-

Count of XRP whales has risen over the past month

This, despite the fall in the crypto’s value

As a seasoned crypto investor with a keen interest in XRP, I find the recent surge in the number of XRP whales holding between 1,000 and 1,000,000 tokens intriguing. Although the value of XRP has taken a hit this month, it’s noteworthy that demand for the altcoin remains strong among investors.

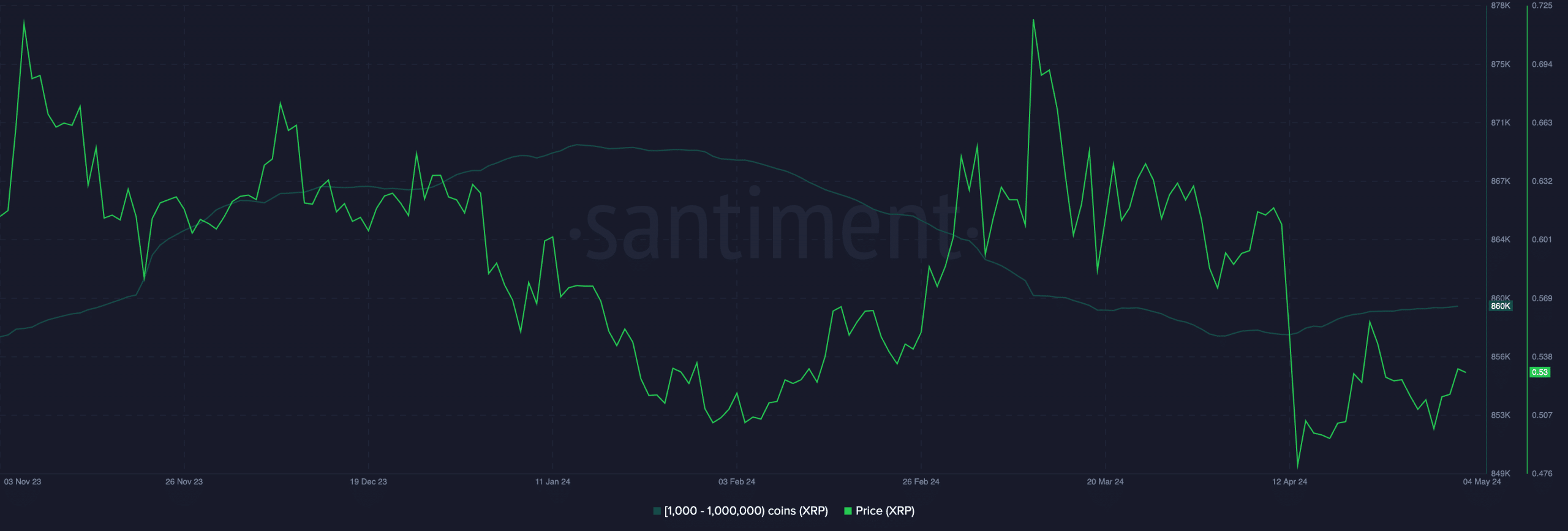

Over the past month, the count of XRP investors holding between 1,000 and 1,000,000 tokens has increased, even as the value of this altcoin decreased. According to Santiment’s data from that timeframe.

I recently analyzed data from Santiment and discovered that the number of XRP holders in this particular group had grown to approximately 860,000. This represents a 0.23% increase within the past thirty days.

Although the increase is small, it’s worth mentioning given the recent significant drop in the number of large XRP investors.

As a crypto investor keeping tabs on XRP, I’ve noticed some intriguing trends in the distribution of whale holdings. At the start of the year, approximately 867,000 addresses held between 1,000 and 1,000,000 XRP tokens. However, by 3rd April, this number had dipped to a year-to-date low of 858,000. Following this decline, the count has been on an upward trend once again.

XRP and its potential

The increase in the number of large investors holding an asset, such as XRP, is noteworthy because it frequently signals an upcoming price surge. Despite a 7% decrease in value due to the recent market slump, there remains strong interest from traders for this altcoin.

