-

Correlation between the OI, price and, active addresses indicated a potential fall to $4.93

Late shorts might not get any reward as TON might begin a slow recovery soon

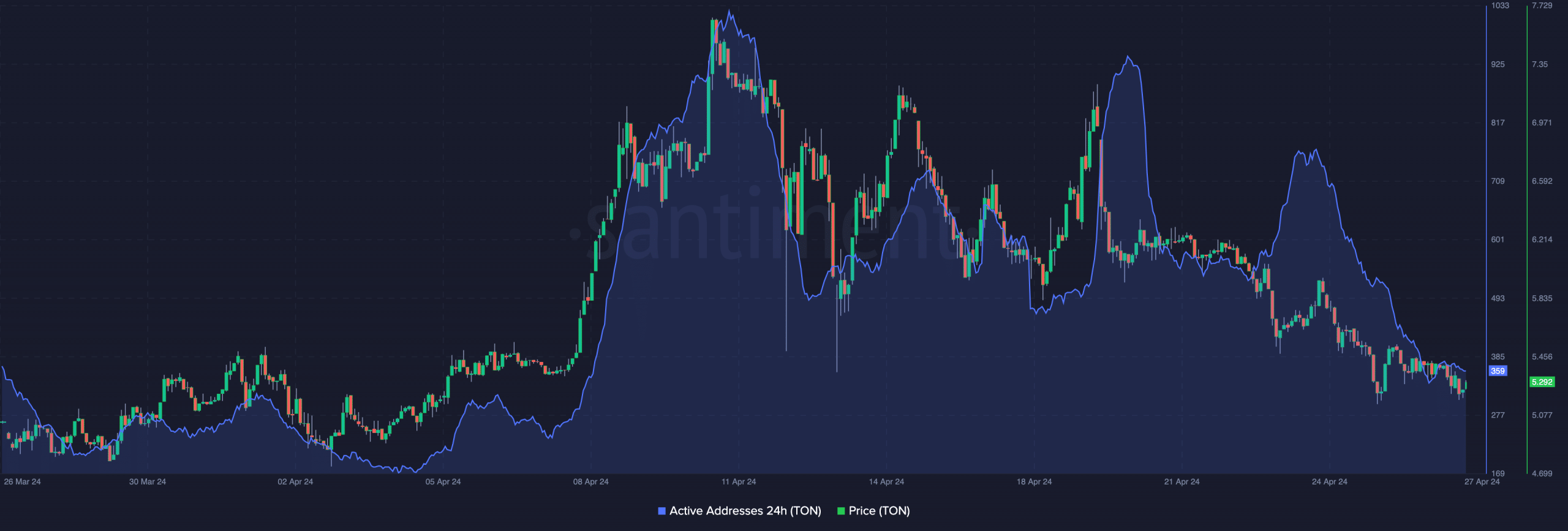

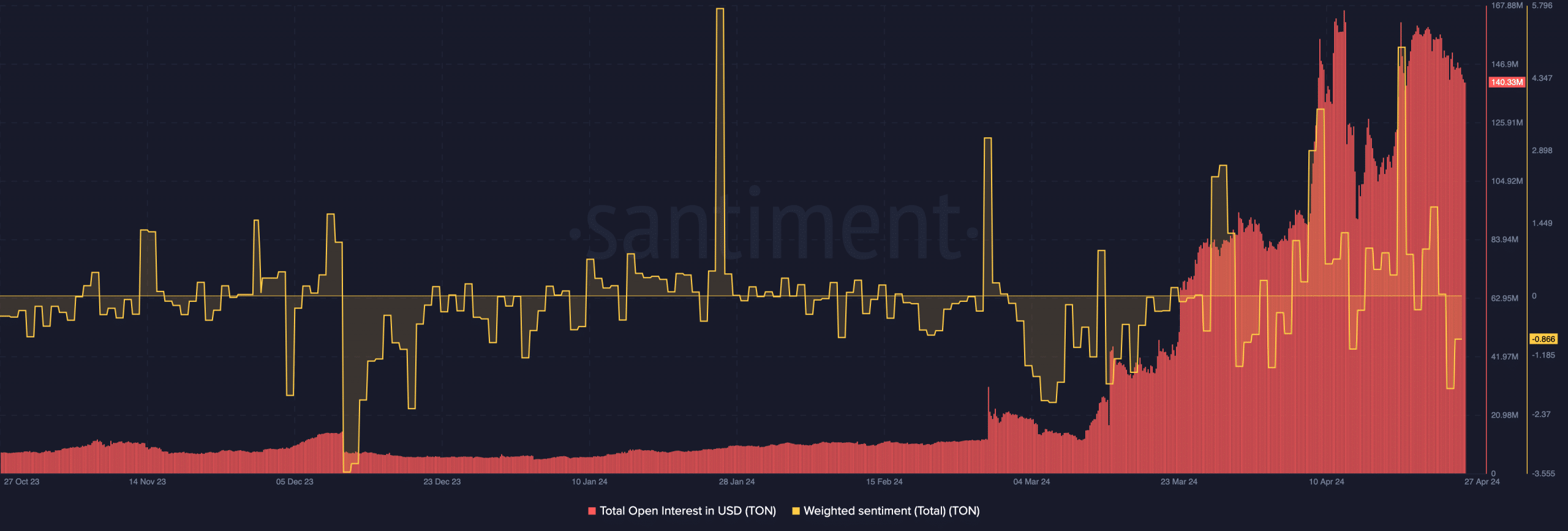

The number of active addresses on Toncoin (TON) has dropped significantly from recent highs, which could be a sign that deposits and withdrawals have decreased. This decline in activity seems to correlate with TON’s price movements, as the chart below shows. With the total Open Interest (OI) also falling and the Weighted Sentiment turning negative, it looks like many traders have lost confidence in TON’s performance.

The analysis by AMBCrypto reveals that the number of active addresses on the Toncoin (TON) network has decreased significantly from past highs. Currently, there are approximately 359 active addresses in the last 24 hours. Contrastingly, this figure was nearly doubled just a month ago on 24 April. Additionally, the metric reached even greater heights on 11 April.

A increase in distinct addresses participating actively in Toncoin’s network translates to a heightened transaction volume. Consequently, this decrease could indicate a reduction in deposits and withdrawals on Toncoin.

As a researcher examining the relationship between TON‘s price and network activity, I find it intriguing that these two metrics appear to be strongly correlated. Based on the chart below, it seems that every time network activity on TON spikes, the price experiences a notable increase as well.

Indicators spot a fall below $5

The network’s activity decreased, causing it to behave differently. This development could potentially lead to a further decrease in TON‘s value. If this trend continues, TON’s price may reach $4.93. It’s important to mention that Open Interest (OI) also saw a drop on the charts.

In simpler terms, the Open Interest (OI) level rises when more buyers are taking active positions in contracts, indicating increased aggression and a growing influx of liquidity. Conversely, a decrease in OI suggests that sellers are dominating the market with their aggressive actions.

