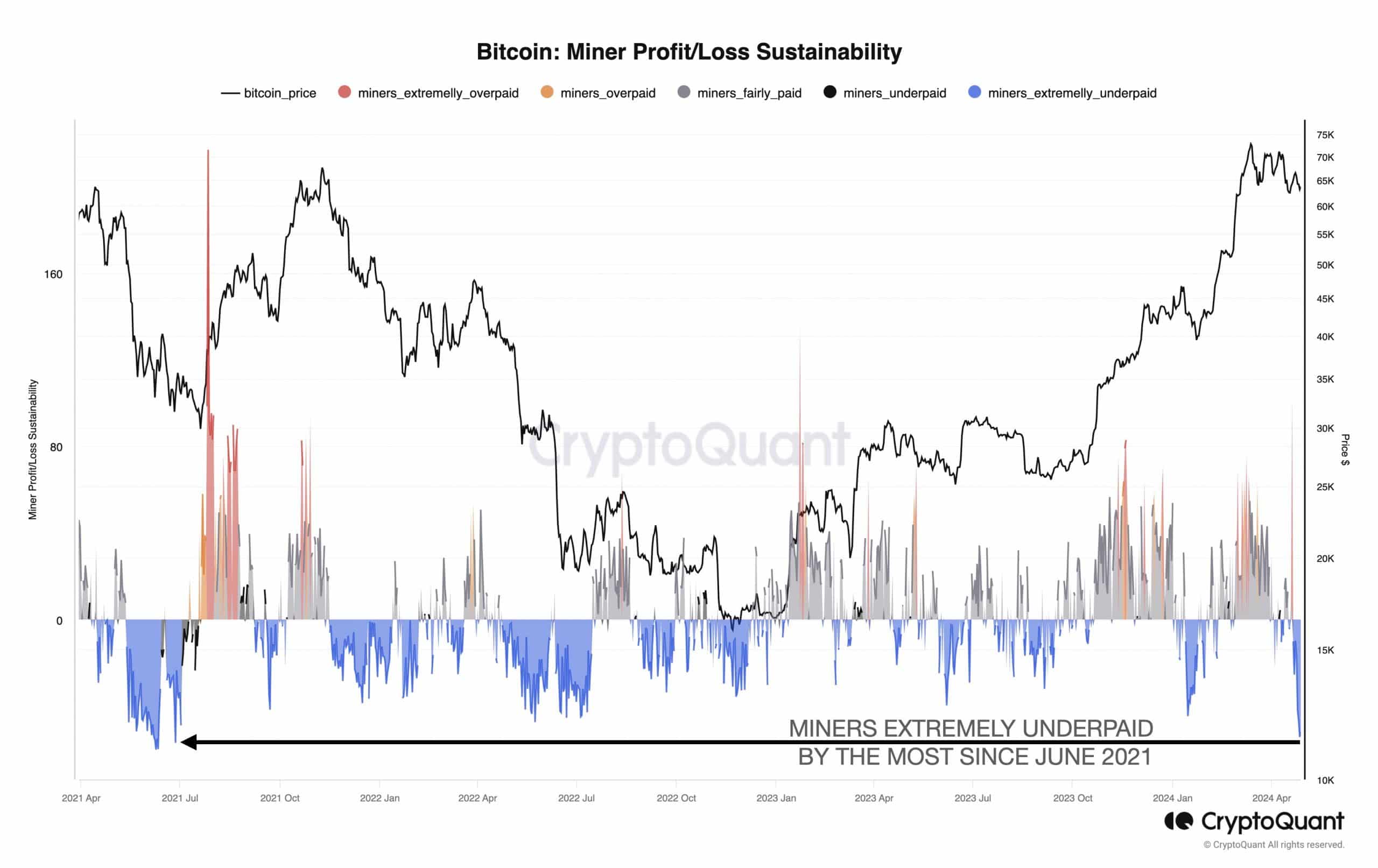

- Miner profit/loss sustainability sank to lows not seen since June 2021.

