- Bitcoin’s price has risen by over 6% in 24 hours

- If the bulls hold on to market control, a rally past $65,000 might be possible

As a researcher with extensive experience in cryptocurrency markets, I find the recent shift in Bitcoin’s funding rate from negative to positive on Binance to be an intriguing development. The 6% price surge over the last 24 hours has led to a significant demand for long positions, as evidenced by the shift in funding rates and the increase in trading volume and open interest in its derivatives market.

🚀 Trump Effect: EUR/USD Primed for Wild Swing?

Expert predictions show massive EUR/USD reaction to Trump's latest tariff agenda!

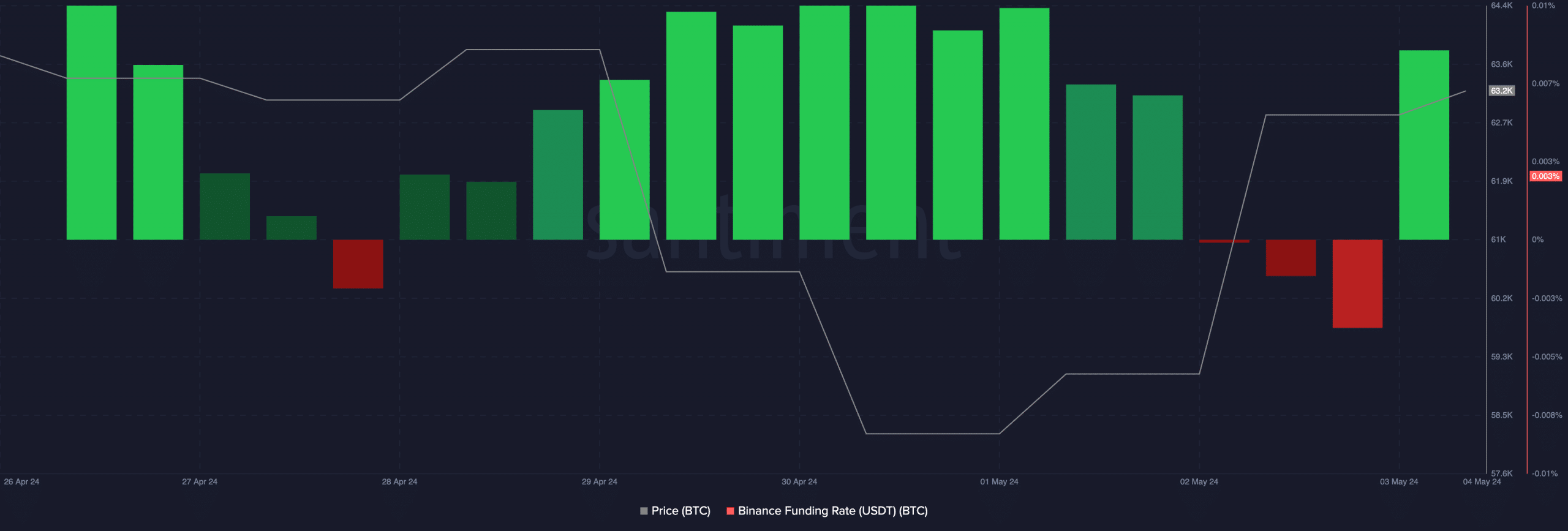

View Urgent ForecastBased on Santiment’s analysis, Bitcoin’s [BTC] price increase of 6% within the past day has resulted in a significant shift in its funding rate on Binance, transitioning from negative to positive.

Bitcoin experienced a significant surge on Friday, leading to a 5.4% increase in its market capitalization within a day. The trading community on Binance has dramatically shifted their positions, moving from short to long contracts following this bounce. However, it’s essential that fear of missing out (FOMO) doesn’t fuel excessive buying for the rally to persist.

— Santiment (@santimentfeed) May 3, 2024

As an analyst, I would explain it this way: In perpetual futures contracts, funding rates serve as a self-adjusting mechanism to maintain the contract price in alignment with the current spot price. When the contract price exceeds the spot price, long position holders are required to pay fees to traders holding short positions. These fees are represented by positive funding rate values.

As an analyst, I would explain it this way: When it comes to trading contracts for an asset, if the price at which the contract is set to be settled (contract price) is less than the current market price (spot price), we refer to this situation as negative funding rates. In such cases, short traders are required to compensate long traders for the difference between the contract and spot prices.

A sudden change from unfavorable to favorable funding rates for an asset indicates robust demand for buying that asset. This situation is perceived as a bullish sign, foreshadowing potential further price increases for the asset.

Based on Santiment’s analysis, Bitcoin’s funding rate on Binance reached a year-low of -0.008% on May 3rd. Yet, following a significant 24-hour price surge of more than 6%, Bitcoin’s funding rate on the top exchange switched to positive.

As of now, the reading stood at 0.0027% – implying that a larger number of long positions existed compared to short positions within the coin’s derivatives market from my perspective as an analyst.

What should you look out for?

In the past 24 hours, Bitcoin’s price increase has sparked heightened trading action in its derivatives sector. As reported by Coinglass, the total trading volume in this market reached an impressive $78.05 billion during this period, marking a notable 30% rise.

