- Both Dogecoin and Shiba Inu have long-term holders with a decent profit

- Speculators seemed more eager to short-sell one of them, compared to the other

As a seasoned crypto investor with a few battle scars and a well-earned grey hair or two, I’ve seen my fair share of market ups and downs. And from where I stand, both Dogecoin (DOGE) and Shiba Inu (SHIB) have had their moments in the sun, but now face the harsh realities of a bearish market.

As an analyst, I’ve observed a setback for Dogecoin [DOGE] and Shiba Inu [SHIB] over the last week, with respective losses amounting to 11.4% and 8.5%. However, it’s important to note that these coins have bounced back in the past 36 hours, recording gains of more than 10%, which makes their weekly losses even more pronounced at their lowest points.

At present, Bitcoin‘s [BTC] price was hovering around $59,000, and there was a palpable sense of apprehension in the crypto market. Consequently, it remained uncertain just how far this downward trend might continue.

To examine whether DOGE or SHIB had reached a possible bottom prior to their bullish bounce-back in the Futures market, AMBCrypto conducted an analysis of the relevant data.

Comparing the speculator sentiment behind Dogecoin and Shiba Inu

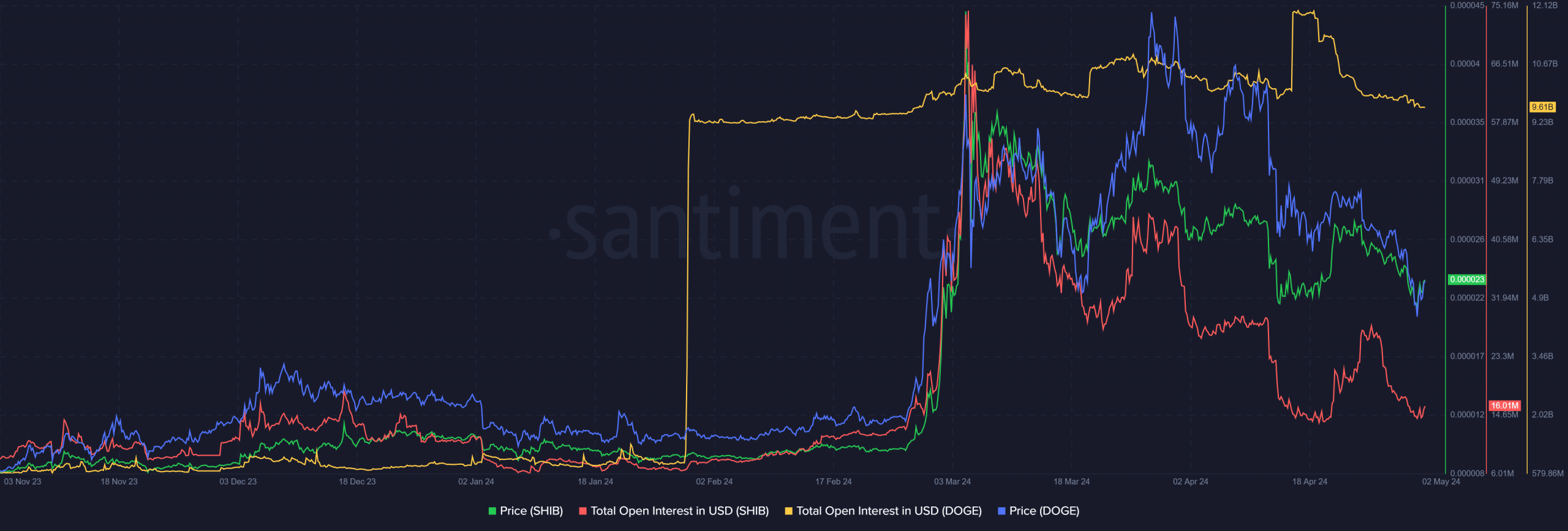

Since early March, the Open Interest for Shiba Inu has progressively decreased, while the coin itself has entered a period of price correction. This dual trend underscores a notable absence of bullish confidence in the market.

As an analyst, I’ve observed some temporary price rebounds in the market, which were accompanied by significant increases in open interest (OI). However, these gains were fleeting and soon reversed. This trend suggests that an increasing number of market participants have been compelled to step back from the action. In contrast, Dogecoin exhibited a distinct behavior.

As an analyst, I observed a decrease in Open Interest (OI) for both DOGE and SHIB, but most of this decline occurred during the second half of April. The price action indicated that the rebound for DOGE toward late March was more pronounced, with a bounce of 86%, while SHIB experienced only a 39% recovery. This discrepancy in Open Interest can be attributed to the varying degrees of sentiment and market activity between these two cryptocurrencies.

