-

Ethereum’s price appreciated by more than 2.5% in the last 24 hours

Most metrics and market indicators looked bullish on ETH’s charts

As a seasoned crypto investor with a keen interest in Ethereum [ETH], I’m thrilled to see the latest price appreciation of over 2.5% within the last 24 hours. The bullish trend is further validated by most metrics and market indicators, which are currently looking optimistic on ETH’s charts.

Over the past few hours, I’ve noticed a shift in market sentiment that has worked to Ethereum’s [ETH] advantage. My daily chart for Ethereum has turned green, indicating potential growth. However, this recent upward trend could be the start of something much bigger. With Bitcoin taking on a bullish pattern as well, Ethereum, the leading altcoin, may experience significant gains in the coming days.

Ethereum’s bullish move

Over the past week, I’ve observed a less than ideal situation for investors as the price of Ethereum (ETH) dipped by more than 5%. However, in the last 24 hours, there’s been a shift in market trends that has led to a noteworthy increase of over 2.5% for ETH’s price. Based on current data from CoinMarketCap, ETH is currently being traded at $2,988.30 with a market capitalization surpassing $358 billion.

As an analyst, I’ve noticed some intriguing developments regarding Ethereum (ETH) recently. Notably, World of Charts, a well-known crypto analyst, pointed out that the ETH/BTC pair was forming an intraday falling wedge pattern on the charts. If this pattern breaks out successfully, we could potentially see ETH reaching new heights against Bitcoin in the near future.

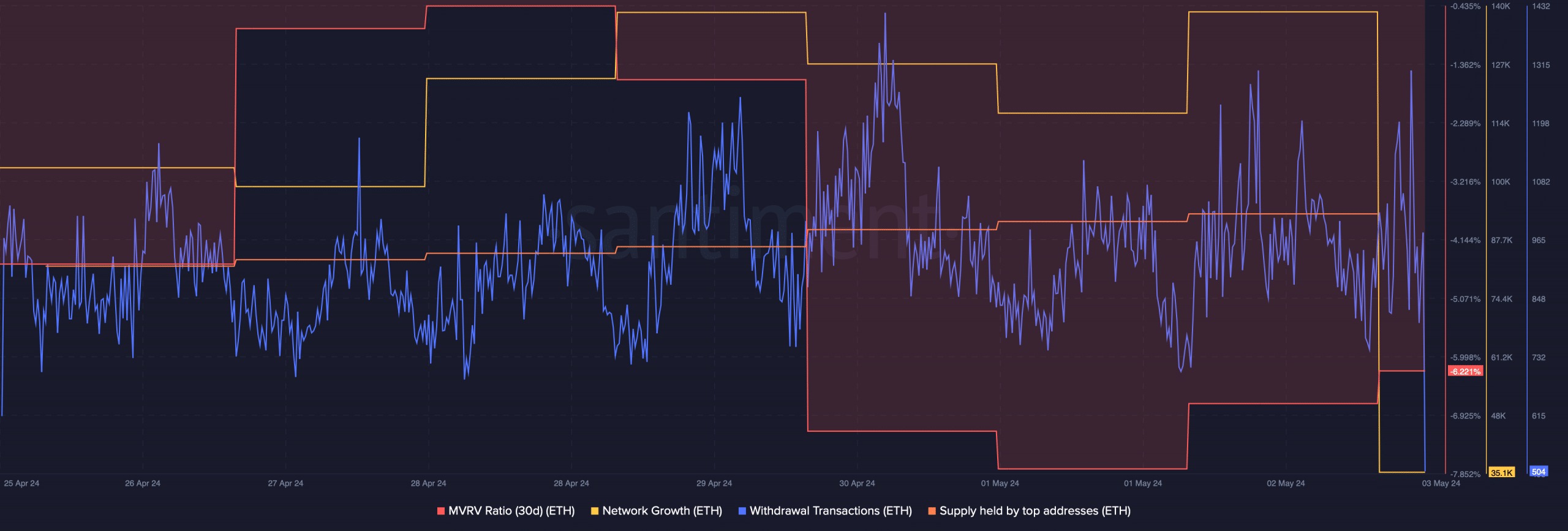

Based on our investigation at AMBCrypto, we examined Ethereum’s key performance indicators to assess if it was poised for a price surge. Using Santiment’s data, we discovered that Ethereum experienced an increase in network growth recently. In simpler terms, the number of new addresses transacting with the token has risen, coinciding with a rise in its withdrawal rate during the past week.

Further evidence of strong demand for Ethereum comes from a slight increase in the amount held by leading wallets, indicating robust purchasing activity for the token.

As a researcher studying Ethereum’s market performance, I’ve found an interesting observation. Contrary to some optimistic expectations, Ethereum’s Miners’ Realized Value (MRV) ratio was relatively low. Specifically, the MVRV ratio stood at -6.22% at the time of my analysis.

