-

A whale sold all his UNI to buy 329.3 billion PEPE.

PEPE holders were increasing at a faster rate than UNI.

As a researcher with experience in analyzing cryptocurrency markets, I find the recent actions of a whale selling all his UNI to buy massive amounts of PEPE intriguing. This decision is significant given that UNI holders made substantial gains, with $7 million being just one example. However, the whale’s move suggests a lack of confidence in UNI’s potential and a bullish conviction in PEPE’s long-term value.

Based on my analysis of the current market trends according to AMBCrypto, I observe that traders have expressed doubts about DeFi tokens repeating their stellar performance from the 2021 bull cycle.

Previously, it has been demonstrated that such behavior exists. On the 30th of April, an additional illustration surfaced— a whale chose to dispose of all his Uniswap [UNI] tokens. In place of this, he amassed a substantial amount of Pepe [PEPE], which amounted to 329.3 billion units, and subsequently withdrew it from Binance.

Nevertheless, it’s worth mentioned that those traders earned a profit of $7 million by keeping UNI tokens. However, selling the tokens during the initial stages when altcoins hadn’t yet reached their projected growth suggests a lack of faith in UNI’s future prospects.

No PEPE, no show

In addition, buying more PEPE indicated strong belief in its future worth. Yet, such moves may not have taken others by surprise, given their prior awareness of market trends.

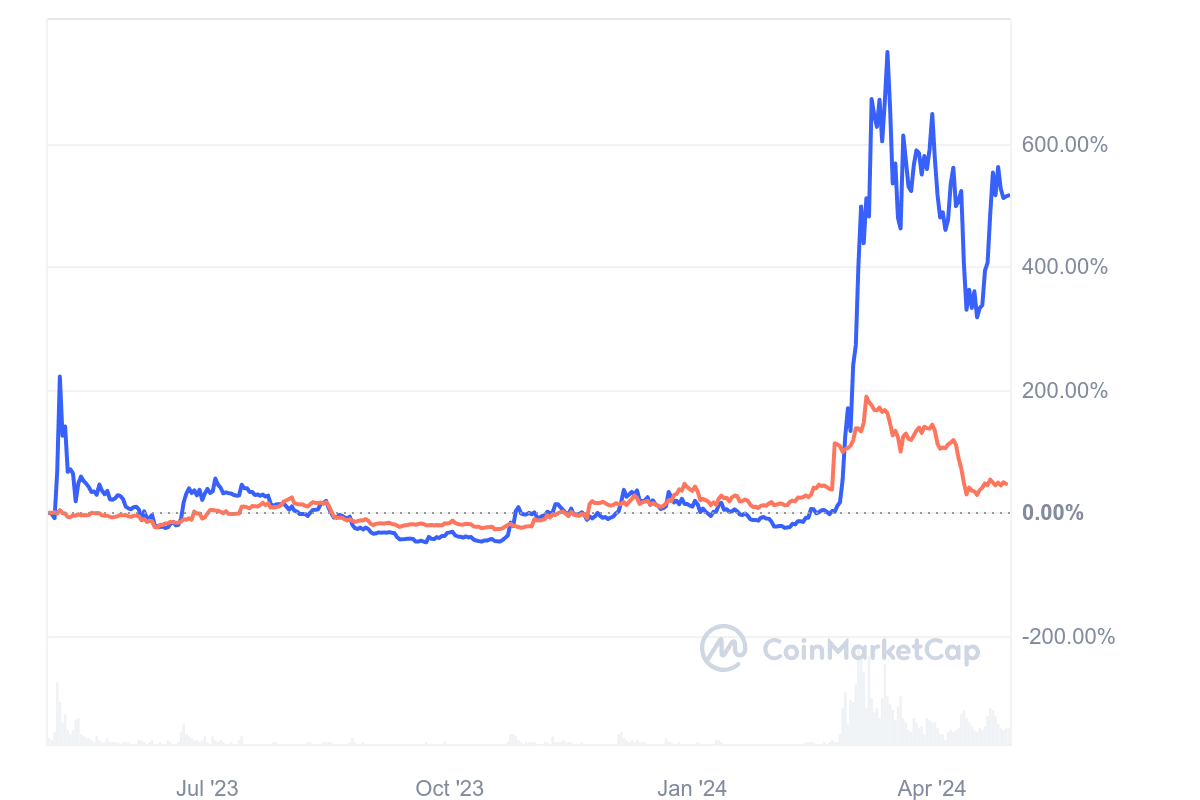

At present, PEPE‘s remarkable YTD growth rate of 420% underscores its strong influence in the memecoin sector. This significant price surge serves as evidence of PEPE’s market supremacy when compared to other tokens.

