-

Despite its recent price troubles, SHIB’s long-term outlook remains bullish

SHIB’s key on-chain indicator flashed a buy signal too

As a technical analyst, I’ve been closely monitoring Shiba Inu‘s [SHIB] weekly chart and have identified several key indicators suggesting that this memecoin could be due for a long-term rally. Despite the recent price volatility and turbulence, these signs are promising and indicate potential growth in the future.

Currently, the altcoin is priced at $0.000025 based on my writing. However, as per CoinMarketCap’s latest update, this digital asset has experienced a 20% decrease in value within the past month.

SHIB prepares for a lift-off

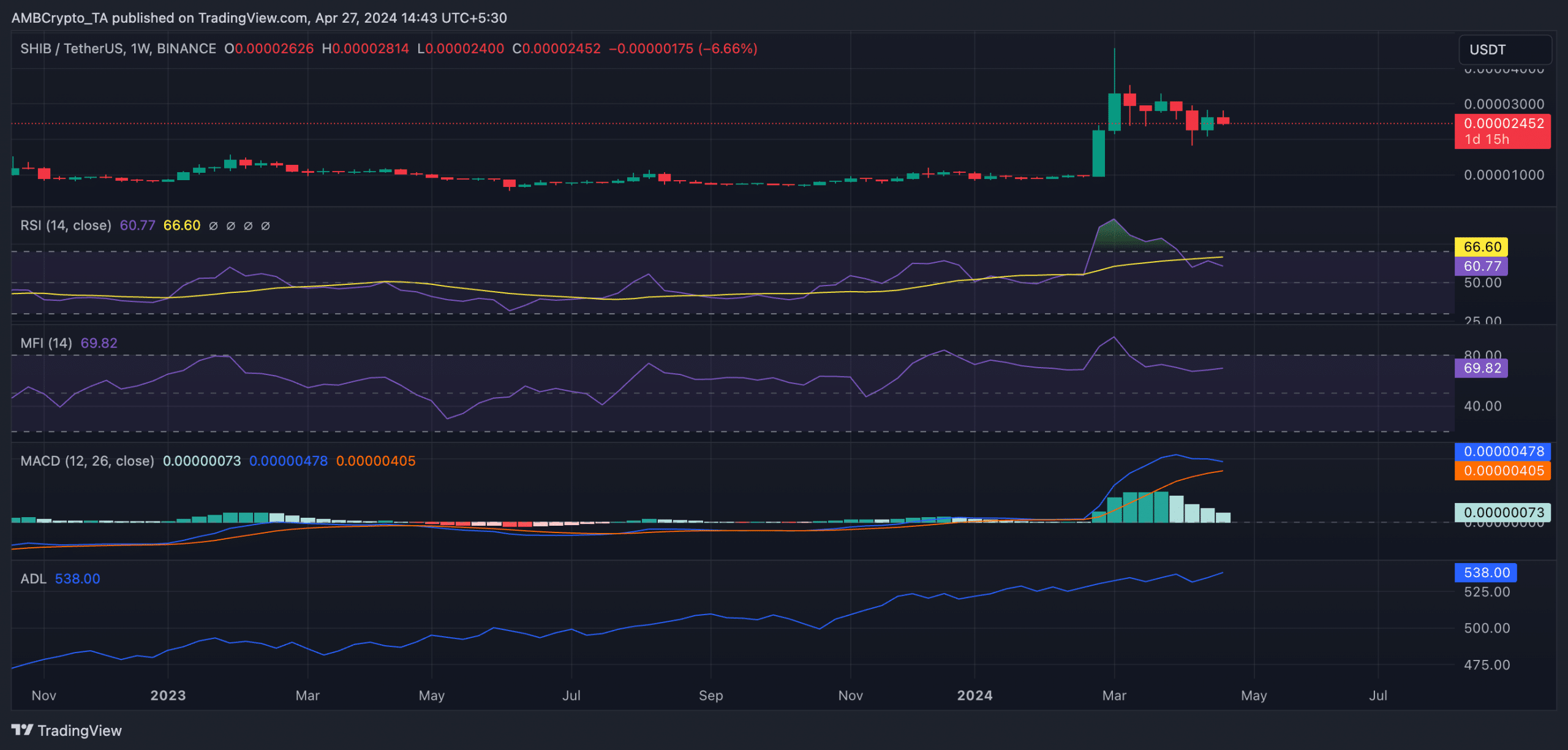

Notable initially is SHIB‘s Moving Average Convergence Divergence (MACD), which monitors market trends and shifts in price momentum for this cryptocurrency. Currently, the MACD line (represented by the blue color) hovers above its signal line (orange).

Traders view this as a positive indicator and frequently respond by buying stocks and closing any short sales they may have open.

