-

Increasing calls to sell BTC could fuel a rebound towards $68,600

An important metric revealed that the coin has not yet hit the peak of this cycle

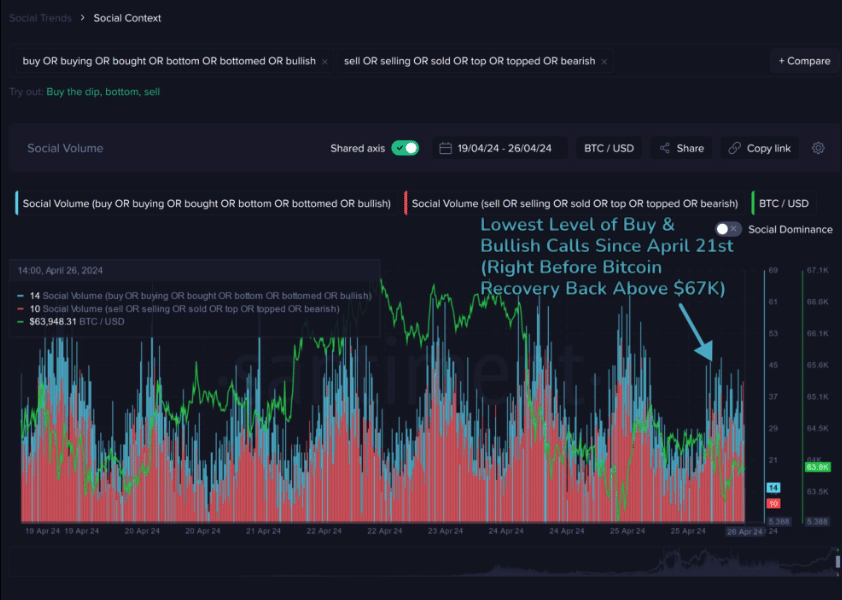

In recent developments, Bitcoin’s [BTC] dip below $63,400 has sparked a surge of Fear, Uncertainty, and Doubt (FUD) among traders. According to AMBCrypto’s analysis using Santiment’s on-chain social tool, calls to sell have outnumbered “buy the dip” cries in the last 12-24 hours. Contrastingly, a few weeks ago, bullish calls dominated any slight price dips.

Recently, Bitcoin‘s [BTC] dip below the $63,400 mark has sparked a wave of anxiety and apprehension amongst investors, as evidenced by the prevailing sentiment among traders over the past day or two.

According to Santiment’s on-chain social analysis, AMBCrypto observed a significant difference in crypto market sentiment recently. Previously, there were more “buy the dip” messages than “sell” calls. However, this trend has reversed in the past few weeks. During that period, even small price drops sparked a surge of bullish rhetoric.

Is fear the power source for a hike?

Despite the current unfavorable conditions for Bitcoin, this situation isn’t all negative. In fact, a surge of fear, uncertainty, and doubt (FUD) could trigger a rebound in the market. A recent example occurred on 21 April.

As a crypto investor, I remember that fateful day when Bitcoin took a turn for the worse. The value of BTC dipped down to a disheartening $64,531, leaving many traders convinced that a deeper plunge was on its way. Surprisingly enough, however, Bitcoin defied those expectations and bounced back with renewed vigor, reaching an impressive high of $67,169 instead.

After making that arrangement, there’s a likelihood of observing a similar occurrence if bears maintain their public stance on the issue. Nevertheless, it’s essential to consider this perspective from a quantitative standpoint as well.

