-

BTC’s price moved marginally in the last 24 hours.

Metrics and indicators suggested that BTC might turn volatile in the next seven days.

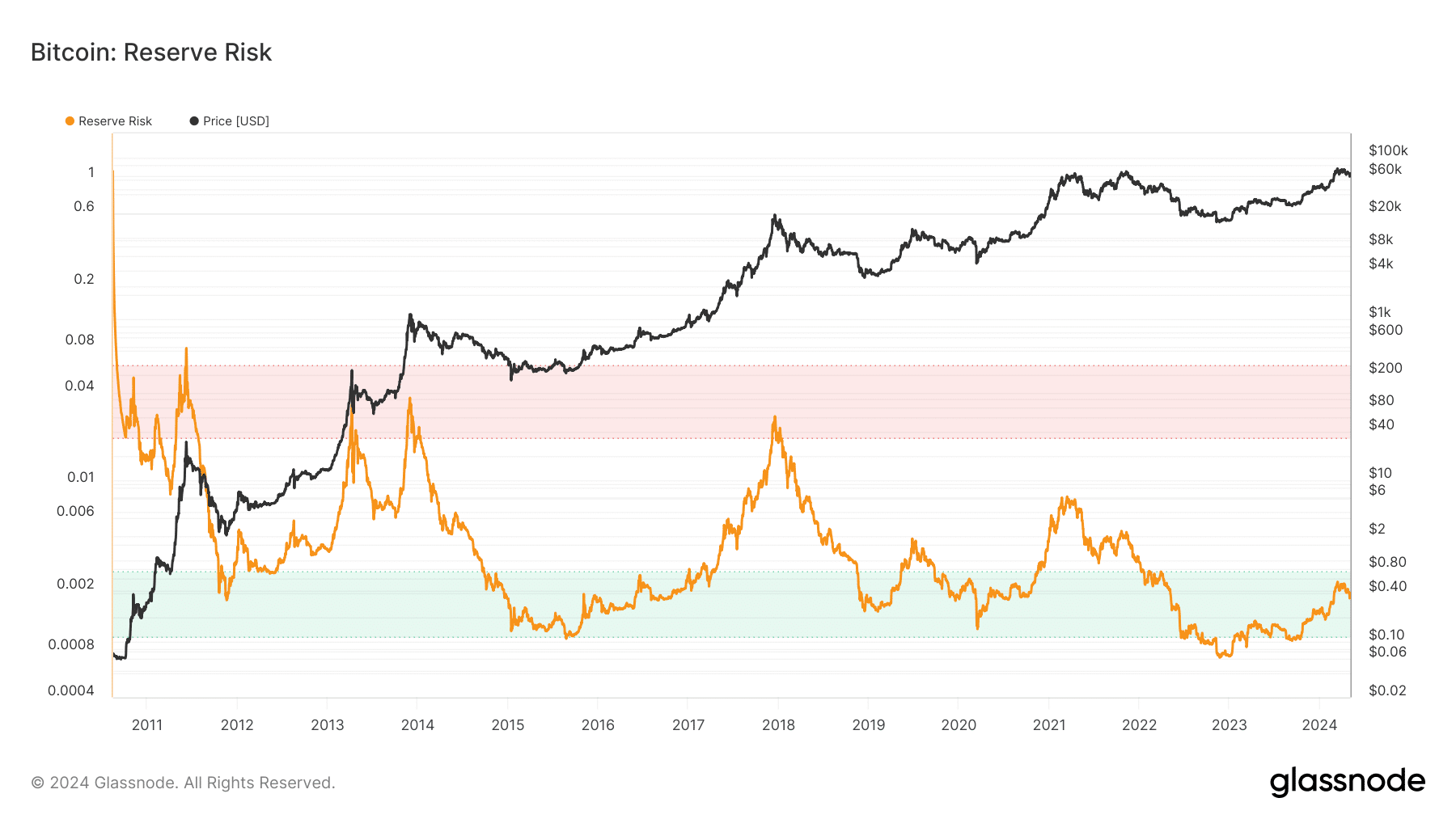

As a seasoned crypto investor with a keen interest in Bitcoin’s price movements, I find the recent developments intriguing. Moustache’s analysis of BTC‘s rebound from key support levels and bullish signals from metrics like RSI and Glassnode’s reserve risk have been promising indicators of an impending bull rally.

Some investors believed that Bitcoin‘s price surge on May 3rd signaled the beginning of a new bull market.

As an analyst, I’ve observed that the crypto market leader’s price has shown minimal movement over the past 24 hours, resulting in a decelerated growth rate. This stagnation could potentially indicate another price correction.

Is Bitcoin actually bullish?

Recently, cryptocurrency analyst Moustache drew attention to several advancements in the digital currency market that could potentially signal an upcoming bull run.

As a researcher studying cryptocurrencies, I’ve noticed an intriguing development in the Bitcoin market. On the 30th of April, its value took a significant dip, falling below the $61,000 mark. Yet, remarkably, Bitcoin managed to rebound and surpass this price point once more. This reversal transformed $61,000 into a new support level. The regained position above this threshold offers an encouraging sign, suggesting that we might witness further price growth in the near future.

In simpler terms, the tweet pointed out that Bitcoin’s price bounced back after brushing against a significant trendline. Previously, every time Bitcoin’s price recovered from this trendline, it experienced a notable surge.

As an analyst, I’ve noticed that the Relative Strength Index (RSI) has surpassed the resistance line of a falling wedge formation. This signifies that the RSI is likely to trend upward, providing a strong indication for the potential continuation of Bitcoin’s bullish market.

