- Bitcoin’s dominance persists amidst growing excitement for altcoins.

- Retail interest continues to remain significant and should not be overlooked.

In 2024, the crypto market has seen its fair share of surprises. From Bitcoin’s halving to price fluctuations and regulatory scrutiny, investors have faced their share of challenges. Yet, despite these hurdles, Bitcoin continues to be a favorite among many investors.

As a crypto investor, I can tell you that the year 2024 has been an unpredictable rollercoaster ride in the world of digital currencies. The long-awaited Bitcoin halving event, which was supposed to bring stability, instead introduced new uncertainties. Add to that the continuous price swings, and it’s safe to say that we have witnessed significant shifts in the market landscape.

As a researcher, I’ve noticed that the regulatory environment has become more intricate due to increased scrutiny from organizations such as the Securities and Exchange Commission (SEC) and the Federal Bureau of Investigation (FBI).

In spite of the significant challenges, there continues to be strong interest among investors in Bitcoin, according to AMBCrypto’s interpretation of Bitbo statistics.

In a recent chat between Anthony Pompliano and Zach Pandl, the Managing Director of Research at Grayscale Investments, commented on the same topic.

“I am incredibly bullish on this asset class.”

Bitcoin or altcoins?

However, contrary to the above sentiment, Brett Tejpaul, Head of Coinbase Institutional, claimed,

“As exciting as Bitcoin and Ethereum are, the altcoin products to me are far more exciting.”

He added,

“In my opinion, this fact highlights the robustness of those who are purchasing these items and the careful consideration they put into their decisions.”

The growing buzz and interest in altcoins within the cryptocurrency community were underscored by this development.

As a crypto investor, I’ve noticed that despite the volatile nature of the market, there has been a steady inflow of interest and investment in certain altcoins like Uniswap [UNI], Cardano [ADA], Polkadot [DOT], and Solana [SOL].

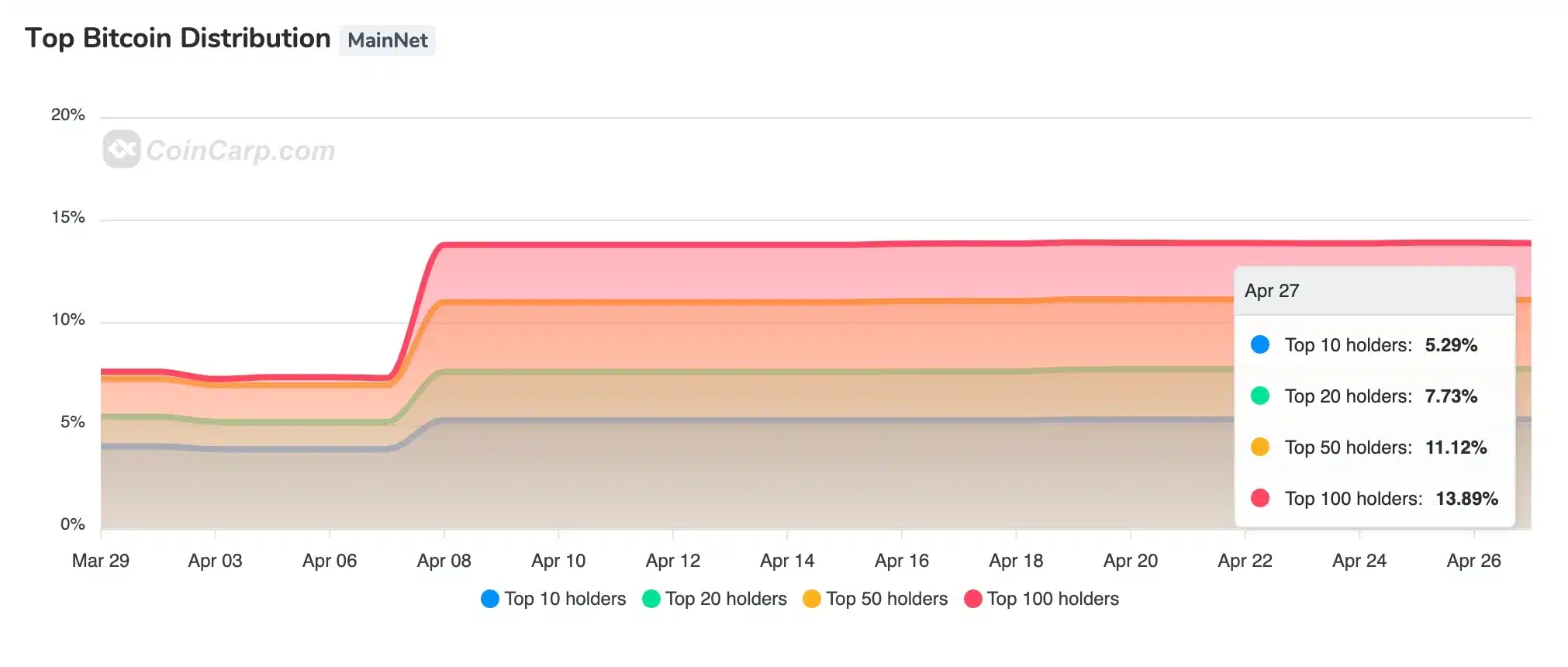

The findings from CoinCarp added credence to the fact that the top ten BTC holders collectively control a mere 5.29% of the entire Bitcoin supply.