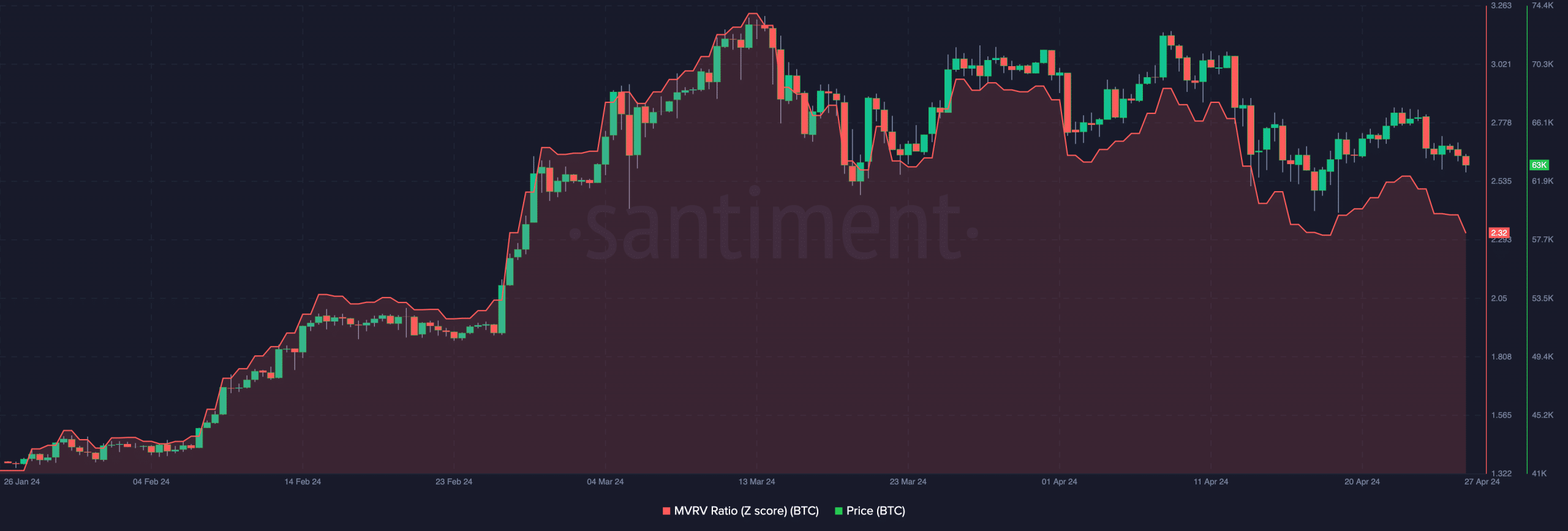

Initially, AMBCrypto analyzed the Market Value to Realized Value (MVRV) Ratio’s Z-Score. For those unfamiliar, this financial metric helps identify the peaks and troughs of a cryptocurrency’s price movement. Moreover, it provides insight into whether an asset is relatively overvalued or undervalued in the market.

When I penned down these words, Bitcoin’s MVRV Z Score stood at 2.32. The enclosed graph indicates that the bitcoin price has bounced back each instance since March when this specific metric dipped beneath 2.60.

As a crypto investor, I acknowledge the possibility that Bitcoin’s price may dip below the $62,400 mark if bears manage to maintain control. However, should this scenario unfold, a potential recovery could follow, leading us to a new high of around $68,600.

