- Solana has a strongly bearish market structure on the lower timeframes.

- The 78.6% Fibonacci level has been valiantly defended – but for how much longer?

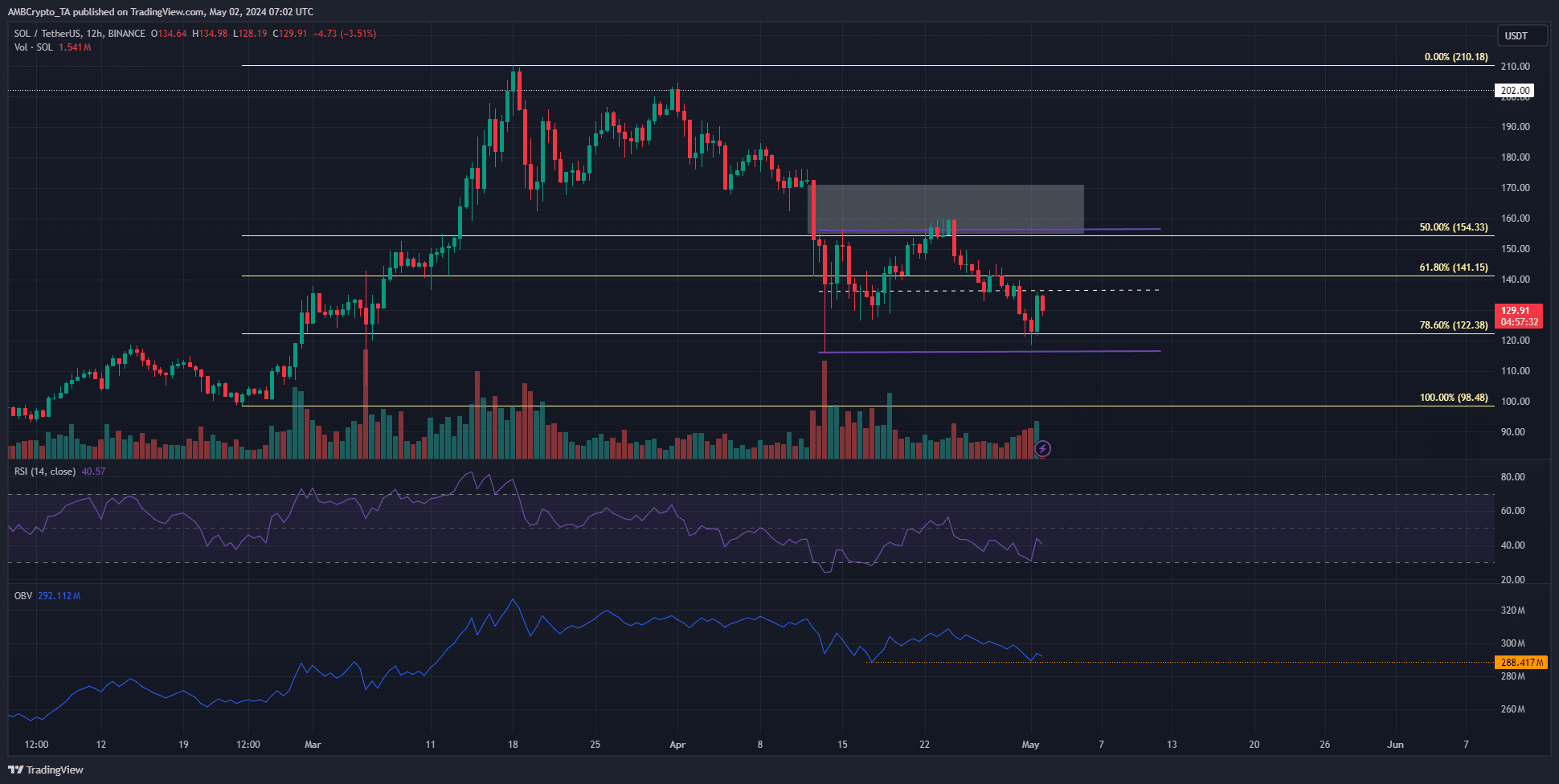

As a crypto investor with some experience under my belt, I’ve been keeping a close eye on Solana (SOL). From where I stand, the market structure for SOL is strongly bearish on the lower timeframes. The 78.6% Fibonacci level has held firm, but for how much longer?

At present, Solana (SOL) hasn’t seen significant price improvement. Following unsuccessful attempts to surpass the resistance level at $160 on larger timeframes, it has taken a pause and is now trading within a defined range.

As an analyst, I’ve noticed that the price range for this asset moved from a high of $156 down to $116.3. The technical indicators I’m observing have a bearish tilt to them. Moreover, a recent report by AMBCrypto brought attention to the decreasing Open Interest surrounding SOL and the potential negative impact it could have on its price.

The mid-range level was resistance now

As an analyst, I’ve identified that the midpoint of the range for the price of Solana (SOL) sits at $136.6. Currently, SOL is being traded at $129.1 as of press time. It seems to be moving towards this midpoint as a potential retest. However, based on historical trends and market conditions, I anticipate that it may encounter resistance and potentially reverse course within the upcoming hours.

