- Increasing money flow into AI firms might trigger a bounce for these tokens

- Healthy social dominance might be key to bringing the rally to life

As a crypto investor, I’ve noticed an intriguing correlation between the stock of NVIDIA Corp (NVDA), an AI firm, and certain AI-themed tokens like Fetch.ai (FET) and Render (RNDR). In the last five days, NVDA’s value has surged by over 12%, and this could potentially trigger a bounce for FET and RNDR.

As a market analyst focusing on AI-related stocks, I’ve noticed an intriguing correlation between the recent performance of Fetch.ai (FET) and Render (RNDR), and that of NVIDIA Corporation (NVDA). Given NVDA’s impressive 12.26% growth over the past five days, as per Google Finance data, it could be worth considering a potential rebound for FET and RNDR.

According to AMBCrypto’s analysis of a recent Bloomberg report, the surge in investments towards artificial intelligence (AI) projects this week has resulted in the price rise.

Approximately two weeks ago, NVDA’s stock price experienced a significant decrease as a result of geopolitical instability in the Middle East. Simultaneously, the graphs of FET and RNDR indicated substantial declines in their prices as well.

Attention to shift to these tokens if…

During this time, the cryptocurrencies’ prices aligned with those of the stocks. Notably, their increase may not solely be attributable to stock market influences.

As an analyst, I’d like to share how AMBCrypto approaches analysis in this article by examining various on-chain indicators to assess their alignment with the stated prediction. Initially, I delved into the aspect of social dominance.

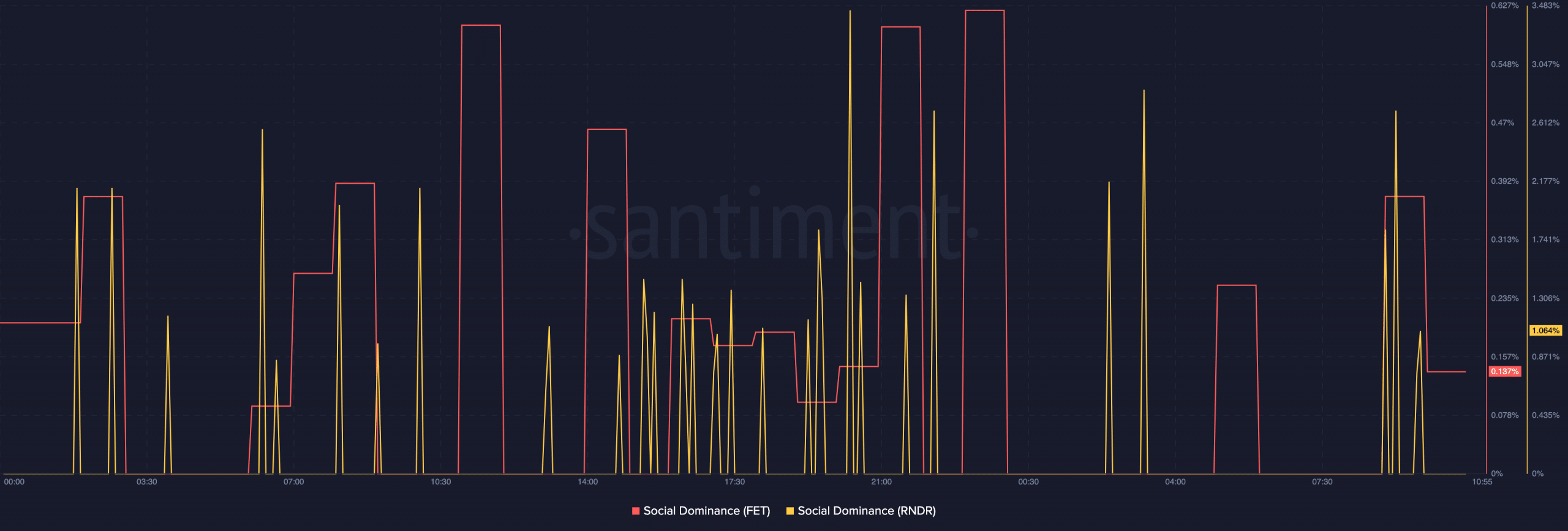

Based on Santiment’s data, Render’s social influence peaked at 2.69% on April 27th, only to decline later as shown in the charts. Similarly, FET experienced a surge to 0.37% before dropping down to 0.13% as of the current report.

