-

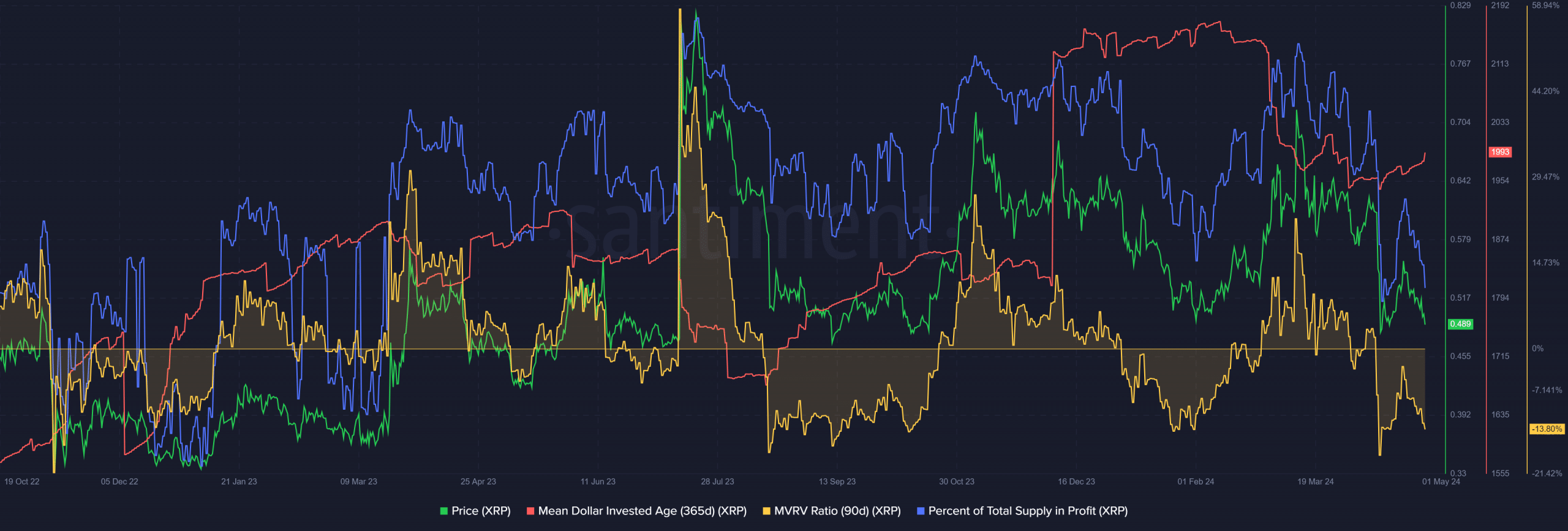

XRP’s MVRV and MDIA were similar to August and September 2023.

The social metrics were not wholly positive.

As a long-term XRP investor with a few years of experience under my belt, I’ve seen the ups and downs of this token’s price action. The recent sell-off, where XRP failed to hold above $0.5, was disheartening but not entirely unexpected given the broader market conditions.

As a researcher studying the cryptocurrency market, I’ve observed that Ripple [XRP] didn’t manage to hold onto its short-term support level at $0.5 over the past two days. The intense selling pressure surrounding Bitcoin [BTC] caused numerous altcoins, including XRP, to lose ground at crucial support points.

For long-term Ripple network investors, it was a bitter pill to accept criticism labeling the network as having minimal use and deserving classification as a “zombie token.” However, this shift in sentiment presents an opportunity for agile swing traders to capitalize on the recent market fluctuations.

What do the on-chain metrics show for XRP prices?

Approximately 92% of the total supply was earning profits as of March 12th, but this figure had dropped to 72.6% at the time of reporting. This shift can be explained by XRP‘s significant losses over the past six weeks, amounting to a decrease of 32.6%. However, there were signs that the Mean Dollar Invested Age (MDIA) was starting to improve.

As a crypto investor, I was thrilled to see this development. It signaled that accumulation was happening again. Furthermore, the MVRV ratio for XRP suggested that it was significantly undervalued. Despite incurring a substantial loss, holders chose to hang on.

From August to September in the year 2023, the Miners’ Realized Value to Realized Price (MVRV) ratio remained below -10%, whereas the Moving Average Difference (MDIA) was gradually increasing. During this same timeframe, XRP prices found stability at the $0.48 support level before experiencing a surge in value.

As an analyst, I’ve noticed that the price behavior, along with the Maker (MKDA) and Market Value to Realized Value (MVRV) ratio, have been mirroring their patterns from September 2023. If MKDA manages to keep advancing, it could provide a solid incentive for buyers to enter the market and acquire more tokens.

The social metrics were uninspiring

I analyzed the social media data and noticed a modest decline in social volume in April relative to the robust levels seen in March. Additionally, social dominance displayed a decrease and barely registered a significant spike during the early part of April. These findings suggest that the level of engagement with XRP on social media has weakened.

Realistic or not, here’s XRP’s market cap in BTC’s terms

On the contrary, the three-day moving average showed a positive sentiment. But, a positive sentiment was also observed back in early April when stock prices rebounded from $0.56 to $0.63.

It highlighted that market sentiment, while powerful, could shift in an instant.

Read More

- OM PREDICTION. OM cryptocurrency

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Oblivion Remastered – Ring of Namira Quest Guide

- Lisa Rinna’s Jaw-Dropping Blonde Bombshell Takeover at Paris Fashion Week!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Sophia Grace’s Baby Name Reveal: Meet Her Adorable Daughter Athena Rose!

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Quick Guide: Finding Garlic in Oblivion Remastered

- Gumball’s Epic Return: Season 7 Closer Than Ever!

2024-05-02 10:15