BTC looks sound for the latter part

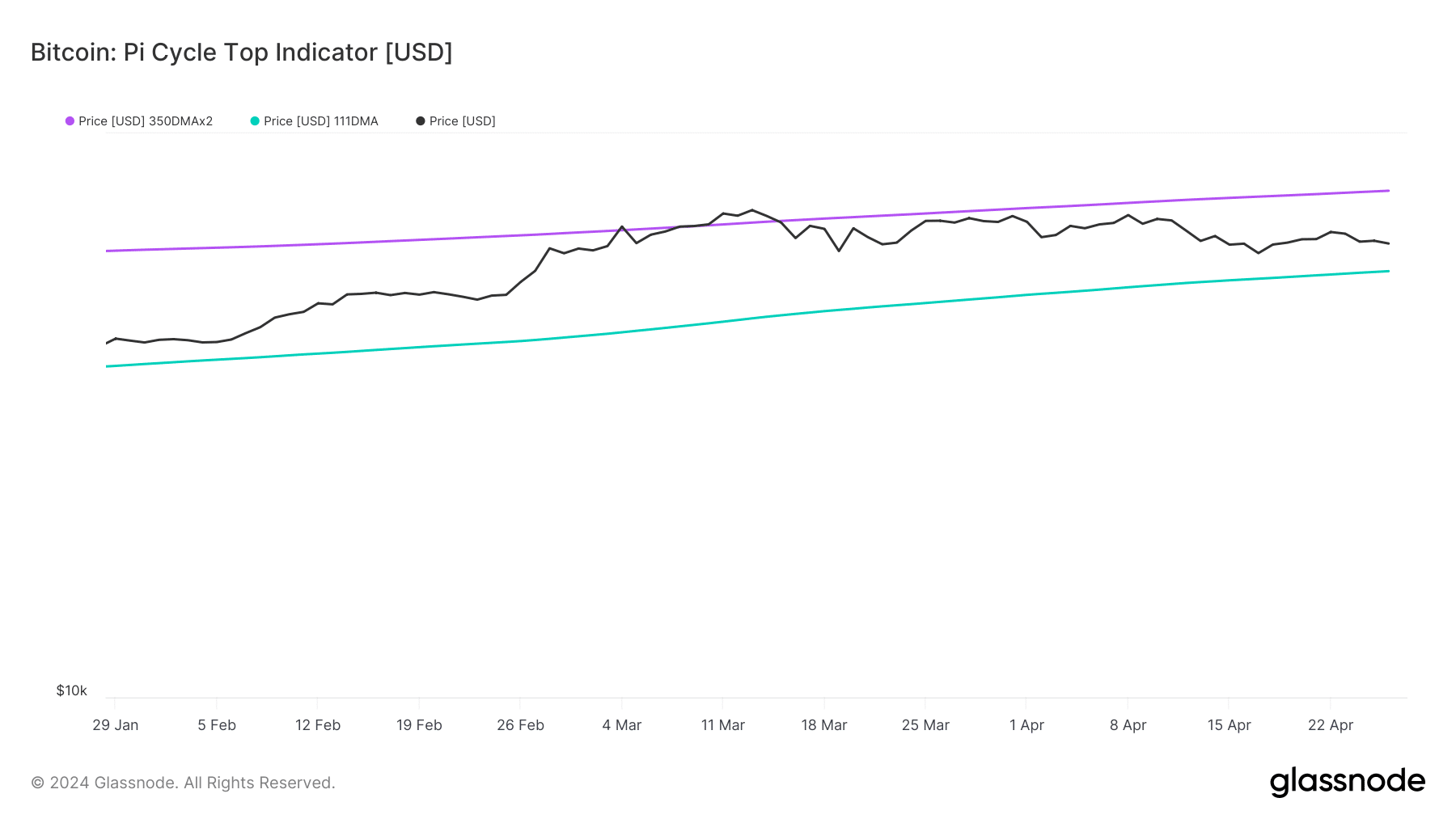

As an analyst, I’ve examined the Pi Cycle Top indicator assessed by AMBCrypto. This metric holds significant historical value in determining whether Bitcoin is experiencing overheating or not. The indicator displays two lines: a green one and a purple one. The green line signifies the 111-day Simple Moving Average (SMA), whereas the purple line represents the 350-day Moving Average.

Generally speaking, Bitcoin approaches the peak when the 111-day Simple Moving Average (SMA) aligns or surpasses the 350-day SMA. However, presently, this condition has not been met as the 111-day line lies beneath the 350-day line.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

In simpler terms, Bitcoin bulls found the metric’s condition extremely favorable, not just recently but throughout the majority of its current growth phase.

If the Pi Cycle Top maintains its current stance in the upcoming months, Bitcoin’s price could surge. Furthermore, a potential target of $80,000 to $85,000 might be within reach.

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-04-28 03:03