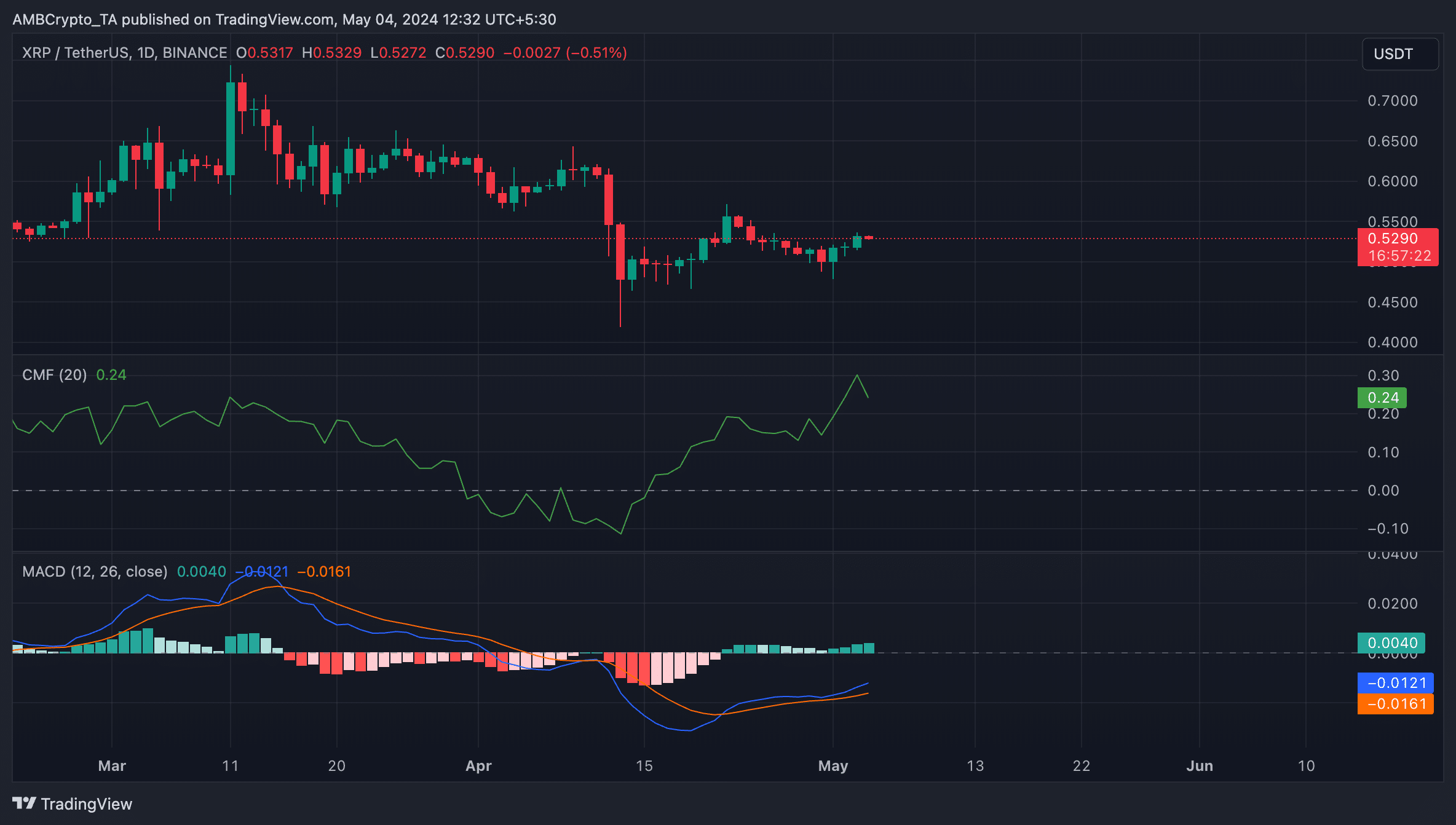

As a researcher studying market trends, I’ve noticed an intriguing development in the daily chart of the asset under observation. Despite the downward price movement, the Chaikin Money Flow (CMF) indicator has shown a consistent uptrend. This disparity between price and CMF could suggest that institutional buying pressure is present, potentially signaling a potential reversal or continuation of an uptrend.

Realistic or not, here’s XRP’s market cap in BTC’s terms

This metric monitors the movement of funds into and out of a specific asset. When this metric increases while the asset’s value decreases, it results in a bullish divergence. This situation indicates that investors are actively purchasing the asset despite its declining price. Their motivation could be based on the belief that the price drop is temporary or represents an attractive buying opportunity.

Recently, XRP‘s price drop indicated strong selling forces at play. Yet, the increasing Chaikin Money Flow (CMF) suggested that if purchasing pressure grows further, it may ultimately surpass the selling pressure, leading to an uptick in XRP’s price.

At present, the short-term probability of XRP‘s price rising is supported by its MACD line’s behavior. This line, denoted by the blue color, surpassed the signal line (orange) on April 21st and has been trending upward since then. When an asset’s MACD line lies above its signal line, it indicates a bullish trend, suggesting that the market momentum is strengthening in a favorable direction.

As a crypto investor, I’ve noticed that XRP‘s moving average convergence divergence (MACD) and signal lines have yet to cross above the zero line as of now. This indicates that bears continue to hold the upper hand in the XRP market.

Read More

- Gold Rate Forecast

- Discover Liam Neeson’s Top 3 Action Films That Will Blow Your Mind!

- OM PREDICTION. OM cryptocurrency

- Kanye West Praises Wife Bianca’s Daring Naked Dress Amid Grammys Backlash

- Nintendo Switch 2 Price & Release Date Leaked: Is $449 Too Steep?

- Netflix’s New Harlan Coben Series Features Star-Studded Cast You Won’t Believe!

- Meet the Stars of The Wheel of Time!

- Why Gabriel Macht Says Life Abroad Saved His Relationship With Family

- Where Teen Mom’s Catelynn Stands With Daughter’s Adoptive Parents Revealed

- EUR PKR PREDICTION

2024-05-05 02:15