-

Lido’s price rise leads to an increase in the market cap of liquid staking assets.

At the time of this writing, LDO was trading at approximately $2.13

As an experienced financial analyst, I have closely monitored the recent developments within the Ethereum [ETH] and liquid staking market, specifically focusing on Lido Dao [LDO]. Based on the data available, it is evident that Lido has been a significant contributor to the growth of liquid staking assets.

Towards the end of last week and as the new one started, Ethereum [ETH] and Lido Dao underwent a small recovery.

The data shows that the amount of Ethereum being staked has consistently increased, yet the influence of the DAO (Decentralized Autonomous Organization) remains strong.

Lido’s rise helps liquid staking market cap

According to Santiment’s data, Liquid staking assets had a productive weekend, with Lido among the top performers.

The latest data indicates that the value of liquid staking assets in the market grew by more than 5 percent. Notably, LDO experienced an impressive surge of over 5% during this timeframe.

How Lido has trended

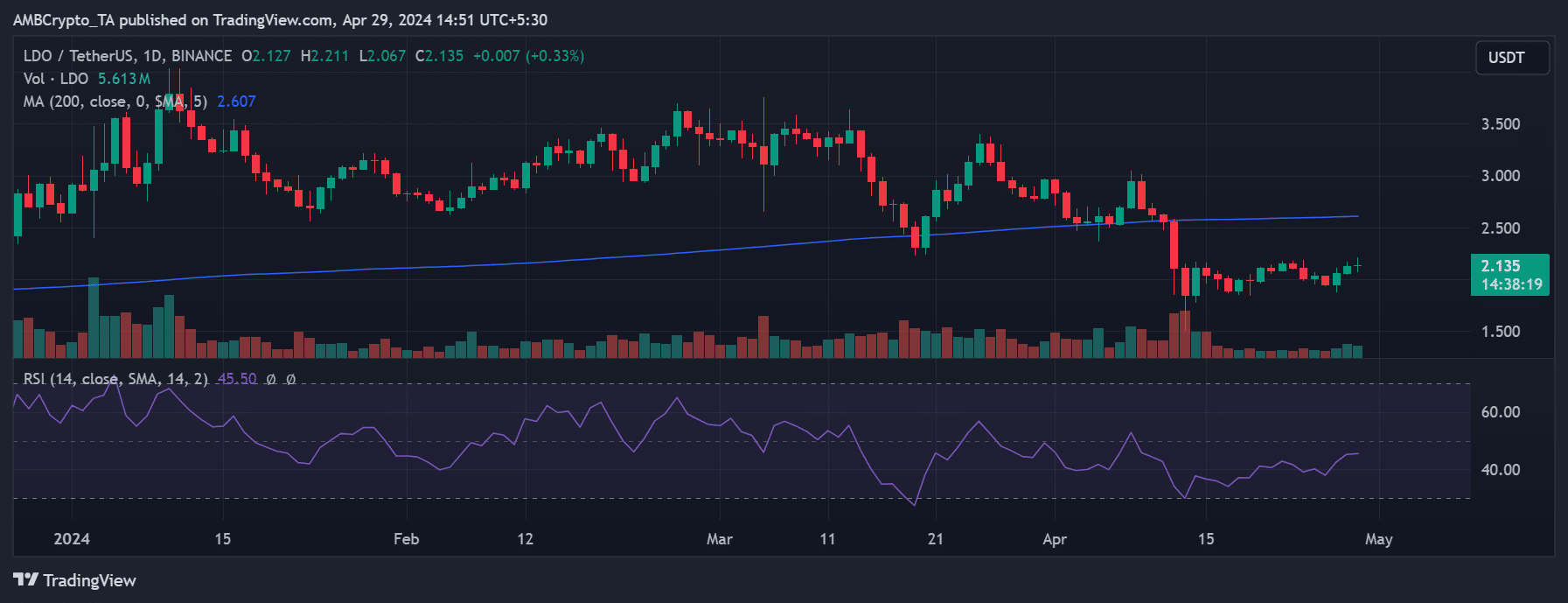

Examining Lido DAO’s daily price chart over the past week, I noticed an uptrend forming towards the end.

On the 27th of April, LDO underwent a significant surge, resulting in a trading price of roughly $2.05, which represented an over 5% rise. The next day, the 28th of April, saw the upward trajectory persist, bringing about an additional 3% increase and raising the price to approximately $2.12.

In my current update, the price was hovering around $2.13, experiencing a minimal gain of approximately 0.6%.

As a market analyst, I’ve noticed that if LDO continues to trend upwards until the 29th of April, it will represent a unique occurrence this month: three successive days of upward momentum. Previously, the last time we saw such a pattern was back in March, and it happened just once.

The RSI analysis of LDO reveals that although it has shown some recent gains, this cryptocurrency is still exhibiting a downward trend.

When I penned down these words, the Relative Strength Index (RSI) for LDO was beneath the neutral threshold. A closer look, however, reveals that since February, LDO has not experienced a prolonged spell above the neutral zone. This observation suggests a predominantly bearish market trend for LDO during the past few months.

Despite the volatility in pricing, Ethereum staking on this platform remains unchallenged.

Lido gets the most Ethereum stakes

Based on information from Dune Analytics, over 32 million Ethereum have been staked so far, representing approximately 27% of the entire Ethereum supply.

Among the contributors, Lido stands out with a substantial impact, accounting for approximately one quarter (28%) of the entire staked Ethereum. This corresponds to around 9.3 million Ethereum units being staked via Lido.

As a crypto investor, I’ve noticed an intriguing development in the Ethereum staking landscape: the past six months have seen a nearly 6% surge in staking activity on this particular platform. This upward trend underlines its enduring significance within the Ethereum staking community.

Upon further investigation of the data, it appears that staking netflow has been on a downward trend in the last several weeks. This decrease in staking activity corresponds with falling prices for Lido’s token (LDO) and Ethereum.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- Peter Facinelli Reveals Surprising Parenting Lessons from His New Movie

2024-04-29 21:12