- Optimism leads Arbutrum and Polygon in L2 rankings.

- Their native assets had a poor trend in the past month.

As a researcher with experience in the cryptocurrency market, I find the recent developments in Layer 2 platforms Optimism, Arbitrum, and Polygon quite intriguing. According to various reports and data analysis, these platforms have been leading in development activity and TVL (Total Value Locked) in the decentralized finance (Defi) ecosystem.

As a researcher studying the current landscape of Layer 2 solutions, I’ve discovered that Optimism (OP) has gained significant momentum with a high degree of development activity. Notably, Arbitrum (ARB) and Polygon (MATIC) have also been actively contributing to the top tier of projects in this space.

Although there have been some challenges, a closer look at the recent price movements of OP, ARB, and MATIC tokens uncovers notable patterns.

Optimism, Arbitrum, and Polygon features in top dev activity

As a data analyst, I’ve examined the latest developments in Layer 2 networks using Santiment’s data. Notably, Optimism stands out with an impressive average development activity score of 540 over the past month. This figure underscores a substantial amount of ongoing work and advancements on their platform.

Third place went to Arbitrum with a score of 110, reflecting significant development endeavors. In contrast, Polygon occupied the eighth spot with a lower score of 20.43, suggesting less activity compared to Optimism and Arbitrum.

Additionally, there was a correlation in their Total Value Locked (TVL).

Arbitrum leads Optimism and Polygon in TVL

A current examination of the aggregated value, or TVL, held across these Layer 2 DeFi platforms, as reported by DefiLlama, has uncovered some intriguing patterns.

As a crypto investor, I’ve noticed that among the three platforms I follow closely – Optimism, Ethereum, and Solana – Optimism is the most active in development. However, its total value locked (TVL) is significantly lower than the others, with a TVL of approximately $860 million nearly.

Among the three networks, Polygon boasts a TVL (Total Value Locked) of nearly $872 million, which is significantly high and closely followed by others. Notably, Arbitrum takes the lead with an impressive TVL of over $1 billion, approaching $2.5 billion during the analysis period.

Despite the varying total value locked (TVL) amounts across these three platforms, they have all recently seen decreases in their TVL figures. These declines could indicate that the value of projects hosted on these platforms is decreasing or that the worth of their native tokens is being reduced.

