-

ETH’s price appreciated by over 5% on 3 May

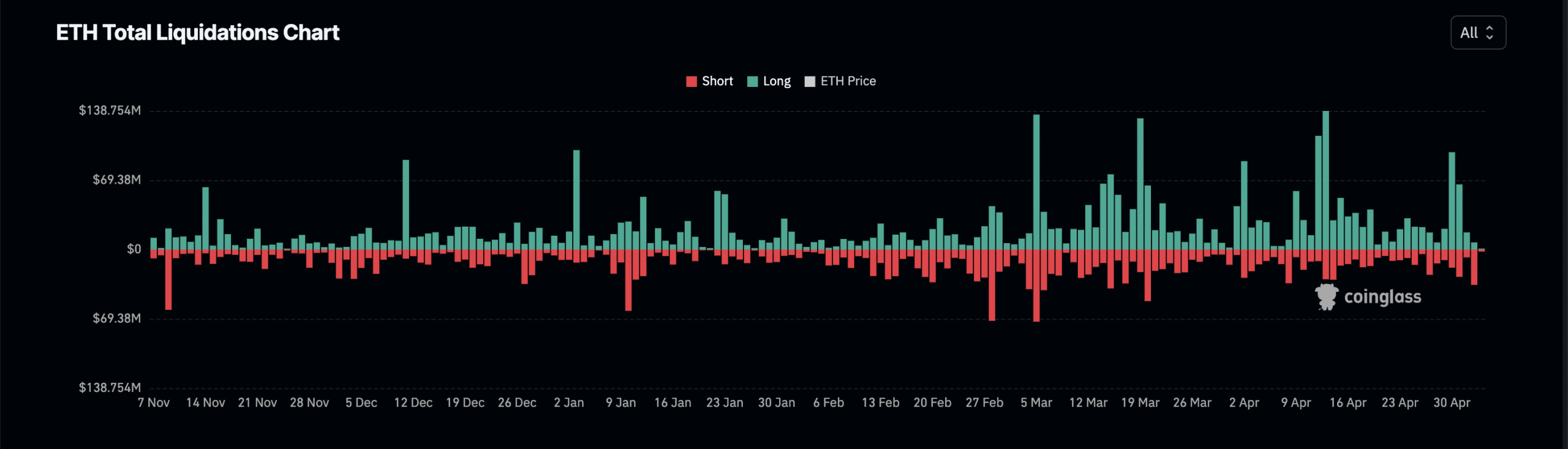

This contributed to a hike in the number of short positions liquidated

As a researcher with a background in cryptocurrencies and derivatives markets, I find the recent price rally of Ethereum [ETH] on May 3rd intriguing. The sudden surge in ETH’s price led to a significant increase in short position liquidations, which reached a two-month high of $35 million, while long liquidations amounted to just $7.16 million (Coinglass, 2024).

On May 3rd, during regular stock market hours, Ethereum‘s [ETH] value increased by 7%, resulting in a significant surge in short positions being liquidated within the Ethereum derivatives market, reaching a two-month peak as reported by Coinglass.

On that particular day, the amount of short positions for Ethereum, valued at around $35 million, was liquidated in on-chain transactions. Conversely, the value of long positions being liquidated came up to only about $7.16 million.

As a crypto investor, I’m no stranger to the concept of liquidations. It’s what happens when my position in a derivative contract is forcibly closed due to insufficient funds to keep it open. Short liquidations specifically occur when the value of an asset unexpectedly spikes upwards, leaving me with no choice but to sell my positions that bet on a price decrease.

I’ve been closely monitoring the altcoin market according to Santiment’s data, and I noticed an intriguing development. For the better part of May, this altcoin had been trading beneath the $3000 mark. However, on the 3rd of this month, something shifted – it closed above that price level. This marks a significant reversal in its recent trend.

Derivatives market traders stay their hands

At present, Ethereum’s price continues to rise and had increased by more than 5% within the past 24 hours. The top altcoin was priced at approximately $3,104 when this statement was composed.

As a crypto investor, I’ve noticed that despite the price surge of Ethereum (ETH), the derivatives market hasn’t shown much activity based on Coinglass data. In other words, the trading volume in ETH’s derivatives market has only increased by a modest 2%.

Read Ethereum’s [ETH] Price Prediction 2024-25

As a crypto investor, I’ve observed that the coin’s futures open interest experienced a modest 3% increase over the past week. At present, Ethereum (ETH) futures open interest stood at $10.68 billion. Surprisingly, ETH options volume took a significant hit, plunging by more than half during this period of analysis.

Participants are granted the ability to purchase or sell an asset through options trading at a future date. A decrease in ETH‘s options trading volume signifies reduced anticipation of price changes, as investors hold off on making moves until they have a clearer understanding of where the cryptocurrency’s market may be trending next.

The recent increase in Ethereum’s Futures trading activity coupled with a decrease in Options trading activity indicates that derivatives market players are taking a cautious stance. Essentially, they are hesitant to make large wagers on Ethereum’s future price direction.

Read More

- Disney’s Animal Kingdom Says Goodbye to ‘It’s Tough to Be a Bug’ for Zootopia Show

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

2024-05-05 05:11