-

Whales recently moved significant ETH to the exchanges.

The positive trends have been wiped out with recent declines.

As a researcher, I find the recent Ethereum [ETH] market trends intriguing. Whales have significantly impacted the netflow by moving over $140 million worth of ETH to exchanges in April. This large-scale deposit has coincided with a notable increase in the supply on exchanges and a reversal of the minor uptrend, pushing Ethereum back into a bear trend.

Recently, large Ethereum [ETH] investors, referred to as “whales,” executed substantial transactions. These actions led to noticeable changes in the market’s netflow. Simultaneously, the value of Ethereum began to decrease, and there was a progressive rise in the amount of ETH available on exchanges.

Whales move over $100 million in Ethereum

According to recent findings from Lookonchain, six major Ethereum holders have moved their ETH to Binance and Coinbase in the latest transactions.

As a crypto investor, I’ve noticed that the largest deposit made on FTX/Alameda was equivalent to 10,431 Ethereum, which translates to a staggering value of around $32.66 million at the time. Conversely, the smallest deposit recorded amounted to only 2,000 Ethereum, corresponding to approximately $6.28 million in value.

Approximately $178 million worth of Ethereum, in total, was deposited by these large investors (whales) into exchanges. This includes the previous deposit of around $38 million or 11,892 ETH.