As a researcher studying the cryptocurrency market, I’ve noticed that despite encountering some pricing challenges lately, Shiba Inu (SHIB) continues to exhibit strong demand based on its momentum indicators. Specifically, its Relative Strength Index (RSI) stood at 60.77, and the Money Flow Index (MFI) registered a reading of 69.82. These figures indicate that SHIB traders have been more inclined towards accumulating rather than distributing the memecoin.

As a researcher studying the behavior of market participants in the SHIB market, I’ve observed a strong preference for accumulating this cryptocurrency. This trend is also reflected in the Accumulation/Distribution Line (A/D Line), which was on an uptrend at the time of my analysis.

This metric tracks the net inflow or outflow of funds into an asset over a given timeframe. An increase in this figure signifies that more capital is entering the asset, driven by increased demand, potentially leading to a price rise.

SHIB Whales unmoved by losses

In spite of a price drop of more than 10% for the memecoin SHIB during the last month, large SHIB investors holding between 100,000 and 1,000,000 SHIB coins have increased their buying activities.

At present, a group of 299,000 investors had been identified, and this number had grown by 4% within the past thirty days based on information from Santiment’s data.

Despite seeing red daily from their SHIB transactions, as indicated by a 0.359 transaction volume ratio of losses to profits according to Santiment, memecoin holders have shown remarkable tenacity.

In simpler terms, out of every 10 SHIB transactions resulting in a loss, approximately 6 or fewer resulted in a profitable outcome.

Is your portfolio green? Check the SHIB Profit Calculator

Now might be the time to buy

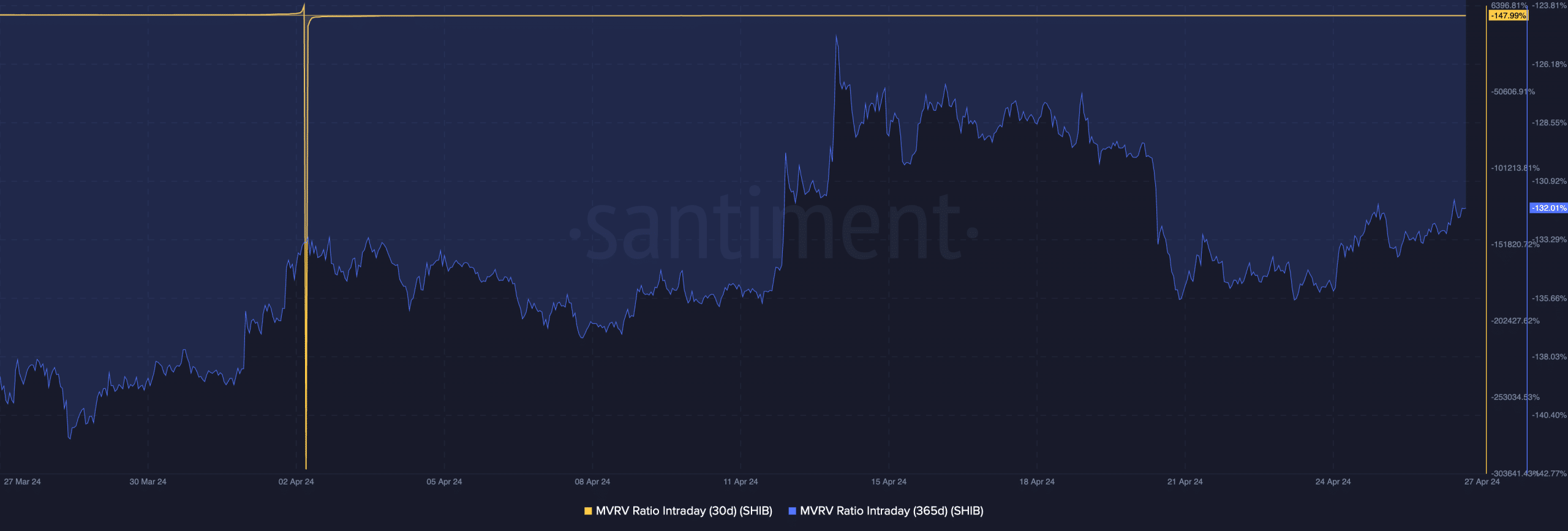

Lastly, based on blockchain information, SHIB‘s Market Value to Realized Value (MVRV) indicator signaled a purchasing opportunity. As per Santiment’s analysis, SHIB’s MVRV ratios for the 30-day and 1-year periods were recorded at -132% and -147%, respectively.

The MVRV (Market Value to Realized Value) ratio measures the relationship between a cryptocurrency’s current market value and the average purchase price of each coin or token in your portfolio.

As an analyst, I would describe it this way: When an asset’s market value falls short of the average cost at which all its circulating tokens have been bought, it is considered undervalued. This perception opens up an attractive possibility for investors, who see it as a chance to purchase the asset at a potentially lower price than its true worth.

Read More

- Masters Toronto 2025: Everything You Need to Know

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- The Lowdown on Labubu: What to Know About the Viral Toy

2024-04-28 06:15