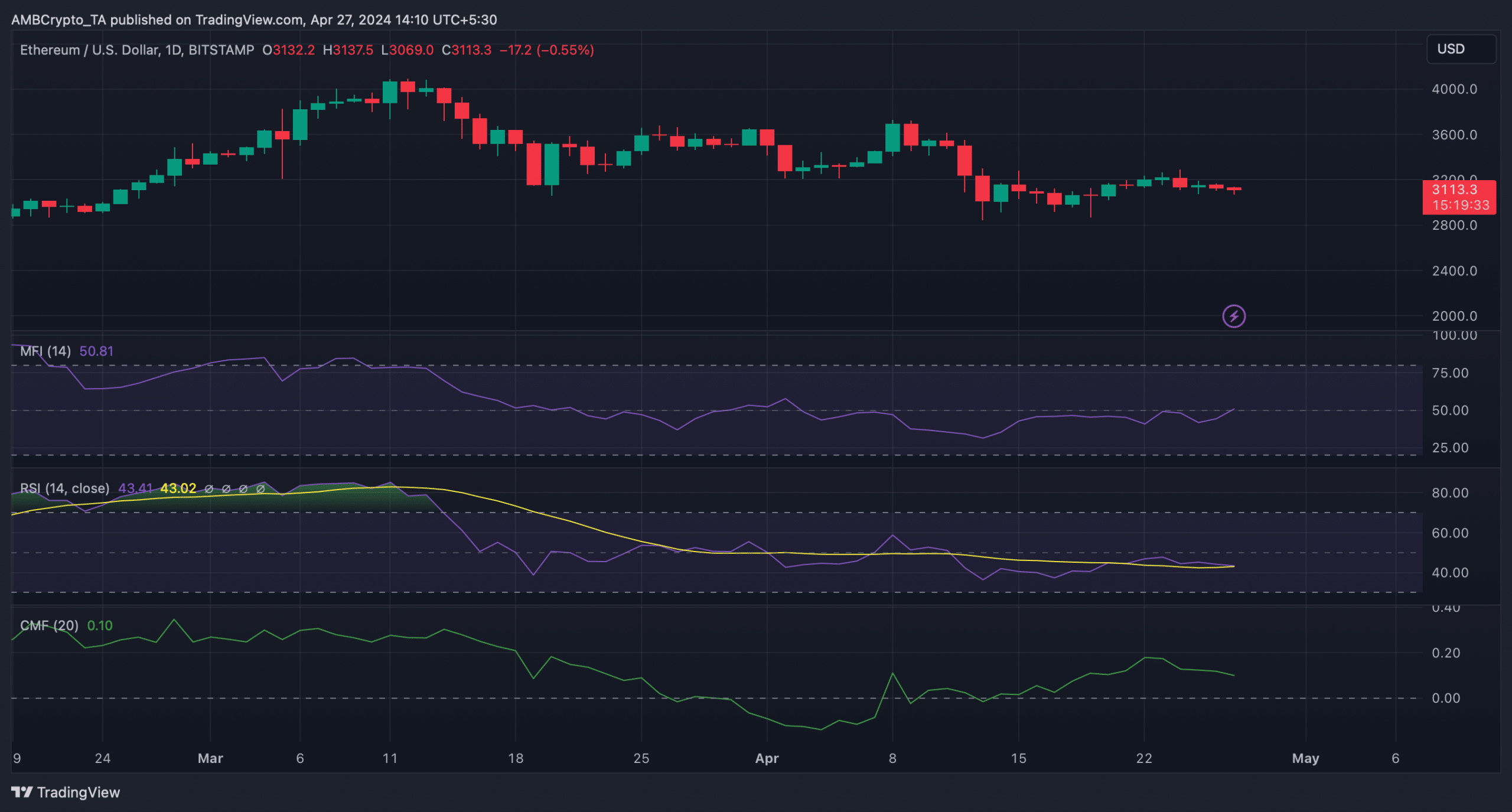

Instead of “AMBCrypto then checked ETH‘s daily chart to find whether a sustained downtrend is imminent or not,” you could say:

Despite the fact that other signals appeared pessimistic, the following indicators for Ethereum took a downturn: its Relative Strength Index (RSI) and Chaikin Money Flow (CMF) moved in a downward direction. This implies that the possibility of a more significant price decrease was likely.

Is your portfolio green? Check the Ethereum Profit Calculator

After analyzing Hyblock Capital’s data, AMBCrypto found that Ethereum has a robust support level around $3,100 should the price experience a downturn.

As a researcher studying the cryptocurrency market, I’ve identified a crucial level for Ethereum (ETH) at a price point slightly above current levels. Should ETH dip just below this level, it could potentially trigger a sharp decline, pushing the price down to around $2.8k before hitting its tested support at approximately $2.7k in the upcoming days or weeks.

Read More

2024-04-27 21:11