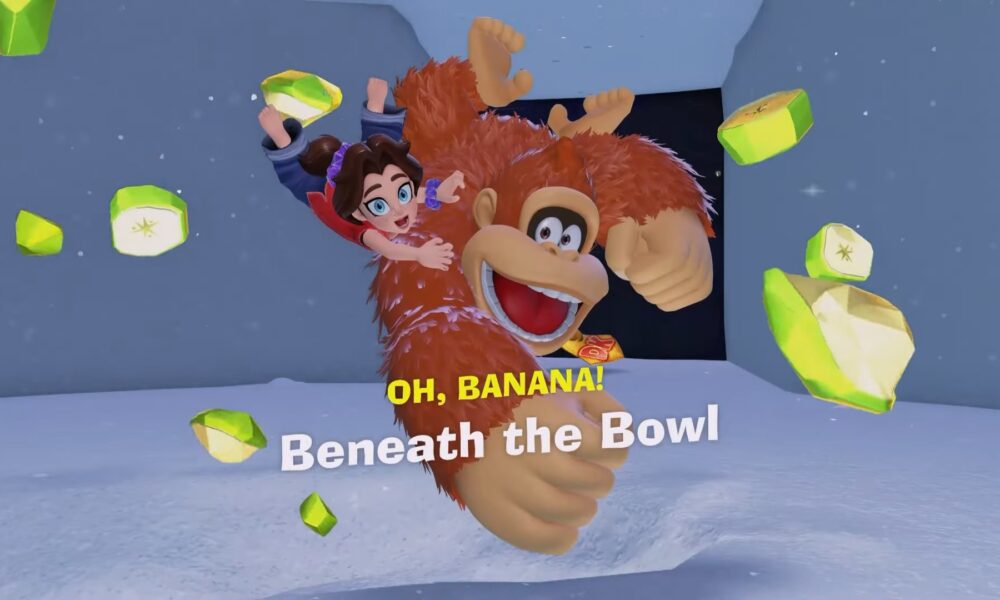

Quick-Service Ice Treats Guide in Donkey Kong Bananza

According to the title of this speed-focused level, it’s crucial to boost your performance. To do so, consider enhancing your Striking Force. This improvement will help you move faster! By the way, don’t forget to trigger the lever at the entrance to activate the ice cube dispenser. It will release colorful ice cubes, initiating the challenge.