-

EigenLayer’s deposits equated to about 4% of ETH’s total circulating supply.

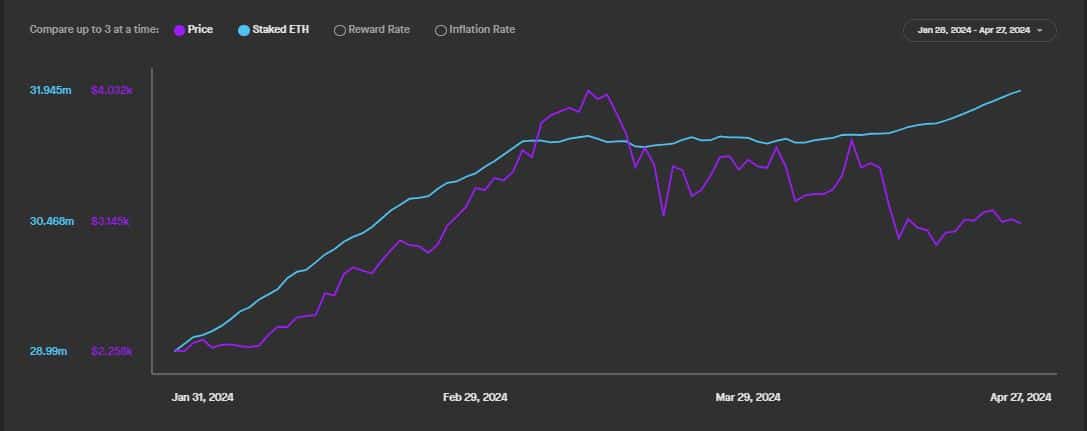

Due to EigenLayer, staked ETH supply has risen 1o% YTD.

EigenLayer has been a game-changer in the decentralized finance (DeFi) world, attracting over $15 billion in deposits since its launch. The protocol’s total value locked (TVL) has surged 14x this year, making it the second-largest DeFi project by TVL. EigenLayer’s impact on Ethereum [ETH] staking is noteworthy. About 4% of Ethereum’s circulating supply was tied up in deposits with EigenLayer.

In the past year and a few months since its debut, EigenLayer has amassed deposits totaling over $15 billion, making it one of the most thriving decentralized finance (DeFi) initiatives to date.

The total value locked in the Restaking protocol has experienced an astonishing 14-fold increase since the beginning of the year, positioning it as the second largest decentralized finance (DeFi) project in terms of TVL, based on AMBCrypto’s evaluation of DeFiLama’s data.

Approximately 4% of Ethereum‘s (ETH) entire circulating stockpile is equivalent to these deposits, a significant portion given Ethereum’s main application hinges around this asset.

ETH staking gets energized

One popular discussion point in the Web3 community is the concept of “stake recasting” with Ethereum (ETH). Instead of just securing the Ethereum mainnet, this process enables ETH to be utilized to ensure the safety of various other applications.

The setup helps stakers earn additional yields on their deposits.

It is commonly held that EigenLayer, as the largest restaking protocol, has significantly impacted Ethereum staking.

As an analyst, I’ve examined the data from both AMBCrypto and Staking Rewards, and I can report that there has been a noteworthy 10% increase in staked Ethereum (ETH) supply so far this year. This growth mirrors the significant rise in deposits being made on EigenLayer.

