- Stablecoins are set to be “mainstream,” per Bitwise exec.

- Exec suggests Ethereum, Solana as starting points for stablecoins investments.

As a seasoned crypto investor with a keen interest in the stablecoin market, I believe that the growing importance of stablecoins is an opportunity not to be missed. The recent profit surge of Tether, the leading stablecoin issuer, is a testament to the potential of this subsector.

Bitwise Asset Manager views the thriving $159.5 billion stablecoin sector as an intriguing new cryptocurrency landscape deserving of investors’ scrutiny.

In the first quarter of 2024, Tether (USDT), the top-ranked stablecoin provider by market capitalization, generated a remarkable $4.5 billion in earnings. For those not engaged in issuing stablecoins, how can they profit from this sector?

As a researcher focusing on the digital asset landscape, I’d like to emphasize the significance of examining the distribution of stablecoins. Following this line of thought, in a recent memo to my investment professional colleagues at Bitwise, our Chief Investment Officer Matt Hougan highlighted:

As a crypto investor, I understand that holding stablecoins directly may not yield appreciation since their primary function is to maintain a stable value. However, there’s an opportunity to invest in the underlying infrastructure that supports stablecoins and Decentralized Finance (DeFi) applications. These foundational elements are referred to as “picks and shovels.” In our crypto context, these picks and shovels are Layer 1 blockchains such as Ethereum and Solana. By investing in these platforms, you’re not only gaining exposure to stablecoins but also to the DeFi apps that interact with them, potentially leading to significant returns.

Ethereum, Solana for stablecoin ventures?

To begin with, Bitwise’s perspective was influenced by the significant possibility that the United States would enact stablecoin legislation towards the end of 2024 or the beginning of 2025.

This could lead to the “mainstreaming of stablecoins,” per Hougan.

As a crypto investor, I strongly believe in the significance of stablecoins for the US economy. These digital currencies are pegged to the US dollar, making them a reliable alternative to traditional fiat money. Moreover, stablecoins function as one of the largest buyers of US Treasuries. This means that they help support the US government bonds market and contribute to financial stability.

“Next, it’s important to note that stablecoins are significant purchasers of US Treasury bonds. Currently, they rank as the 16th largest holder of these securities globally. This figure is impressive before taking into account the expected surge in popularity following mainstream adoption.”

As a crypto investor, I’d recommend considering Bitwise’s approach to selecting Ethereum (ETH) and Solana (SOL), along with their related decentralized finance (DeFi) ecosystems. This strategy focuses on the dominance and usage of stablecoins within these platforms. By keeping an eye on the prevalence and activity of stablecoins, we can potentially identify promising opportunities for investment in the tokens and projects that are driving this growth.

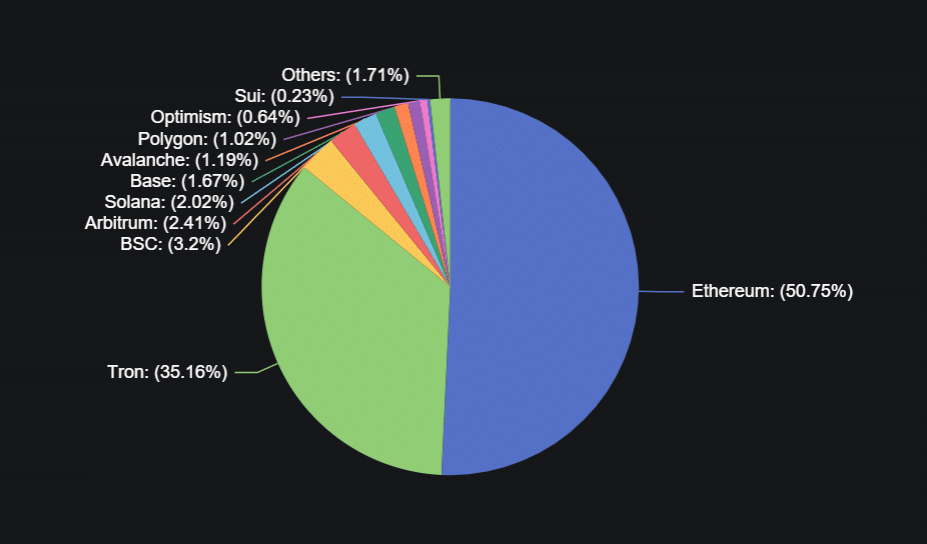

As a crypto investor, I’ve noticed that, according to DeFiLlama’s latest data, over half of the stablecoin market share – approximately 50.75% – is under Ethereum’s command on the Ethereum chain.

It was followed by Tron [TRX], BSC, Arbitrum [ARB], Solana, and the rest in that order.

As a researcher investigating the subject, I found that the executive was rather tight-lipped about the strategies for engaging with the leading stablecoin networks and Decentralized Finance (DeFi) platforms.

As a crypto investor, I would interpret the executive’s statement as follows: I believe the intention is for us to acquire the native tokens of the leading blockchain networks and platforms.

When it comes to Bitwise’s alpha in the crypto world, keep in mind that this figure doesn’t serve as a definitive guide for financial decisions without conducting extensive research first.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Quick Guide: Finding Garlic in Oblivion Remastered

- WCT PREDICTION. WCT cryptocurrency

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

2024-05-02 17:11