-

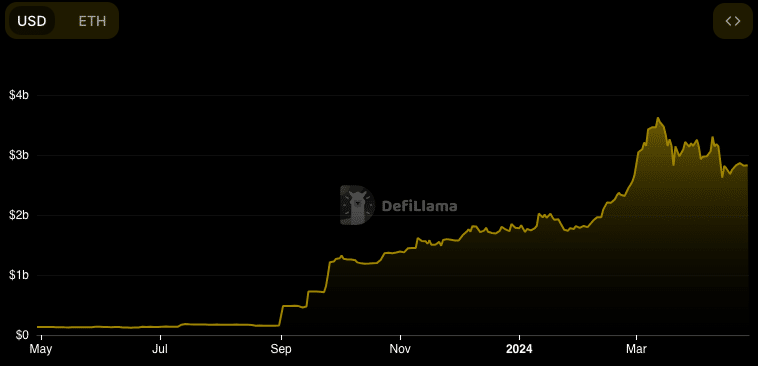

Though assets locked increased, the overall TVL lost 22% of its value.

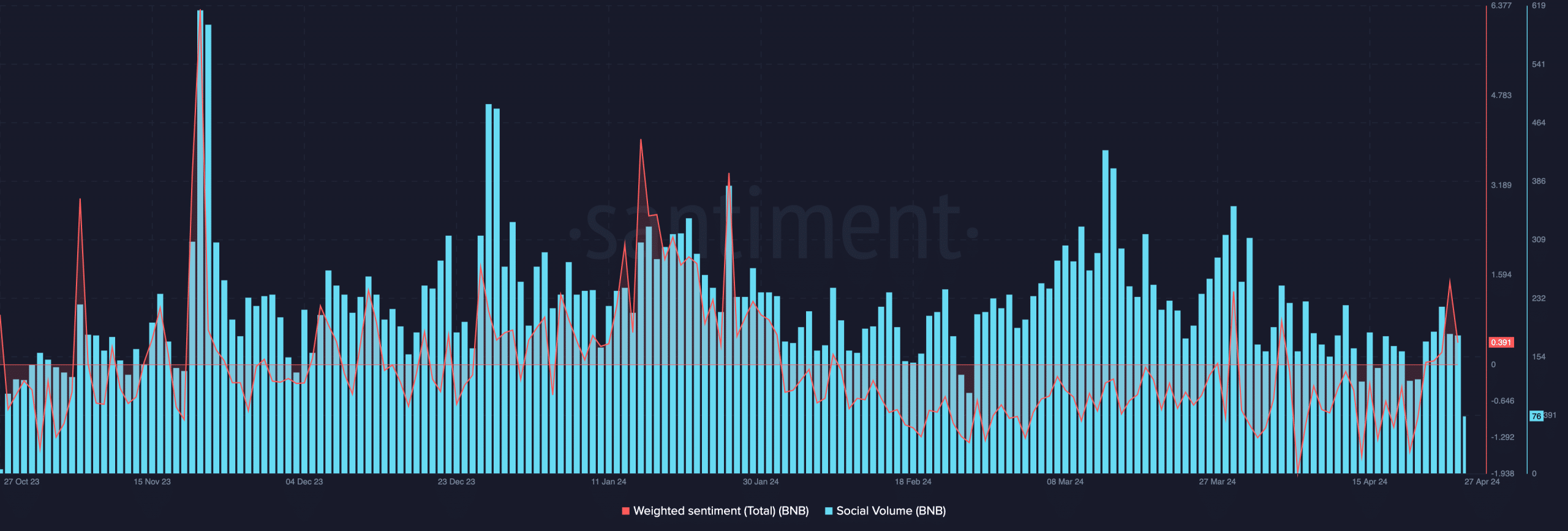

Sentiment around BNB remained positive but search for the coin fell.