Ethereum’s weekly target

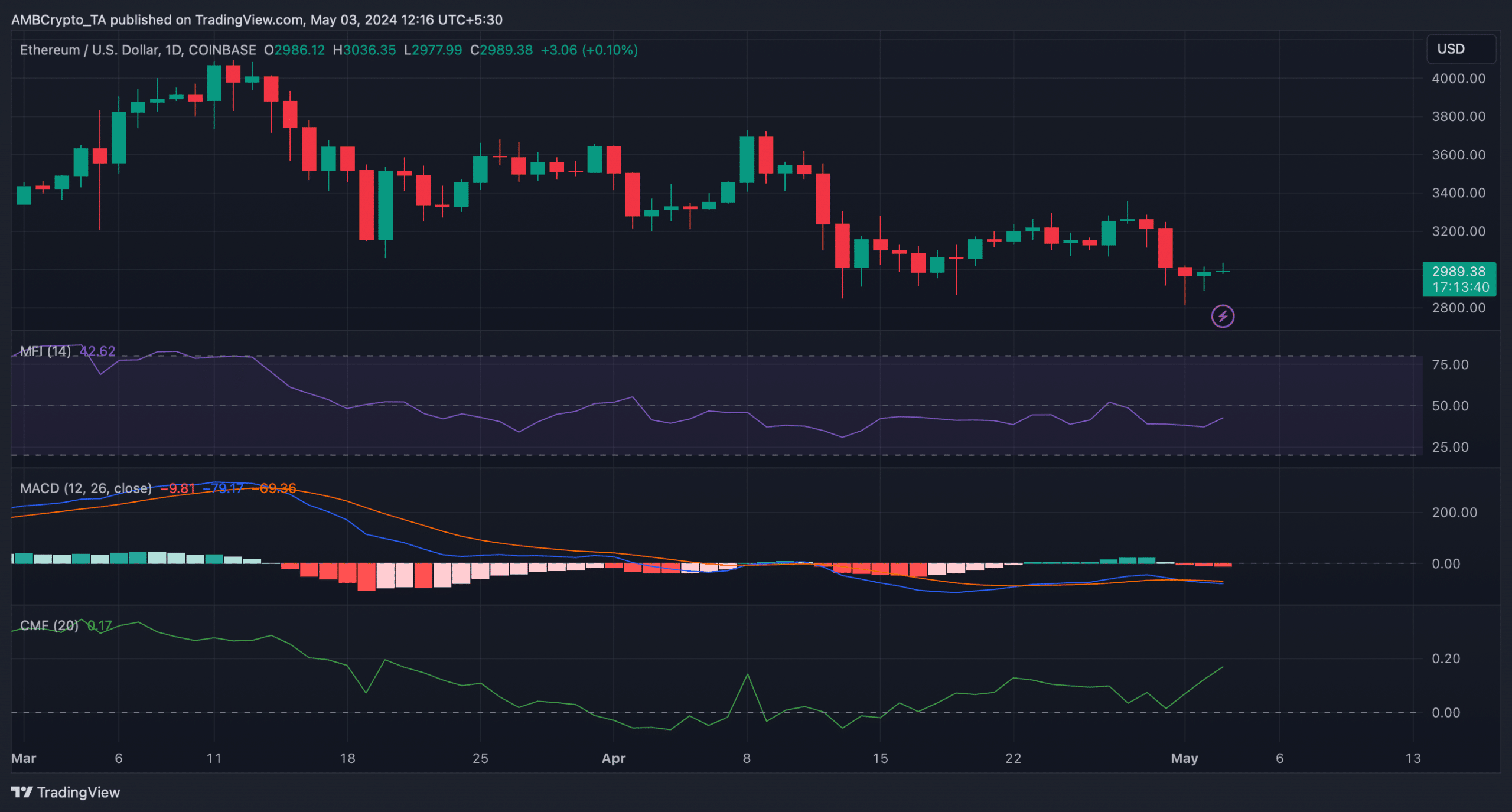

After observing that most indicators pointed to a positive trend, AMBCrypto examined Ethereum’s daily chart to determine if a continued upward movement was likely.

The Chaikin Money Flow (CMF) and Money Flow Index (MFI) of Ethereum showed notable increases, moving away from the neutral zone. This upward trend in these indicators points to a strong possibility of an extended bull market for Ethereum.

On the other hand, the MACD supported the sellers as it flashed a bearish crossover on the charts.

After examining Hyblock Capital’s data, we identified potential Ethereum (ETH) price levels this week if the bull market continues. For ETH to maintain its upward trend, it is essential that the token surpasses $3,100 to prevent significant liquidations.

Read Ethereum’s [ETH] Price Prediction 2024-25

A drop in the value of liquidations might lead to a price adjustment. If Ethereum manages to surpass that threshold, it could potentially reach $3,300 by the week’s end under ideal circumstances.

Read More

2024-05-03 18:15