Bitcoin leads the market

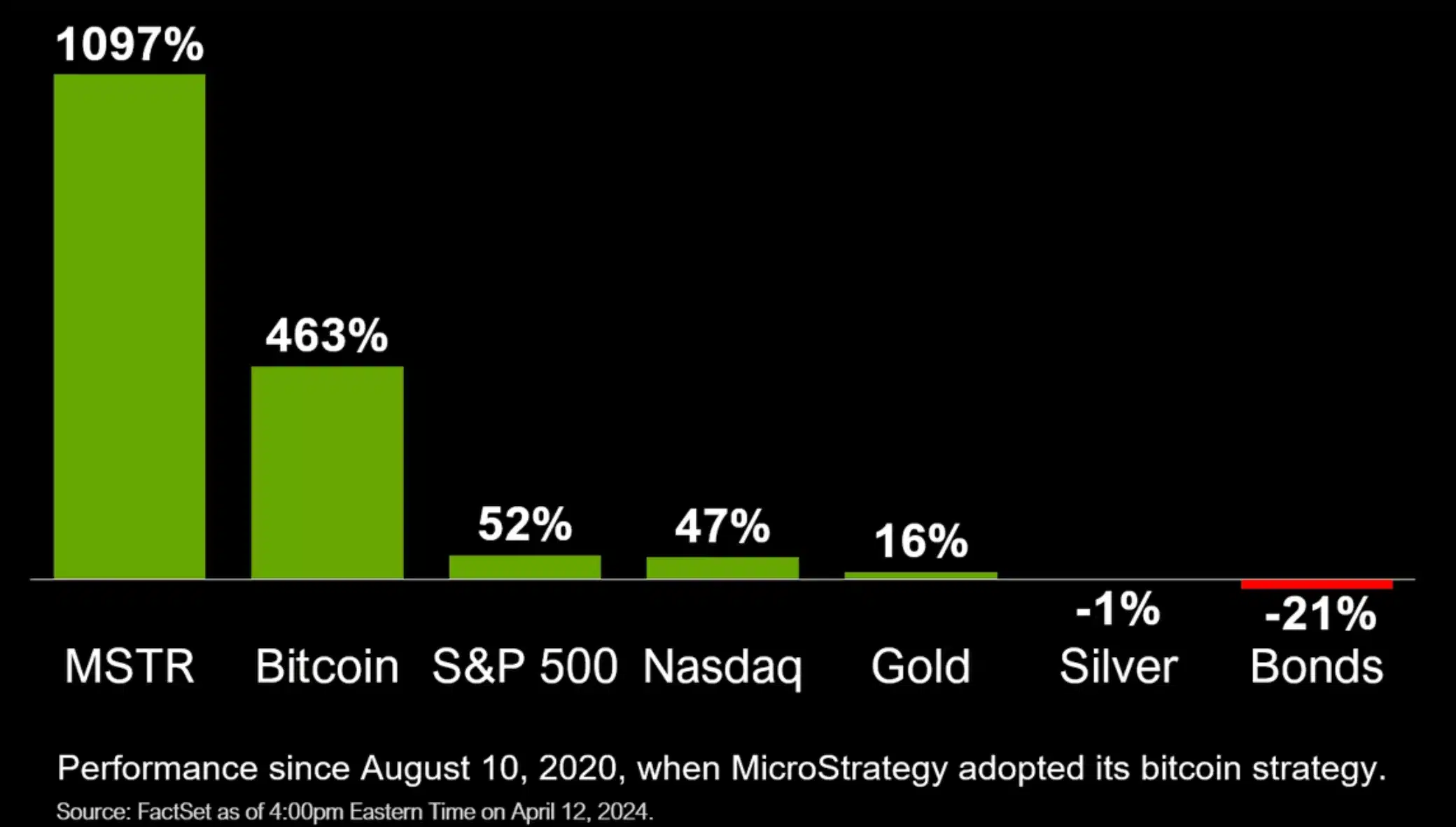

According to Tejpaul’s viewpoint, Michael Saylor held an opposing outlook regarding Bitcoin, or the “king coin.” In a recent post on X (previously known as Twitter), Saylor presented a chart to demonstrate that his business had gained profitability from Bitcoin investments.

As of the 19th of March, MicroStrategy owned 214,246 BTC.

In 2021, institutional demand boosted Bitcoin’s rise, setting a new precedent.

In the year 2024, institutional investors showed renewed enthusiasm for Bitcoin Exchange-Traded Funds (ETFs). This surge in interest underscores the significant impact these funds have on fueling market demand and influencing price movements.

Role of retail investors

In the midst of all the excitement about traditional financial institutions entering the cryptocurrency market through ETFs, it’s important to remember the considerable impact that individual investors, or retail investors, have on this dynamic sector.

Reiterating the same, Russell Star, Head of Capital Markets at Defi & Valour added,

“Well the ETF welcomes a combination of institutional and retail as a starter.”

As a researcher studying the impact of Exchange-Traded Funds (ETFs) on institutional investment in cryptocurrencies, I’d like to emphasize that introducing ETFs into this market adds an extra layer of liquidity for larger investors. However, it is crucial not to overlook the fact that early adopters have already made direct investments in cryptocurrencies before these funds were available.

As a researcher studying the financial market, I’ve discovered that ETF approval is an essential step forward. However, it might take some time before we witness significant institutional investments pouring in.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-04-28 09:11