-

Bullish sentiment around the token dropped as the next briefing neared.

Traders preferred to open long XRP positions despite the uncertainty.

As a long-term crypto investor with some experience in the market, I’m keeping a close eye on XRP‘s price action and sentiment leading up to the SEC hearing scheduled for May 6th. The bullish sentiment around the token has dropped significantly, and while traders are hesitant due to uncertainty, many have chosen to open long positions despite the risks.

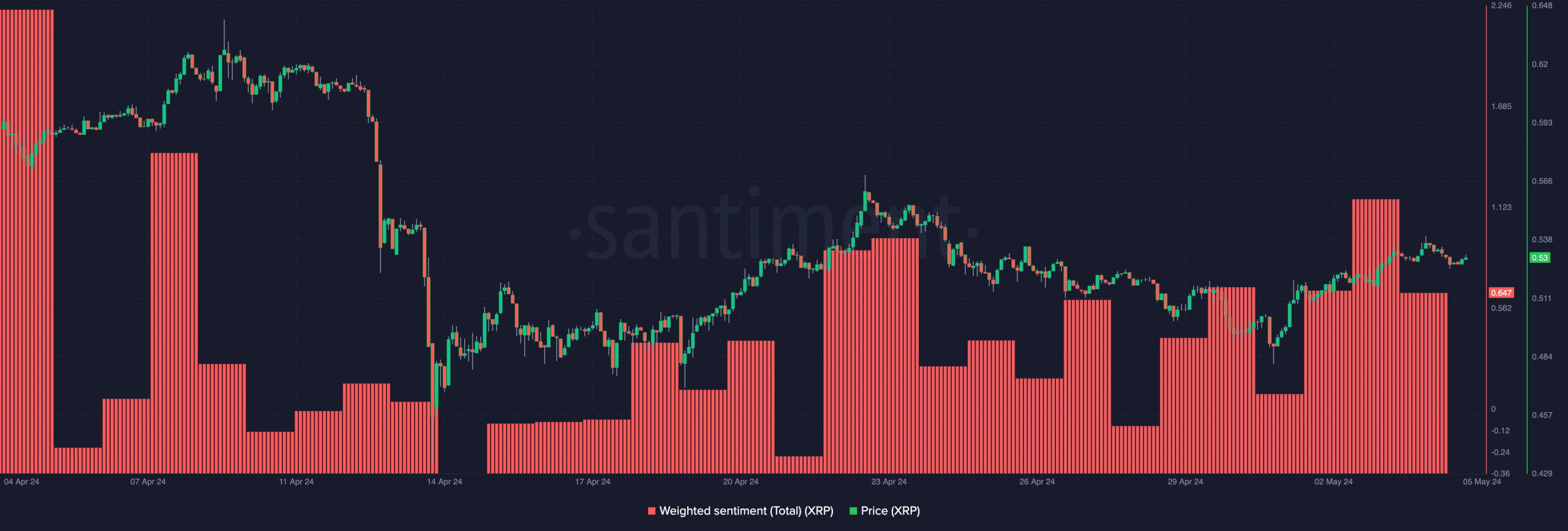

Despite an uptick on May 3rd, Ripple‘s [XRP] Weighted Sentiment has taken a downturn. Currently, this metric is reportedly down from 1.16 to 0.64 as observed by AMBCrypto.

The upbeat tone of the text persisted, yet the downward trend hinted at a lack of optimism among wider markets regarding XRP‘s potential for significant price increases in the near future. What could be the reasons behind this pessimistic outlook?

Will the hearing make or mar XRP?

Based on our findings, it appears that the significant event occurring on May 6th could influence people’s perceptions. Notably, the U.S. Securities and Exchange Commission (SEC) is anticipated to issue a response to Ripple’s rebuttal on this date regarding the ongoing legal matter.

During the past weekend, there was no new information regarding the issue. Consequently, XRP held steady around $0.49 before climbing to reach a high of $0.52. Nevertheless, the price may change based on the results of the upcoming hearing on Monday.

In my analysis as an observer of regulatory matters, previously, the Securities and Exchange Commission (SEC) had presented a proposal to the court to impose a $2 billion penalty on Ripple for allegedly breaching U.S. securities laws in their opening brief. Yet, Ripple disagreed with this suggestion.

Based on Ripple’s estimation, they wouldn’t have to pay over $10 million in penalties. The judge’s upcoming decision, which has yet to be made, could significantly impact XRP‘s position for better or worse.