As a data analyst, I recently examined the insights shared by AMBCrypto from Glassnode’s data. I discovered an intriguing bullish indication: Bitcoin’s reserve risk has been gaining traction within the green zone. This means that the number of Bitcoins being held in exchanges, considered at risk due to their potential for quick selling, has decreased significantly. Consequently, this reduction in available supply on exchanges could lead to price appreciation as demand for Bitcoin increases.

Each time this happened in the past, BTC’s price gained bullish momentum.

What to expect from BTC

Despite the promising indications from the previously mentioned statistics, Bitcoin’s price behavior didn’t align. According to CoinMarketCap, Bitcoin’s price experienced minimal change during the past 24 hours.

In my current composition, the price of the coin stood at $63,368.70 during the point of recording this data, while its market value exceeded an astounding $1.25 trillion.

However, investors mustn’t lose hope yet, as a few metrics hint at an increase in BTC’s volatility.

According to AMBCrypto’s interpretation of CryptoQuant’s findings, the amount of Bitcoin being transferred into cryptocurrency exchanges for selling has been relatively minimal compared to the recent weekly average, indicating a reduced urge among investors to offload their Bitcoins.

The premium on Coinbase for buying coins was a vibrant green, signaling strong demand from American investors.

Based on some market signals, Bitcoin might experience increased volatility and potentially rise in value over the next week.

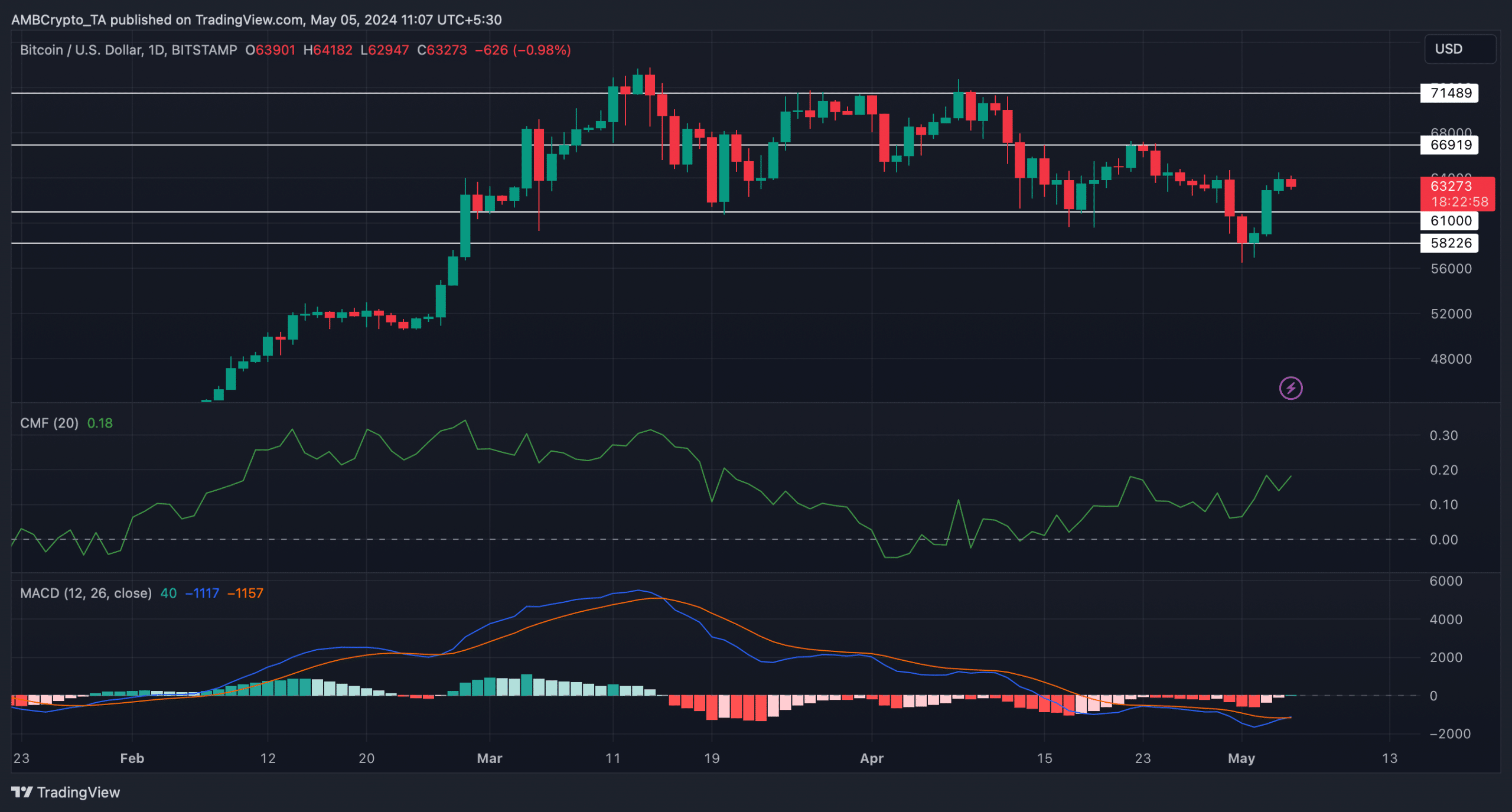

Significantly, the Chaikin Money Flow (CMF) indicator for the coin showed a marked increase, while its Moving Average Convergence Divergence (MACD) suggested the potential for a bullish trend reversal.

Should Bitcoin display volatility in the coming week, surpassing the $66,900 resistance point would become essential for its growth. Overcoming this barrier may pave the way for a potential reach towards $71,000.

If everything remains bullish, then BTC can even cross its all-time high in coming days.

Read More

2024-05-05 16:07