- SEC’s crypto involvement raises questions about partisan regulation in upcoming elections.

- Darius Dale expects Biden-aligned policies in budget deficit financing.

As an experienced financial analyst, I believe the ongoing involvement of the SEC and DOJ in crypto regulation raises significant questions about potential partisan influences on upcoming elections. Senator Lummis’s criticism of the DOJ’s stance on Bitcoin wallets underscores these concerns, highlighting the need for clear guidelines to avoid contradictory interpretations.

Among the significant occurrences in 2024, the US presidential election and the Bitcoin halving are two highly anticipated events.

Although significant advancements have been made in the cryptocurrency sector during President Joe Biden’s tenure, regulatory issues continue to pose a challenge.

Significantly, the Securities and Exchange Commission (SEC’s) growing interest in the cryptocurrency market sparks debate: Could the expanding political divide over crypto regulations shape the stance adopted during the 2024 elections?

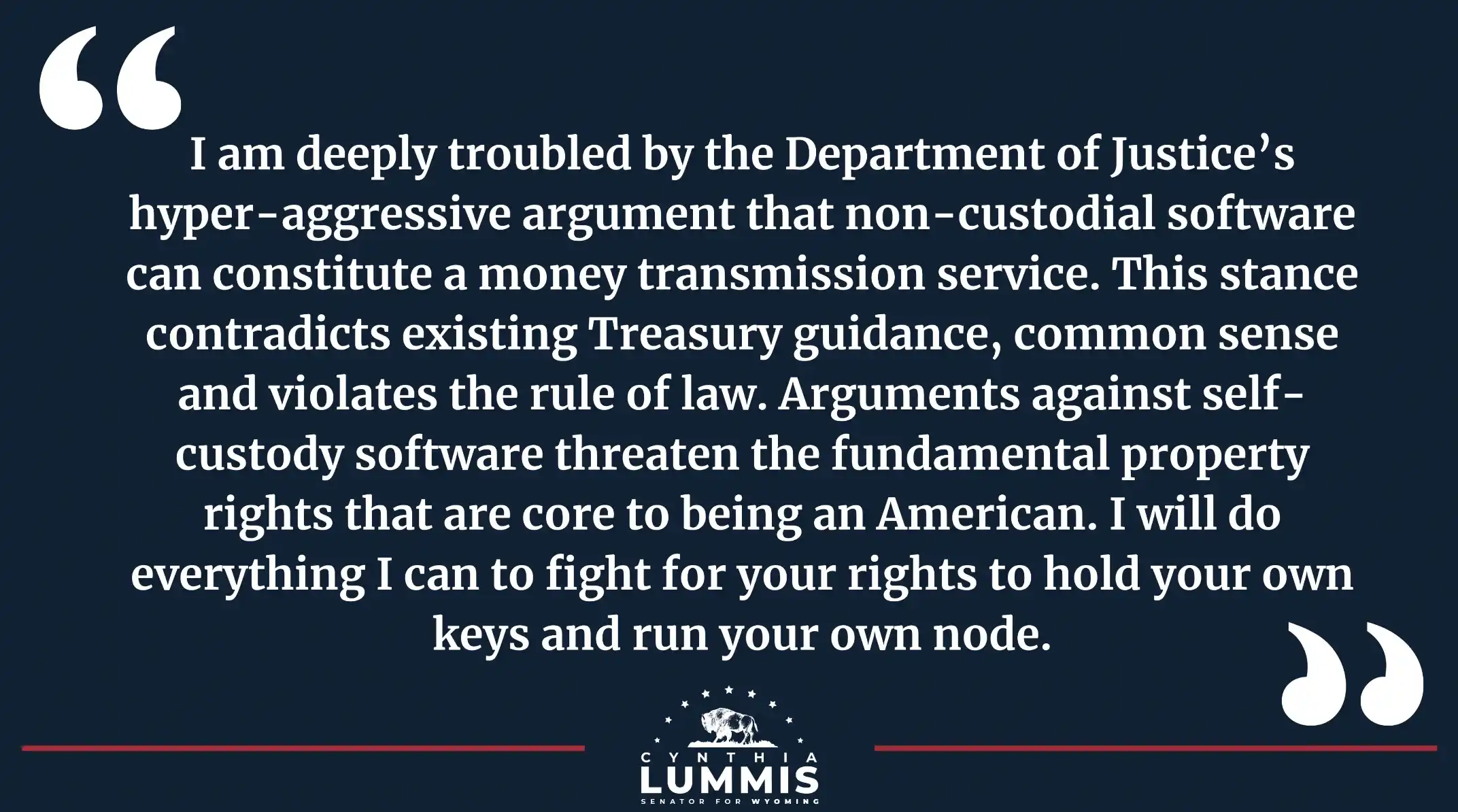

Senator Lummis criticizes DOJ’s Bitcoin stance

In the face of growing apprehensions, Senate representative Cynthia Lummis from the United States has voiced her disapproval towards the Department of Justice (DOJ) over their stance on the application of regulations to non-custodial digital wallets.

Voicing her apprehension on the same, Senator Lummis took to X (Formerly Twitter) and noted,

“I’m troubled by the Biden administration’s actions that could potentially criminalize fundamental elements of Bitcoin and decentralized finance.”

She added,

A disagreement arose after the Department of Justice (DOJ) accused developers associated with Bitcoin mixing services such as Samourai Wallet and Tornado Cash, for engaging in unlawful money transfer activities according to the DOJ’s perspective.