As of the latest report, Toncoin’s overall open interest had decreased to $140.33 million. This figure from a market standpoint could potentially lead to Toncoin shedding value and touching its underlying support. Consequently, the token price for Ton might dip below $5 in the near future.

As a crypto investor, I’ve noticed a significant shift in market sentiment towards TON. Previously, there was confidence in its potential performance, but now, that faith has waned. The Weighted Sentiment, which measures the overall sentiment towards a cryptocurrency, supports this observation. At the moment, it stands at -0.866, indicating that the majority of comments about TON are bearish. This negative reading underscores my concern about the current state of the investment in TON.

TON is not dead

Should this persist, the market appetite for TON may prove hard to satiate. On the other hand, if altcoins begin to rally, public opinion could shift in favor of a price increase for TON.

An alternative method to assess TON‘s near-term prospects is by examining its liquidation thresholds. These thresholds represent approximate prices at which massive selling off of positions could transpire.

If a trader is privy to this information, it could give them an edge over their less informed peers. Based on our assessment, there’s a strong likelihood that several short positions may need to be closed if Toncoin reaches a price of $5.78. Simultaneously, long positions face the risk of being wiped out should TON drop down to $5.02.

At the present moment, the gap between the number of open long positions being liquidated and those on the short side, represented by the Cumulative Liquidation Levels Delta (CLLD), showed a deficit.

Is your portfolio green? Check the TON Profit Calculator

In its current form, the CLLD indicator indicates that investors attempting to buy the dip in TON could face potential losses. This is due to the sudden price drop potentially triggering a bullish sentiment in the future, which could lead to a gradual recovery for TON.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Flight Lands Safely After Dodging Departing Plane at Same Runway

2024-04-28 08:07