- Polkadot recorded a rise in demand in Q1

- However, revenue plummeted despite demand peaking over the period

As a researcher, I find it intriguing that Polkadot experienced a substantial increase in user activity during the first quarter of this year, as evidenced by the surge in new and returning addresses on its Relay Chain and parachains. However, this surge in demand failed to translate into meaningful revenue growth for the network.

As a researcher studying the blockchain ecosystem, I’ve noticed an intriguing development in the first quarter of this year: Polkadot [DOT], often referred to as Layer-0 blockchain, experienced a noteworthy surge in user activity. This finding comes from Messari’s most recent report.

Based on data from a reputable on-chain provider, there was a marked increase in demand for Polkadot’s Relay Chain and its parachains, reaching unprecedented levels. Contrastingly, the network’s earnings experienced a substantial decrease during the specified period.

What happened on Polkadot in Q1?

As a crypto investor, I’ve noticed an intriguing development in Polkadot’s Relay Chain during the first quarter. The number of both returning addresses and new ones created on this network’s central chain has significantly increased. The Relay Chain plays a crucial role in managing Polkadot’s blockchain coordination and ensuring its security. This growth could be indicative of heightened activity and interest in the Polkadot ecosystem.

In the past three months, approximately 8,200 unique addresses have transacted on Polkadot’s Relay Chain, marking a noteworthy 9% increase from the previous quarter.

As a researcher observing Polkadot’s network, I discovered that approximately 3,100 new addresses were generated on the Relay Chain over the past 90 days. This figure represents a significant jump of 23% compared to the previous quarter when only around 2,500 new addresses came into existence in the last three months of 2023.

As an analyst, I’ve observed remarkable consistency in the performance of parachains within the Relay Chain network. Parachains refer to independent blockchains that operate concurrently and are linked to the main Relay Chain. In the recent quarter, I discovered that active addresses on these parachains hit a new record high of 514,000, representing a significant 48% surge from the previous quarter.

As an analyst, I’ve observed notable growth in the usage of parachains like Moonbeam, Noodle, Astar, and Bifrost during the last three months. The demand for these chains has surged significantly, resulting in a noticeable uptick in user activity.

Read Polkadot’s [DOT] Price Prediction 2024-25

Messari went on to add,

“Moonbeam strengthened its role as the top parachain, boasting 217,000 monthly active addresses, marking a significant 110% increase from the previous quarter. Nodle came in second place with 54,000 monthly active addresses, more than doubling compared to the last quarter. Astar experienced a moderate rise of 8%, resulting in 26,000 monthly active addresses. Bifrost Finance’s monthly active addresses also showed a slight uptick of 2% QoQ, reaching 10,000.”

I’ve analyzed the data for Q1 and found an intriguing discrepancy between the surge in Polkadot network activity and a notable decrease in transaction fee revenue.

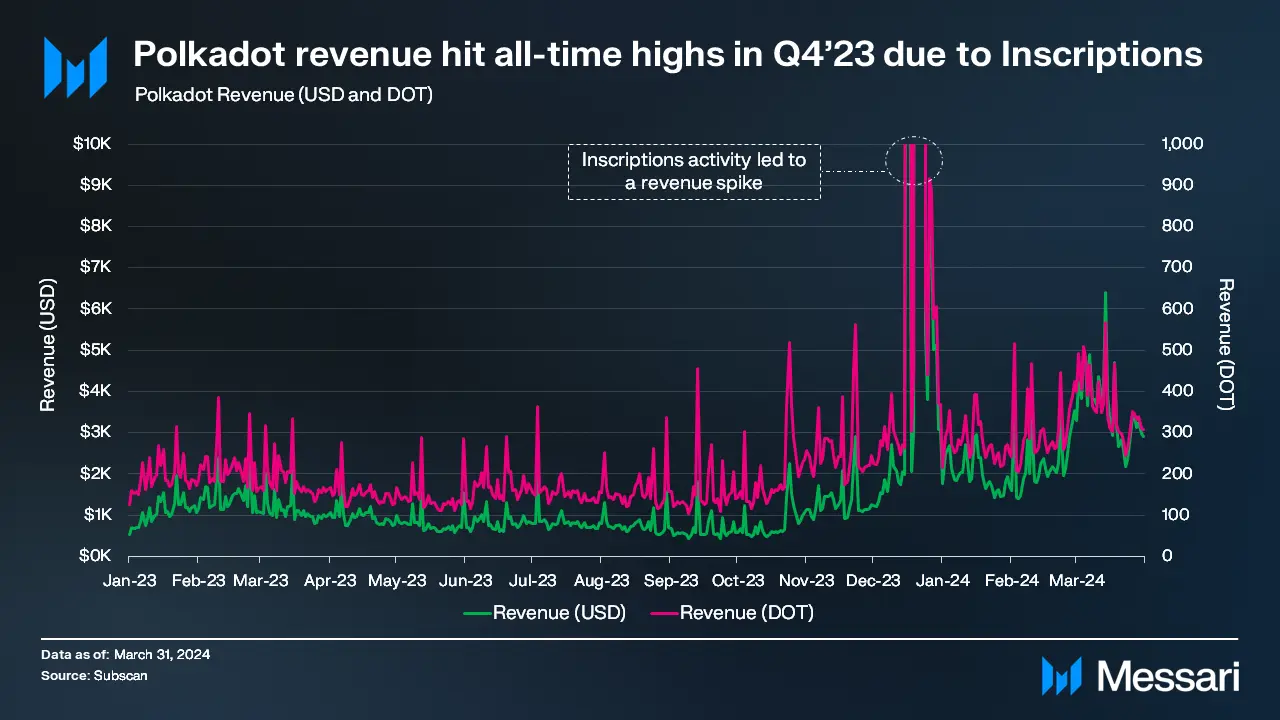

Based on the data in the report, Layer-0 earned a revenue of $241,000 during the first quarter of the year. This represents a significant decline of approximately 91% compared to the $2.8 million they brought in during the last quarter of 2023.

Messari concluded,

In the fourth quarter of 2023, Polkadot generated a revenue of approximately $2.8 million, representing a massive jump of over 2,800% compared to the previous quarter. This substantial growth can be attributed mainly to the dramatic uptick in extrinsics toward the end of December, fueled by the Polkadot Inscriptions. Conversely, revenue figures saw a sharp decline in the first quarter of 2024, with US Dollar revenue at around $241,000 (-91% QoQ), and DOT revenue at roughly 28,800 tokens (-92% QoQ).

Read More

2024-05-03 17:11