-

Bitcoin dominance and a technical indicator suggested it might be time for swing traders to look at altcoins.

Relative strength against BTC is an important factor alongside long-term support zones to gauge underperforming altcoins.

As a researcher with a background in cryptocurrencies, I have observed the recent trends in Bitcoin (BTC) dominance and the altcoin market. Based on my analysis, it seems that Bitcoin’s range-bound trading and the potential for underperforming altcoins might present an opportunity for swing traders.

Bitcoin’s price moved between bounds within another boundary. Adopting a pessimistic perspective for the short term, both Bitcoin and the broader crypto market didn’t appeal to potential long-term investors.

Based on current market conditions and the substantial price increases prior to the cryptocurrency halving event, it’s possible that the market may need several weeks to stabilize. During this period, certain alternative coins (altcoins) that have demonstrated resilience could offer attractive purchasing opportunities.

Examining the recent BTC reset

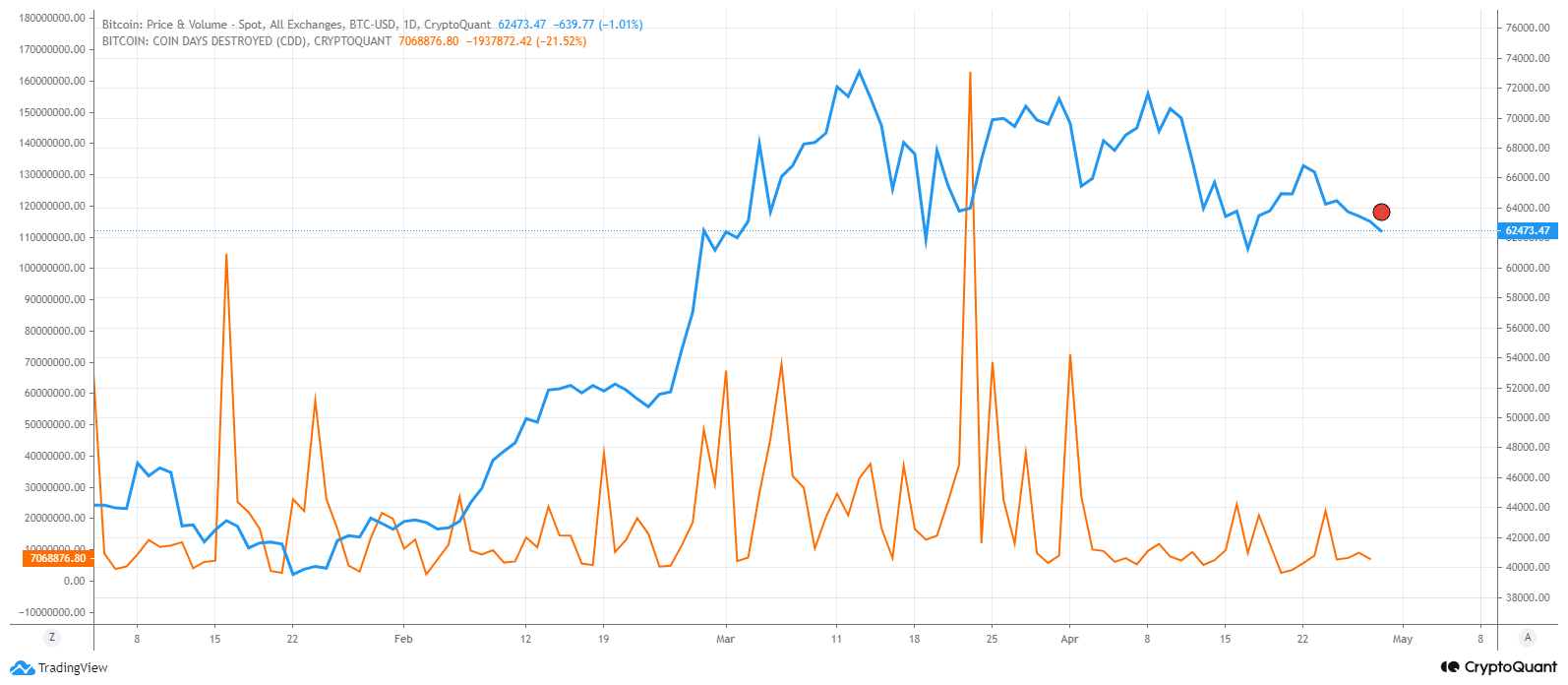

The concept of Coin Days Destroyed (CDD) refers to a measurement that signifies the age of cryptocurrency coins involved in a given transaction. This metric is computed by multiplying the quantity of coins transferred during a transaction by the duration, expressed in days, since those coins last underwent a transaction.

A significant surge in coin days destroyed (CDD) indicates that previously inactive bitcoins have been transferred. Long-term investors may decide to sell their holdings during a market uptrend, such as the one on March 23rd, or following a substantial price decline, like on April 1st.

