-

XRP’s downward pressure may be losing momentum

Market bears still retain significant influence across the market though

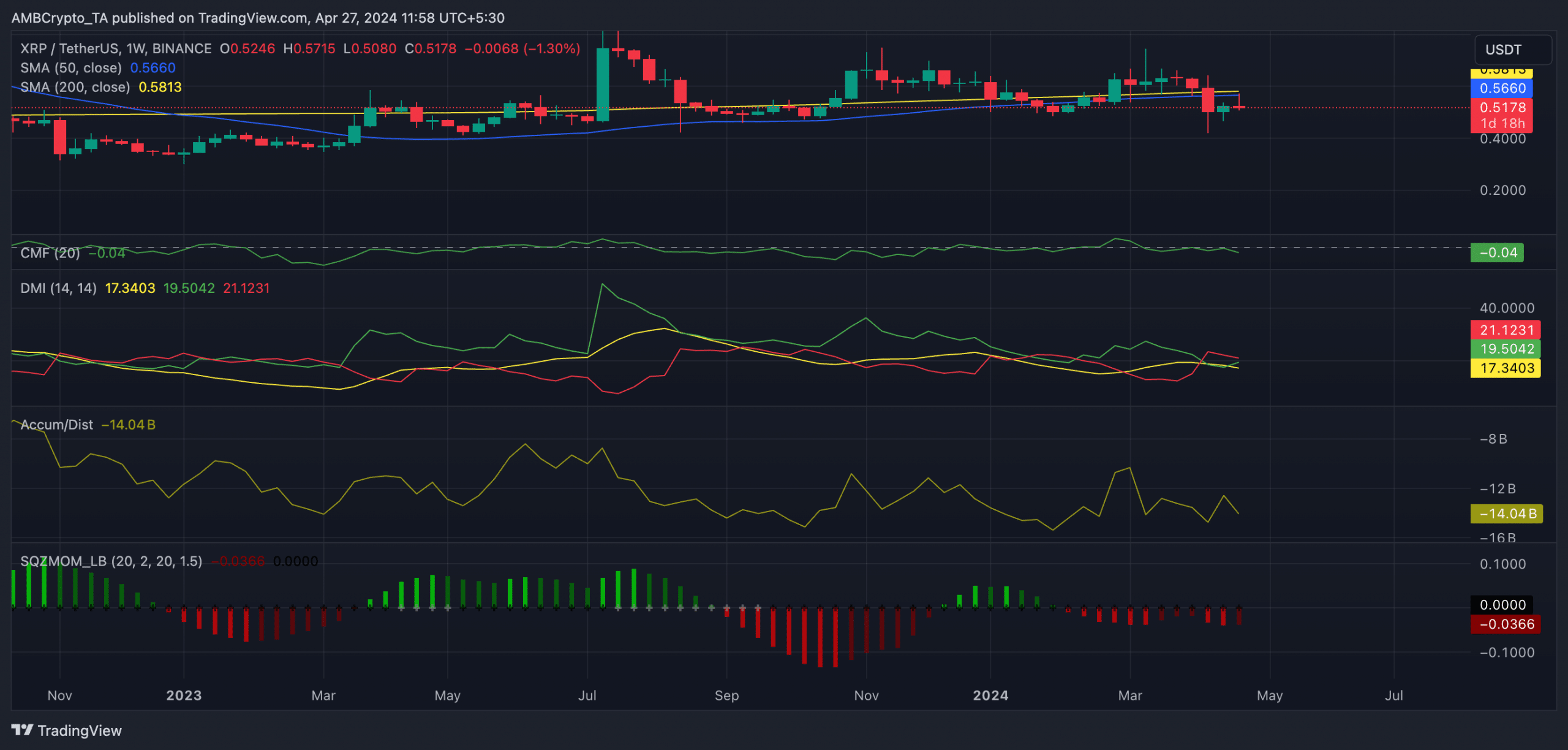

As a crypto investor, I’ve noticed that XRP‘s downtrend may be losing steam. The gap between its short-term and long-term moving averages is getting smaller on the weekly chart. However, market bears are still in control.

The trend of XRP‘s price decline over the long term has been showing signs of weakness recently. The distinction between its 50-day and 200-day simple moving averages on the weekly chart is shrinking, indicating a potential shift in momentum.

As a researcher studying financial markets, I would describe the relationship between an asset’s 50-day Simple Moving Average (SMA) and its 200-day SMA in the following way:

When the distance between XRP‘s 50-day and 200-day moving averages lessens, with the former sitting beneath the latter, this pattern typically signals a weakening downtrend. Essentially, it implies that XRP’s short-term trend is nearing its long-term trend, suggesting a decrease in the downward pressure.

Bears may have it all

Despite a potential lessening of bearish pressure on XRP, other significant technical signals suggest that pessimistic attitudes towards the cryptocurrency persist.

At present, the Chaikin Money Flow (CMF) figure for this asset is showing a negative value, having done so since March. A negative CMF signifies a significant increase in market selling pressure or coin distribution. Essentially, it means that more coins are being sold than bought, resulting in a net outflow of funds from the asset.

At present, the trend in XRP hoarding, as indicated by its Accumulation/Distribution Line (ADL), is decreasing.

This metric monitors the net movement of funds into and out of an asset throughout a specific timeframe. A decrease in this metric implies that more traders are disposing of the asset than are acquiring it.

Read Ripple’s [XRP] Price Prediction 2024-25

Additionally, the XRP Squeeze Momentum Indicator, which signifies the coin’s momentum and assists traders in navigating sideways markets, displayed red, downward-pointing signals recently. This marker has shown a negative value since the start of this year.

When it displays these kinds of bars, the asset in question is recording southbound momentum.

In simpler terms, when the red line representing a token’s negative directional index is higher than the green line indicating its positive directional index, it means that the bearish force (selling pressure) is stronger than the bullish force (buying momentum) for XRP. This trend can be observed on charts.

Currently, XRP is priced at approximately $0.51 in the markets. However, over the past month, there has been a nearly 20% decrease in its value as indicated by CoinMarketCap’s data.

Read More

2024-04-27 22:15