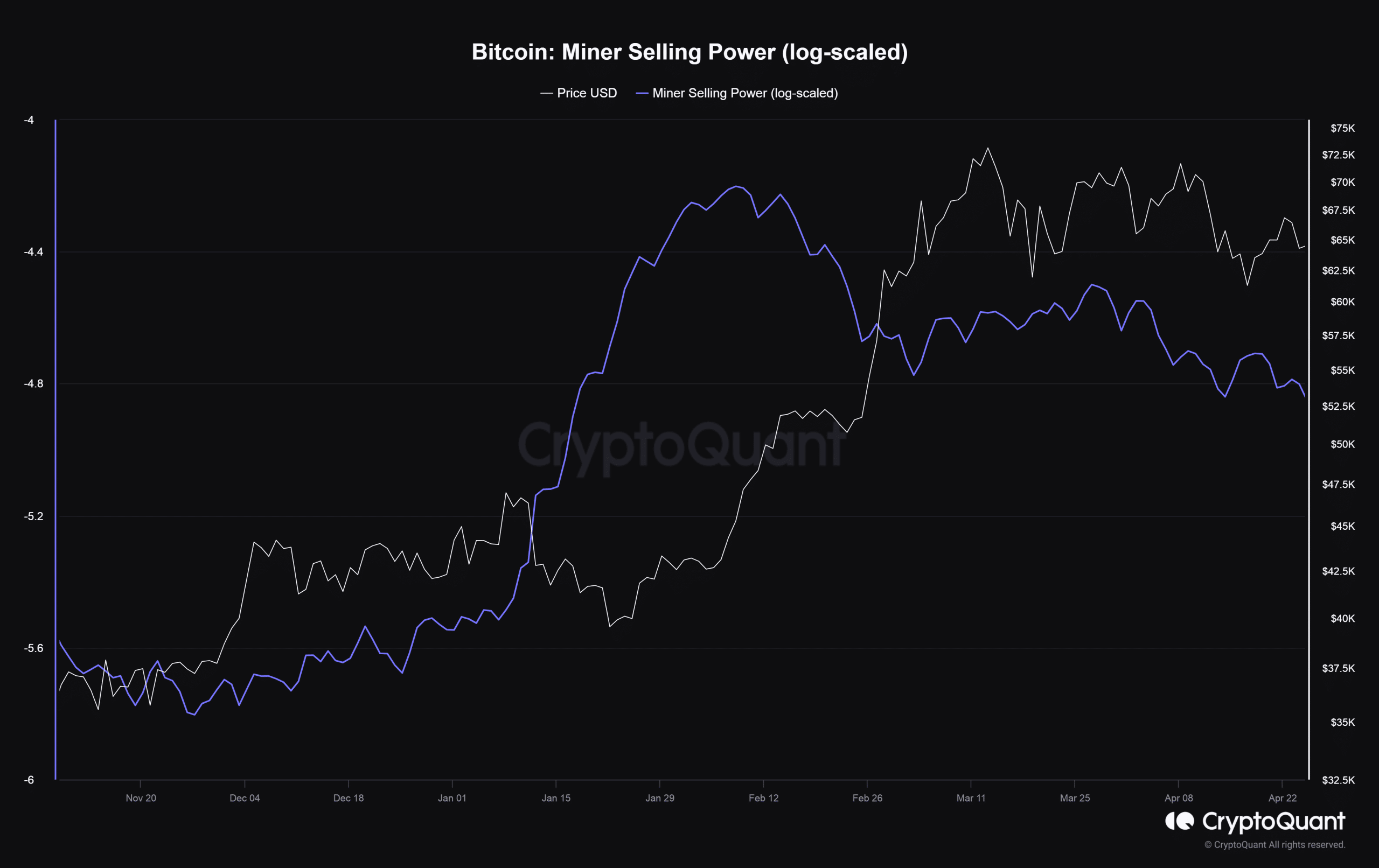

- Due to the dip in profitability, selling pressure from miners dipped further.

As a researcher, I’ve been closely monitoring the Bitcoin mining industry, and the recent developments have been particularly challenging for miners. The profitability dips we’ve seen since the halving earlier this month have reached lows not witnessed since June 2021. This trend is deeply concerning as it impacts the sustainability of the mining ecosystem that plays a crucial role in the smooth functioning of Bitcoin.

The earnings of Bitcoin [BTC] miners have taken a significant hit following the recent halving event, bringing hardship to an essential sector that plays a pivotal role in the proper operation of the globe’s leading digital currency.

Miners face losses

On April 29th, as reported in a post for CryptoQuant, the Head of Research there, Julio Moreno, disclosed that miner profits had plunged to levels last observed in June 2021.

Interested readers, the following measurement compares the expansion of block rewards, a significant income source for miners, to the rising mining complexity, reflecting their expenses. The noticeable decline suggested that miners were experiencing significantly lower compensation levels during the period in question.

As a crypto investor, I’ve noticed that the daily miner revenues, when compared to the current price of Bitcoin, have been quite disappointing based on previous data.

The latest Bitcoin halving reduced the reward for mining a block from 6.25 Bitcoins to 3.125 Bitcoins, making it necessary for miners to invest twice as much to merely cover their costs.

As a financial analyst, I would put it this way: Small-scale miners, due to limited resources, may struggle to endure market fluctuations and ultimately face the possibility of withdrawing from the mining industry. Meanwhile, larger players with substantial financial reserves can more easily ride out the turbulence.