While it is not a crystal ball, it is a useful metric to gauge the HODLer sentiment.

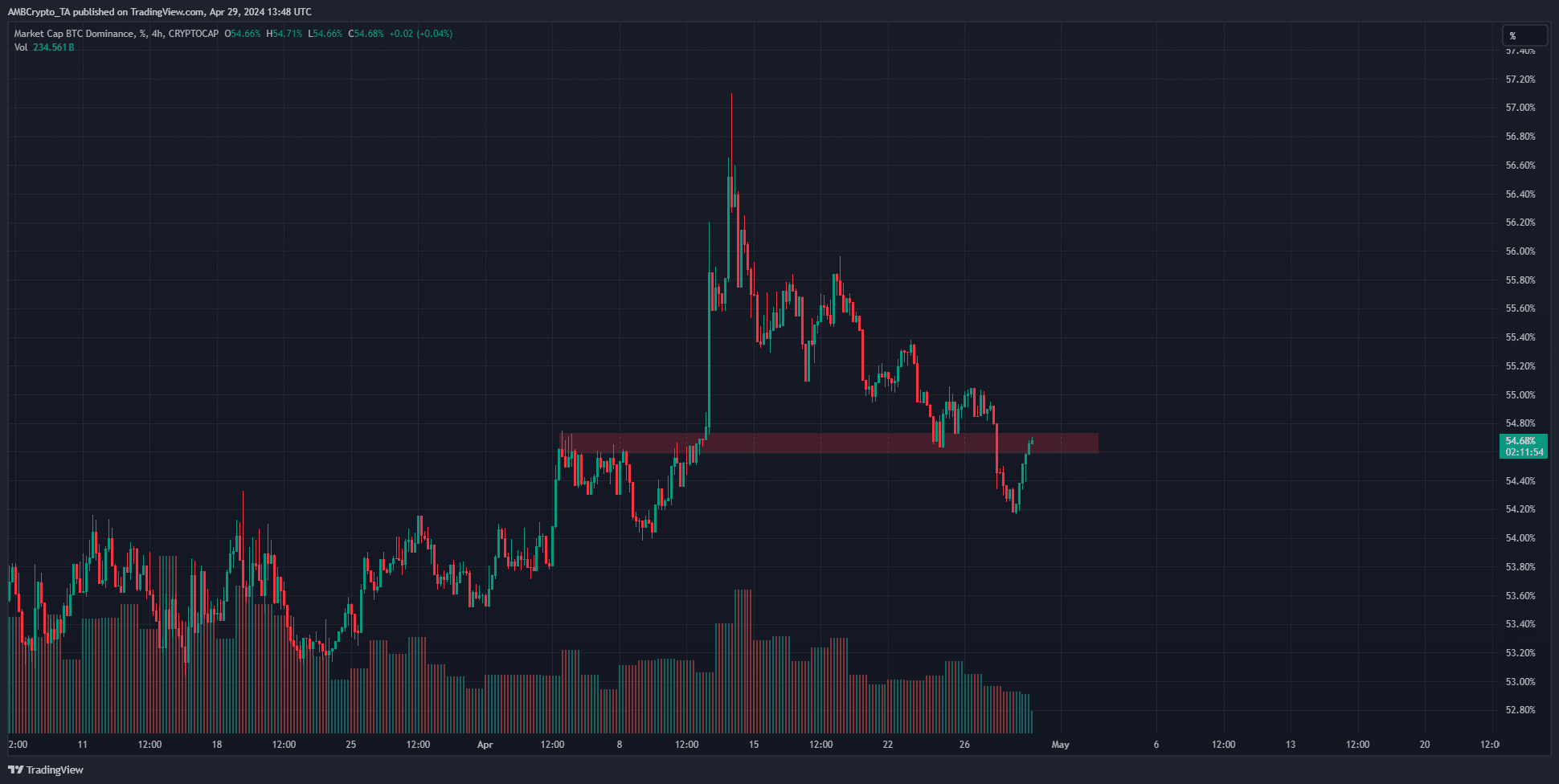

At present, the Bitcoin Dominance graph indicates that Bitcoin makes up approximately 54.68% of the entire cryptocurrency market’s value in terms of market capitalization. This figure has dropped below a previous support point.

As a researcher studying the cryptocurrency market, I’ve identified this specific area, marked in red, as potentially offering resistance to Bitcoin’s (BTC) price trend. Consequently, should BTC’s dominance continue to decline, altcoins might seize the opportunity and experience gains as a result.

Which altcoin could you focus on?

In his latest analysis piece on X, cryptocurrency expert Ali Martinez mentioned that the TD Sequential Indicator signaled a purchase opportunity for Chainlink (LINK) based on its 12-hour chart readings. However, LINK experienced a significant price drop of approximately 33% since the 26th of March.