Source :DeFiLlama

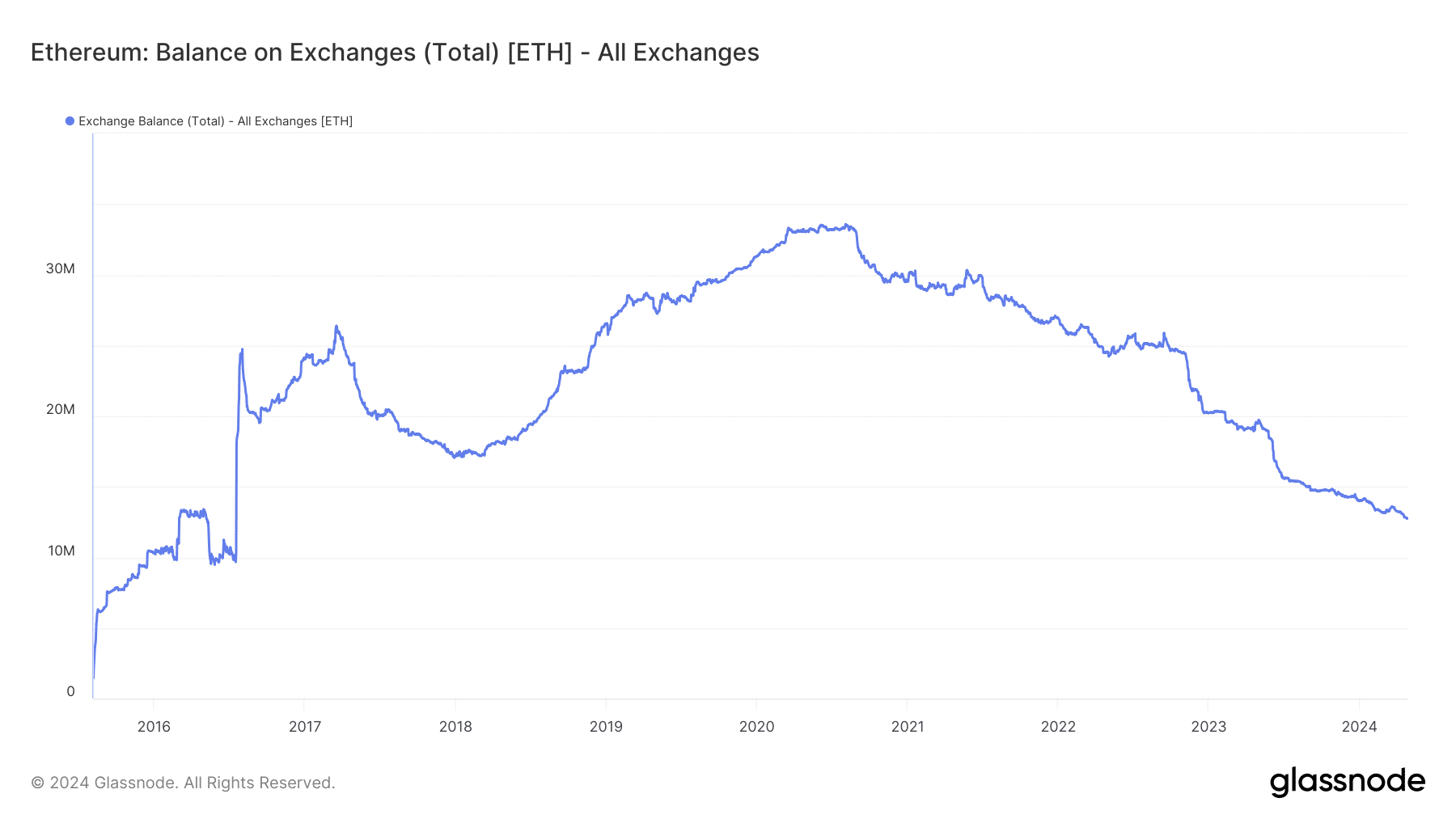

In contrast, the amount of Ethereum liquidity on exchanges has persisted in decreasing, according to AMBCrypto’s observation based on data from Glassnode.

EigenLayer’s ascent.

A shift in market structure?

As an analyst, I’ve observed a significant shift in Ethereum (ETH), moving it further from its speculative trading origins and towards being recognized as a valuable, long-term investment with yield-generating capabilities.

As a crypto investor, I’ve noticed that an increasing amount of Ether (ETH) is being locked up in staking services. This trend has led me to believe that the volatility of ETH would decrease, making it an attractive option for a wider range of investors who may be more risk-averse or prefer more stable investments.

At present, the second largest asset was priced at $3,141 during my research, marking a 2.38% increase over the past week according to information from CoinMarketCap.

Based on the most recent data from the Ethereum Fear and Greed Index, the market attitude towards this cryptocurrency was characterized by intense desire or avarice, suggesting that the appetite for purchasing Ethereum remains robust.

Read More

- OM/USD

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Solo Leveling Season 3: What You NEED to Know!

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Moo Deng’s Adorable Encounter with White Lotus Stars Will Melt Your Heart!

- The Perfect Couple season 2 is in the works at Netflix – but the cast will be different

- Joan Vassos Reveals Shocking Truth Behind Her NYC Apartment Hunt with Chock Chapple!

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

2024-04-28 12:07