In simpler terms, the number of new Bitcoin trading positions opened by market participants has increased by 7% within the past day, as indicated by a rise in Bitcoin futures open interest. Currently, the Bitcoin futures open interest amounts to approximately $30 billion, with the cryptocurrency itself valued at around $63,000 on the charts.

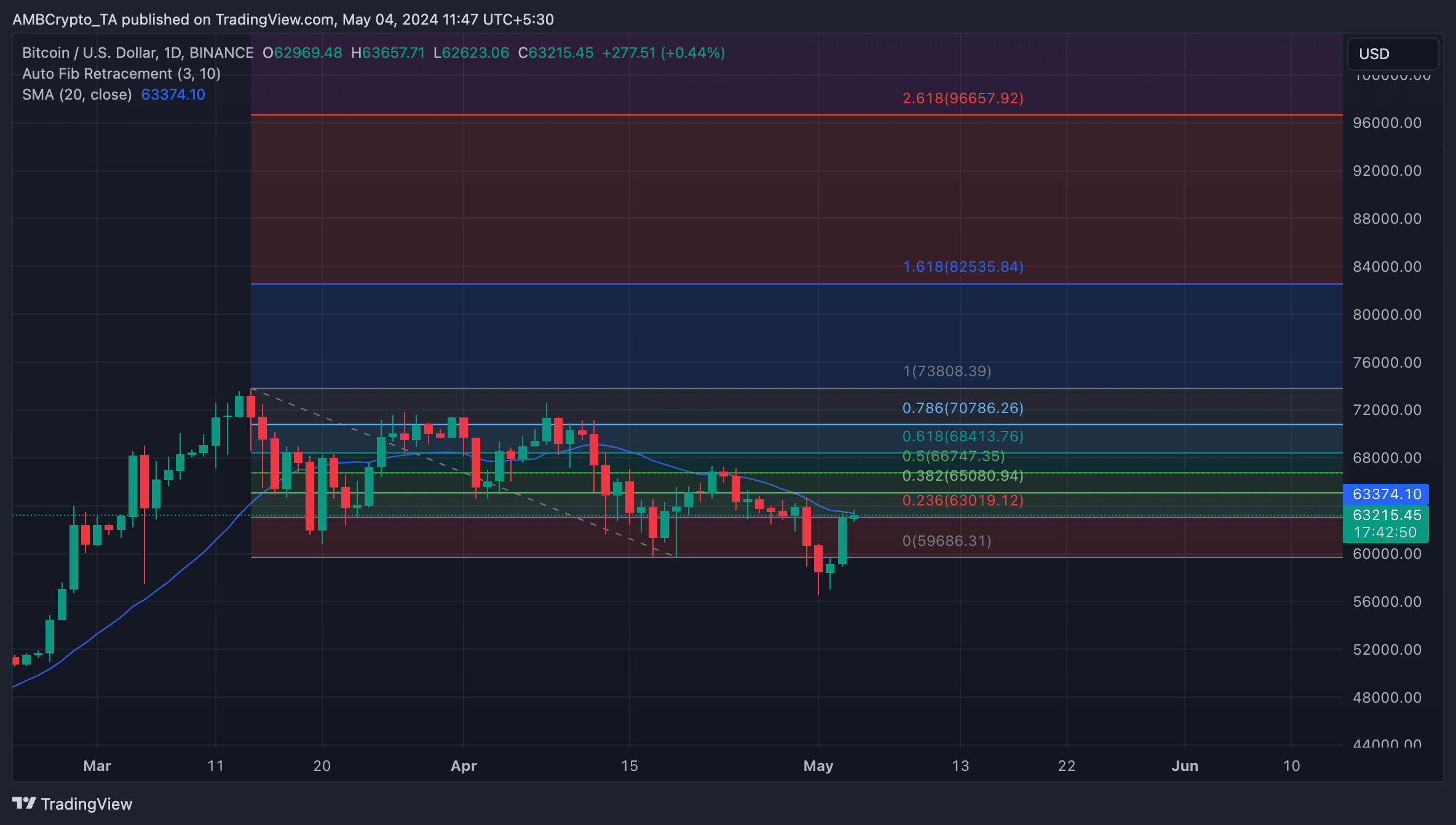

The analysis of Bitcoin’s (BTC) Fibonacci retracement levels on its 1-day chart indicates that if the current bullish trend continues, the coin may reach a price of $65,050 next.

As a researcher studying Bitcoin’s price movements, I have made a bullish prediction based on current trends. However, should bears re-emerge and mount significant pressure on the market, invalidating the bullish projection, Bitcoin’s price will likely drop below $60,000 to around $59,700.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Everything Jax Taylor & Brittany Cartwright Said About Their Breakup

- The Battle Royale That Started It All Has Never Been More Profitable

- ANKR PREDICTION. ANKR cryptocurrency

- DOOM: The Dark Ages Debuts on Top of Weekly Retail UK Charts

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- Solo Leveling Arise Tawata Kanae Guide

- Upper Deck’s First DC Annual Trading Cards Are Finally Here

2024-05-04 16:07