-

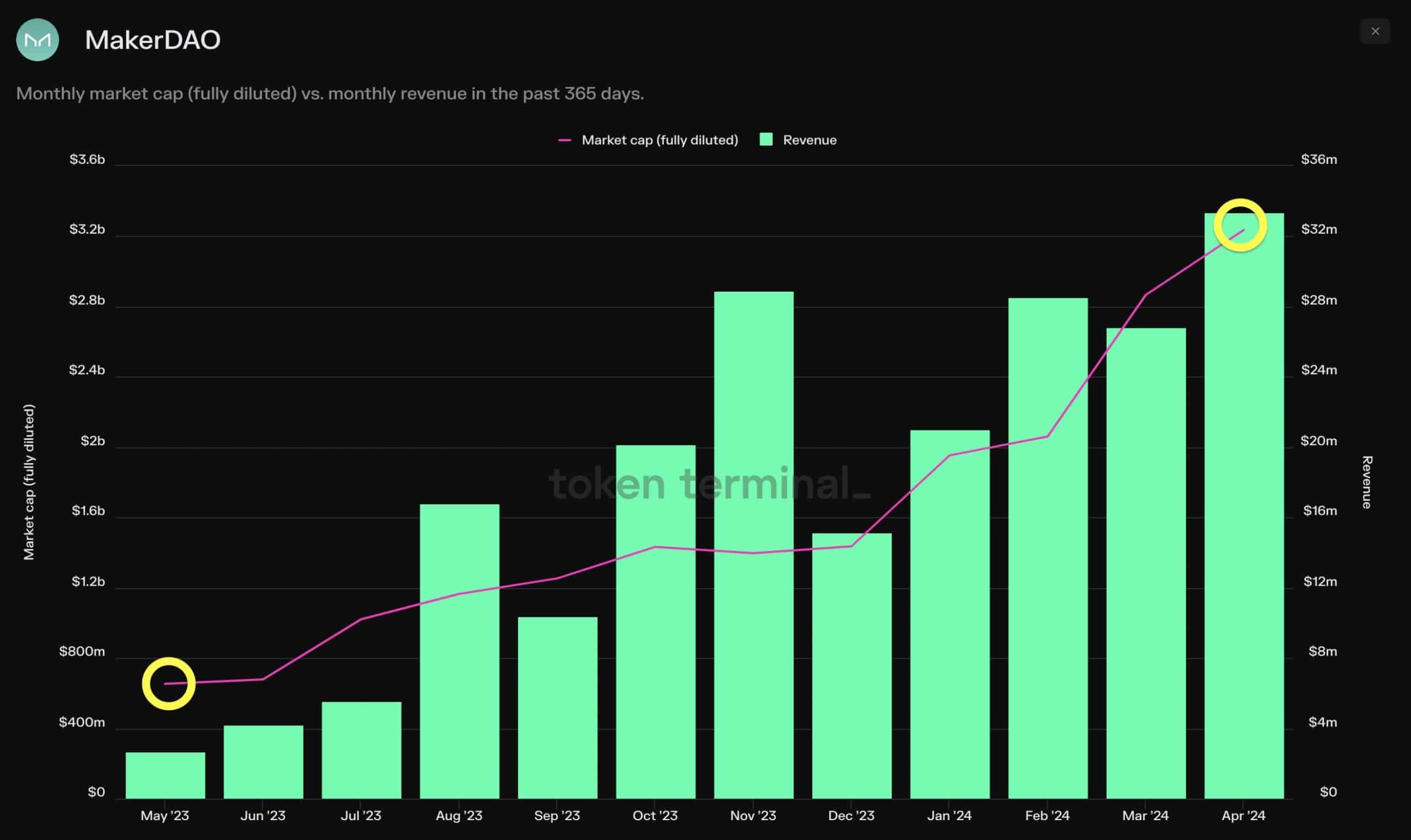

MakerDAO’s market cap and revenue grew significantly over the past year.