Two days after BNB Chain announced native liquid staking on Binance Smart Chain (BSC), staked assets on the network surged. With DeFiLlama reporting a 2.75% increase in TVL for Binance Staked ETH, the top liquid staking protocol on the chain, deposits on BSC rose and showed increased trust in the protocol. However, despite this growth, the overall TVL of BSC fell by 22.16% within the last 24 hours.

Within two days of BNB Chain’s announcement about integrating native liquid staking on Binance Smart Chain (BSC), the value of staked assets saw an increase.

BNB Chain is a blockchain platform that supports smart contracts, similar to Ethereum, and can run Ethereum Virtual Machine (EVM) code.

Based on DeFiLlama’s latest report, there has been a 2.75% rise in the Total Value Locked (TVL) for Binance Staked ETH over the past week. This represents the leading liquid staking protocol on the chain.

Quick impact but it’s still early days

As of the moment this information is being released, the reported figure for the value stood at $582.76 million. Simultaneously, Stader, another liquid staking platform on the network, experienced a 6.98% growth during the same timeframe.

The rise in metrics signifies that market players have deposited a larger amount of assets onto the BSC. This surge also underscores growing confidence in the protocol.

As a BNB Chain analyst, I would explain that the upcoming finalization of the Beacon Chain sunset fork in June served as the impetus for the introduction of new elements within the BNB Chain ecosystem. In simpler terms, this means that an important update to the Beacon Chain was scheduled for completion in June, and in response, BNB Chain chose to make some additions to their own platform.

As a researcher studying decentralized finance (DeFi) solutions, I would explain it this way: “Users will soon be able to participate in DeFi activities while keeping the utility of their staked BNB through the integration of Liquid Staking Derived Finance (LSDFi). This exciting development is projected to take place between April and early May of 2024.”

As a crypto investor, I’m excited about the recent advancements that allow me to easily compound my staking rewards on the Binance Smart Chain (BSC) and potentially migrate assets seamlessly between BSC and the BNB Beacon Chain. This means more earnings for me and greater flexibility in managing my cryptocurrency investments.

BSC can’t catch up, can BNB?

As an analyst, I’ve observed a decrease of 22.16% in the total value locked (TVL) on the Binance Smart Chain (BSC) within the past 24 hours, despite a rise in staked assets. A potential explanation could be that other factors are impacting TVL more significantly than the increase in staking. If staking activities continue to improve on the network, we might witness a reversal of this trend and an upward movement for the TVL metric.

If the chain doesn’t see significant returns for its participants, otherwise, this may occur. On the other hand, staking actions could impact BNB Chain financially as well. Notably, in the first quarter, AMBCrypto shared that the chain experienced a 70% increase in growth.

As a crypto investor, I’ve noticed that April hasn’t been the most generous month for the network, with daily revenues taking a hit on several occasions. However, there’s a silver lining: the full liquid staking integration could be completed before May comes to an end. If this comes to fruition, the revenue situation is likely to bounce back.

Based on our examination of other facets of the project, we identified that public perception toward it has become more favorable. As per Santiment’s analysis, the Weighted Sentiment dipped to a low of -1.631 on the 20th of April.

During the specified period, the data from the press indicated a favorable trend for BNB‘s value. This uptick served as evidence that the pessimistic sentiment towards BNB had lessened compared to a week prior.

Should the value of this reading go up, investments placed in staking on BNB Chain could potentially see growth. Conversely, if it doesn’t rise, the value may plateau, or in extreme circumstances, stakeholders could choose to withdraw their assets.

As an analyst, I’ve noticed from the on-chain data that the social volume surrounding BNB, as an asset, has diminished. In simpler terms, there has been a decrease in discussions and mentions of BNB in various social media channels.

Although decreased demand for the cryptocurrency could be a consequence, a decline in network activity isn’t automatically indicative of a drastic drop.

Read More

- OM/USD

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Solo Leveling Season 3: What You NEED to Know!

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- The Perfect Couple season 2 is in the works at Netflix – but the cast will be different

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

2024-04-28 13:11