As a crypto investor, I’ve observed that UNI‘s price remained relatively stagnant throughout the year, barely changing from its initial value. Surprisingly enough, this was the case despite the DeFi token market cap reaching an impressive $104.48 billion. On the other hand, the memecoins sector boasted a market cap of $49.50 billion.

From my perspective as an analyst, while the gap between the two entities’ growth rates over the past year is noticeable in favor of the second one, the disparity in the number of holders for the first entity, UNI, presents a murkier image.

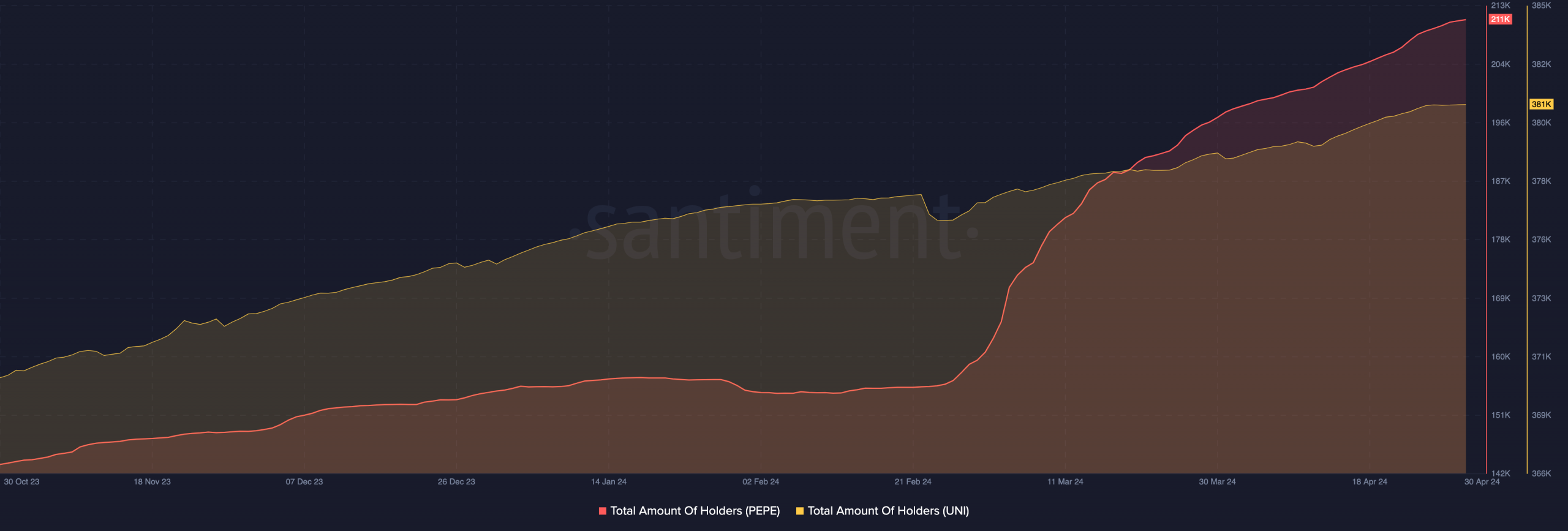

As a researcher studying the cryptocurrency market, I observed that there were 211,000 holders of PEPE, while UNI had a holder base of 381,000. However, these numbers alone do not convey the complete picture.

UNI may gather strength but not as much as…

As an analyst, I’ve noticed that PEPE saw a quicker rate of growth in terms of acquiring new holders compared to UNI. This observation raises the possibility that the DeFi narrative may not be as dominant during this market cycle.