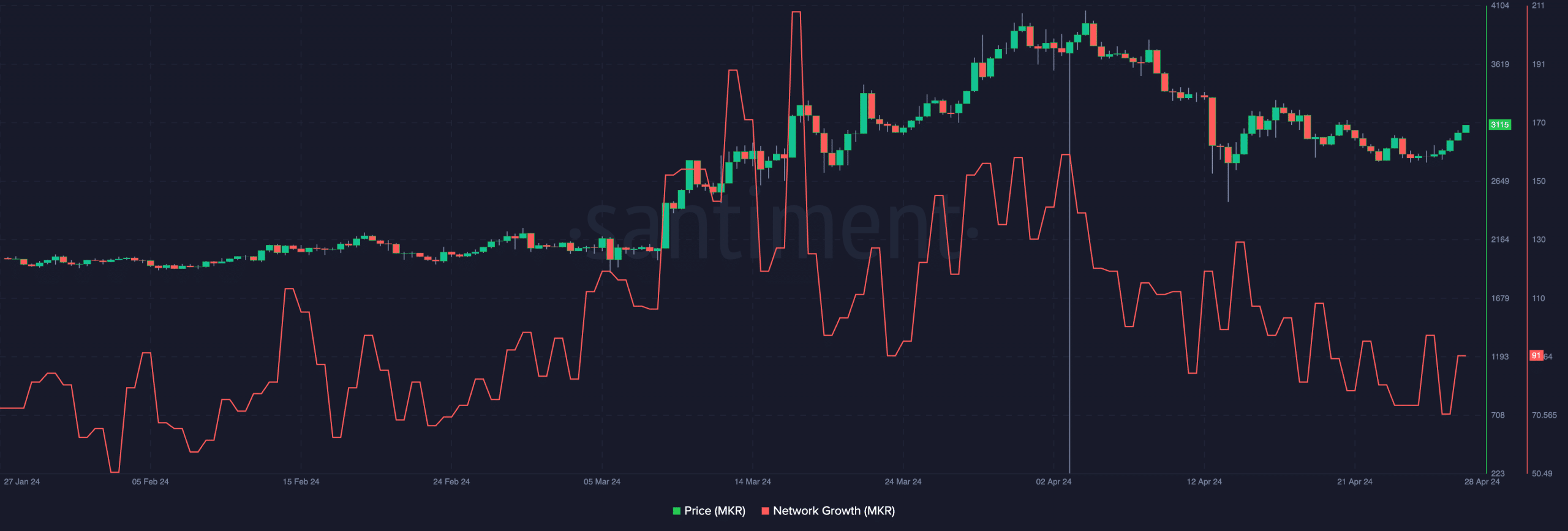

Price of MKR surged, despite declining network growth.

As an analyst with a background in crypto markets and DeFi, I’ve been closely following the developments at MakerDAO (MKR) over the past year. And based on my analysis of the available data, I believe that MakerDAO is poised for continued growth despite some recent setbacks.

In the midst of the volatile crypto market conditions over the past few months, MakerDAO (MKR) has managed to deliver consistent strong performance.

MakerDAO expands

Based on current figures, MKR‘s market capitalization has increased fivefold compared to the previous year, and its monthly revenues have seen a tenfold surge over the same period.

The substantial influence of MakerDAO over the Decentralized Finance (DeFi) market is evident as it generates almost half (around 40%) of the earnings in this sector on the Ethereum [ETH] network.

As a researcher, I would describe it this way: I’ve found that the platform’s primary advantage is its stablecoin, DAI. With a broad user base, significant liquidity, numerous integrations, and an established history of success, DAI stands out in the stablecoin landscape.

Maker’s financial capability is impressive enough to produce more fees than numerous Layer 1 and Layer 2 solutions.

Staking season

As a researcher studying the evolution of Maker, I’ve come across criticisms pointing towards its traditional approach. Yet, with the current rollout of Endgame, Maker is actively working to reshape this image. By fostering a more expansive ecosystem comprised of modular protocols, Maker aspires to become a more adaptable and scalable platform.

During this stage, Maker holds significant importance in the ecosystems of staking, restarting, and token-based trading through providing on-chain lending solutions for users.