OP, ARB, and MATIC’s prices show poor trends

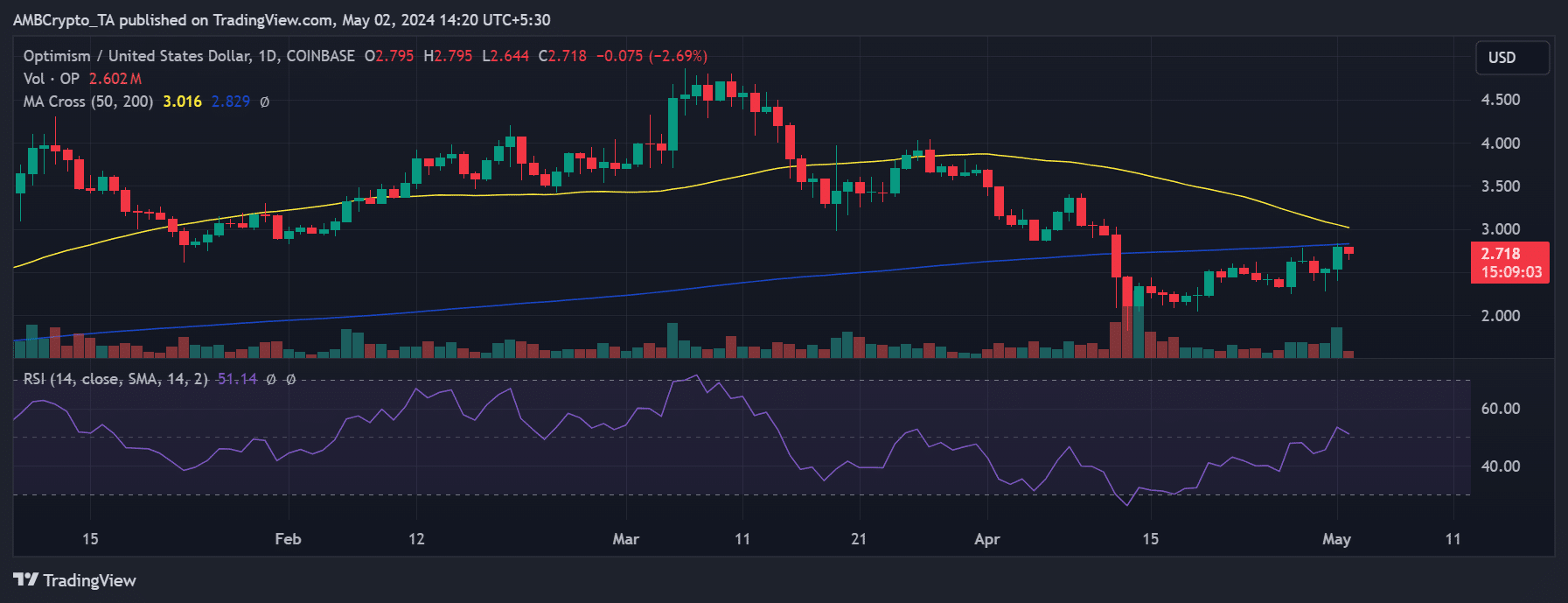

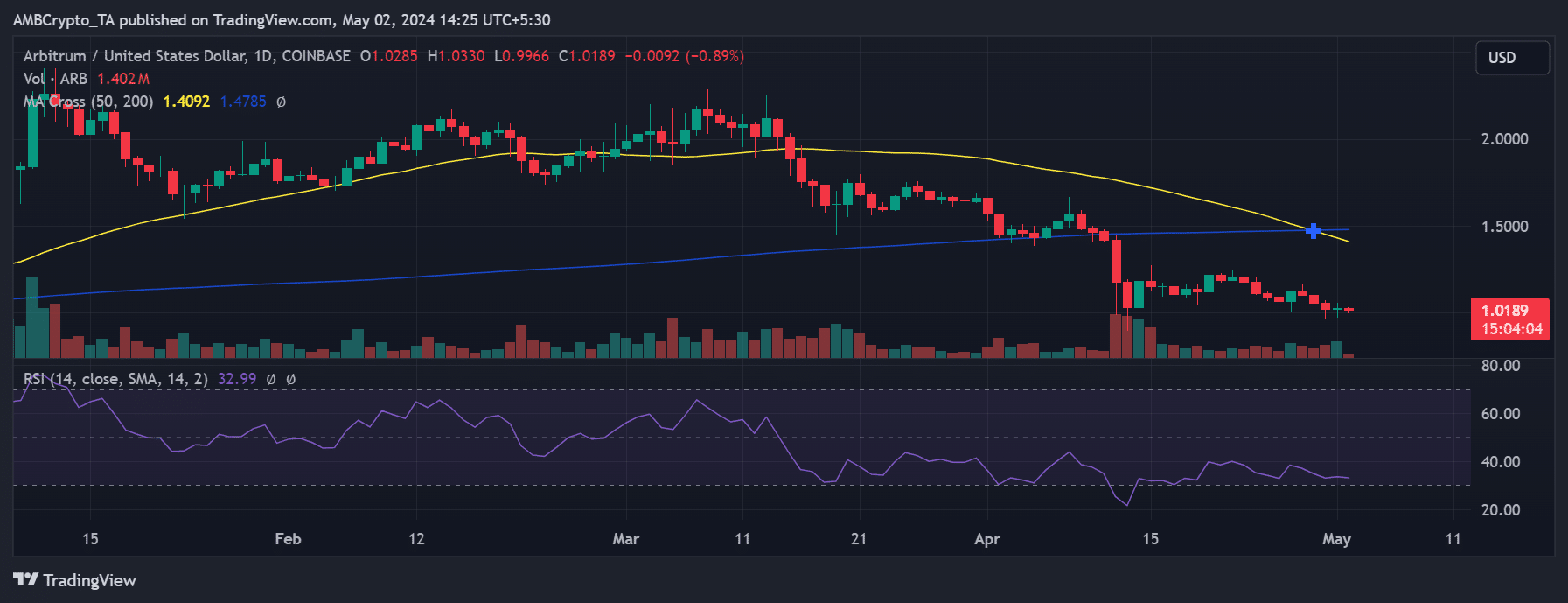

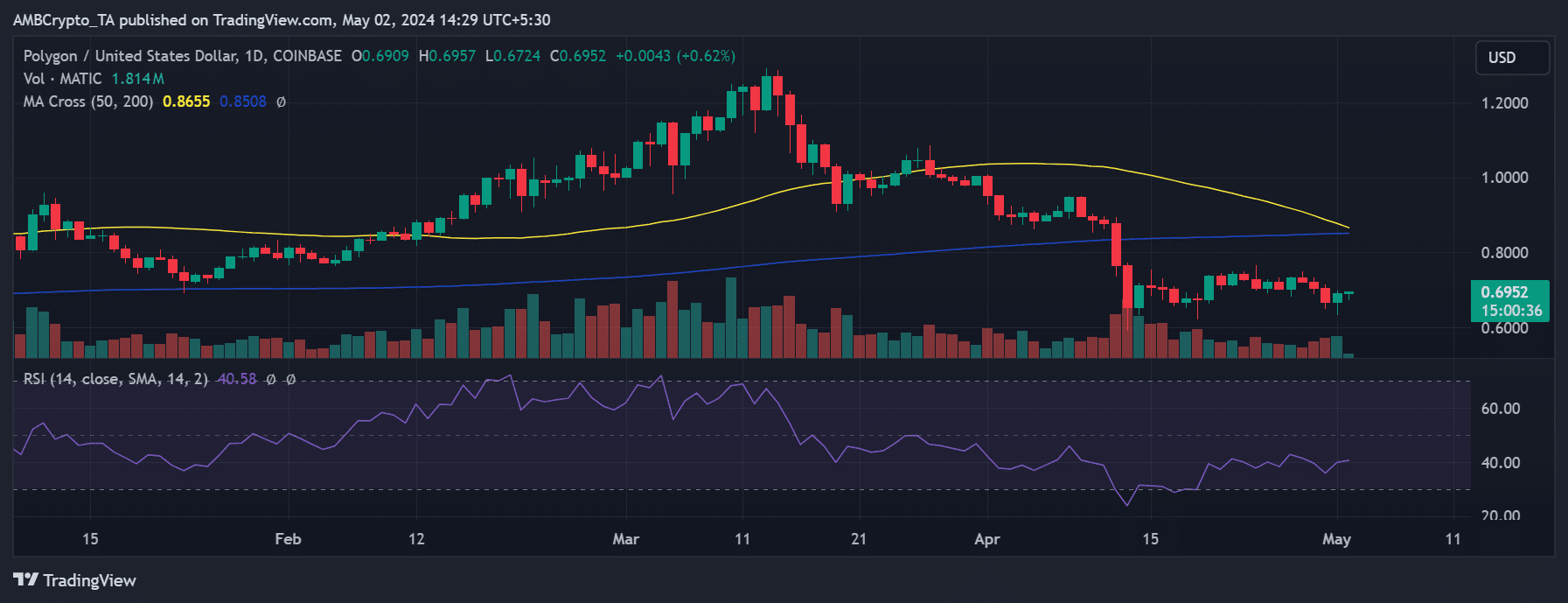

On May 1st, I examined the price patterns for Optimism, Arbitrum, and Polygon in the Layer 2 marketplace. Each displayed distinct price behaviors.

As a crypto investor, I’m thrilled to see optimism making significant strides with a robust gain of more than 10% in value. This uplifting trend has brought optimism’s price tantalizingly close to the $2.80 mark. The bullish momentum at the onset of the month is particularly encouraging given its lackluster showing during April.

However, at the time of analysis, it experienced a decline of over 2%, trading around $2.71.

Instead of “Arbitrum, on the other hand, had a more challenging trend with consecutive declines leading up to 1st May,” you could say “Arbitrum faced a tougher path, experiencing continuous decreases until May 1st.” Additionally, instead of “Although it attempted a modest increase on that day, the gain was less than 1%,” you could paraphrase as “Despite trying to rise slightly on that day, its growth was minimal, barely reaching 1%.”

Currently, Arbitrum is experiencing a small decrease in value and can be found hovering around the $1 price mark.

Realistic or not, here’s MATIC market cap in BTC’s terms

In April, Polygon endured more decreases than increases. However, the beginning of May brought about a positive shift for the cryptocurrency, recording a rise of over 3%, which approximated around $0.6.

At present, it continues to hold onto its gains, trading at a minimal uptick of under 1%, and is currently priced within the $0.6 range. It’s worth noting that among all Layer 2 assets, only Polygon displayed a positive gain during this period.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Quick Guide: Finding Garlic in Oblivion Remastered

- WCT PREDICTION. WCT cryptocurrency

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

2024-05-02 18:15