As a researcher observing the cryptocurrency market, I can assert that both Shiba Inu and Meme Coin have been facing significant selling pressure. The sentiment towards both coins has leaned bearish, yet Shiba Inu has shown signs of weakness for an extended duration.

Which of the two is closer to forming a bottom?

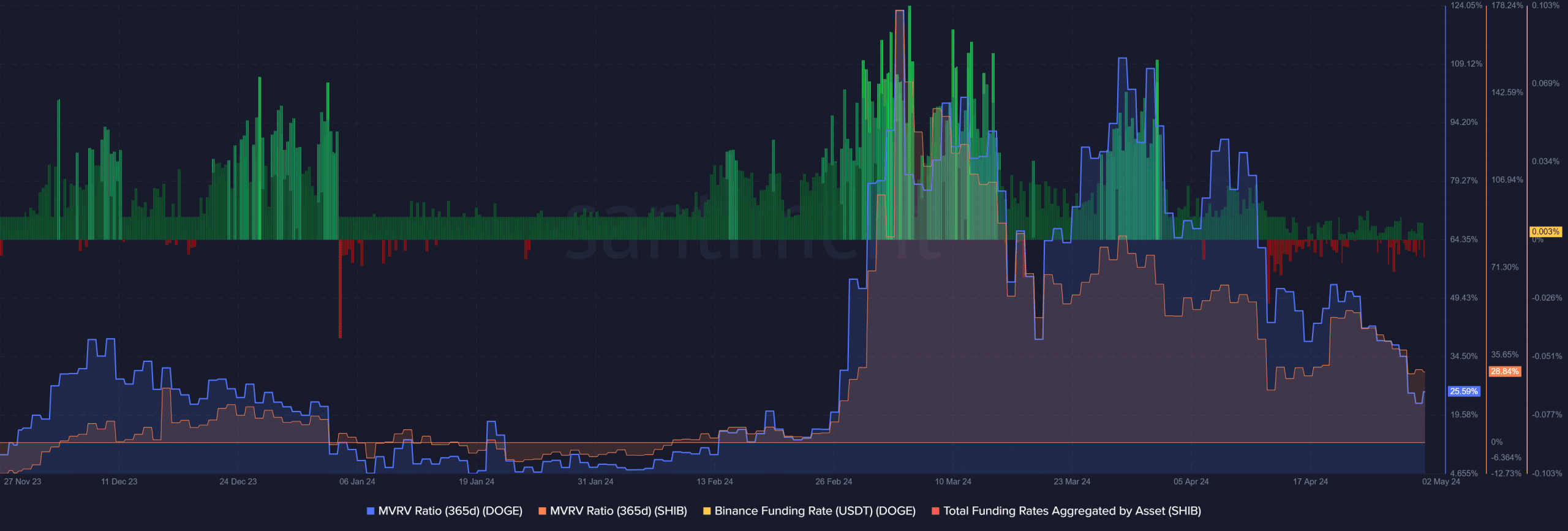

Based on its prolonged price retracement, is it possible that SHIB is nearing its bottom? During the entire month of April, SHiba Inu’s funding rate has consistently been negative, specifically between April 13-21 and April 27 – May 2.

Instead of “On the contrary,” you could say “Despite this,” or “Despitely.” For paraphrasing the second part, you could say “In the previous two weeks, DOGE experienced a small net outflow of funds on Binance for a few days. This indicated that traders were more keen to sell SHIB than DOGE, further fueling the bearish trend.”

Realistic or not, here’s DOGE’s market cap in BTC’s terms

After a recent setback, the yearly MVRV ratios of Dogecoin and Shiba Inu stood strong at 25.58% and 28.84%, respectively. This figure indicates that investors had made a decent profit of around 26% and 29% on their initial investment.

As a crypto investor, I believe it’s plausible that Dogecoin (DOGE) and Shiba Inu (SHIB) might require Bitcoin (BTC) to regain its bullish momentum before they can bounce back. Until then, it seems reasonable to anticipate that SHIB may experience larger losses than DOGE during a significant sell-off.

Read More

- OM PREDICTION. OM cryptocurrency

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Moo Deng’s Adorable Encounter with White Lotus Stars Will Melt Your Heart!

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Solo Leveling Season 3: What You NEED to Know!

- Billy Ray Cyrus’ Family Drama Explodes: Trace’s Heartbreaking Plea Reveals Shocking Family Secrets

- 1923 Sets Up MASSIVE Yellowstone Crossover

2024-05-03 10:15