-

BTC and ETH traded below their maximum pain points, suggesting that traders might face severe losses

Implied Volatility dropped, implying a lack of bullish expectations going forward

As a researcher with experience in the cryptocurrency market, I have been closely monitoring the upcoming expiry of Bitcoin (BTC) and Ethereum (ETH) options contracts worth approximately $2.3 billion. The cautious price action of both BTC and ETH over the past week has led to a decline in the number of open positions, with traders being wary of entering new ones due to the uncertainty surrounding their expiry.

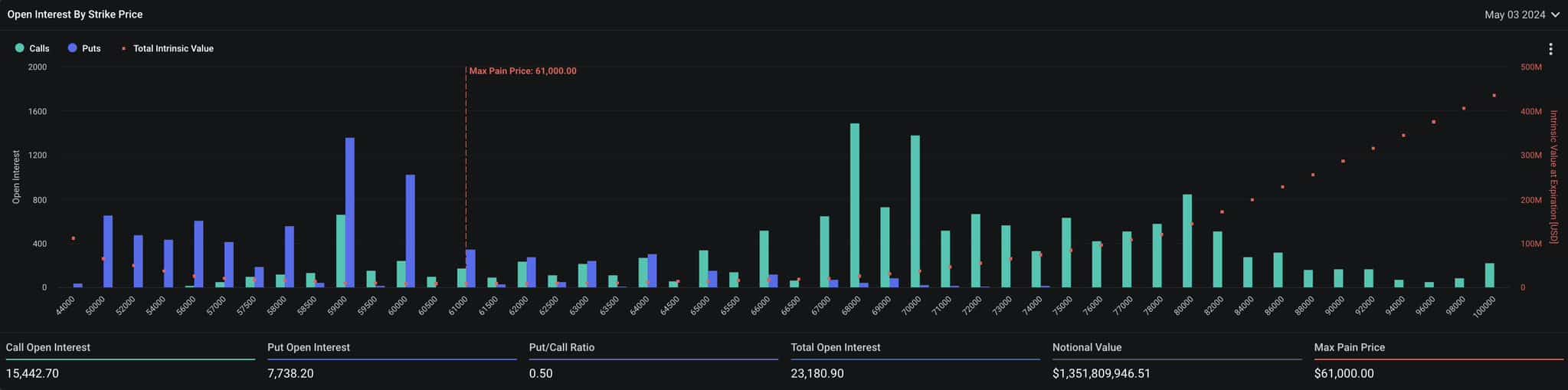

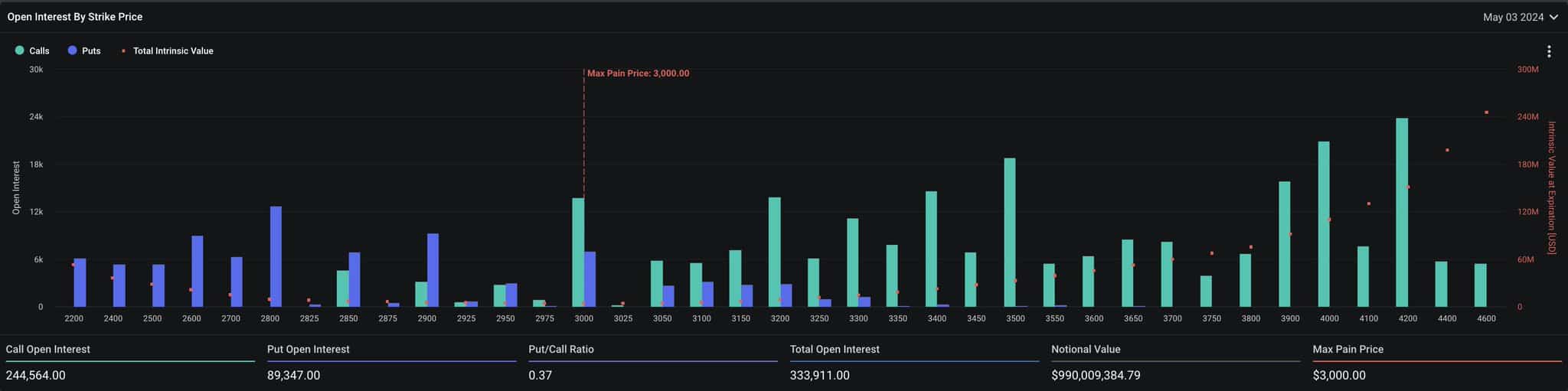

Approximately $2.3 billion worth of Bitcoin [BTC] and Ethereum [ETH] options contracts are approaching their expiration date on May 3, 2023. Based on Deribit Exchange data, the value of Bitcoin options amounts to approximately $1.35 billion, while Ethereum options are valued at around $990 million. However, it’s worth noting that the reported figure from AMBCrypto last week was higher, with a total value of approximately $9.3 billion.

