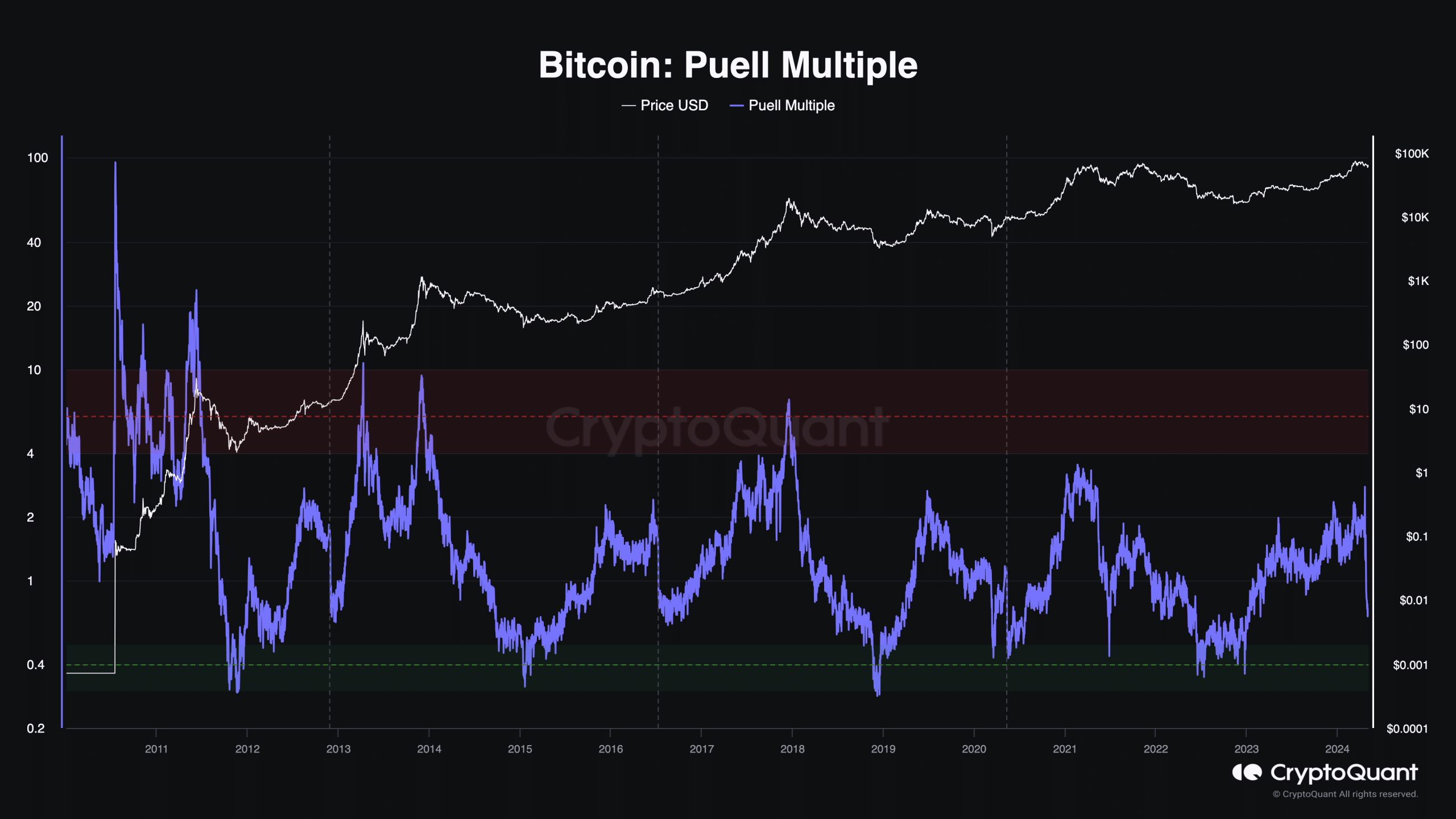

- The Puell Multiple closed in on a historical accumulation point

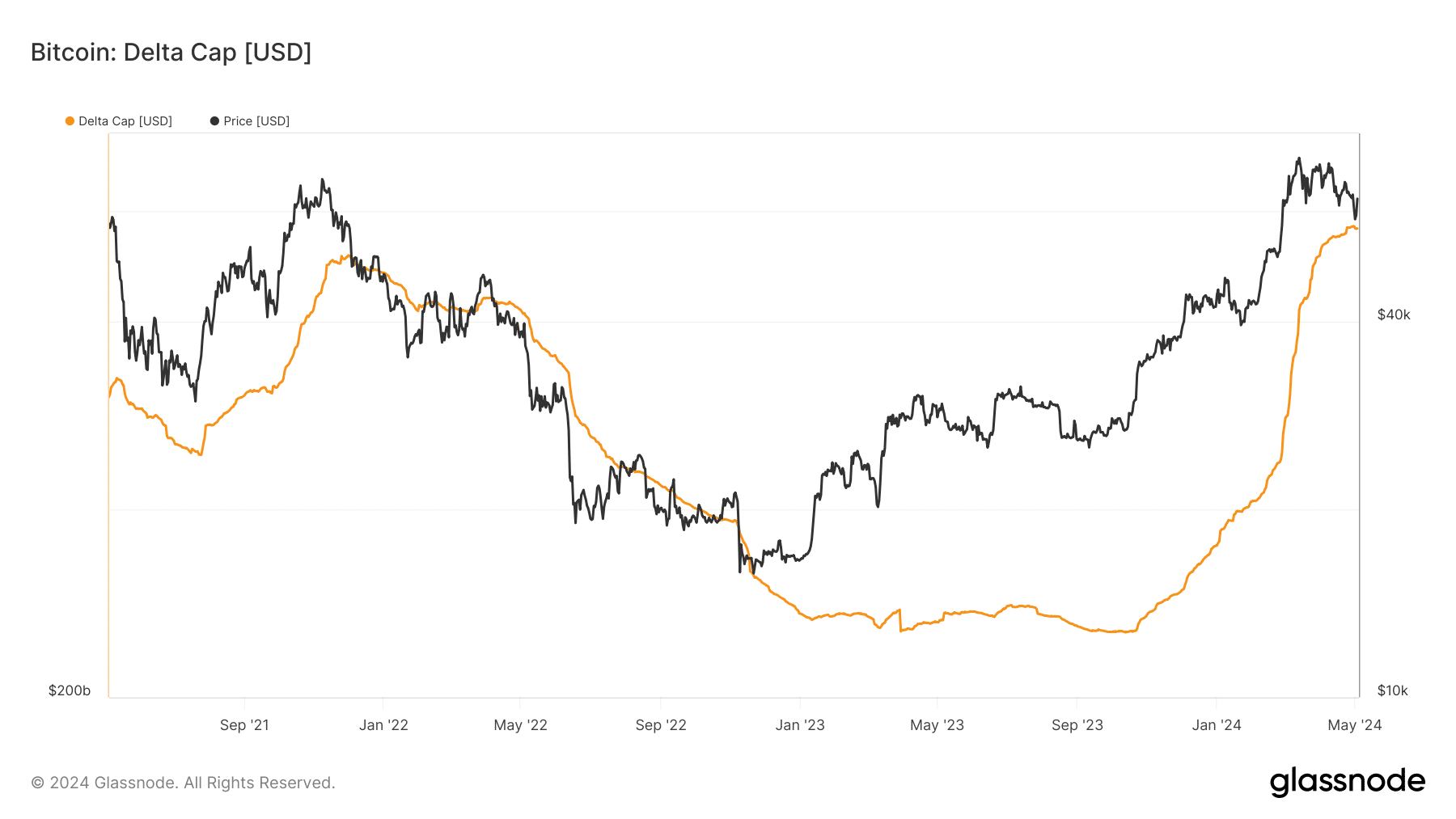

- Bitcoin’s Delta Cap surged, suggesting that the price might not hit $100,000 this cycle

As a seasoned crypto investor with a few cycles under my belt, I find the recent developments in Bitcoin’s Puell Multiple and Delta Cap quite intriguing. The Puell Multiple dropping to 0.56 is a significant event, as it has historically indicated potential buying opportunities.