As a crypto investor, I would interpret this as follows: The conversations surrounding this token’s metric have been relatively positive compared to other assets in the market. This is a good sign for the token’s price, which has managed to maintain a healthy position despite market fluctuations.

Based on historical trends, if the metric surpassed 3.45%, it would indicate that the tokens were at risk of becoming overheated. Consequently, rather than a possible increase in price, there could be a downward trend observable on the chart.

If there is a modest increase in demand for FET tokens, their price could surpass its previous weekly high of $2.62. Similarly, RNDR may have the potential to reach and even exceed its weekly high of $9.53 with a similar uptick in demand.

Is no one there to help?

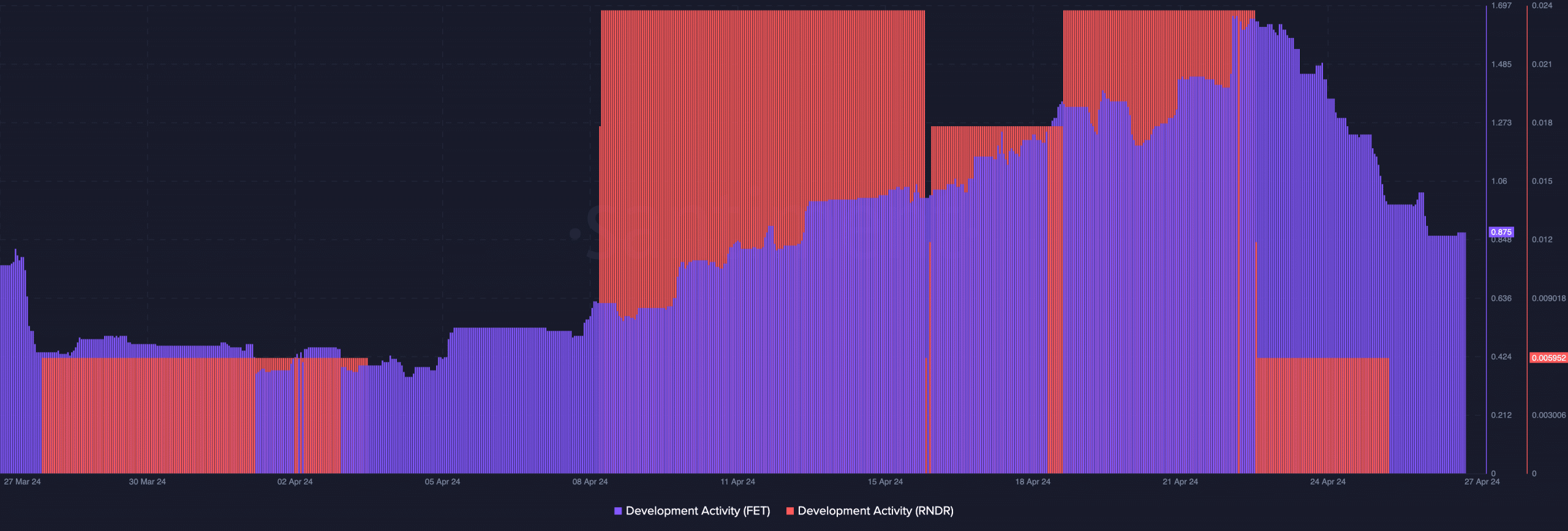

From a researcher’s perspective, I would emphasize the significance of evaluating development activity as an additional key performance indicator in the AI crypto economy. The rationale behind this is that ongoing advancements and enhancements to these projects play a crucial role in expanding their use cases. For instance, the past intention to integrate FET with AGIX and OCEAN serves as evidence of this continuous improvement effort. Consequently, it’s imperative for development progress to maintain its momentum if utility is to effectively drive demand.

As a researcher examining the data, I’ve noticed an unfortunate trend: Fetch’s development activity took a downturn following its peak on April 22. Coincidentally, around the same time, Render’s metrics began to decline as well.

The decrease in this metric indicates that developers have reduced their pace of releasing code for delivering new network features. It’s crucial for investors and traders to monitor both this metric and Nvidia closely.

Realistic to not, here’s FET’s market cap in RNDR’s terms

If social dominance increases and NVDA’s price rises as a result, it could potentially lead to price growth for RNDR and FET. With heightened development activity, double-digit percentage gains are a possibility in the near term. Conversely, should the factors contributing to this trend reverse, the bullish outlook may no longer hold.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-04-28 04:07