On the 12-hour chart, the Relative Strength Index (RSI) stayed below the threshold of 50, indicating a bearish trend. Specifically, its value was 40.57. As for the On-Balance Volume (OBV), it has been exhibiting a gradual decline since the middle of April. However, the past two days have seen a rebound from that low point.

Should the obvious support at this level give way, it could signal growing strength among SOL sellers. This development might be sufficient to cause prices to fall below the range lows, around $116. According to our analysis of Solana’s internal structure, $122 represents a crucial support point.

The next magnetic zone could deflate all bullish hopes

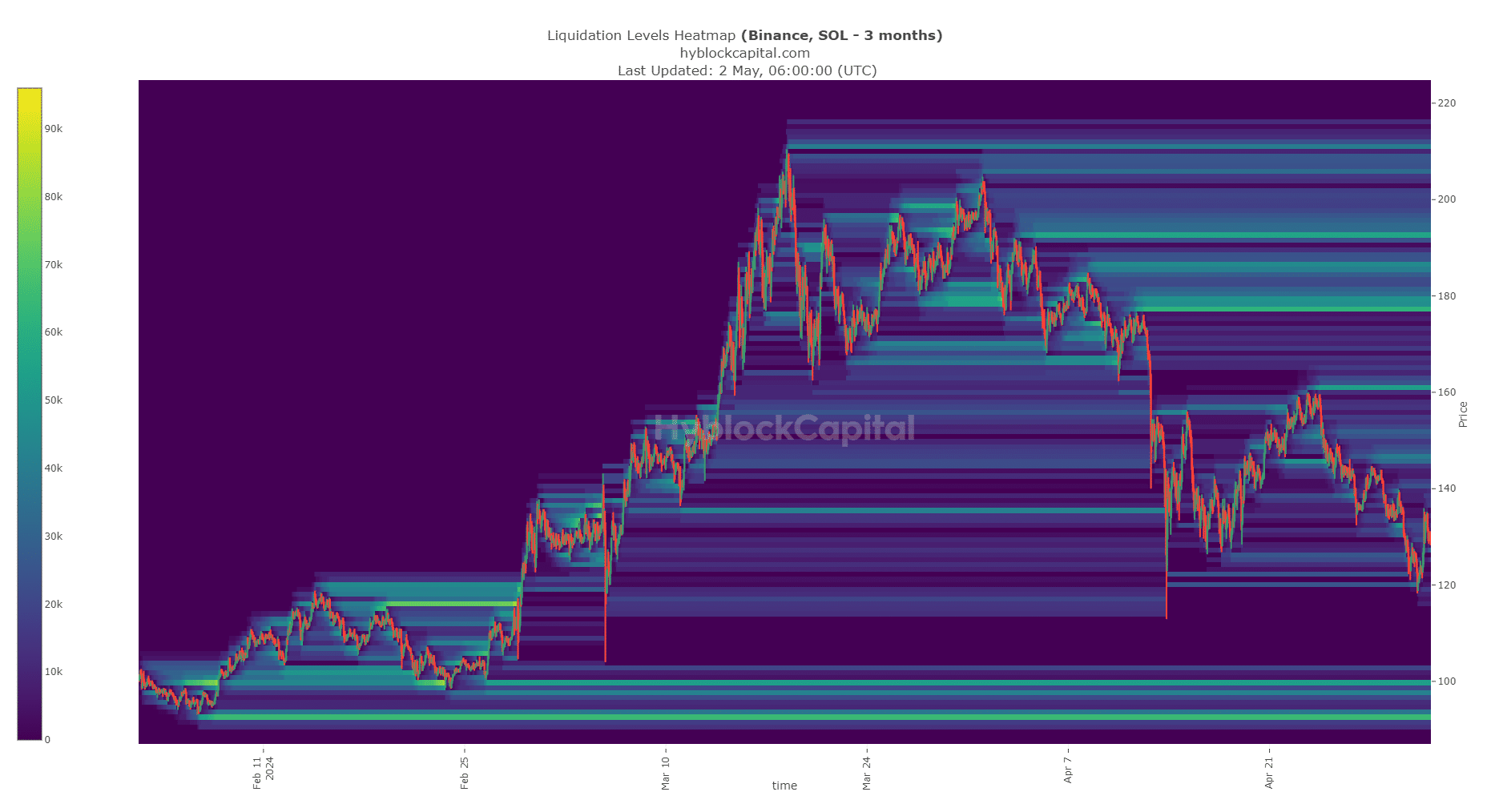

The market had shown signs of apprehension prior to the price drop to $116 on April 13th. It appeared that the available buying power at the $120 level had been exhausted, resulting in the subsequent rebound.

Read Solana’s [SOL] Price Prediction 2024-25

Currently, the significant liquidity reserve lies at the $100 mark. Previously, the levels of resistance to keep an eye on were located at $160 and $145.

Based on the analysis of the price movement and technical signals, it’s plausible that the price could reach $100 or even dip slightly to $92 in the near future.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-05-02 21:11