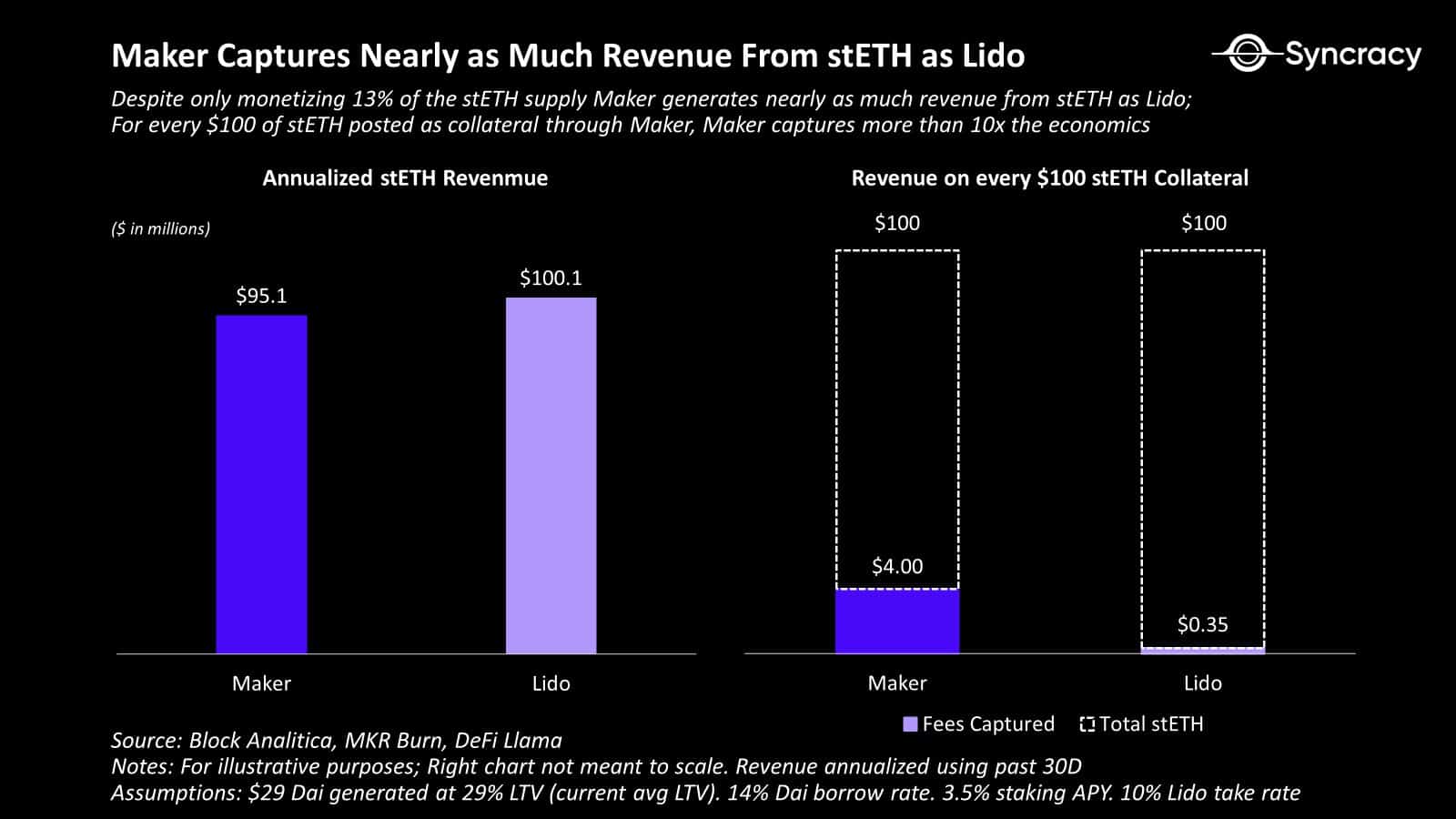

Maker has the potential to rake in billions of dollars in fees due to its strategic placement within the Decentralized Finance (DeFi) market, allowing it to claim a substantial share of the profits.

As an analyst, I’ve observed that Maker currently earns a significant amount of revenue through lending against just a portion of the stETH supply. This income is comparable to what Lido generates in total from the entire stETH pool.

The proposed applications of liquid rebalancing tokens and tokenized margin trading are predicted to bring about comparable benefits, thereby strengthening Maker’s financial standing.

Realistic or not, here’s MKR’s market cap in BTC’s terms

As of the current moment, MKR was being exchanged for $2,706.20 and its value had climbed by 4.28% over the past 24 hours. The trading volume for this asset saw a significant increase of 20.16%.

Based on network expansion, the graph as a whole showed a decrease, suggesting that the influx of new addresses was diminishing.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Flight Lands Safely After Dodging Departing Plane at Same Runway

2024-05-03 02:15