A significant shift occurred in the Bitcoin market as of late: The Puell Multiple, which had remained above 0.56 since December 2022, dipped down to this level for the first time.

The Puell Multiple calculates the relationship between daily new coin supply and the annual average. This indicator enables market observers to identify potential market peaks and troughs. When the value surpasses 6, it indicates miners are currently earning more than the previous year’s average. In Bitcoin price terms, this could suggest that a peak is near.

Bitcoin to $87,593?

As a crypto investor, I would interpret a Puell Multiple of less than 0.5 in the following way: The current market conditions suggest that miners are earning below average revenues from their Bitcoin mining activities. Consequently, this could be an indication that the Bitcoin price might be nearing its bottom on the charts.

As an analyst, I’ve observed that the metric’s current standing at present suggests the potential for a coin to approach a purchasing zone shortly. Therefore, it would be insightful to delve into the historical data from 2022 to better understand the circumstances surrounding such occurrences.

According to the previously mentioned chart, Bitcoin’s price was approximately $16,832 when the Puell Multiple reached its current value. Within a short span of only four months, the price experienced a significant increase of over 39%. This finding suggests a strong correlation between the Puell Multiple and Bitcoin’s price.

As a financial analyst, based on the current value of Bitcoin at $63,017 and considering its past price trends, it’s reasonable to anticipate that its price could potentially reach around $87,593 by the end of October. However, it’s important to remember that historical patterns do not guarantee identical outcomes in the future.

Top is not here, but it may be close

As a crypto investor, I’ve noticed that the price of this particular coin could potentially experience corrections during its upward trend. To gain a better understanding of where Bitcoin stands in its current cycle, I recently referred to AMBCrypto’s analysis using the Delta Cap indicator.

The Delta Cap represents the variation between the current Realized Capitalization and the historical average of the Market Capitalization for a particular asset. By monitoring this measure, investors can potentially identify significant market turns, be it peaks or troughs.

In the year 2021, as the Delta Cap reached a peak of $340.93 billion, the Bitcoin price started to decline. Currently, the Delta Cap is valued at approximately $355.86 billion.

As an analyst, I’ve noticed that the current figure for Bitcoin’s price is greater than what we observed during the last bull market. It’s a common assumption that this could indicate Bitcoin’s peak in this cycle is near. However, it’s essential to consider that Bitcoin has already set a new all-time high in 2021, surpassing its previous record. This could imply that there’s still room for growth before we reach the true top.

The Delta Cap is anticipated to increase further. Although Bitcoin’s value may climb to hit $85,000 or even $90,000, reaching $100,000 could prove to be a tougher prediction.

Is your portfolio green? Check the Bitcoin Profit Calculator

Based on historical trends, Bitcoin may approach or even reach prices nearing six figures, but there’s a strong possibility it could be met with resistance and potentially experience a decline at that threshold.

If the crypto market encounters significant opposition, it may lead to selling pressure, causing the price to dip below even the most bullish forecasts.

Read More

- Gold Rate Forecast

- Discover Liam Neeson’s Top 3 Action Films That Will Blow Your Mind!

- OM PREDICTION. OM cryptocurrency

- Kanye West Praises Wife Bianca’s Daring Naked Dress Amid Grammys Backlash

- Nintendo Switch 2 Price & Release Date Leaked: Is $449 Too Steep?

- Netflix’s New Harlan Coben Series Features Star-Studded Cast You Won’t Believe!

- Meet the Stars of The Wheel of Time!

- Why Gabriel Macht Says Life Abroad Saved His Relationship With Family

- Where Teen Mom’s Catelynn Stands With Daughter’s Adoptive Parents Revealed

- EUR PKR PREDICTION

2024-05-05 03:03