The reason for the decrease can be linked to the price fluctuations of Bitcoin (BTC) and Ethereum (ETH). Throughout much of the week, both cryptocurrencies experienced significant drops before recovering somewhat. Consequently, traders have become wary about entering new positions.

When I penned down this text, Bitcoin’s put-to-call ratio (PCR) stood at 0.50. This indicator reflects the general market sentiment. A PCR greater than 1 implies that investors are purchasing more put options than call options—A bearish indication.

Anarchy looms as traders gear up for results

As a researcher studying the intricacies of Bitcoin trading, I’ve discovered an intriguing observation. When the PCR (Put-Call Ratio) falls below the threshold of 0.70, it indicates that there are more open put positions than call positions. In simpler terms, this implies a greater demand for downside protection compared to upside potential. This situation can be interpreted as a bullish sentiment prevailing among traders. Essentially, they anticipate Bitcoin’s price to increase by the end of the week, surpassing its current value.

As a researcher studying Bitcoin’s market trends, I’ve identified a significant level of potential distress for options traders. The price point of maximum perceived pain sits at around $61,000 on the charts. If Bitcoin were to drop below this price, many options contracts would result in substantial losses for their holders.

As a researcher studying Ethereum’s options market, I discovered that the Put-Call Ratio (PCR) stood at 0.37. This figure indicates that there were more bullish bets than bearish ones among traders. Looking ahead, it is important to note that the maximum pain point for Ethereum was identified at $3,000. Consequently, if you’re an Ethereum trader, you might be hoping for the altcoin to surpass this level before the end of the trading day.

As of the current news cycle, the value of Bitcoin and Ethereum fell short of their maximum potential loss points for option holders. Should this trend persist until the expiration date, it could result in significant losses for numerous traders.

As a crypto investor, I’ve been keeping an eye on the market trends and there are some potential reasons why Bitcoin (BTC) and Ethereum (ETH) might close out the week with bearish sentiments. According to Greeks.live, a well-known Options trading figure on the platform, here’s what we could be looking at:

“The Hong Kong ETF launch didn’t generate significant additional trading activity. In contrast, the US Bitcoin ETF has seen continued outflows. The market downturn has eroded investor confidence, and the current sideways trend is unlikely to be sustained without a rebound. A major investor, or ‘giant whale,’ is contributing to this lack of faith in the market.”

Volatility falls: Will BTC and ETH follow?

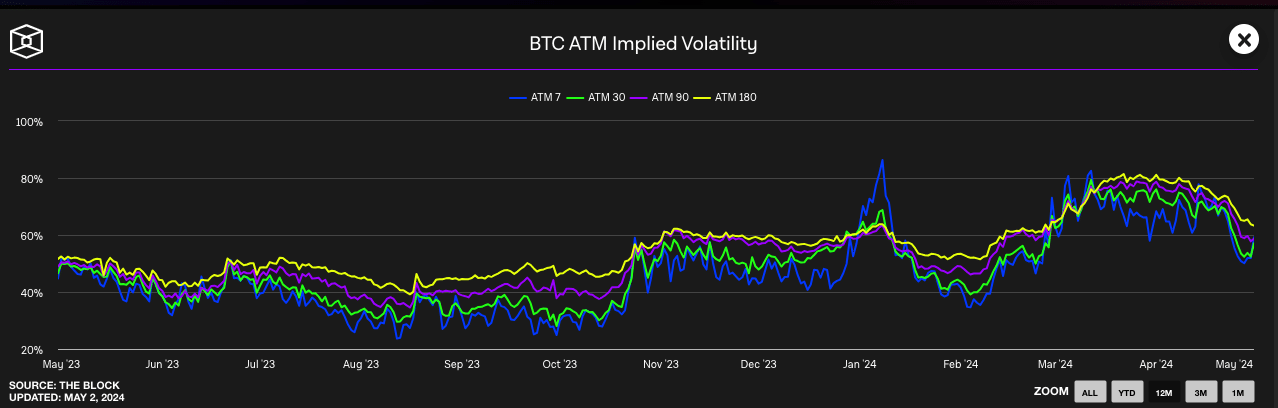

Furthermore, AMBCrypto examined Bitcoin’s Implied Volatility (IV) as an indicator. This volatility measure reflects the degree of certainty in the market and provides insight into whether purchasing call or put options could be profitable in the near future.

If the IV (Implied Volatility) rises, investors and traders are unsure of the direction for future price movements. Conversely, a decreasing IV suggests that market participants are reluctant to incur extra costs to protect their current holdings.

As a researcher studying the cryptocurrency market, I’ve observed that the implied volatility (IV) for both Bitcoin and Ethereum has decreased recently. This reduction in IV indicates that traders have become less confident in their bullish wagers, as they are now hesitant to pay a premium for the potential price swings associated with these assets.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

If this occurs, the price of Ethereum could potentially drop below $2,900 once more. As for Bitcoin, its value might begin to trade at a level lower than $59,000 if this sentiment comes to pass.

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-05-03 16:07