Selling pressure dips

Based on my research into the recent decline in Bitcoin profitability for miners, I’ve found that most have chosen not to sell their coins and instead hold onto them despite the financial strain. According to AMBCrypto’s interpretation of data from CryptoQuant, miner selling pressure has decreased even more since the halving event.

As a researcher studying cryptocurrency markets, I’ve noticed an intriguing trend following the latest coin halving event. The sell pressure among miners has noticeably decreased, as evidenced by a lower volume of coins transferred from mining pools to exchanges over the past week. Specifically, the seven-day moving average for miner-to-exchange flows has dropped by approximately 70%.

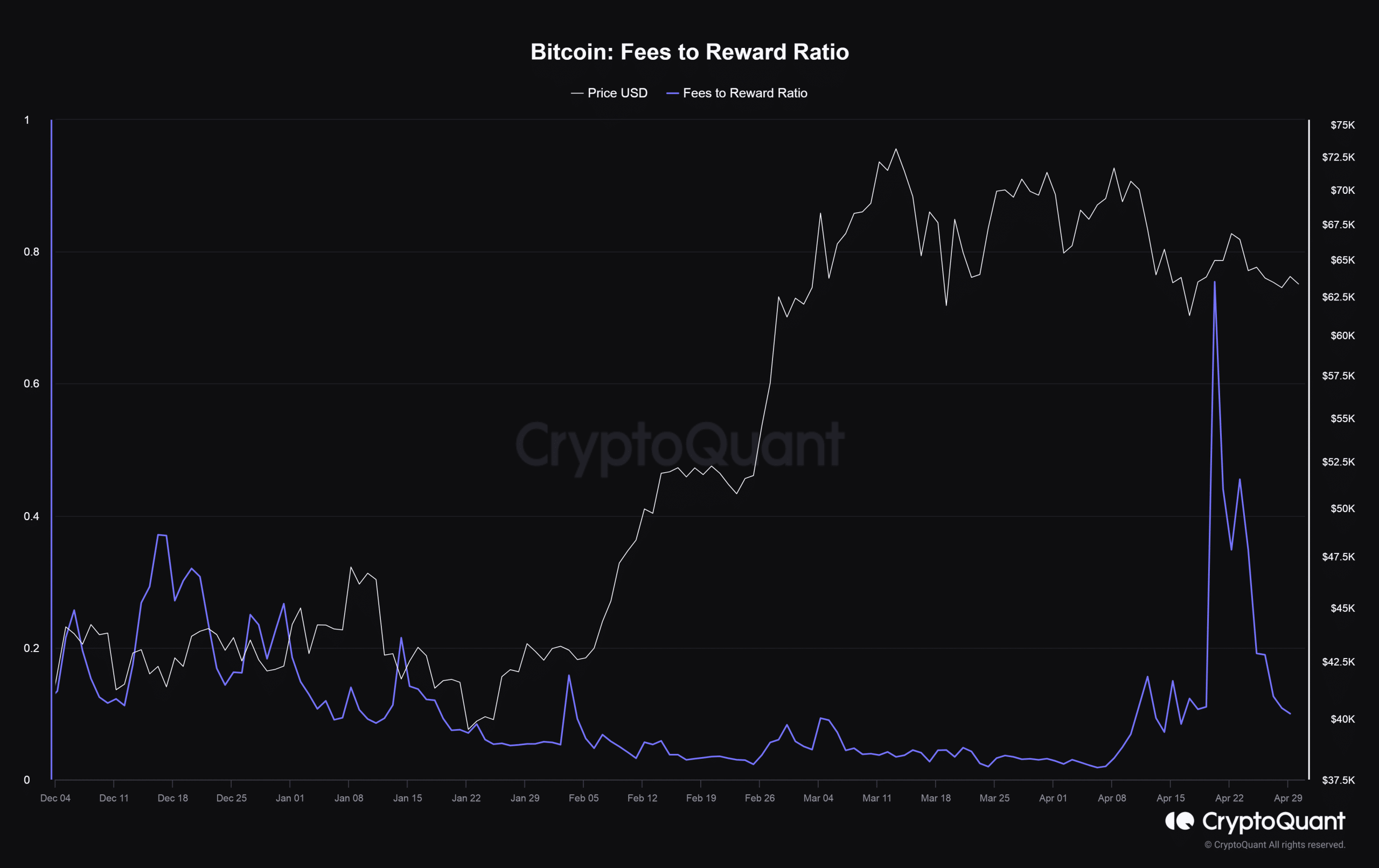

Fees not coming to the rescue

Miners were also hit by a sharp fall in transaction fees since the halving day frenzy.

From the 20th to the 29th of April, the proportion of fee revenue within the overall block rewards decreased steadily, going from 75% to 9%.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

- Bitcoin’s Golden Cross: A Recipe for Disaster or Just Another Day in Crypto Paradise?

2024-04-30 14:15