If the Securities and Exchange Commission (SEC) insists on the $10 billion penalty and the judge agrees, the price of XRP could significantly drop. Conversely, a ruling against the SEC might boost XRP’s value.

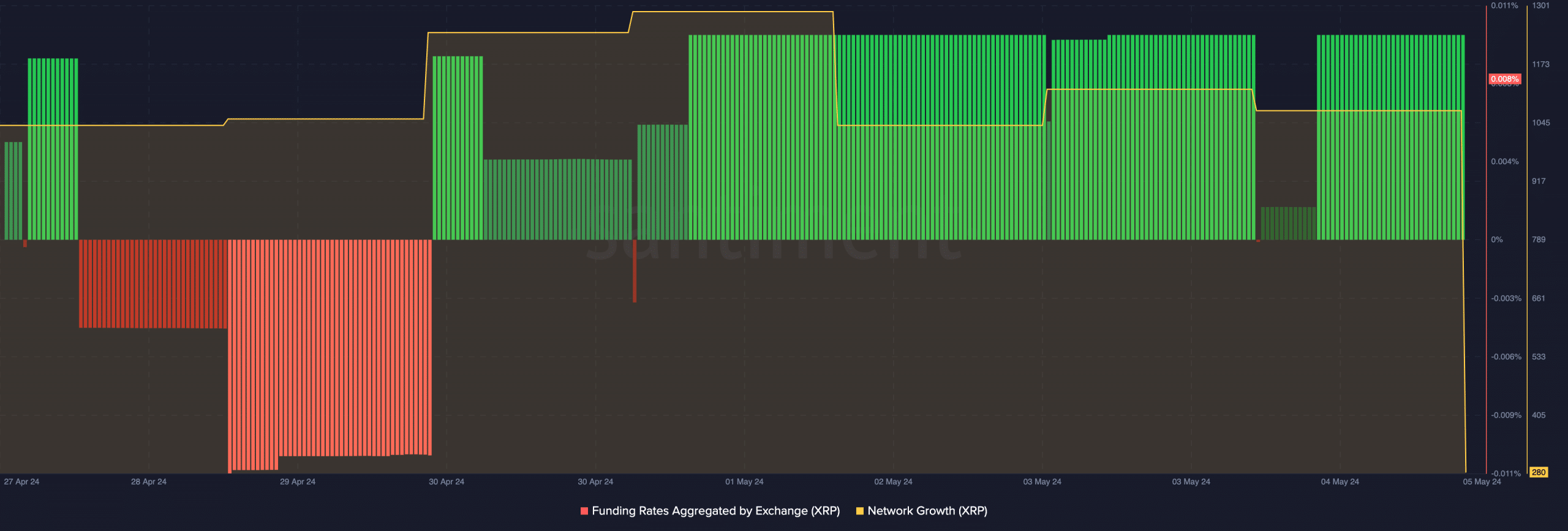

As a researcher examining trading activity, I observed that the data from Santiment’s Funding Rates suggested traders held bullish positions, indicating their expectations for a favorable market trend.

Some participants are confident

At present, the funding rate for XRP stands at 0.008%. A negative figure in this context would indicate a rise in bearish wagers against the cryptocurrency.

On the optimistic interpretation, short sellers are being compensated by long investors to maintain their bearish positions.

As a researcher studying the cryptocurrency market, I can say that holding positions in XRP carries potential rewards if the token’s price rises. Conversely, a decrease in XRP’s value may result in losses for those who have purchased the token at higher prices and are yet to sell.

Although traders expressed optimism, data from the blockchain indicated a decrease in the formation of new user accounts, as evidenced by a drop in network growth figures. Network growth is calculated by identifying the initial transactions made by newly created digital wallets.

As a researcher observing the data, I’ve noticed an uptick in the metric, which is indicative of enhanced acceptance for the given project. Conversely, the decrease in XRP‘s metric suggests that the project has yet to generate sufficient interest or adoption.

As a token analyst, I would interpret this scenario as follows: If the adoption rate of XRP fails to pick up, it’s likely that demand for the token will remain sluggish. Consequently, XRP may not witness a significant price surge. Furthermore, if the expansion of the XRP network continues to decline, its holders might consider selling some of their tokens due to diminishing faith in the project’s prospects.

Realistic or not, here’s XRP’s market cap in BTC terms

As a researcher following the developments between Ripple and the Securities and Exchange Commission (SEC), I’ve yet to come across any official statement from Ripple regarding their planned response should the judge side with the SEC’s perspective.

Regardless of the outcome, it’s likely that the lengthy lawsuit will reach its conclusion soon.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-05-05 20:07