During the same timeframe, Bitcoin decreased by 12.2%. A strong altcoin typically maintains its value relatively steadily when Bitcoin experiences losses. Unfortunately, LINK failed to demonstrate such resilience versus Bitcoin over the past month.

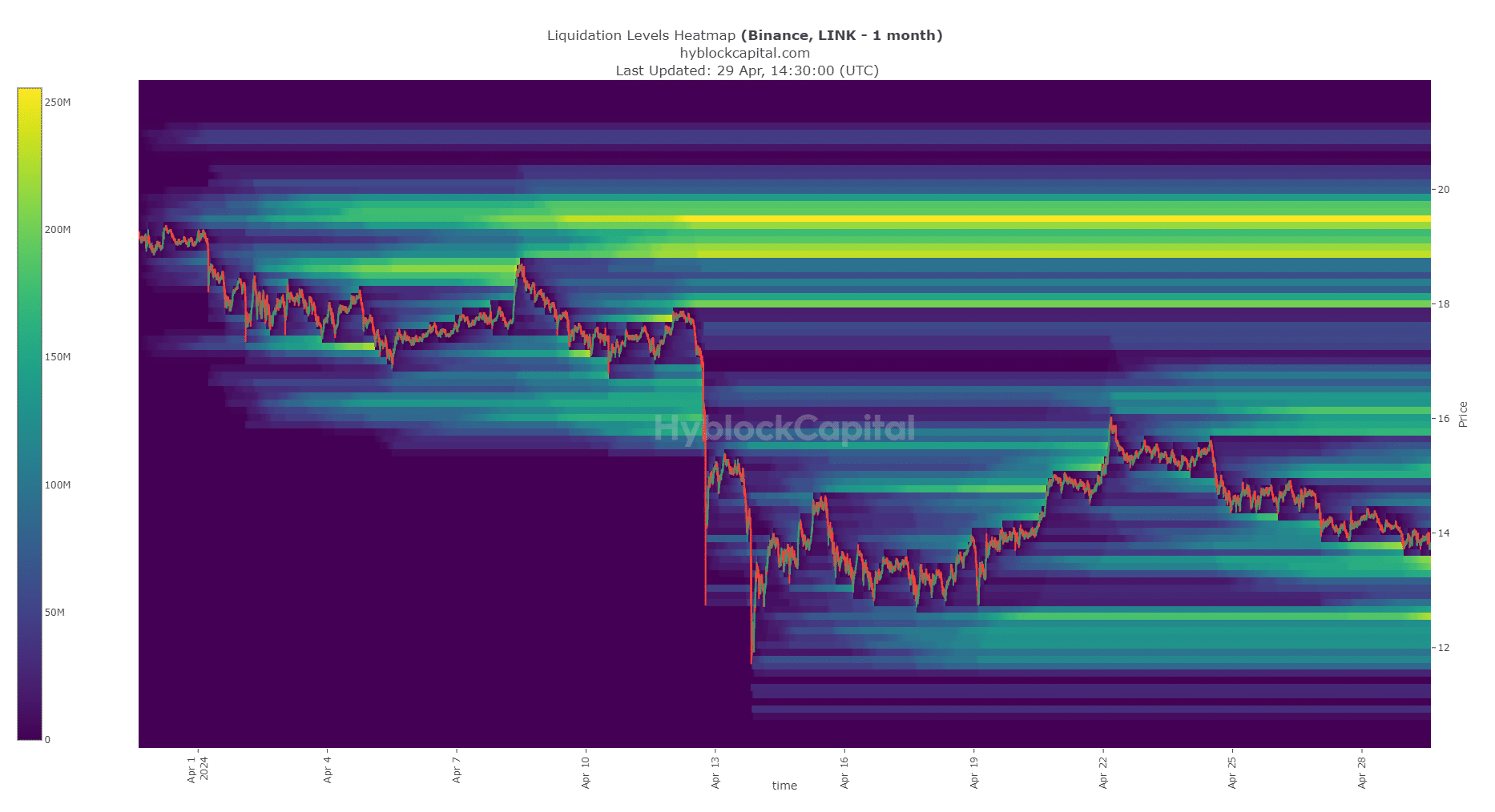

As a crypto investor, I closely examined the liquidation heatmap and noticed that the price levels of $16, $18, and $19.5 stood out with significant concentration of liquidation orders stacked above them. These levels represented bullish targets due to the high demand for sell-offs in those areas. However, it was important to remember that the downtrend was still active and could potentially push prices lower.

Is your portfolio green? Check the Chainlink Profit Calculator

At $13.5 and $12.5, the price differences for LINK were relatively small, increasing the likelihood of these levels being hit in the near future.

Although BTC Dominance and the TD sequential indicators may have signaled a buy opportunity for swing traders, it’s crucial to consider the possibility of a price drop to those support levels prior to opening any trade positions.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- ETH Mega Pump: Will Ether Soar or Sink Like a Stone? 🚀💸

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-04-30 09:11