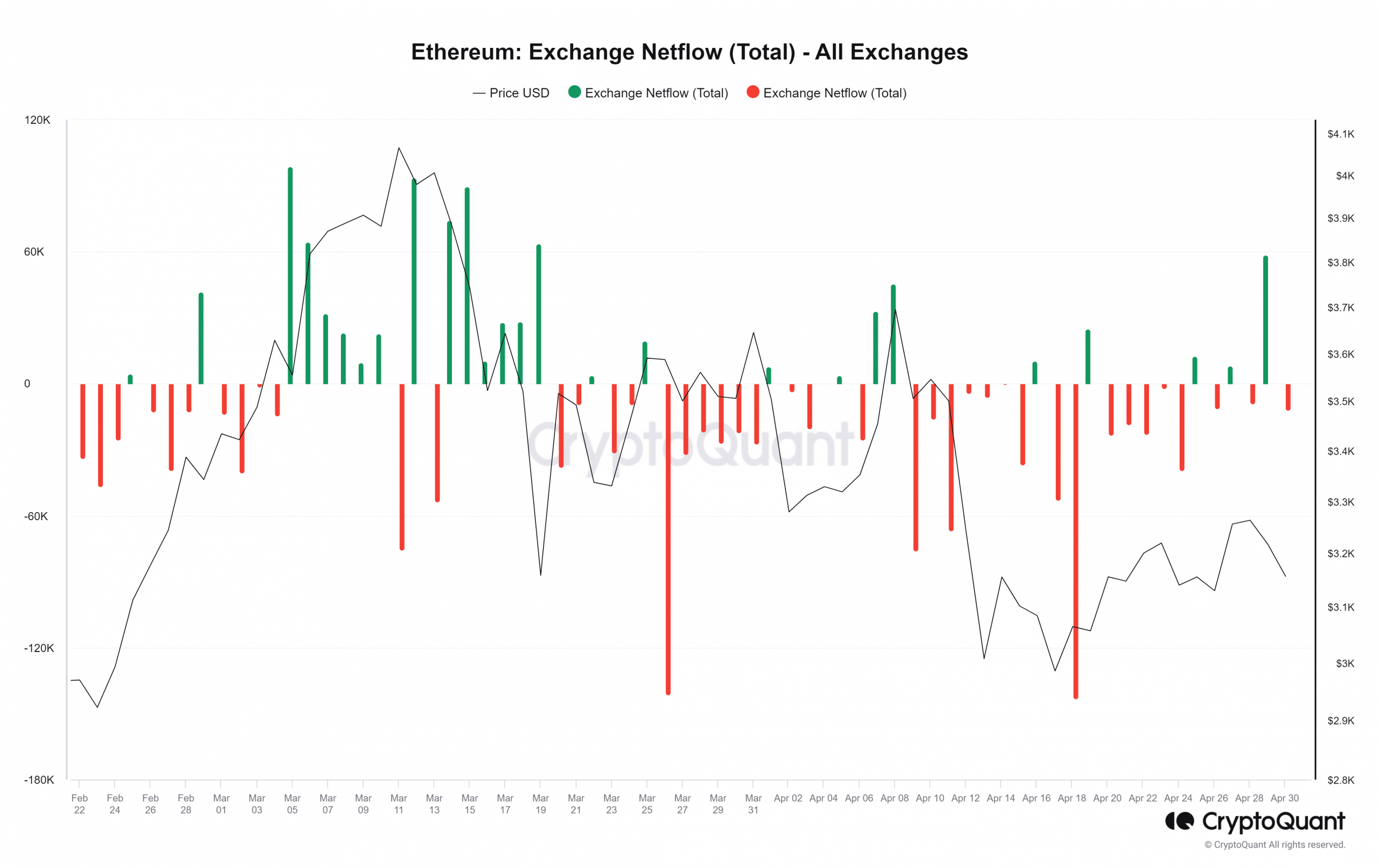

Ethereum netflow sees monthly high

As a crypto investor, I’ve been keeping an eye on Ethereum deposits into exchanges to gauge market sentiment. According to my analysis of the data from CryptoQuant, on the 29th of April, approximately 281,000 ETH entered exchange platforms. This was a notable increase, but it wasn’t the largest deposit seen that month; that title goes to the 13th, when over 401,000 ETH were deposited.

An intriguing pattern emerged when analyzing the net Ethereum exchange flow. On the 29th of April, a significant amount of ETH, over 58,500 units, moved into exchanges. Remarkably, this inflow outpaced outflows during that period. This was the most substantial influx observed in the month, with the 19th of March being the previous instance of such noticeable exchange activity.

The current trends indicate that a greater number of traders are opting to sell Ethereum (ETH) instead of buying it. At present, approximately 57,000 ETH have been transferred into wallets, but this inflow has been overshadowed by the significant outflow of roughly 8,900 ETH.

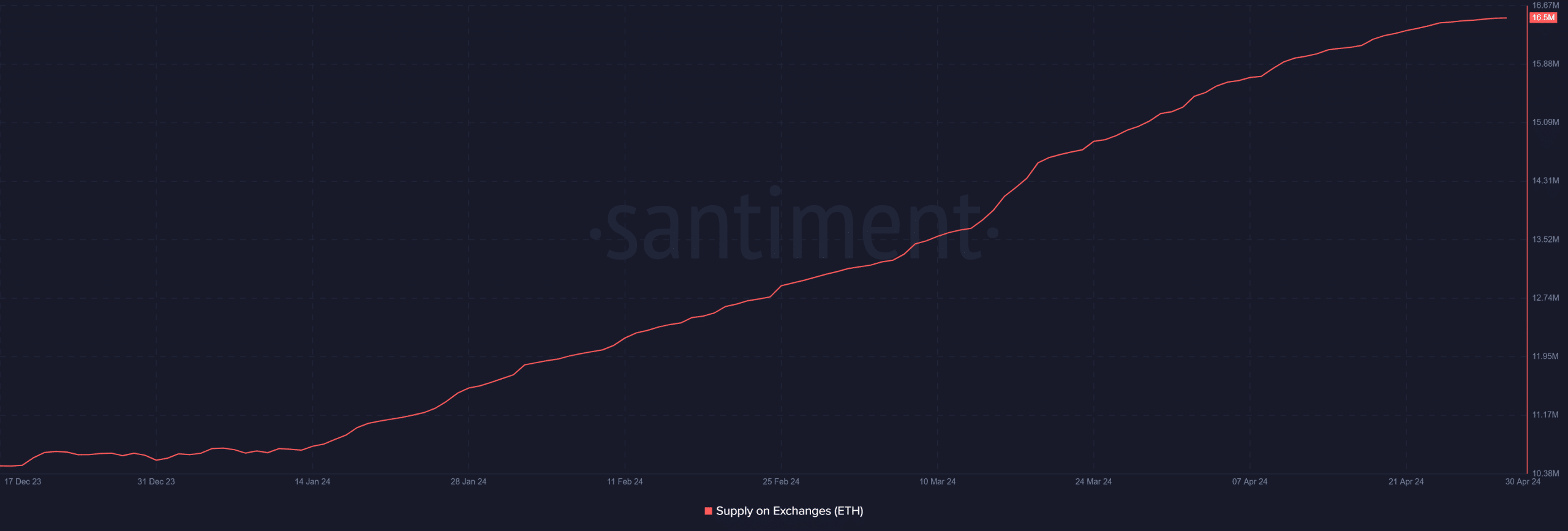

More Ethereum supplied to exchanges

As a crypto investor, I’ve been closely monitoring the Ethereum market and recently noticed an intriguing trend in the supply on exchanges metric. Initially this month, approximately 15.31 million Ether were held on cryptocurrency exchanges. However, over time, there has been a noticeable uptick in the volume of Ethereum being stored on these platforms.