As a crypto investor, I’ve noticed the conflicting stance of the Department of Justice (DOJ) regarding previous Treasury guidance on Bitcoin and Decentralized Finance (DeFi) operations. Senator Lummis’s comments shed light on this issue, raising concerns that some essential aspects of these digital assets could be deemed criminal.

Insights from Darius Dale

In a separate interview with Anthony Pompliano, Darius Dale, the CEO of 42Macro, shared his insights on how different trends are influencing the crypto market and the election results.

Exploring the possible impact of President Biden’s administration on Treasury policies, specifically focusing on how the federal budget deficit will be funded. Dale mentioned,

As an analyst, I would say: “I understand that the Treasury anticipates a budget deficit, yet the means by which they will finance this shortfall remains at their discretion.”

Secretary Janet Yellen’s strong bond with President Joe Biden highlights their shared vision and anticipation for policies in line with the administration’s goals.

Stock market trends

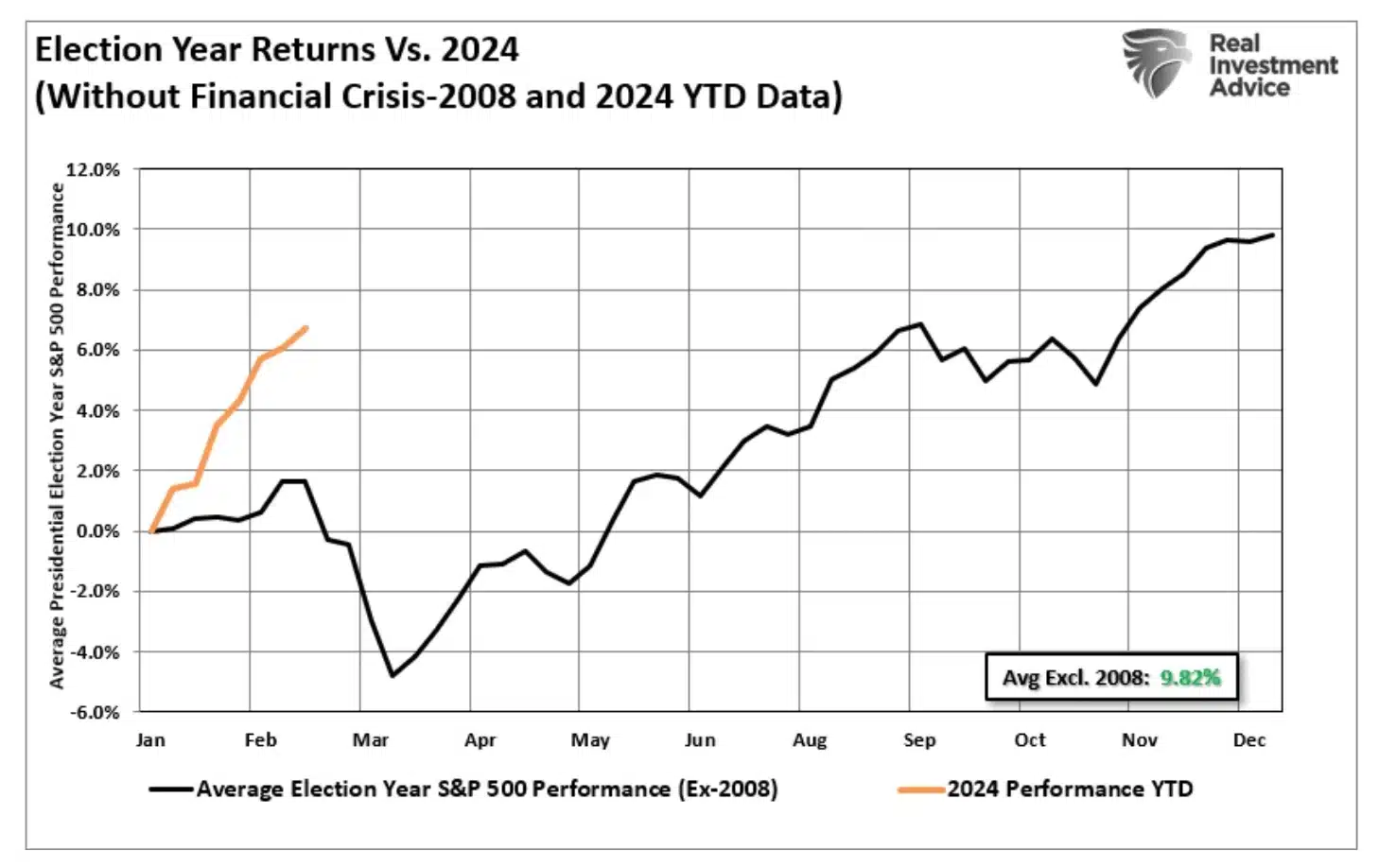

Based on past records, the stock market usually performs well before presidential elections. The market’s growth in the approach to the 2024 election is remarkably greater than average historical gains.

It’s worth mentioning that Dale placed great emphasis on the intricate relationship between sticky inflation and the appropriate actions of Treasury policies. He asserted,

As a researcher observing the ongoing debate, I can’t help but notice an emerging trend leaning towards more aggressive or hawkish stances.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- Elon Musk’s Wild Blockchain Adventure: Is He the Next Digital Wizard?

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- BLUR PREDICTION. BLUR cryptocurrency

2024-05-02 16:08