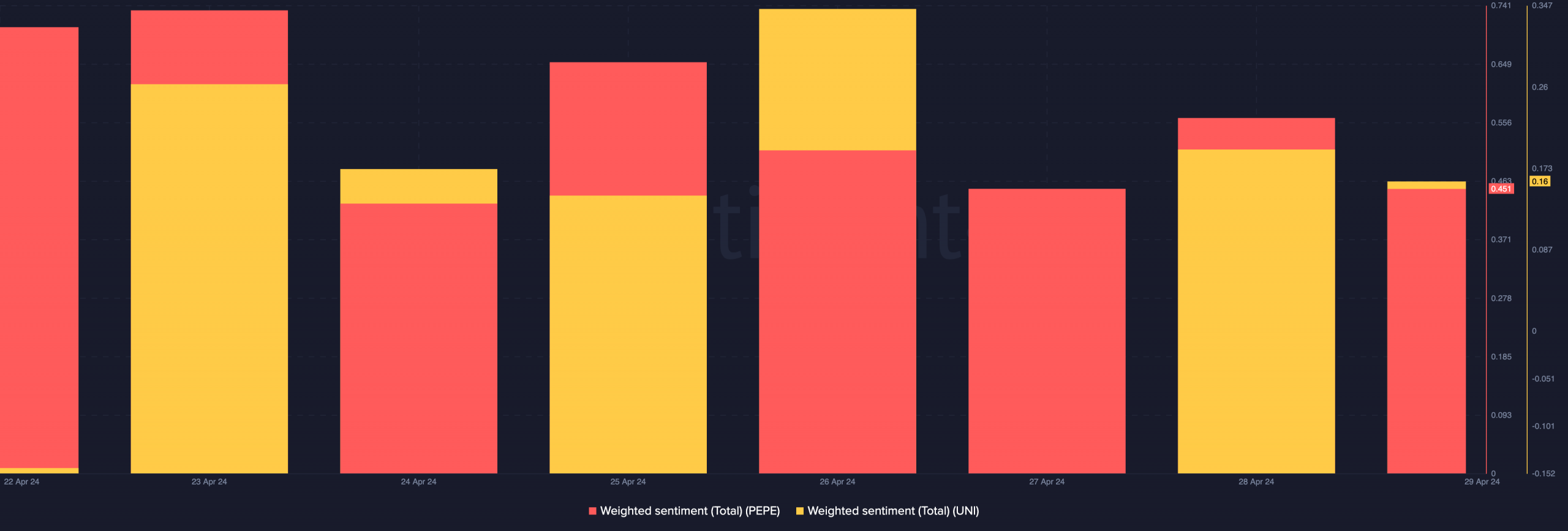

Although the current market sentiment may not differ, according to our analysis at AMBCrypto, we’ve examined the Weighted Sentiment as well, which indicates that it could shift in the future.

The given metric evaluates public opinion towards projects based on social media buzz. At present, the sentiment analysis for both PEPE and UNI indicates a predominantly favorable view.

With a PEPE value of 0.45, contrastingly lower than UNI‘s 0.16, implies that more traders hold a bullish stance towards the memecoin compared to UNI.

Furthermore, the disparity in sentiment does not mean UNI won’t experience a notable upswing.

Realistic or not, here’s PEPE’s market cap in UNI terms

Based on historical trends, the flow of funds, and current popular narratives, PEPE may continue to surpass UNI in performance.

In a favorable market condition, the potential growth of PEPE may surpass UNI by an additional 200%. Although this may not materialize currently, it’s plausible that such a development could unfold within the next few months.

Read More

- OM/USD

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Solo Leveling Season 3: What You NEED to Know!

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Moo Deng’s Adorable Encounter with White Lotus Stars Will Melt Your Heart!

- The Perfect Couple season 2 is in the works at Netflix – but the cast will be different

- Joan Vassos Reveals Shocking Truth Behind Her NYC Apartment Hunt with Chock Chapple!

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

2024-04-30 16:07