However, as of this writing, this volume has risen to approximately 16.5 million.

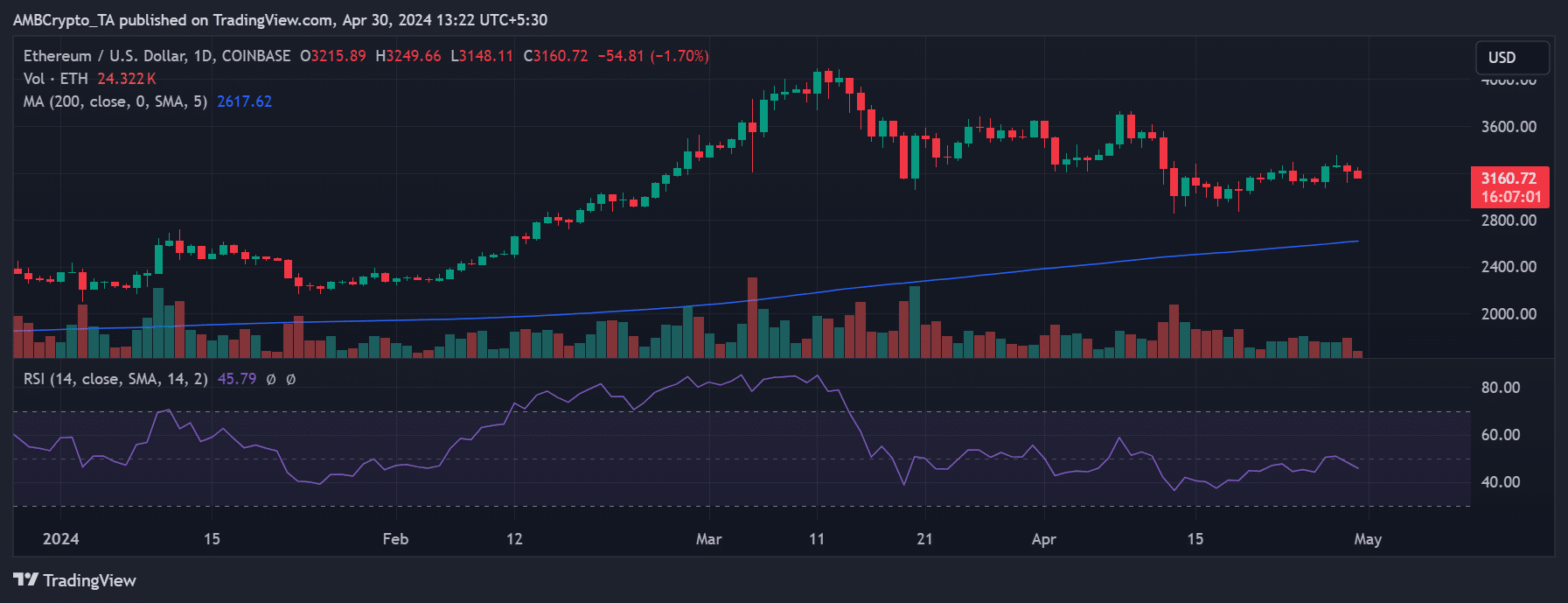

ETH goes back to bear trend

As an analyst, I examined the daily timeframe chart for Ethereum and noticed a downturn on the 29th of April. The cryptocurrency was priced at approximately $3,215 at the time, resulting in a 1.44% decrease. This decline disrupted the modest upward trend that had been observed prior to this event.

Read Ethereum (ETH) Price Prediction 2024-25

The chart showed that Ethereum’s Relative Strength Index (RSI) dropped below the threshold of 50, implying a resumption of its downward trend. At present, Ethereum was priced around $3,160, representing a additional decrease of nearly 1.7%.

Additionally, its RSI had moved even further below the neutral line.

Read More

- OM/USD

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Solo Leveling Season 3: What You NEED to Know!

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- The Perfect Couple season 2 is in the works at Netflix – but the cast will be different

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

2024-04-30 15:04